Bahrain’s High Criminal Court charged three bank officials last week to five years in prison, respectively, for their involvement in a money laundering case tied to the Central Bank of Iran and other Iranian banks, according to the Bahrain News Agency. The Court also issued individual fines of $1 million to several Iranian banks and ordered the seizure of $13 million in illegal money transfers.

Future Bank’s money laundering scheme

This sentencing is the latest in a series of money laundering cases related to the investigation of Iranian-owned Future Bank, which currently faces $47 million in fines.

Investigations began after Bahraini regulators formally closed the Manama-based bank in 2016 because of money laundering allegations. In response to Future Bank’s closure, Iranian shareholders brought the case to the Permanent Court of Arbitration (PCA) — they accused Bahrain of unlawfully closing the bank and requested the return of frozen assets.

To defend their claims, Bahrain disclosed a government audit that uncovered efforts by the Central Bank of Iran to launder at least $7 billion dollars through Future Bank in circumvention of U.S. sanctions from 2004-2015. In addition to falsifying financial records to obscure its illicit transactions, Future Bank also opened hundreds of bank accounts for individuals convicted of money laundering and terrorism finance charges, according to the audit.

The origins of Future Bank

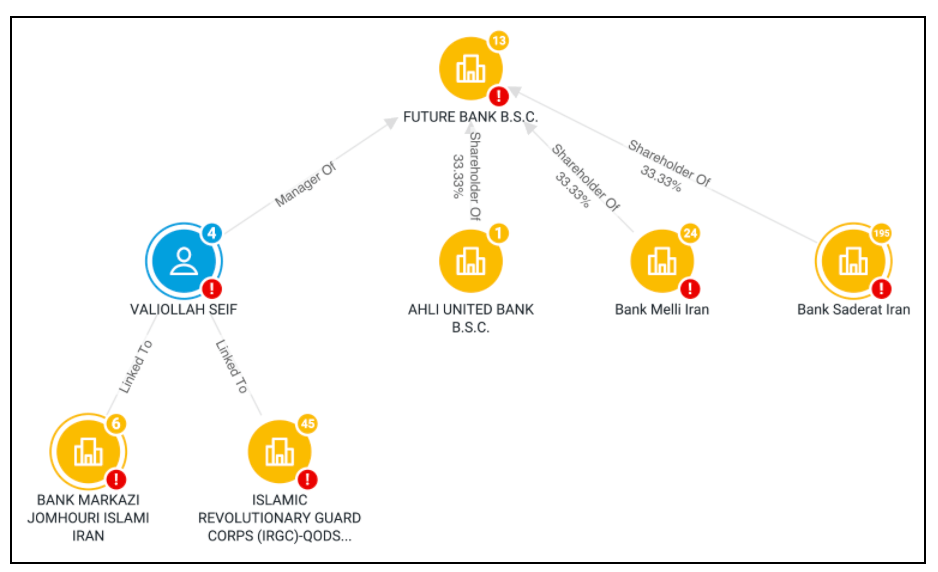

Future Bank was established in 2004 as a joint venture among Bahrain’s Ahli United Bank and Iran’s Bank Melli and Bank Saderat, with each entity holding 33 percent of the shares. However, Bahrain closed the bank in 2016 shortly after severing diplomatic ties with Iran.

Bank Melli and Bank Saderat are both sanctioned by the U.S. Department of Treasury’s Office of Foreign Assets Control (OFAC) for providing financial support to Iran’s nuclear and ballistic missile programs and the Islamic Revolutionary Guard Corps (IRGC).

Fig. 1: Sayari Graph visualization of Future Bank and its shareholders

Although Future Bank’s operations in Bahrain officially ceased in 2016, it maintains an active branch in Iran’s free trade zone on Kish Island. The shareholders of the bank include members of the GCC as well as European and East Asian financial markets, according to Iranian media outlets.