International mining conglomerates could be supplying cobalt mined by child laborers in the Democratic Republic of Congo (DRC) to leading technology companies and automotive manufacturers, according to public records and open-source information.

An ongoing federal class action lawsuit filed by the International Rights Advocates in 2019 revealed the names of five mines based in the DRC where forced child labor was reportedly exploited for the mining of cobalt from 2011-2019. The plaintiffs allege the cobalt ore extracted from these five mines was purchased by various intermediaries before reaching some of the largest U.S. tech companies.

In this investigation, we trace cobalt supplied from several of these mines to intermediaries Glencore and Zhejiang Huayou Cobalt. Companies involved with these well-known suppliers should be aware of the possibility that their cobalt supply chains may be indirectly associated with child labor in the DRC.

What is cobalt used for?

Approximately 60 percent of the world’s cobalt production comes from the DRC where there are numerous well-established reports of child labor, forced labor, and inhumane working conditions. Still, cobalt is sought after as a critical component in the production of lithium-ion batteries used in electric cars, cell phones, laptops, and many other consumer goods.

The cobalt supply chain

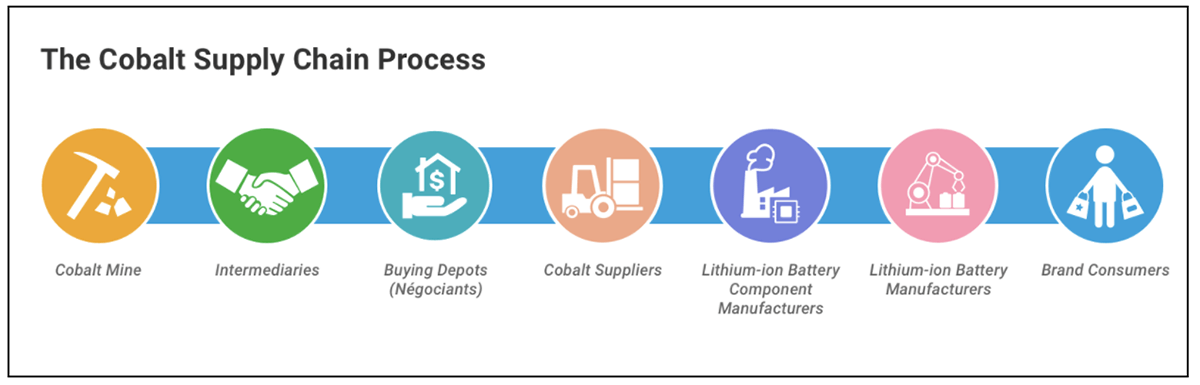

Cobalt is extracted from the earth by industrial mining equipment or artisanal and small-scale mining (ASM) by hand. After cobalt ore is washed and sorted, it is purchased by traders (négociants) — cobalt extracted by ASM and industrial mining is mixed together, thereby obscuring its original source.

This particular stage makes it challenging for multinational corporations to guarantee their cobalt supply chain is free of child labor, as illicit mining practices are often camouflaged with responsibly sourced cobalt.

Next, traders aggregate, weigh, and assess the purity of the cobalt at an on-site depot or a nearby open market. Traders sell the ore to larger cobalt supplier companies that transport the minerals to their facilities for processing. The refined cobalt is then sold to battery manufacturers and battery component manufacturers that build the lithium-ion batteries purchased by major consumer brands. (See Fig. 1)

Fig. 1: Diagram of the cobalt supply chain based on open-source information

Introduction to the five mines named in the lawsuit

The class action lawsuit claims that Musonoi, Lac Malo B5, Tilwezembe, Kamilombe No 1, and Metalkol SA mines all used child labor at some point between 2011-2019. Using these five mines as starting points, we identified connections between the Tilwezembe and Kamilombe mines to Glencore and Zhejiang Huayou Cobalt (Huayou Cobalt), respectively.

THE GLENCORE NETWORK

Background on Glencore

Glencore, the world’s largest commodities trading group, is not entirely new to controversial dealings. Aside from its alleged exploitation of child labor, Glencore received a subpoena from the U.S. Department of Justice in 2018 for its involvement in corrupt business deals in the Congo, Nigeria, and Venezuela. Glencore is also known to have partnered with Dan Gertler, an Israeli businessman sanctioned by the U.S. for leveraging his relationship with Congo President Joseph Kabila to obtain lucrative mining deals on behalf of multinational corporations.

Although its precise involvement in these business deals is still unclear, Glencore remains the largest western company operating in the DRC’s mining sector.

