Garcia Luna has been indicted in the U.S. for drug trafficking and accused of accepting bribes from Mexico’s Sinaloa Cartel. His arrest and indictment reach the highest echelons of the Mexican government and is among the most high-profile cases for U.S. authorities in recent years.

The identification of a luxury real estate asset in Texas directly linked to Jonathan Alexis Weinberg Pinto — a known associate of Garcia Luna — via a Delaware-registered shell company, may provide additional leads to track down proceeds that were ultimately derived from alleged bribe payments.

U.S. federal agents arrest Genaro Garcia Luna in Texas

In December 2019, U.S. federal agents arrested Mexico’s former Secretary of Public Security Genaro Garcia Luna, charging him with drug trafficking-related crimes and making false statements. A superseding indictment filed in July 2020 tacked on an additional charge; “engaging in a continuing criminal enterprise.”

Between 2001 and 2012, “while occupying high-ranking law enforcement positions in the Mexican government, Garcia Luna received millions of dollars in bribes from the Sinaloa Cartel in exchange for providing protection for its drug trafficking activities,” according to a Department of Justice (DOJ) press release. Garcia Luna served as Mexico’s secretary of public security from 2006 to 2012.

Since the U.S. indictment in 2019, two additional criminal complaints have been filed with Mexico’s Attorney General’s Office (Fiscalía General de la República, FGR), accusing Garcia Luna of money laundering and corruption.

