These findings demonstrate the importance of examining the broader corporate networks of companies accused of manufacturing and exporting counterfeit goods to mitigate supply chain risk.

U.S. Authorities Target Chinese Paper Company

In June, U.S. federal prosecutors filed a complaint against King Year Paper and Packaging Co. Ltd. for allegedly manufacturing and exporting 495,200 counterfeit N95 face masks to the United States.

King Year allegedly used forged approval forms from the Food and Drug Administration to show that its masks had been certified. They also labeled the masks as “NIOSH-approved” even though they did not meet NIOSH’s standards, according to the complaint.

King Year, which was incorporated in 2012, has exported goods to the U.S. before. Between 2015 and 2018, the most recent year that trade data is available for China, the company sent 15 shipments to the United States, according to commercial trade data provided by Panjiva. The shipments included printed paper goods, toys, and ceramics.

The King Year case is indicative of a broader trend witnessed by U.S. authorities in recent months, namely, the high volume of counterfeit Covid-19-related goods sourced from China. Homeland Security Investigations, an arm of U.S. Immigrations and Customs Enforcement, has reported that about half of the counterfeit Covid-19 goods that have arrived in the U.S. came from China.

The Hong Kong Connection

King Year is owned by three individuals: Sun Haitao, Wu Ruowen, and Xu Zhaohui, according to Chinese corporate records. These three individuals are also linked to other companies involved in a variety of industries that have previously exported to the United States.

An individual named Sun Haitao was also the founding director and sole shareholder of a Hong Kong-registered company named King Year Printing and Packaging (Hong Kong) Co. Ltd. King Year Hong Kong was registered almost a year and a half before King Year China was incorporated.

There are a variety of reasons why a business owner would register a company in both Hong Kong and mainland China. Lax regulations in Hong Kong give some businesses financial incentives to maintain an office there. Mainland Chinese companies may also use Hong Kong companies as fronts to receive payments and pass on orders to a factory on the mainland.

Commercial trade data show that King Year Hong Kong has also exported to the United States. Between 2015 and 2018, the company sent 53 shipments to the U.S., which also included printed paper goods, toys, and ceramics.

In May 2020, an individual named Wu Yingluan replaced Sun Haitao as the director of the Hong Kong-based King Year. Both Wu and Sun’s names appear in association with another, related group of manufacturers — the Shenzhen Jiaxinda Group.

King Year China and the Shenzhen Jiaxinda Group

King Year China reports on its website that it’s part of the “Shenzhen Jiaxinda Group.” The website does not specify King Year’s exact relationship with the group. However, we found several companies with the Jiaxinda name operating in a variety of industries that have shareholders and directors named Sun Haitao and Wu Yingluan. The multiple name matches along with the purported relationship between King Year and the Jiaxinda Group suggest that these are the same individuals as the Sun Haitao and Wu Yingluan linked to King Year.