The Tilwezembe mine

Tilwezembe is owned by Glencore-subsidiary Kamoto Copper Company (KCC) but was taken over by artisanal miners in 2011 and no longer provides Glencore with cobalt, according to a recent press release. Despite this claim, several reports in 2012 found that the cobalt mined by artisanal miners at Tilwezembe was sold through various intermediaries until finally reaching Mopani Zambia, a Glencore subsidiary in Zambia.

The Coopérative Minière Maadini kwa Kilimo (CMKK) is responsible for overseeing ASM at Tilwezembe as of 2017, according to public records. (see p. 131 of the DRC’s Directory of Mining Operators)

Glencore’s Downstream Supply Chain

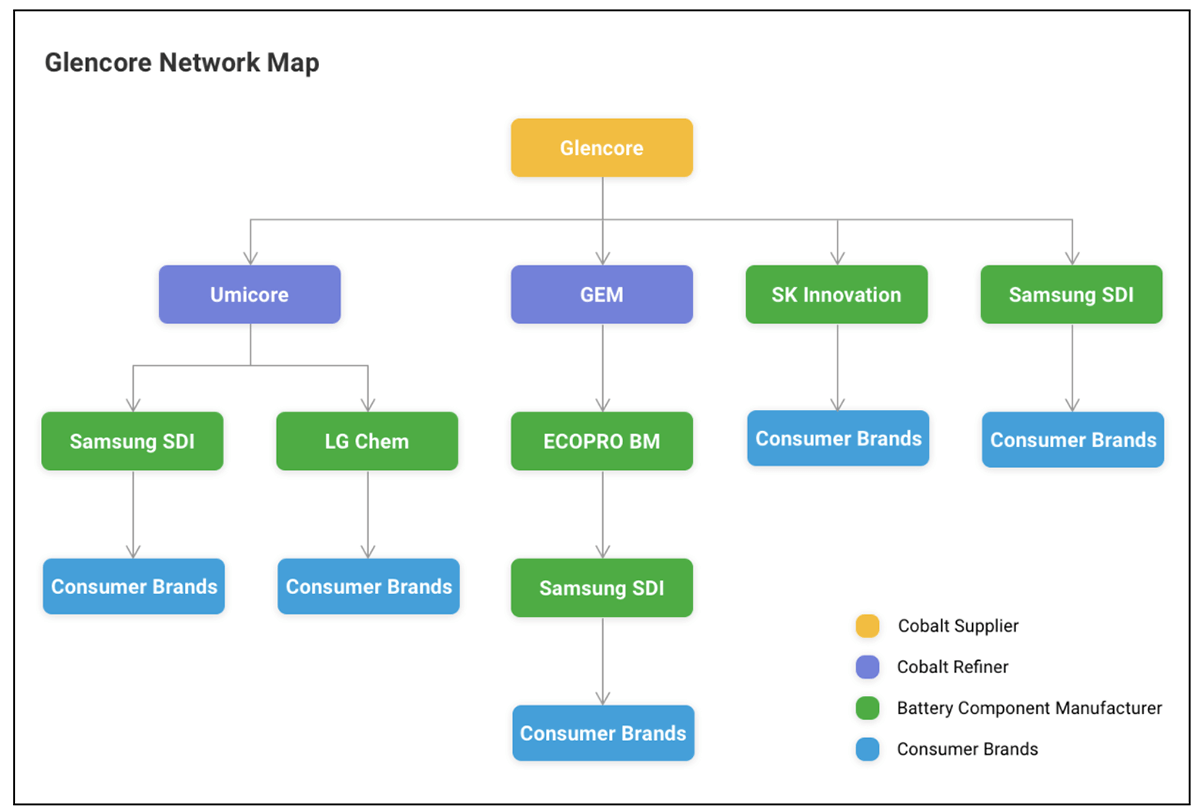

Based on Glencore’s affiliation with the Tilwezembe mine, we identified four cobalt refiners and battery component manufacturers that purchase cobalt from Glencore’s mines in the DRC.

Using corporate press releases, we found that Umicore, GEM, SK Innovation, and Samsung SDI all buy Congolese cobalt from Glencore. These four companies, in turn, sell refined cobalt or battery components to battery manufacturers that assemble the lithium-ion batteries for prominent consumer brands. (See Fig. 2

Fig. 2: Network map of Glencore’s cobalt supply chain, according to corporate press releases

- Umicore sells battery components to lithium-ion battery manufacturers Samsung SDI and LG Chem. Both lithium-ion battery manufacturers maintain long-term supply deals with leading companies in the automotive manufacturing and tech industry

- GEM, a Chinese battery recycling company, has a five-year deal to provide ECOPRO BM with battery components until 2023. ECOPRO BM, in turn, holds 60 percent ownership in a joint venture with Samsung SDI to produce cathode materials for electric vehicle batteries; Samsung SDI owns the remaining 40 percent stake.

