Table of Contents

Executive Summary

Financial institutions today are faced with a large and growing list of regulations and corporate responsibility requirements. In this rapidly evolving environment, anti-money laundering (AML), compliance, and investigative teams struggle to keep pace.

Effective Suspicious Activity Reports (SARs) are essential to the success of financial institutions and their compliance with Bank Secrecy Act (BSA) and AML requirements, serving as the front line of defense against illicit finance and a core element of compliance mandates. Today’s landscape has led to an increased volume of SAR filings submitted by financial institutions over the past few years. The challenge isn’t just in the sheer number of filings, but the lack of meaningful intelligence to inform the reports. Too often, SARs are filed based on transactional data alone, providing a limited, two-dimensional view of a complex issue. This leaves law enforcement with a flood of reports that are difficult to act on and can lead to missed opportunities to disrupt illicit activity.

This emphasis on quality aligns with the Treasury Department’s recent directive to modernize the BSA system, a change financial institutions have eagerly sought. As Under Secretary for Terrorism and Financial Intelligence John K. Hurley recently stated, the goal is to reform the SAR system by providing the government with the most useful information, “not by overwhelming the system with noise.”

The Under Secretary calls for prioritization because a weak SAR is a burden on all parties, wasting valuable time and resources for both the bank and law enforcement. Relying on a purely transactional approach to SARs is a recipe for alert fatigue and a failure to effectively combat financial crime.

Proactive financial institutions have the ability to transform the process of filing a SAR from a basic reporting requirement into a strategic opportunity. By integrating corporate and trade data, investigators can provide a compelling, evidence-backed narrative that empowers law enforcement to act decisively.

This ebook offers insight into how to leverage corporate and trade data to support clear-eyed analysis. It also details how organizations are using Sayari to provide the crucial context that makes their SARs more actionable and effective.

