Conflict minerals have been making the news recently as organizations continue efforts to derisk supply chains. In late 2024, Apple suspended the purchase of these minerals from the Democratic Republic of Congo (DRC) and Rwanda following a criminal complaint that accused Apple subsidiaries of using these minerals in its supply chain. Automotive and other technology companies have faced similar scrutiny in recent years over conflict minerals.

Let’s take a look at what distinguishes conflict minerals from critical minerals and rare earth elements, the current regulatory landscape, and how organizations can minimize conflict mineral import risk.

A brief overview of mineral and element classifications

Conflict minerals, critical minerals, and rare earth elements are three designations used globally. While countries may maintain unique listings of minerals deemed critical based on economic needs and geological resources, there is broad global alignment on conflict and rare earth designations:

- Critical minerals, such as copper and lithium, have a high risk of supply chain disruptions.

- Conflict minerals (tantalum, tin, tungsten, and gold (3TG)) are linked to armed conflict and human rights abuses.

- Rare earth elements, such as cerium and dysprosium, are not geologically rare but their extraction and processing is difficult and results in harmful waste products.

Given some of the characteristics of these minerals and elements, global regulations govern their sourcing, extraction, and processing. Controls on the import of conflict minerals, in particular, fall under regulations tied to the fight against forced labor and corruption.

Regulations for responsible sourcing of conflict minerals

In 2012, the Securities and Exchange Commission (SEC) adopted a new rule, as mandated by Section 1502 of the Dodd-Frank Act, to require publicly traded U.S. companies to disclose their use of conflict minerals (specifically 3TGs) in products that originate from the DRC and surrounding regions. The rule requires Reasonable Country of Origin Inquiry (RCOI), due diligence, and public disclosures to ensure transparency in the mineral supply chain.

The EU Conflict Minerals Regulation, in effect beginning in 2021, acknowledges that trade in 3TGs can be used to finance armed groups, fuel forced labor, and support corruption and money laundering. The regulation requires EU companies to ensure they import these minerals from conflict-free sources. Unlike the U.S. rule, which focuses on the DRC and surrounding regions, the EU regulation covers a broader geographic range.

How Sayari helps organizations mitigate conflict mineral import risk

Guarding against the import of conflict minerals is not just a compliance concern; it’s an ethical and brand reputation concern. To maintain compliance and protect corporate reputation, organizations must verify that their upstream supply chains are free of these minerals sourced from high-risk areas. A comprehensive due diligence approach requires that organizations verify supplier disclosures to ascertain mineral origin.

Sayari’s risk indicators play a critical role in helping compliance teams identify supplier red flags and conduct deeper due diligence. Sayari risk factors cover risks such as adverse media, forced labor, export controls, sanctions, political exposure, and more.

>> Learn how the automotive industry is identifying and mitigating risk in supply chains <<

Our conflict minerals risk factors can help organizations identify entities that may have exported 3TGs from a country classified as a conflict-affected and high-risk area (CAHRA) under the EU Conflict Minerals Regulation.

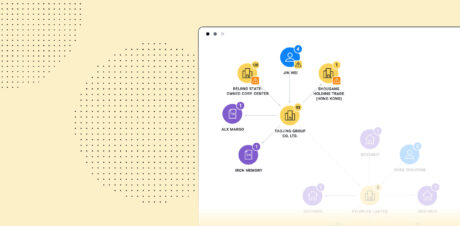

These conflict mineral risk factors are displayed in multiple workflows in Sayari solutions, giving organizations the ability to spot risk at a glance when viewing a supply chain, building a relationship graph, viewing an entity’s profile, or investigating an entity’s relationships.

Risk factors surface both obvious and, more importantly, non-obvious or emerging risk. This allows organizations to learn more in less time — and without devoting additional resources to the effort. Additionally, risk factors are configurable, allowing organizations to recategorize factors to best reflect priorities and focus attention on the risks that matter most.

Request a demo to learn more about how Sayari can help your organization screen for conflict mineral import and other risk factors.