Garcia Luna’s private sector associates

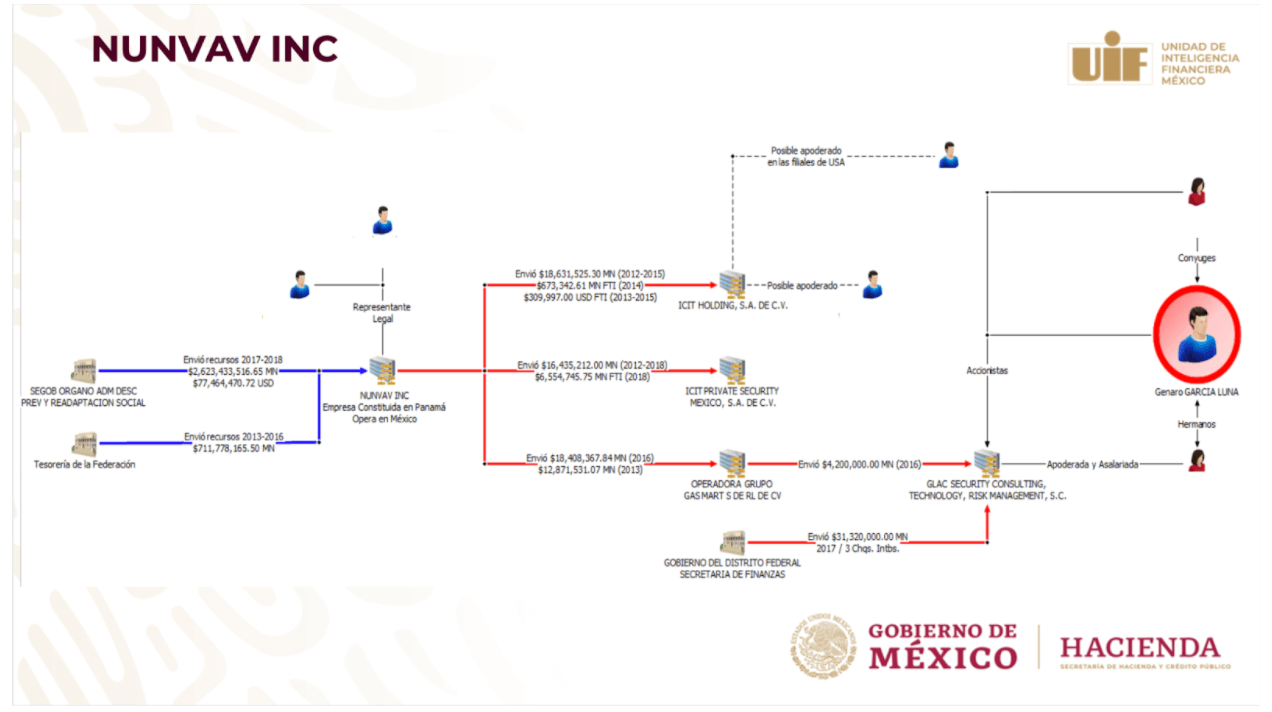

Shortly after Garcia Luna’s arrest in Texas, Mexico’s financial intelligence unit (Unidad de Inteligencia Financiera, UIF) filed their own complaint, alleging that Garcia Luna, along with associates Mauricio Samuel Weinberg Lopez (Samuel Weinberg), Jonathan Alexis Weinberg Pinto (Jonathan Weinberg), and Natan Wancier, among others, created a network of front companies to move upwards of $50 million through accounts in 11 countries, according to Univision.

The UIF asserts that some of these proceeds may have been derived from bribes paid by organized crime groups to Garcia Luna.

Samuel Weinberg, and his son Jonathan, have long operated in Mexico’s private security space, both as Mexico-based representatives of Israeli firms selling high-tech surveillance equipment to foreign governments, and as businessmen of their own. However, over the years, the two cultivated a close corporate relationship with Garcia Luna’s family.

At the center of the alleged laundering network are two security firms controlled by the Weinbergs and their associate Natan Wancier — ICIT and Nunvav. Throughout the course of its investigation, Mexico’s UIF found that companies in the network deposited more than $200 million into the Mexican financial system, according to the UIF complaint reviewed by Univision.

While some of these deposits appear to have been derived from payments made by Mexican federal entities, the UIF alleges that others came from an “unknown origin” and may have been the result of bribe payments made to Garcia Luna.

Between 2013 and 2017, Nunvav Inc, received over $104 million from Mexico’s Interior Ministry (Secretaría de Gobernación). And between 2013-2016, the company received over $34 million from Mexico’s federal treasury (Tesorería de la Federación).

Nunvav would then go on to transfer funds to accounts in various countries, along with two additional security companies controlled by the Weinbergs — Icit Private Security Mexico, S.A. de C.V. and Icit Holding S.A. de C.V., according to the UIF.

Icit Private Security Mexico, for its part, purportedly transferred a portion of the funds to a Sinaloa-based company called Operadora Grupo Gas Mart S de R.L. de C.V. This company, in turn, transferred funds to a company ultimately owned by Garcia Luna in Mexico

Fig 1: A network chart from Mexico’s UIF depicting money transfers from Mexican federal entities to companies associated with Natan Wancier, Samuel Weinberg, Jonathan Weinberg, and Genaro Garcia Luna.

The Weinbergs’ expansive U.S. corporate network

Both Samuel and Jonathan Weinberg have registered scores of companies in the U.S., Mexico, and Panama over the years. These companies have been involved in various business pursuits, including serving as corporate vehicles to purchase a number of luxury real estate assets.

Some of these properties appear to have been purchased for explicit use by Garcia Luna, raising serious questions as to who the ultimate beneficiary of the properties is. In October 2012, a Florida-registered company called 274 SIGB LLC, purchased real estate valued at over $3 million dollars in Golden Beach, Florida. 274 SIGB LLC was owned by a Panamanian company called NOA S.A., whose president is Natan Wancier, according to an investigation by C4ADS, a Washington D.C.-based organization that studies transnational security issues.

Shortly after Garcia Luna’s tenure as secretary of public security ended, and four months after SIGB LLC purchased the property, Garcia Luna moved his family into the mansion in Golden Beach, according to a 2019 report by Univision. In an interview with Univision in March 2019, Jonathan Weinberg claimed that the house was rented to Garcia Luna and his family.

From 2016 to 2018, Garcia Luna and his family lived in a second property that formed part of the Weinberg family’s South Florida portfolio, valued at $2.3 million.

Garcia Luna himself is directly linked to an additional six properties via two companies for which he previously served as the Manager — Delta Integrator LLC and GL & Associates Consulting LLC.

The Weinbergs and Grupo Arhe

According to Mexico’s UIF, Sinaloa-based Operadora Grupo Gas Mart S de R.L. de C.V. was one of the companies that allegedly served as a conduit to move money ultimately destined to Garcia Luna.