The Anatomy of a Powerful SAR

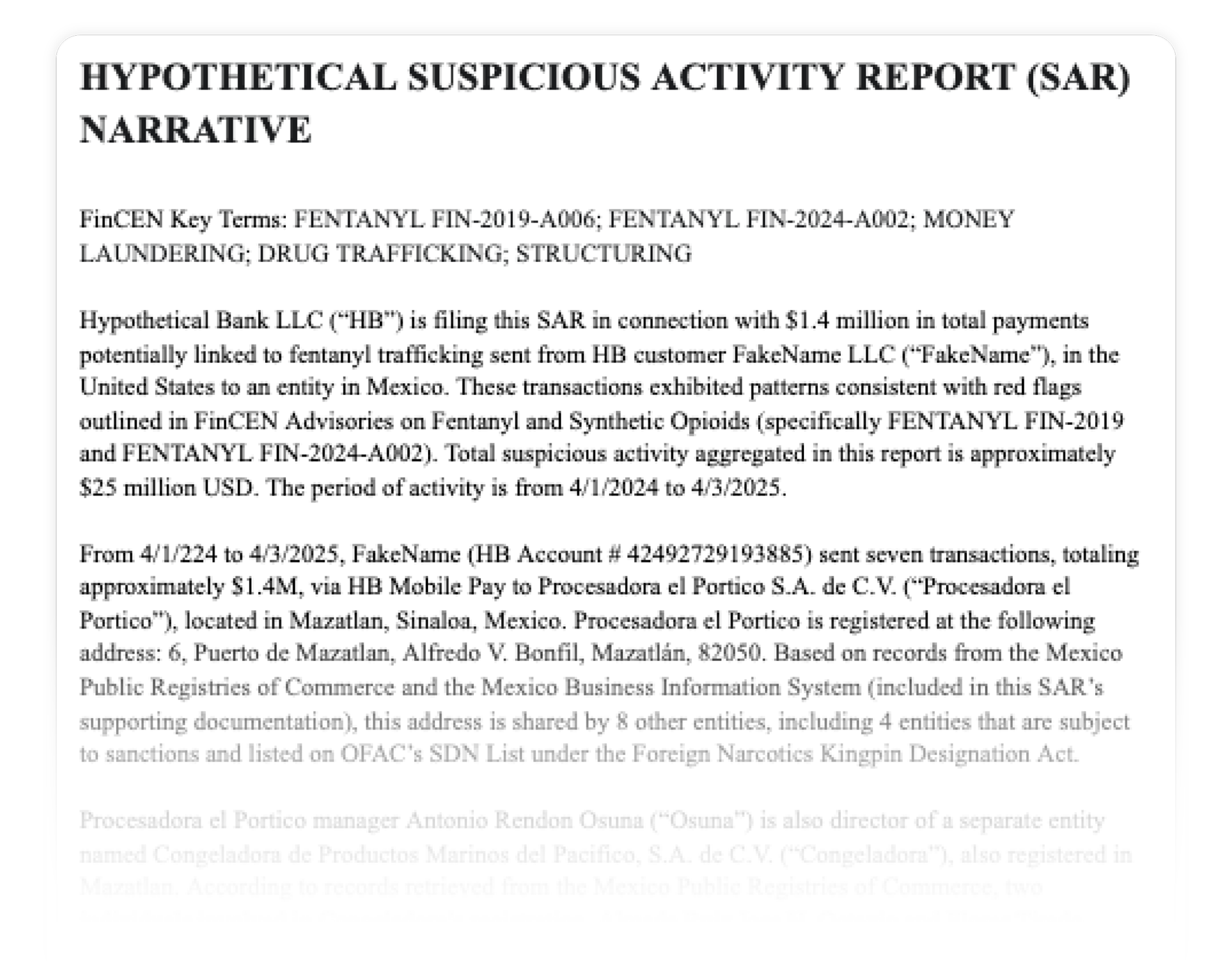

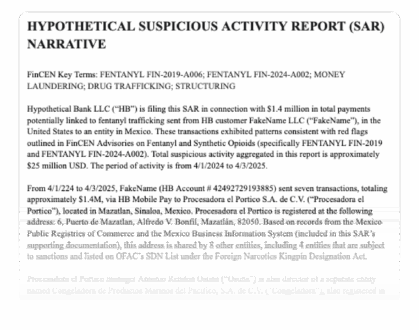

What separates an effective SAR from one that’s a mindless exercise in compliance? According to the Financial Crimes Enforcement Network (FinCEN), a narrative is what transforms data into a clear and compelling story for law enforcement. A powerful SAR is a critical piece of intelligence that can lead to successful investigations and prosecutions.

The SAR narrative is the only free-text section on the report and is considered its most vital component. It serves as a detailed description of the suspicious activity and provides the rationale behind the filing. A strong narrative uses clear, concise language, avoids internal jargon, and is written with a law enforcement audience in mind. It turns a collection of numbers into a coherent and actionable story.

To achieve this, every powerful SAR narrative rests on these core elements, as outlined by FinCEN guidance:

The 5 W’s (and one H):

- Who is the subject, including any known associates or related parties?

- What instruments or mechanisms are being used to facilitate the suspect transactions?

- When did the suspicious activity take place, and over what duration?

- Where did the activity occur, including any foreign jurisdictions involved?

- Why is this activity considered suspicious, including any patterns of suspicious activity?

- How was the activity conducted, detailing the method of operation?

The Supporting Evidence:

The narrative must be grounded in facts. A powerful SAR doesn’t just simply state that an entity is suspicious; it provides the specific documents that support that conclusion. This includes information readily available to the filing institution, such as account numbers, transaction amounts, and dates. It should also incorporate any external information that led to the filing, such as a news report or other public records, providing a clear citation or explanation for its inclusion.

The common gaps in traditional SARs are precisely what external data can fill. Without corporate and trade records, investigators cannot identify who the ultimate beneficial owners are, the legitimacy of trade transactions, or the true business purpose behind a shell company.

The Power of Context: How Sayari Adds Value to SARs

A SAR is a static document, with its strength limited to the data provided by the filing institution. This information, while essential, represents only a fraction of the full story. The true value of a SAR emerges when that transactional data is enriched with a broader understanding of the entities involved. Sayari provides the external context needed to transform a basic SAR into a comprehensive intelligence report, allowing for a confident assertion of risk and providing law enforcement with the rich, verifiable details needed to take action.

