Jordan is witnessing the largest corruption trial in its history, known locally as Qadhiiyat Al-Dukhan (the smoke case). The trial began in the summer of 2018 amidst major protests and the arrival of a new prime minister, Omar Al-Razzaz. This trial has now become a litmus test for the government’s ability to curb corruption and perhaps even Al-Razzaz’s political future.

This investigation highlights risk within the Middle East’s tobacco industry and in Jordan in particular, where there are some of the highest smoking rates in the world and a serious cigarette smuggling problem. Jordan is also home to Phillip Morris Jordan, which owns a production factory that employs around 210 people.

Counterfeit tobacco in the Middle East

The production and smuggling of counterfeit cigarettes in the Middle East has increased in recent years as consumers look for cheaper options amidst rising cigarette costs from taxes on tobacco. The growth of free-trade zones and the porous nature of regional borders have also helped to facilitate illicit trade.

The United Arab Emirates imposed a 100 percent excise tax on tobacco and tobacco products in 2017, which incentivized consumers to seek out cheaper and sometimes illicit products. “Cheap whites,” as they are known in the UAE, are cigarettes manufactured from lower quality materials in UAE’s free-trade zones. These cigarettes rarely meet local regulations and are often smuggled into the local economy. A 2018 Tobacco Atlas report found that cheap whites comprise one third of UAE tobacco sales.

Eastern Company S.A.E., Egypt’s largest tobacco producer, is struggling to stop counterfeits of their most popular brand — Cleopatra — from making it into their economy. The government’s revenues have taken a hit and the cigarettes are often smuggled through neighboring Libya, according to an investigation by Balkan Insight.

Lebanon has also struggled to combat illicit tobacco smuggling, due in particular to the porous nature of the Lebanese-Syrian border. Cigarettes smuggled by land, air, and sea cost the Lebanese Treasury tens of millions of dollars in lost tax revenue annually.

Jordan’s smoke case

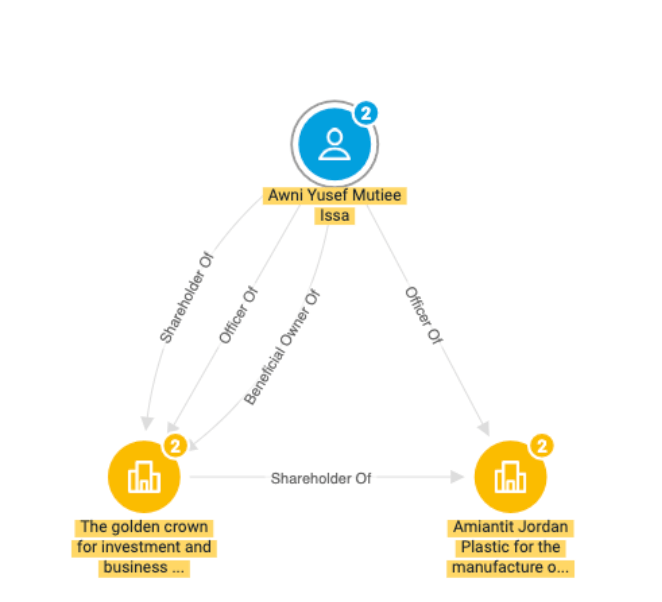

The primary defendant in our investigation, Awni Yousef Mutee Eissa, ran a counterfeit cigarette production and smuggling operation from 2006-2018, according to the 64-page Arabic indictment.

Jordanian authorities brought charges against Mutee and the 53 other defendants, including companies. Prosecutors argue that the scheme resulted in $760 million in lost tax revenue.

The State Security Court has heard the case at the request of Prime Minister Omar Razzaz since 2018. The charges vary among the defendants and include:

- Endangering the safety and security of society through economic crimes

- Money laundering

- Offering and receiving bribes

- Abuse of authority

- Customs evasion

- Tax evasion

- Economic fraud

- Trademark counterfeiting

The trial is marked by dramatic events including the deaths of multiple defendants mid-trial and the matter of several fugitives on the run, including Mutee’s brother.

Mutee, co-conspirators establish companies and factories

Mutee and his collaborators exploited two Jordanian free-trade zones — the Al-Zarqa Free Zone (ZFZ) and the Al-Muwaqqar Free Zone (MFZ). Jordan’s free-trade zones offer tax exemptions to companies exporting to international markets only.

Fig. 1: An aerial view of the Al-Zarqa Free Zone north of Amman. (photo: Aerial Photographic Archive for Archaeology in the Middle East / CC BY 2.0)

Mutee and Salamah Al-Alamat, the second named defendant, had a history of producing and smuggling counterfeit cigarettes from factories in Syria and Northern Iraq before operating in Jordan, according to the indictment. They established their first Jordan-based cigarette factory in the ZFZ north of Amman in December 2006.