Operadora Grupo Gas Mart forms part of a large Sinaloa-based conglomerate operating in various industries called Grupo Arhe. Grupo Arhe is overseen by two Sinaloan brothers named Juan José and Erick Arellano Hernández. The brothers, having started their business ventures in 2005, have built a corporate empire that comprises over 100 companies, operating in everything from hotel investments and construction firms to financial consultancies and gas stations, according to a recent two-part investigation published jointly by Mexican news outlets Quinto Elemento and RioDoce.

The Arellano Hernandez brothers’ quick rise did not come unnoticed. In 2015, Mexico’s UIF began investigating unusual transactions related to a company connected to Juan José and Erick. And in 2016, the UIF blocked the bank accounts of 116 individuals and companies connected to the Arellano Hernandez brothers, and presented a criminal complaint to Mexico’s Attorney General’s Office (formerly known as the Procuraduría General de la República, PGR) for money laundering.

Both the blocking of bank accounts and complaint were based on a 527 page report by the UIF detailing the irrational business activities and financial transactions carried out by Grupo Arhe, according to the Quinto Elemento/Rio Doce report.

However, not only are the Arellano Hernandez brothers linked to Garcia Luna via the alleged role of Operadora Grupo Gas Mart in moving money ultimately destined for Garcia Luna; at least one company that falls within the Grupo Arhe conglomerate was previously connected to Jonathan Weinberg.

