Major business leaders and political figures from the Gulf Cooperation Council (GCC) monarchies invest billions of dollars into the UK real estate market annually. UK property records show that some investors are members of or even lead these royal families.

The UK does not provide an easily searchable database of individual property owners — a problem for financial institutions (FIs) that are interested in screening politically exposed persons (PEPs) with UK property holdings. Fortunately, graph analytics can be applied to two different sets of UK data to quickly identify such property holdings and more efficiently screen high-profile or potentially risky clients.

The first data set is Companies House, the UK’s primary commercial database, which lists company directors and persons with significant control (PSC). PSCs must hold at least 25 percent of shares to be listed. The second data set is the Commercial and Corporate Ownership Data (CCOD), which lists property held by UK commercial entities, but not private individuals. Graph analytics help connect the dots between PSCs and property held by commercial entities to uncover the ultimate beneficial owner (UBO) of UK real estate.

Gulf capital in UK real estate

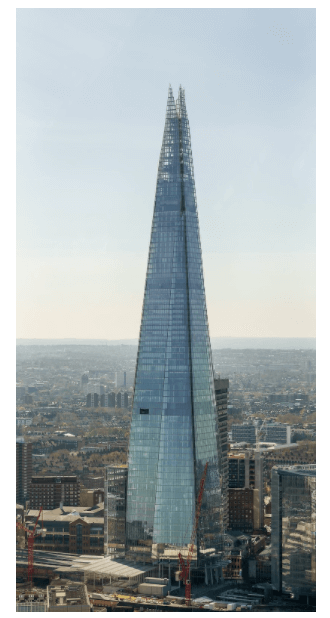

GCC investors occasionally target real estate megaprojects that transform the UK’s urban landscape. The Shard, completed in 2012, remains Western Europe’s tallest building and a distinct feature of London’s cityscape. Funding for the Shard came primarily from Qatar’s sovereign wealth fund, known as the Qatar Investment Authority (QIA). The UK is Qatar’s largest investment destination, totaling $53 billion to date.

Fig. 1: The Shard in London (© User:Colin / Wikimedia Commons / CC BY-SA 4.0)

Qatar remains a prominent investor, but investments into UK real estate flow from numerous oil-rich GCC countries. Moreover, some of these investors might not seek out highly publicized mega projects, but maintain a wide and lucrative reach thanks to their large UK real estate portfolios.

UAE-based Gulf Islamic Investments (GII) maintains a portfolio worth approximately $420 million, as of June 2019. That information comes from a GII press release announcing the acquisition of a $188 million office in Birmingham, UK — a clear signal of their continued reach into the market. More recently, GII began developing a seven-story mixed-use luxury building in Chelsea, only a few minutes from Buckingham Palace.

Public records show that GCC-based PEPs have a propensity for following the latter model of investing in unassuming, yet ubiquitous and highly valuable real estate.

UK real estate investments by members of GCC royal families

Although most GCC-based investors are not necessarily affiliated with Gulf monarchies, some are members of or are closely tied to the royal families of the Arabian Peninsula, which provides them a tremendous amount of economic power.

Royal family members almost exclusively occupy high-ranking public positions, they can skip bureaucratic processes that lay businesspeople are subject to (part of a phenomenon known as wasta), and they have access to nearly unlimited capital due to their countries’ vast oil reserves.

If a royal family member misses out on a high-ranking public position, they often find comfortable private employment thanks to their government connections. This is a great deal for GCC-based companies that might need to meet workforce nationalization requirements, while also benefiting from a well-connected employee that can accelerate bureaucratic processes.

Unfortunately, some of these monarchies also have a well-documented history of human rights offenses. Saudi Arabia and the UAE, for example, lead GCC investments into the UK real estate market, but carry a poor track record of human rights. The 2020 Human Freedom Index places the UAE and Saudi Arabia at 124 and 151 out of 162 countries, respectively.

