Since the mid-1990s, Jordan has steadily moved away from a centrally planned economy — in which the state plays a central role in the manufacturing and distribution of goods — and toward a private one in order to improve the country’s economic prospects. This shift has helped attract foreign investment, but Jordan’s frequently changing laws may puzzle investigators looking at commercial networks with ties to Jordan.

This article provides background on Jordan’s evolving foreign investment laws — an important factor in our own investigations, and necessary context for investigators looking into parties linked to Jordan.

Privatization of state-owned enterprises

The Jordanian government enacted Privatization Law No. 25 in 2000, which established the Executive Privatization Commission (EPC). The EPC is part of the prime minister’s office. It is tasked with guiding Jordan’s privatization policies and managing the Privatization Proceeds Fund (PPF). With direction from the EPC, Jordan privatized 14 state-owned enterprises (SOEs) in the telecommunications, electricity, air transportation, and mining industries by 2008, bringing in $2.3 billion to the PPF. The capital for pritivitzation primarily came from Arab and European countries.

Despite privatization efforts, the government retains its shareholder status in several large companies. In some cases, it appears as a majority shareholder of an already privatized company. Royal Jordanian Airlines, privatized in 2007, is still 82 percent owned by the Government Investment Management Company — the state entity formerly known as the Government Shareholding Management Company.

The Government Investment Management Company is the sole shareholder of eight companies and holds shares of 36 others, according to official government sources.

Liberalizing foreign investment laws

Beginning in the 1990s Jordan passed piecemeal legislation to liberalize foreign investment laws in tandem with its privatization efforts. This culminated in Investment Law No. 30 for the Year 2014, which replaced previous investment laws.

Investment Law No. 30 introduced new tax incentives for certain industries, stipulated that a “non-Jordanian investor shall be treated as a Jordanian investor,” and introduced the unified investment window — a one-stop shop to ease the investment process for Jordanian and non-Jordanian investors.

The law also reaffirmed the right of non-Jordanian investors to maintain full ownership within Jordan’s development and free trade zones, regardless of industry.

Foreign investment laws today

Even with some points of clarification, the language regarding non-Jordanian investors contained in Investment Law No. 30 was vague. Subsequently, the government implemented Investment Regulation No. 77 for Non-Jordanians in 2016, which provides more detail on investment laws as they relate to specific industries.

Investment Regulation No. 77, Articles 3-5

Article 3 of Investment Regulation No. 77 states that non-Jordanians have the right to own any percentage of any company — with the exception of those listed in Articles 4 and 5 (outlined below).

Article 4 of Investment Regulation No. 77 limits non-Jordanian investors from owning more than 49.9 percent of any company in the following industries:

- Wholesale or retail services including distribution, import, and export (unless those services are required for fulfilling the company’s main economic activity)

- Engineering services

- Construction contracting and related services

- Brokerage services (unless offered by international banks)

- Money exchange services (unless offered by international banks)

- Food services (unless offered within the hospitality industry)

- Ground and air transportation services

Although non-Jordanians are limited to minority shares of companies in these industries, foreign shareholders can have an outsized influence. Moreover, in practice, the Jordanian authorities often allow foreigners to own 50 percent of companies despite the rule allowing them to hold only 49.9 percent of shares. This additional context about Jordanian foreign investment laws, beyond the public record itself, can help us determine whether the 50 percent shareholding in the example below is a legal necessity or a genuine economic partnership.

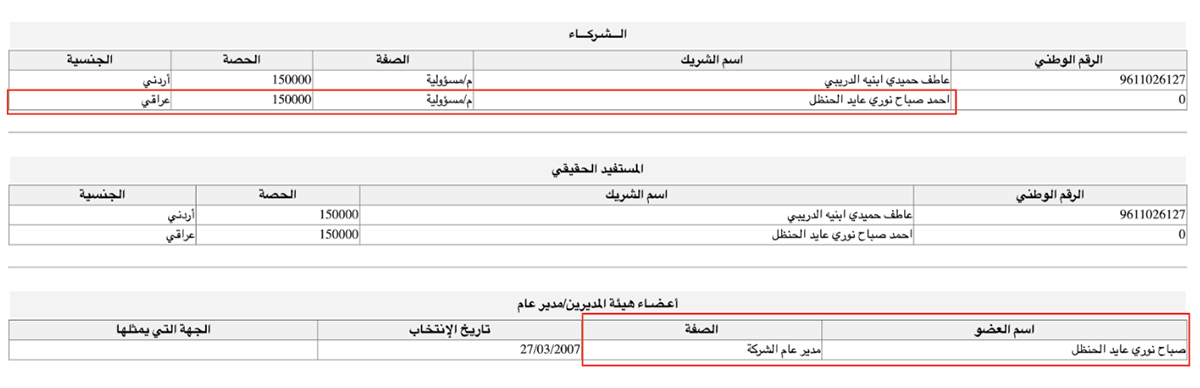

The Al-Handal family, formerly reported on by Sayari, is a prominent Iraqi family that controls businesses across the Middle East. Arab Oil Supplies LLC, a Jordan-based import export company, is 50 percent owned by Ahmed Sabah Nouri Ayyed Al-Handal and managed by Sabah Nouri Ayyed Al-Handal, Ahmed’s father. The other 50 percent owner is a Jordanian. Seeing as the company is an import export company, we know that Al-Handal is restricted from owning more than 49.9 percent.

Fig. 1: A snapshot from the Jordan Corporate Register showing Ahmed Nouri Al-Handal as a 50 percent shareholder and his father Sabah Nouri Al-Handal — the general manager of Arab Oil Supplies LLC.

Finally, Article 5 of Investment Regulation No. 77 prohibits non-Jordanians from owning any shares of companies involved in the following industries:

- Security services, including investigatory

- Customs clearance services

- Trading in firearms and firearm activities

- Bakeries

With the exception of some minor amendments that limit investment in the tourism industry, the non-Jordanian investment law has remained the same since 2016.