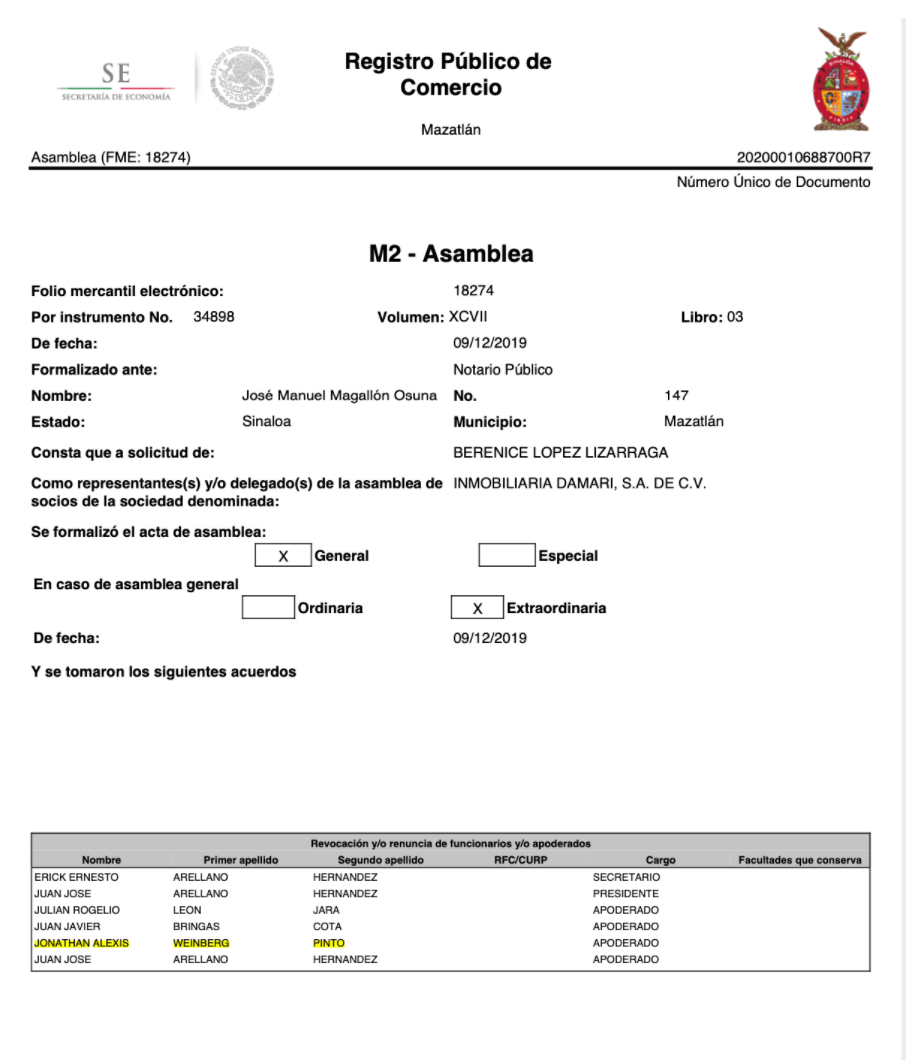

Weinberg appears in a Dec. 9, 2019 corporate filing for a Sinaloa-based investment company called Inmobliaria Damari, S.A. de C.V. The document shows Jonathan Weinberg — along with several additional related parties that also previously appeared as related parties for Operadora Grupo Gas Mart — being removed as an apoderado, an individual with power of attorney. This occurred on the same day that Garcia Luna was arrested by U.S. federal agents in Texas.

Fig. 2: Corporate filing from Mexico’s Public Registry of Commerce (Registro Público de Comercio) for Inmobiliaria Damari S.A. de C.V., showing Jonathan Alexis Weinberg Pinto — a known associate of Genaro Garcia Luna — being removed as an apoderado (an individual with power attorney).

While the corporate filings highlight when Weinberg had his power of attorney removed, it is unclear when he was first given those privileges.

Additionally, the same filing lists Erick and Juan José Arellano Hernández as being removed from the board of directors as secretary and president, respectively. However, at the time, the company was ultimately owned by the Arellano Hernández brothers via Erick and the brothers’ mother.

As of November 2020, the Arellano Hernández brothers had transferred majority ownership of Inmobiliaria Damari to Joaquin Antonio Perusquia Corres, a Sinaloa-based businessman and former spouse of Monica Guadalupe Weinberg Pinto, the sister of Jonathan Weinberg, according to corporate records from Mexico’s Public Registry of Commerce.

Jonathan Weinberg has also been linked to the purchase of real property in Mexico via Inmobiliaria Damari. In August 2017, Weinberg applied to formalize a real estate transaction in Cancún for a residential property valued at $950,000. The purchaser of the property was listed as Inmobiliaria Damari, according to the UIF investigation into Garcia Luna and reported by Quinto Elemento and RioDoce.

The UIF pointed out that Jonathan Weinberg’s role in applying to formalize the transaction was unusual, given that he was neither the buyer nor seller in the transaction.

Inmobiliaria Damari in the U.S.

Jonathan Weinberg is also connected to a U.S.-based company that shares a name with Inmobiliaria Damari.