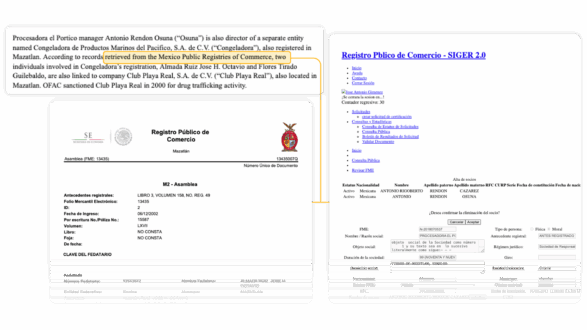

Corporate Records: Unmasking the Actors

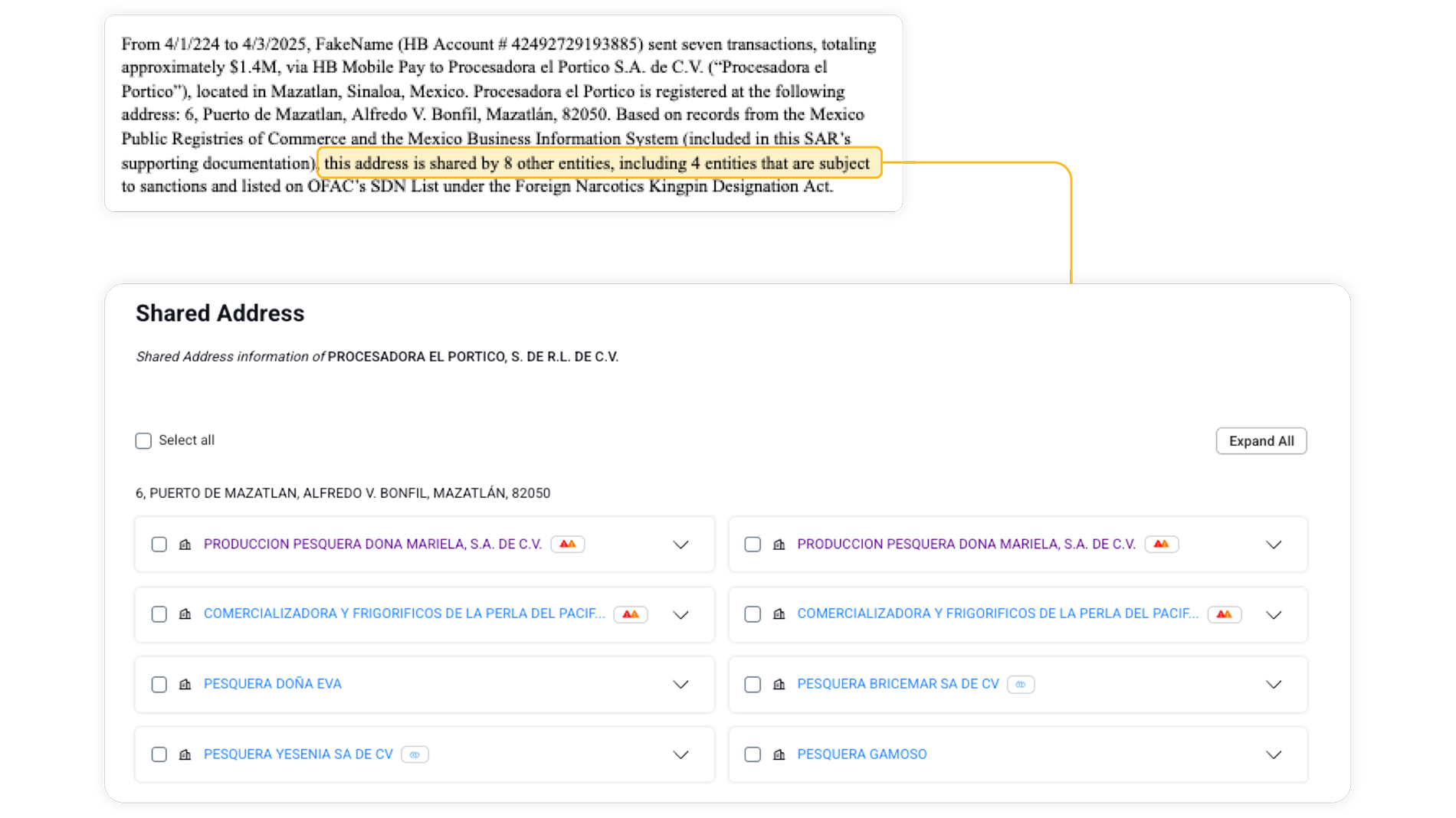

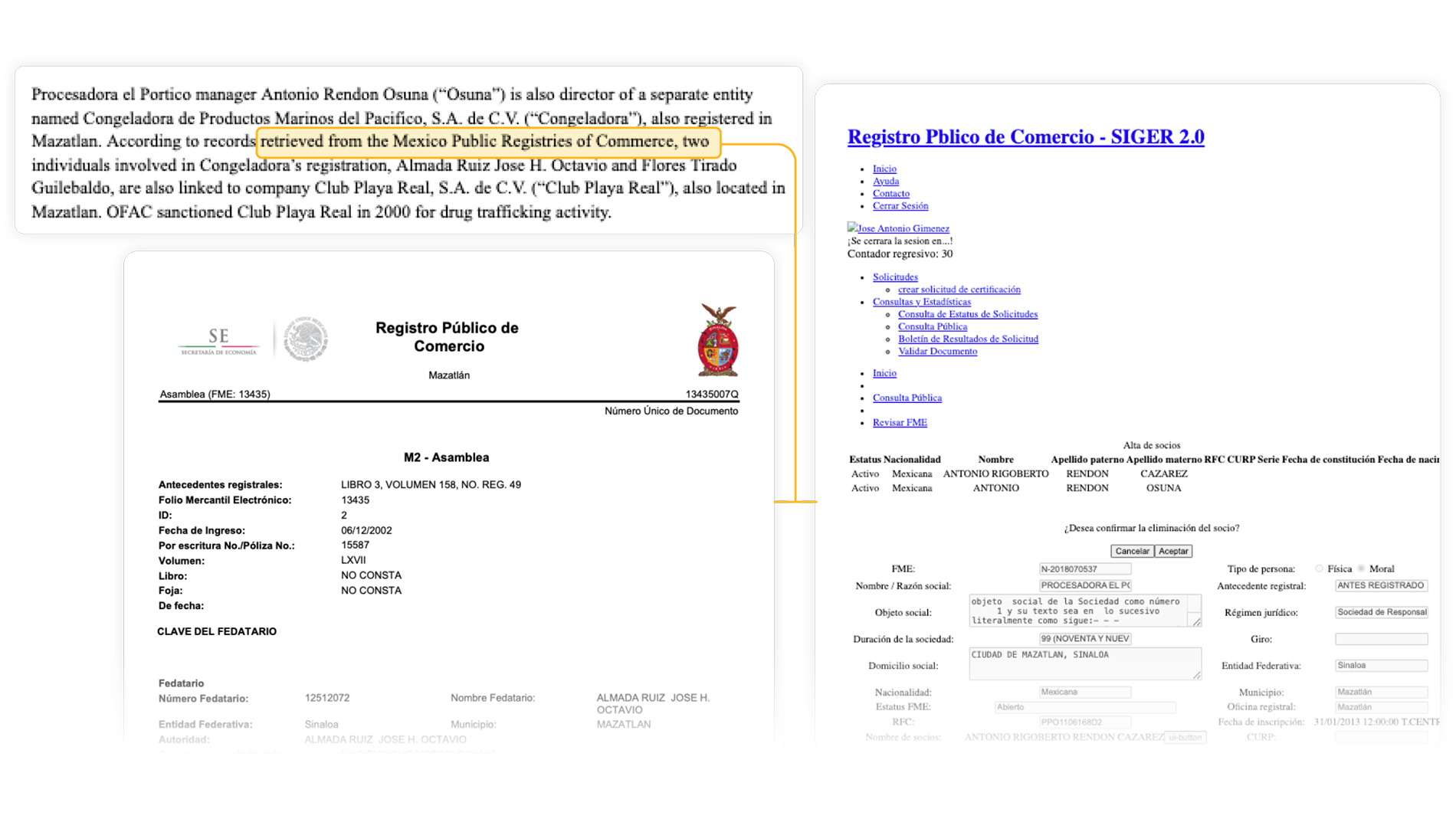

Financial crime networks are deliberately designed to conceal the individuals and relationships behind illicit activity. They rely on complex corporate structures, shell companies, and layers of directorship to obscure their true beneficial owners. Sayari’s corporate records directly combat this obfuscation by providing a clear view of global corporate networks.

With access to this data, analysts can:

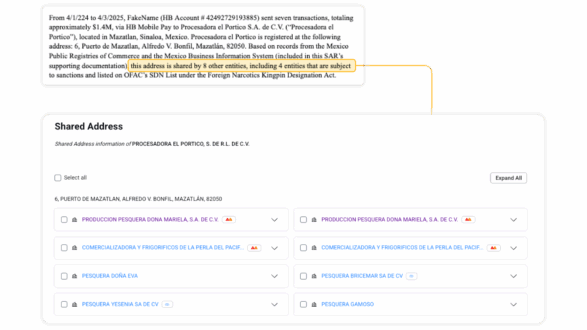

- Uncover Beneficial Ownership: Unmasking the ultimate beneficial owners behind a suspicious transaction is critical for understanding its true purpose. By combining global public data in a pre-computed graph database, Sayari enables analysts with the ability to automatically search across billions of public records to help illuminate where companies operate, and in turn, provide additional avenues to identify who ultimately owns or controls them.

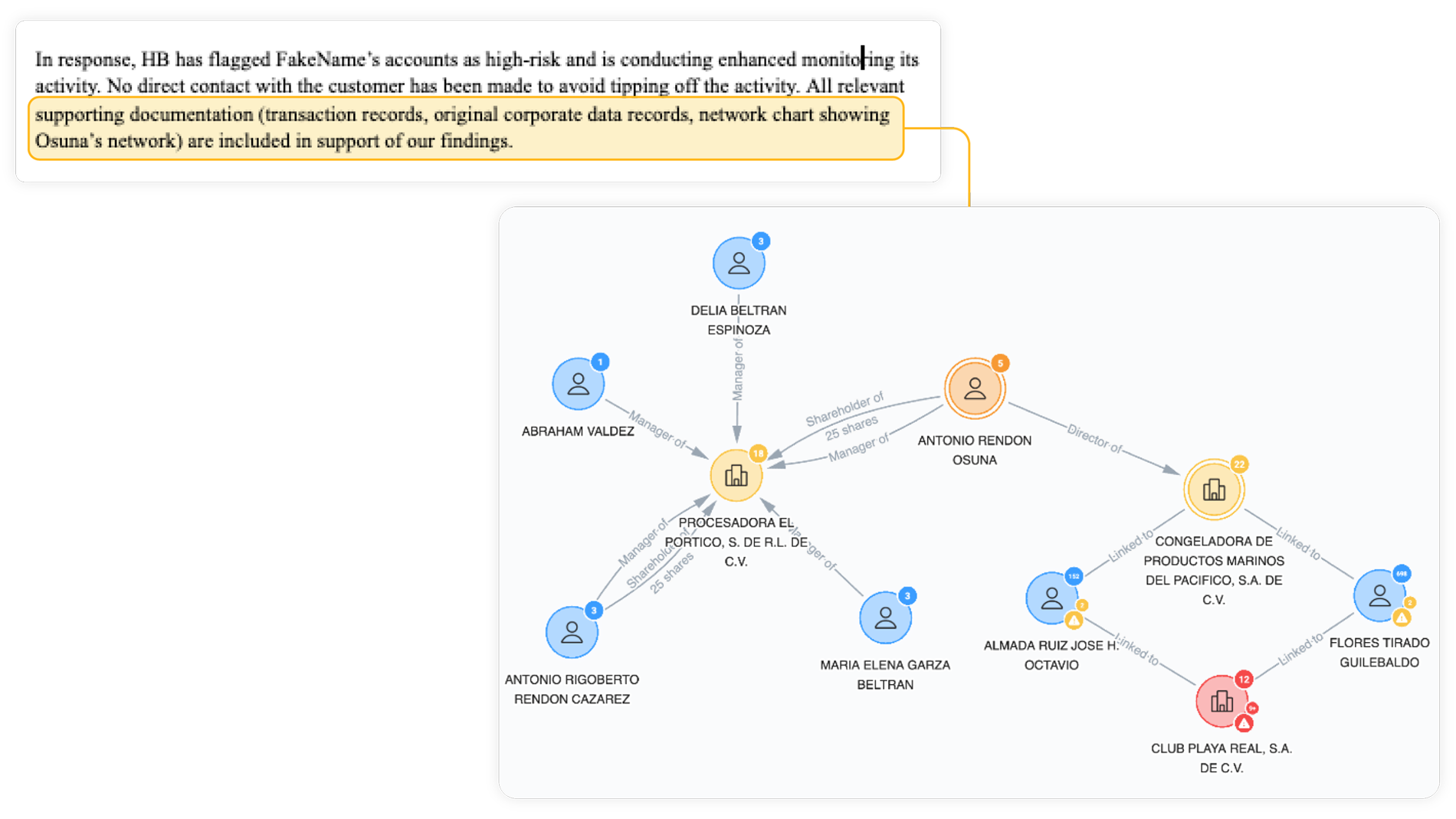

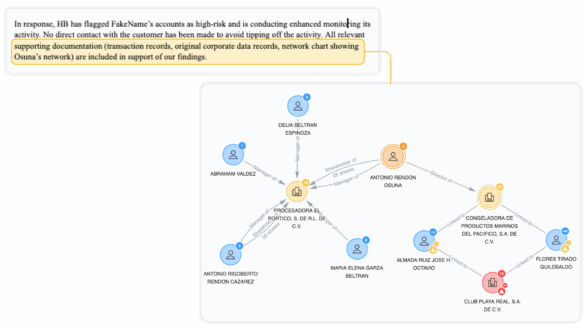

- Visualize Hidden Networks: Corporations, directors, and shareholders are often interconnected in ways that can suggest a coordinated illicit network. Sayari helps visualize these complex relationships, allowing analysts to trace connections and reveal associations that might otherwise go unnoticed.

- Identify Red Flags: A deeper look into corporate records can expose red flags, such as shell corporations with no legitimate business activity, politically exposed persons (PEPs), or companies registered in high-risk jurisdictions with opaque ownership laws.

Trade Records: Verifying the Transactions

Trade-based money laundering (TBML) is a growing threat. TBML is not only one of the most used, but also one of the most difficult to detect methods of money laundering, according to a report by the U.S. Treasury Department. Sayari’s trade records can provide documentation to help confirm or disprove the validity of a transaction if an analyst suspects that a customer or counterparty is engaged in illicit trade.

With global trade and maritime data, analysts can:

- Validate Commercial Activity: The reported activity can be verified against a company’s actual import and export history. This can expose fictitious transactions or over-invoiced and under-invoiced goods, all of which are common indicators of TBML.

- Detect Anomalies: Trade records can be used to find inconsistencies in a company’s declared business. For example, a company claiming to import electronics may in reality be trading in goods that are completely unrelated to its stated business purpose in an effort to evade detection.

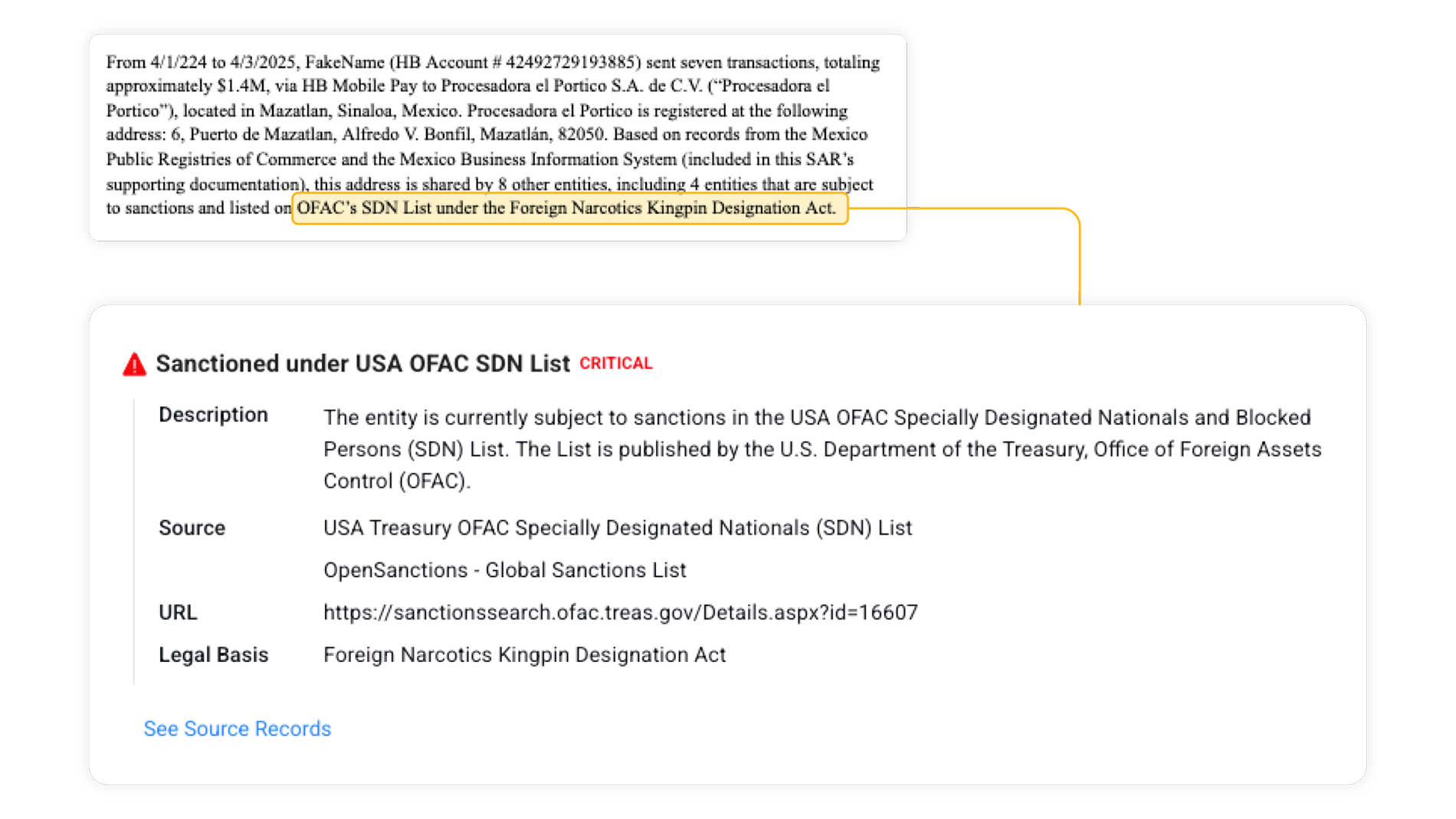

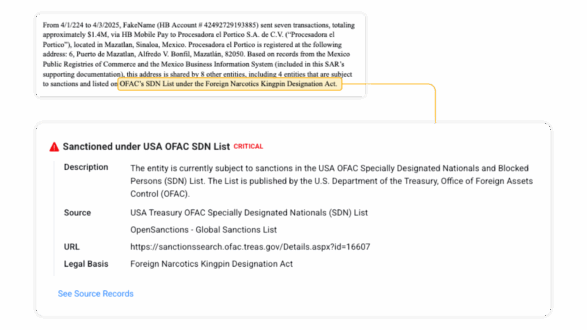

- Screen Against Sanctions: Trade data can be cross-referenced with sanctions lists to identify potential violations. A SAR is significantly strengthened when it can show that a suspicious transaction involved sanctioned entities with authoritative primary source documents.

Practical Application: Integrating Sayari into the SAR Workflow

The SAR filing process is often reactive; in most cases, it arises as a response to a red flag uncovered during standard due diligence. However, proactive risk intelligence can be integrated at every stage of the compliance lifecycle, either by detecting risk before a transaction alert is even generated or by transforming the post-alert investigation.

However, integrating a solution like Sayari allows a financial institution to transform the investigative phase from a rote data aggregation task into a proactive process driven by actionable risk intelligence.

The Proactive Filing Checklist

Before a SAR is submitted, a comprehensive workflow can be followed to ensure the report is as strong as possible. Once an alert has been triggered, the analyst can use a tool like Sayari to perform verification and enrichment of the report with data.

This checklist helps analysts take a proactive approach:

- Initial Alert Assessment: Review the original alert and the associated transaction data to identify the subject and the nature of the suspicion.

- Entity Resolution and Disambiguation: Use Sayari to search for the subject and any associated entities. Verify the identities of all parties involved to ensure they are not linked to a sanctioned list or known bad actors. Sayari’s sophisticated entity resolution minimizes false positives and ensures the focus is on the correct entities.

- Network Mapping: Trace corporate ownership and control to see if the subject is part of a larger network of related companies, directors, or shareholders. Look for any links to offshore jurisdictions or politically exposed persons (PEPs).

- Trade Data Cross-Reference: If the alert involves international trade, use Sayari to verify the legitimacy of the transactions and their relevant counterparties. Look for discrepancies in the types of goods being shipped, the destinations, or the declared value.

- Evidence Gathering: Collect authoritative source documents from Sayari to serve as supporting evidence. This includes corporate filings, trade records, and other publicly available documents. Sayari’s exportable visualizations can also be used to create clear diagrams of the relationships, which can be included as part of SAR supporting materials.

- SAR Narrative Enrichment: Use the newly gathered information to enrich the SAR narrative. The “why” behind the suspicious activity is now supported by verifiable facts, making the report far more compelling and actionable for law enforcement.

The Actual Impact of Enhanced SARs

The true value of a streamlined and data-driven SAR workflow extends far beyond simple regulatory compliance. By leveraging external data to build more comprehensive and actionable reports, banks create a positive feedback loop that benefits all stakeholders, from the compliance team to law enforcement and the wider financial system.

For the Financial Institution:

Moving from a reactive, transactional approach to a proactive, intelligence-based one fundamentally changes an institution’s risk posture.

- Increased Confidence: Analysts can file SARs with a higher degree of certainty and a stronger evidentiary basis to reduce ambiguity and demonstrate a sophisticated approach to due diligence.

- Improved Efficiency: By prioritizing access to external data sources, the time spent on manual research is drastically reduced. This allows financial crime teams to more confidently determine when to file a SAR and how to do so with greater speed, mitigating alert fatigue and improving overall productivity.

- Regulatory Compliance and Reputation: Submitting high-quality, actionable SARs is a powerful demonstration of a robust AML and due diligence program. This not only satisfies regulatory obligations but also enhances the institution’s reputation as a leader in the fight against financial crime.

For Law Enforcement:

For the end user of the SAR, the quality of the report directly correlates with its utility. A SAR enhanced with external context accelerates the speed and effectiveness of law enforcement investigations.

- Actionable Intelligence: Providing investigators with a complete and well-supported narrative saves them valuable time and resources. Rather than having to piece together fragmented data, they can immediately prioritize and act on the report.

- Higher Quality Leads: The inclusion of verifiable public records, counterparty mapping, and other contextual data transforms a SAR from a standard alert into a credible and well-developed lead. This increases the likelihood of a successful follow-up investigation.

- Successful Investigations: By providing a stronger evidentiary basis from the outset, enhanced SARs directly contribute to the successful identification of financial criminals, leading to successful enforcement actions and aiding in the disruption and dismantling of sophisticated illicit networks.

Conclusion

Financial crime is evolving, so the tools used to combat it must evolve as well. For too long, the SAR has been viewed as a document that often lacks detail. Proactive financial teams know that SARs aren’t just a box to be checked, but a powerful tool for intelligence sharing. However, the effective use of a solution like Sayari sets a new standard for the kind of reporting that effectively supports anti-money laundering and counter-terrorist financing efforts.

By moving beyond the limitations of transactional data and embracing a proactive approach, financial institutions can transform their SAR process. The integration of Sayari’s 9 billion and growing global corporate and trade records enables teams to build more complete, data-rich cases. These reports go far beyond regulatory requirements to fundamentally change how financial crime is fought.

Ultimately, financial institutions and law enforcement share a goal to protect the integrity of the global financial system. Enhanced SARs, powered by the right data, provide law enforcement with the actionable intelligence needed to dismantle illicit networks. This helps protect institutions from risk and also ensures that the global financial system remains a place for legitimate commerce. The future of financial crime fighting lies in context, confidence, and collaboration – and begins with a stronger SAR.