UK real estate holdings of royal family members

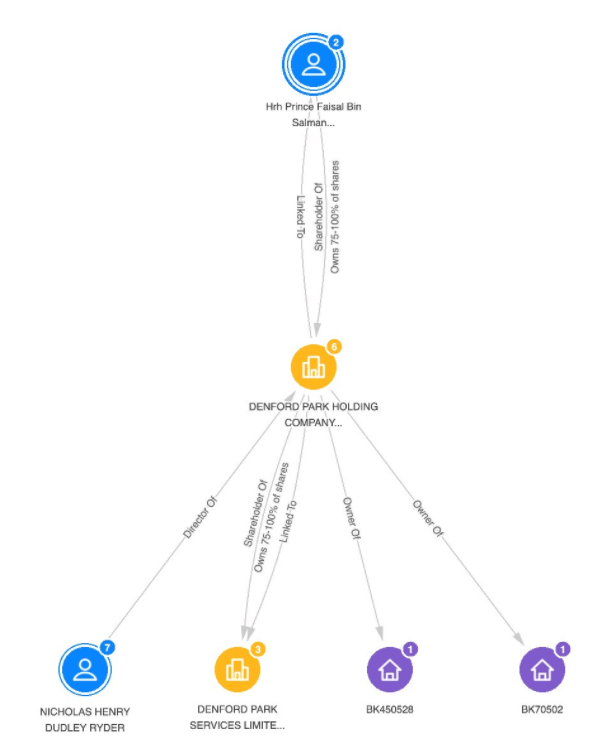

Companies House lists Faisal Bin Salman, the brother of Saudi Arabia’s Crown Prince and de facto leader, Mohammed Bin Salman, as the majority owner of Denford Park Holding Company Limited. Faisal is also the Governor of the Madinah Province in Saudi Arabia.

Unless FIs download and manually trace connections between UK’s inscrutable CCOD data and Companies House, they would not know which properties are held by Denford Park Holding Company Limited, nor their UBO — Faisal Bin Salman.

By applying graph technology to those two disparate data sources, we can demonstrate how Faisal Bin Salman, through Denford Park Holding Company Limited, is the UBO of at least two properties — Holy Trinity Church and Denford Park. Both are in Denford, a small town in Northamptonshire, England, and the latter is a historic house and estate.

Fig. 2: A snapshot from Sayari Graph showing Prince Faisal Bin Salman as the UBO of two UK properties through his control of Denford Park Holdings Company Limited.

Although there is no pricing information for Denford Park, the land comprises hundreds of acres and is located in an area that attracts some of the UK’s wealthiest landowners, including the Sackler Family.

The other GCC country that leads major investments into UK real estate is the UAE. The country’s president and leader of Abu Dhabi — Khalifa Bin Zayed Al Nahyan — is also likely the largest personal Emirati investor in UK real estate. Khalifa owns roughly $6.9 billion worth of London property, according to a Guardian UK investigation.

UK public records list Khalifa as a former PSC and the President’s Private Department as a current PSC of Kaneglen Properties Limited with a 75 to 100 percent shareholding. Khalifa established the President’s Private Department through royal decree in 2016 to manage the assets of the president inside and outside the UAE.

Kaneglen Properties Limited owns two central London properties — one at 17 Upper Grosvenor Street and the other at 19 Culross Street. 17 Upper Grosvenor Street is a historic four-story building with no publicly available approximate value, however a single flat in the building was sold for roughly $2.5 million and another 6-bedroom home in the same neighborhood is listed for roughly $35 million, according to a UK-based realtor.

The other property owned by Kaneglen Properties Limited is located at 19 Culross Street. The building is one street over from 17 Upper Grosvenor and worth roughly $8.2 million, according to a third-party estimator.

Fig. 3: A snapshot from Google Maps showing the front of 19 Culross Street.

Although GCC-based investors lead the Middle East and North Africa (MENA) in UK real estate investments, these public records can be used to track real estate holdings of other MENA PEPs. A previous investigation by Sayari found that a prominent Jordanian businessman who was implicated in a public corruption scheme also maintains a substantial UK real estate portfolio.