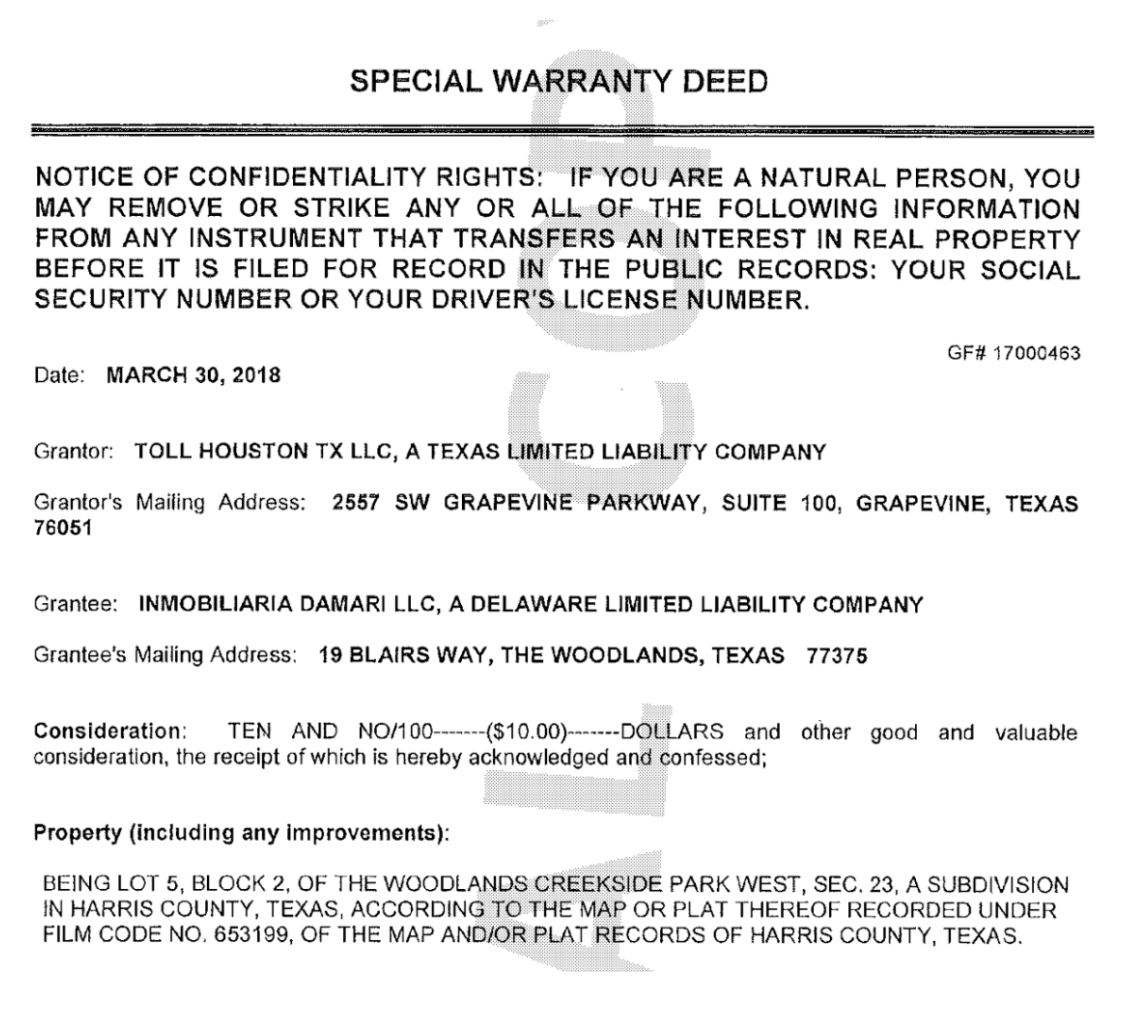

In January 2016, a company called Inmobiliaria Damari LLC was registered in Delaware. On March 30, 2018, the company purchased real property at 19 Blairs Way, The Woodlands, Texas for an undisclosed amount. The 2018 estimated market value of the property — which included a close to 7,000 square foot house — was just over $992,000, according to third-party real estate aggregators.

At the time of sale, an individual by the name of Jorge Allec Blanco was listed as the manager of Inmobiliaria Damari LLC. Jorge Allec is the brother of Raquel Allec Blanco, who, in turn, is married to Jonathan Weinberg.

Fig. 3: Top: Special Warranty Deed for the sale of property at 19 Blairs Way, The Woodlands, Texas between Toll Houston TX LLC and Inmobiliaria Damari LLC. Bottom: A Notice to Purchasers of Real Property Document for the sale of property between Toll Houston TX LLC and Inmobiliaria Damari LLC, showing Jorge Allec Blanco, the brother-in-law of Jonathan Weinberg, as the manager of Inmobiliaria Damari.

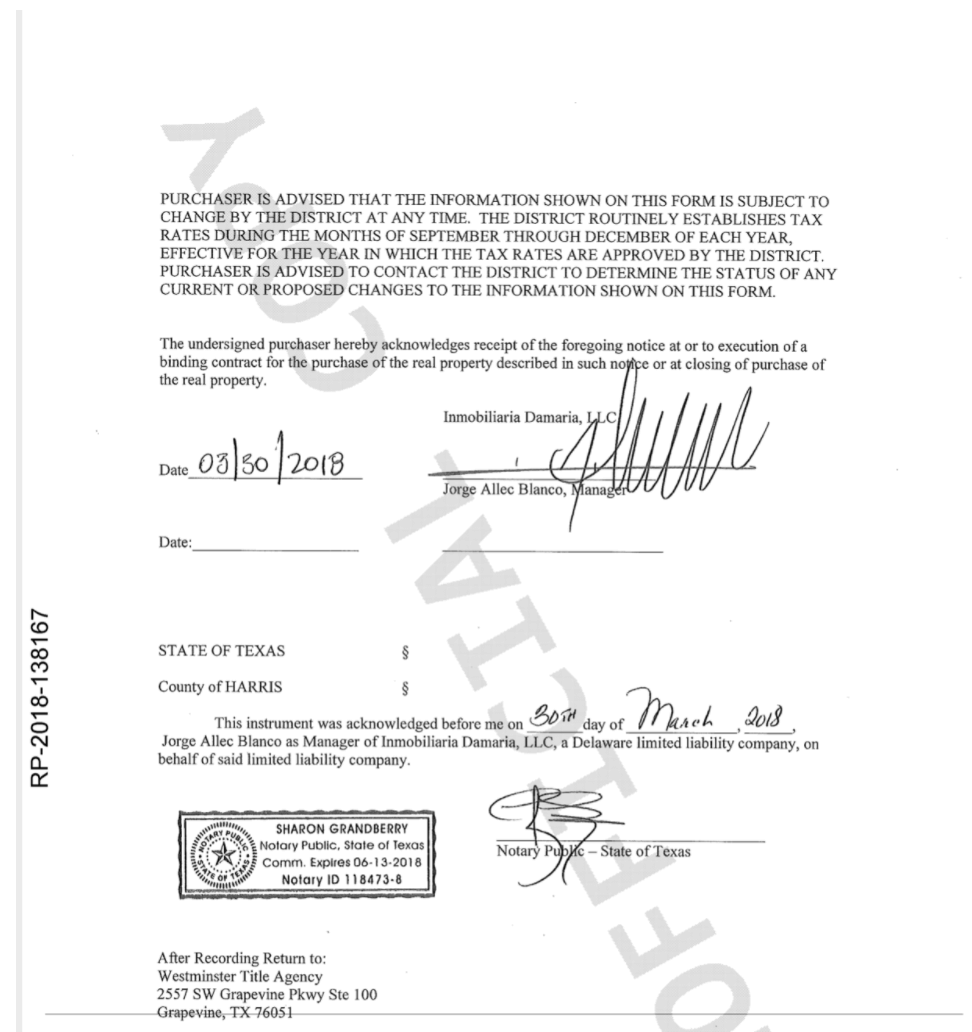

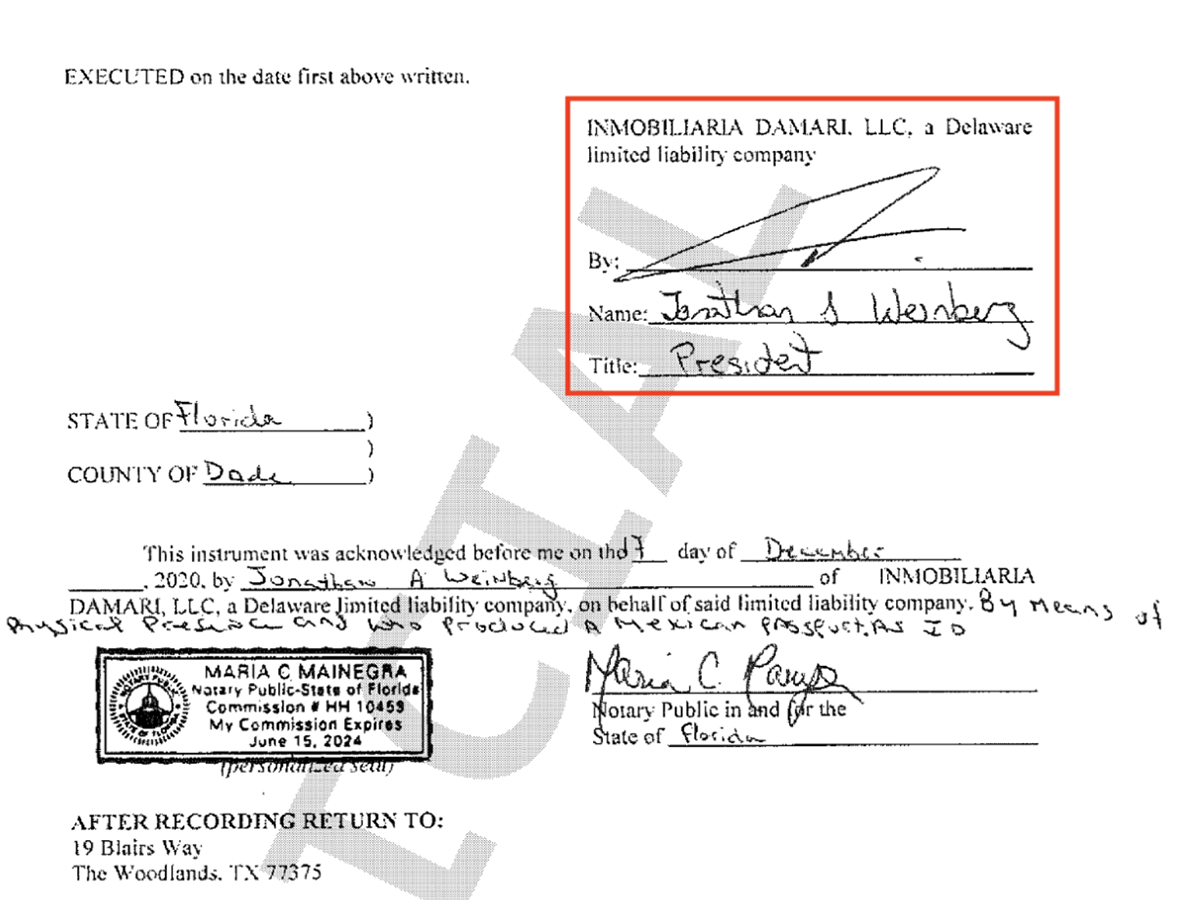

The property was later sold on December 17, 2020 for close to $1.6 million, according to Nino Properties, a Houston-based property management firm. A warranty deed with vendor’s lien document dated December 17, 2020 for the sale of property, lists Jonathan Weinberg as the president of Inmobiliaria Damari LLC.

Fig. 4: A Warranty Deed with Vendor’s Lien document dated December 17, 2020 for the sale of property at 19 Blairs Way, The Woodlands, Texas. The document lists Jonathan Weinberg as the president of Inmobiliaria Damari LLC.

While there is no evidence to suggest that illicit proceeds were used to purchase the luxury property in The Woodlands, at least two factors raise questions as to the possible links between the purchase and sale of the property, and Garcia Luna.

First, the Delaware shell company used to purchase the property in 2018 has the same name as the Sinaloa-based real estate investment company — Inmobiliaria Damari S.A. de C.V. — for which Jonathan Weinberg previously served as an apoderado.

Second, as previously stated, Inmobiliaria Damari S.A. de C.V. is linked — via several shared related parties — to Operadora Grupo Gas Mart, the Sinaloa company that Mexico’s UIF alleges to have funneled money ultimately destined to Garcia Luna.

More broadly, the use of Delaware-registered shell companies in holding real estate assets appears to be a hallmark of the Weinberg family’s investment portfolio. At least six companies registered in Delaware linked to the Weinbergs currently or previously owned a combined total of 14 properties in Miami-Dade County according to county property records

Follow the associates

Garcia Luna’s trial in New York is scheduled to begin on August 25, and has the potential to provide a window into the inner-workings of cartel-related corruption at the highest ranks of the Mexican government.

While several of Garcia Luna’s closest associates, such as Samuel and Jonathan Weinberg, have not been publicly charged with any crimes, their corporate relationships with Garcia Luna as outlined by various news reports and Mexican government documents raise serious questions as to their role in potentially facilitating the movement of bribe payments.

Real estate assets linked to the Weinbergs — some of which may remain anonymous via corporate vehicles registered in secrecy jurisdictions such as Delaware — could provide additional leads to uncover the proceeds of bribe payments ultimately destined for Garcia Luna.