One of Mutee’s businesses outside of the ZFZ — Golden Crown for Investment and Commercial Services — occupied multiple office buildings in Amman including a multi-story complex in Swafiya, a middle-class shopping district in West Amman. This Swafiya office became the headquarters for Mutee’s operations.

Fig. 2: A snapshot of two of Mutee’s companies from Jordanian public records translated from Arabic. Both companies are defendants in the case.

Mutee registered companies in the names of his sons, brothers, and friends — all of whom were on his payroll — in an attempt to protect himself legally. He established ten companies in the ZFZ in four years.

Manufacturing counterfeit cigarettes

The cigarettes were manufactured in shifts, twice daily. Three companies produced the majority of the cigarettes.

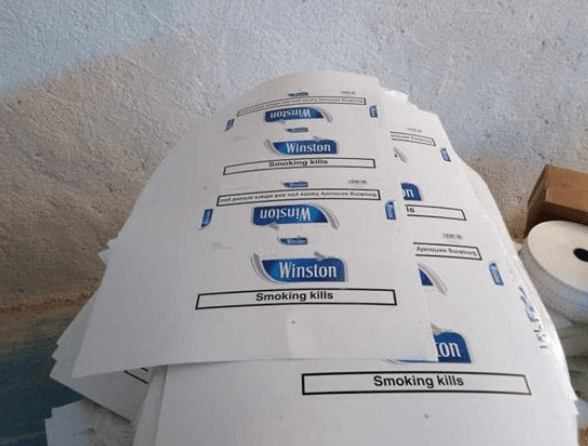

Mutee also established Golden Tiger Printing to print forged labels of cigarette brands including Marlboro, Winston, Elegance, Kent, Rothmans, and Parliament.

Fig. 3: A photo widely circulated in local media showing a stack of counterfeit packaging materials linked to the smoke case (photo: Khaberni News)

Evading authorities, smuggling cigarettes out of the ZFZ

Mutee and his co-conspirators evaded customs by illegally altering inventory records and invoices, bribing officials, moving and hiding cigarette manufacturing supplies among companies within the ZFZ, and mislabeling products. Mutee went so far as to personally finance a fertilizer company in order to disguise smuggled tobacco as fertilizer.

The indictment also charges multiple Jordanian bureaucrats. Mutee regularly bribed the former head of Customs, Widah Al-Hamoud. In exchange, Al-Hamoud tipped off Mutee to any upcoming raids on his factories in the FZF or on his offices in Amman. Al-Hamoud also “facilitated the ease of smuggling cigarettes out of the FZF,” according to the indictment.

Mutee and his co-conspirators used secret compartments within personal or rental vehicles belonging to his employees to smuggle the cigarettes out of the production factories. They subsequently transferred the cigarettes to hidden compartments within differing types of trucks, including water tankers, to smuggle them out of the ZFZ.

Fig. 4: A common style of water tanker used throughout Jordan, similar to what Mutee may have used to smuggle cigarettes out of the ZFZ (photo: High Contrast / CC BY 3.0 DE)

Authorities close in on Mutee and his companies

The Jordanian Customs Anti-Smuggling Authority began investigating Mutee and his co-conspirators after the Authority’s director received a tip regarding a large amount of smuggled cigarettes available in the local economy.

They carried out raids on warehouses suspected of storing smuggled cigarettes. In August 2016, the Anti-Smuggling Authority seized a pick-up truck after it left a suspicious printing company. They found it loaded with counterfeit cigarettes marked with international branding, including Marlboro, Winston, and L&M.

By the fall, Jordan’s Minister of Finance approved the formation of a joint commission to investigate the factories producing tobacco products in the ZFZ. The commission found that one of the companies used in this scheme — Al-Nibal for International Investment — had irregularities in its claimed production totals of its tobacco products. Al-Nibal was heavily fined and the circumstances pushed Mutee to collaborate more often with Al-Hamoud to avoid detection.

By 2018 the authorities raided most of Mutee’s companies registered in either his or his co-conspirators’ names.

Mutee’s previously unnamed corporate network reaches Lebanon

There are 24 companies listed in the indictment. However, a quick search in Sayari Graph reveals previously unnamed companies affiliated with Mutee and his brother Bashar.

One company in particular stands out. According to Lebanese corporate records, Mutee is the 100 percent owner and director of a Lebanese company that specializes in importing and exporting car parts — East Cars. One of the Jordanian companies used in the smuggling operation specializes in trading vehicle parts. Considering Lebanon’s issues combating cigarette smuggling and Awni’s history of smuggling, it is possible that Mutee used East Cars to smuggle cigarettes internationally.