- SK Innovation (SKI) is another South Korean lithium-ion battery supplier for major U.S. automotive manufacturers that purchases cobalt from Glencore.

- Samsung SDI, in addition to purchasing Glencore’s cobalt through Umicore, also maintains a cobalt supply deal directly with Glencore. Samsung SDI provides lithium-ion batteries for the automotive manufacturing and tech industry, as noted above.

Given the numerous intermediaries in this cobalt supply chain, we could not ascertain whether the cobalt purchased by these battery manufacturers were mined by children. However, as mentioned in the previous section, we learned that one of Glencore’s subsidiaries sourced its cobalt from at least one of the mines allegedly engaged in child labor in 2012. Therefore, companies purchasing cobalt from Glencore should be aware of the possibility that their supply chains may be indirectly associated with forced child labor.

THE HUAYOU COBALT NETWORK

Background on Huayou Cobalt

Zhejiang Huayou Cobalt Company Ltd. (Huayou Cobalt) and its wholly-owned subsidiary Congo Dongfang Mining International (CDM) have both been involved in numerous controversies regarding the exploitation of child labor in the DRC.

Most notably, Huayou Cobalt was a supplier for 20 percent of Apple’s batteries until 2016 when media outlets revealed the hazardous conditions of cobalt laborers mining on behalf of CDM. Apple has since distanced itself from CDM and claims it no longer sources its cobalt from Huayou Cobalt.

The Kamilombe mine

DRC-state owned entity Gécamines is the license holder of Kamilombe. CDM is the principal offtaker (i.e. purchaser of future mineral production), according to a June 2020 report published in partnership with Huayou Cobalt.

The report also states that KCC, a subsidiary of Glencore, is the site owner of the Kamilombe ASM site. This contradicts Glencore’s claims that it does not hold a mining concession at Kamilombe.

Huayou Cobalt’s downstream supply chain

Based on Huayou Cobalt’s affiliation with the Kamilombe mine through CDM, we were able to uncover its downstream supply chain by locating Huayou Cobalt’s largest cobalt buyers. We then found connections to several battery manufacturers that supply lithium-ion batteries to major consumer brands.

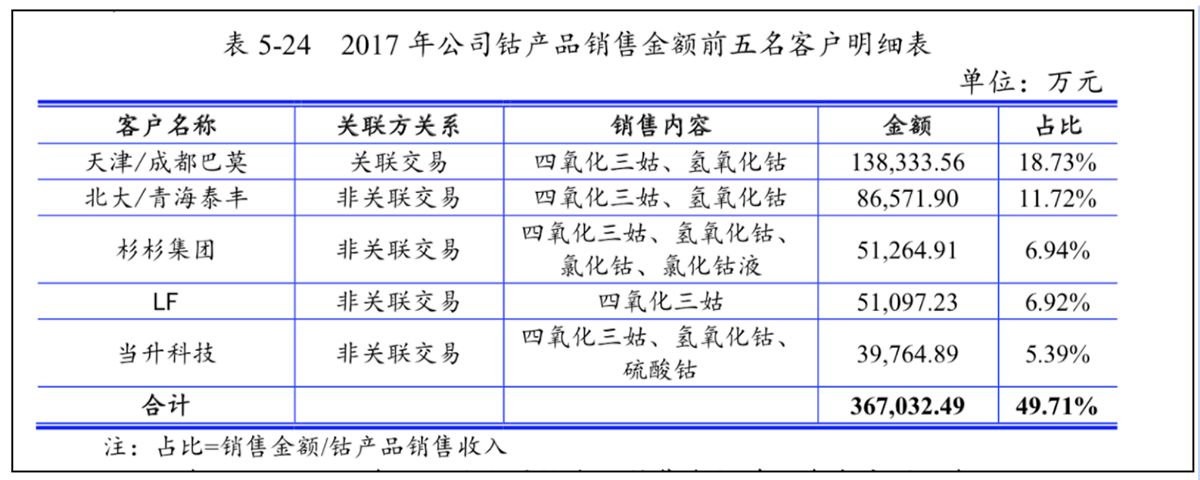

The top three cobalt buyers of Huayou Cobalt are: Tianjin Bamo Technology, Pulead Technology Industry, and Ningbo Shanshan Company Ltd., according to 2017 public records from the Shanghai Clearing House. (See Fig. 3).

- Tianjin Bamo Technology, now a subsidiary of Huayou Cobalt, supplies BYD Electronic with battery components, according to Chinese media. BYD Electronic supplies U.S. tech companies with the lithium-ion batteries used in laptops, computers, and smartphones.

- