Financial Crime

Accelerate Cross-Border Investigations Into Illicit Financial Activity

Features

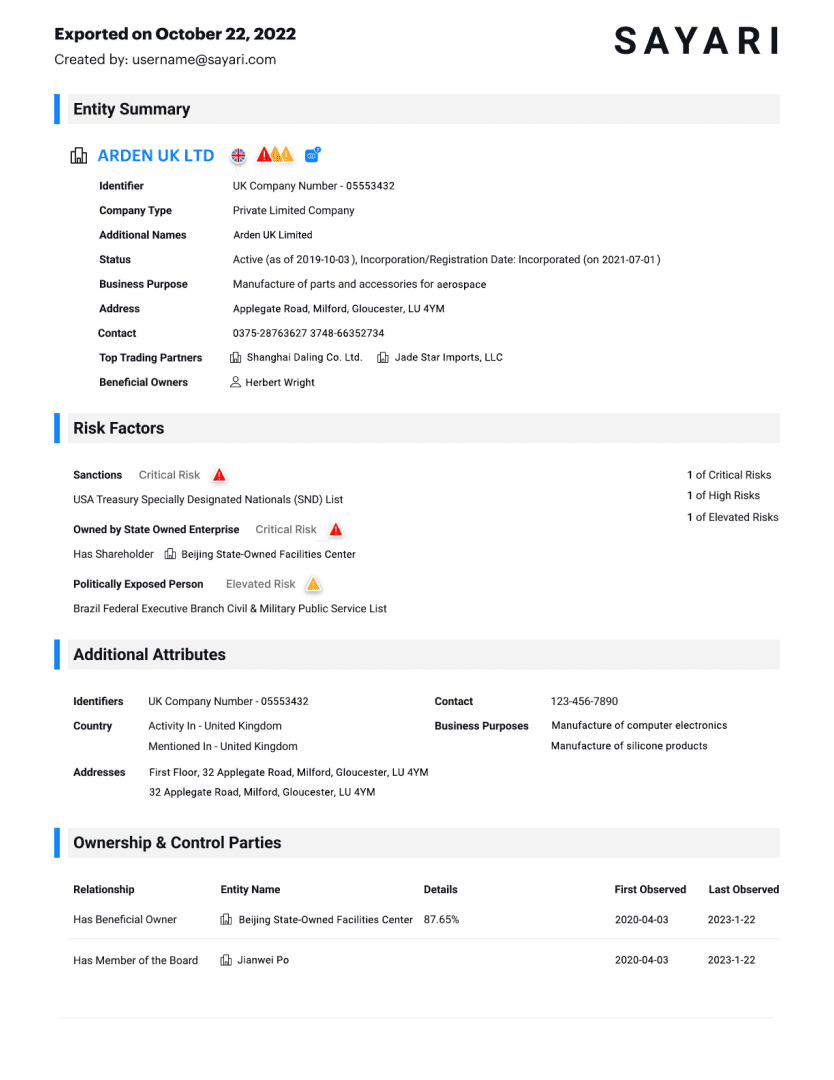

Global sanctions and watchlists

Access enriched sanctions and watchlists with >50% owned subsidiaries, joint ventures, business and trade partners, and more.

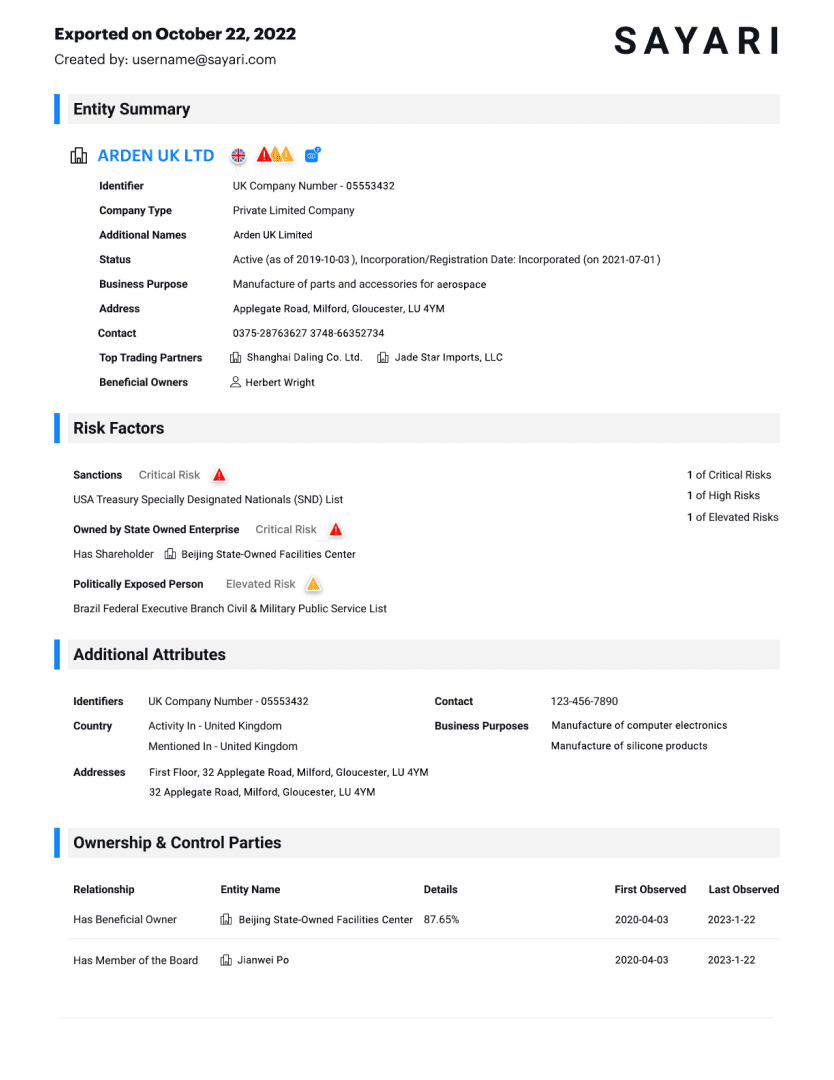

Detailed company profiles

Speed up investigations with company profiles consolidated from 645+ corporate and trade data sources and 350+ international watchlists.

Batch upload and screening

Upload customer or counterparty lists and screen them for hidden compliance, business, and reputational risks within seconds.

Built-in data provenance

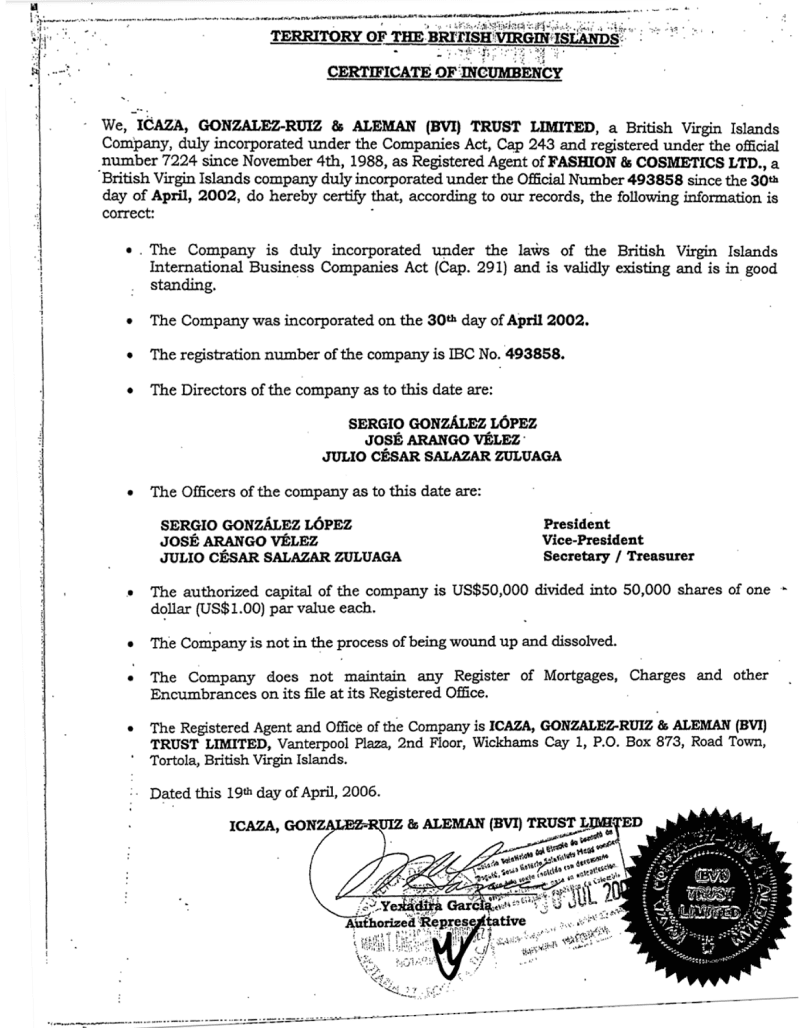

Access reliable public record source documents needed for SARs and other reporting from directly within the platform.

Investigations

Respond to even the most complex alerts and investigation requests with speed and confidence.

Speed up investigations with entity profiles consolidated from 645+ global corporate and trade data sources.

Trace nested ownership and control across borders and into offshore jurisdictions using authoritative public records.

Access source documents needed for reporting from directly within the platform.

Tailor searches to your exact requirements with basic and advanced searching and fully customizable filters.

Enhanced Due Diligence

Conduct enhanced due diligence on high-risk customers quickly and effectively, even where business operations and investments cross borders.

Drive effective EDD at scale with more than 450 corporate data sources and 350 international sanctions and watchlists

Trace nested ownership and control across borders and through offshore jurisdictions using authoritative public records

Tailor searches to your exact requirements with basic and advanced searching and fully customizable filters

Sanctions

Protect your institution from direct and indirect sanctions exposure with Sayari, trusted by regulators including the U.S. Department of the Treasury.

Access enriched global sanctions lists with identifying information, majority-owned subsidiaries, corporate structures, trading partners, and more

Quickly uncover hidden risk with proprietary risk indicators targeting not only sanctions lists but also indirect exposure via nested ownership

Enrich suspicious activity reports with authoritative primary source documents and exportable visualizations

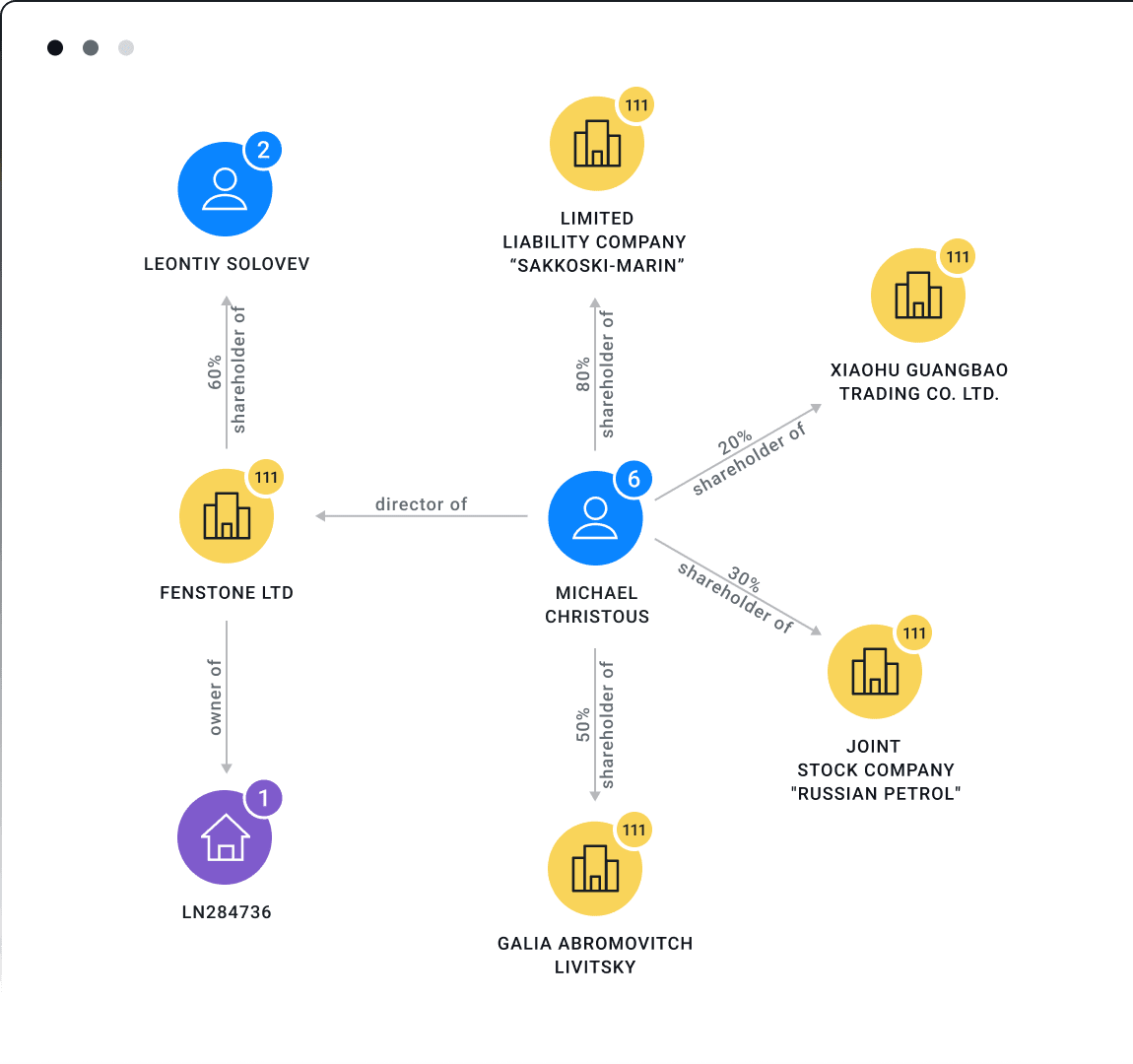

Financial Intelligence

Report more effectively on suspicious activity and complex threads in financial crime priority areas, per guidance from the FATF and the Wolfsberg Group.

Access comprehensive beneficial ownership information from even hard-target jurisdictions like China, Mexico, Russia, and offshores

Drive cross-border network discovery and investigations with robust graph analytics and visualizations

Enrich suspicious activity reports with authoritative primary source documents accessible within the platform

Sayari Also Supports

Trusted by the Regulators & the Regulated

Sayari helps reduce systemic risk by prioritizing transparency, giving organizations more power to protect the people, businesses, and nations they serve.

“We have really come to rely on Sayari as a foundational resource. […] The indictment listed the shell companies, but when we put them in Sayari we found connections to 15-20 more companies, which we then used to better identify [the bank’s] exposure to this risk. We wouldn’t have found this without Sayari.”

Ensure Compliance with Comprehensive Risk Intelligence

Harness authoritative public records efficiently and effectively. Get a trial of Sayari to find out how your organization can conduct investigations that yield results.