A critical supplier suddenly defaults, disrupting your entire supply chain. A new partner is unable to meet their obligations just months into a contract. What if you could have seen the financial warning signs before these events?

Understanding an entity’s financial health is a key component of third-party and supply chain risk management due diligence efforts. Public financial data can support these efforts by helping organizations assess financial performance, default probability, and liquidity risk.

Sayari is addressing the need for comprehensive corporate financial health insights with a new capability that provides in-platform access to financial data to inform financial risk assessments and scoring.

What is the S&P RiskGauge Credit Risk score?

Sayari is incorporating the S&P RiskGauge Credit Risk score into Sayari Graph and Sayari Map. This score is a comprehensive credit risk assessment that statistically matches a credit rating by S&P Global Ratings. To enable financial health assessments and financial risk analysis, Sayari data includes scores for approximately 15 million public and private companies spanning the globe.

Powered by S&P Global Market Intelligence, the S&P RiskGauge Credit Risk score represents a company’s financial strength in conjunction with market-based factors related to the economic, regulatory, and sector environment in which the company operates. It provides a comprehensive evaluation of that company’s credit quality and is designed to support early identification of credit risk deterioration and highlight exposure to broader economic and geopolitical factors.

The score is broken down by three components:

- Financial risk: A set of financial ratios and ratings that are reviewed to determine a company’s risk of defaulting.

- Business risk: Factors that contribute to operational risk for a company, including its operational efficiency, market share, risk assessments of its country and region of operation, and risk scoring based on industry.

- Market-driven risk: A distance-to-default measure that links a company’s credit risk to its equity market movement (changes in the prices or value of that company’s equities traded on financial markets).

When a company doesn’t have any financial information or is not listed on stock exchanges, risk scores instead leverage benchmark risk measures. These benchmarks are calculated using pre-scored companies in the company’s respective industry sector and geographic region and can be leveraged for both the financial risk and market-driven risk measures.

Instant insight within your workflow

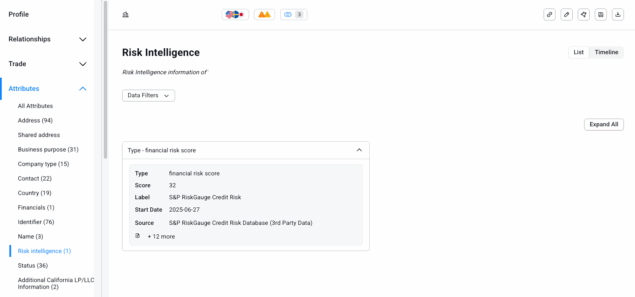

Within Sayari Graph and Sayari Map, a company’s S&P RiskGauge Credit Risk score is refreshed monthly and displayed in the Risk Intelligence section of an entity profile’s Attributes tab. The S&P RiskGauge Credit Risk score ranges from 1 to 100, with 1 representing the highest credit risk and 100 representing the lowest credit risk.

Fig. 1: The S&P RiskGauge score displayed in the Sayari platform’s Risk Intelligence section.

Sayari financial data delivers deeper due diligence

The inclusion of S&P RiskGauge Credit Risk scores in Sayari Graph and Sayari Map gives organizations the ability to perform deeper counterparty due diligence, comprehensive risk assessments, and risk monitoring. Accessing these scores directly within Sayari products helps users more effectively and efficiently assess an entity’s financial health alongside other critical data and risk factors.

Imagine you’re vetting a private manufacturing firm in a high-risk jurisdiction with limited public records. Instead of hitting a roadblock, using Sayari you instantly see an S&P RiskGauge score of 25, indicating high risk. This score, calculated using industry and regional benchmarks, gives you an immediate, data-backed reason to apply greater scrutiny or seek alternate partners. With Sayari, you obtain decisive insight that might have otherwise been missed.

To learn more about how to bring quantitative financial risk assessment into your due diligence workflow, schedule a personalized demo.