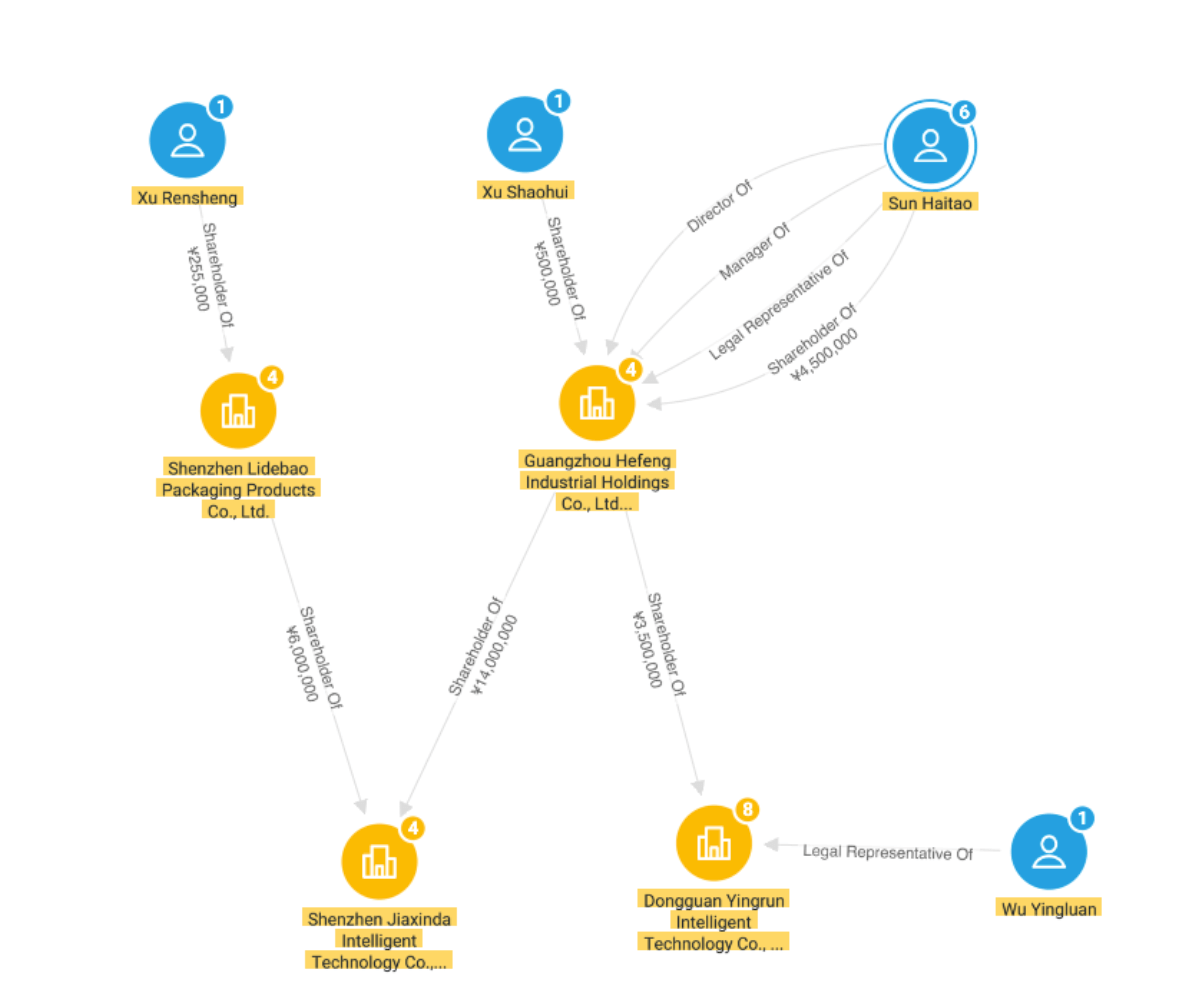

One of those companies is Shenzhen Jiaxinda Intelligent Technology Co. Ltd. The company’s 70 percent shareholder is Guangzhou Hefeng Industrial Holdings Co. Ltd., which in turn lists Sun Haitao as its 95 percent shareholder. Sun Haitao is thus the ultimate beneficial owner of Shenzhen Jiaxinda Intelligent Technology.

Guangzhou Hefeng is also a shareholder of another tech company, Dongguan Intelligent Technology, whose legal representative is Wu Yingluan — the current director of King Year Hong Kong.

Fig. 1: Sayari Graph snapshot showing part of the Shenzhen Jiaxinda Intelligence Technology Co. Ltd. corporate network.

Companies linked to the Jiaxinda Group are involved in various sectors beyond technology, including paper and packaging, the same industry as King Year. Sun Haitao, the owner of King Year, also previously served as the shareholder of a now-defunct paper and printing company linked to the Shenzhen Jiaxinda group.

King Year’s links to its Hong Kong counterpart and the Jiaxinda companies highlight the complexity of Chinese corporate networks, particularly those with alleged illicit operations. For due diligence, these broader corporate networks must be taken into account to mitigate the risk of counterfeiting in a supply chain.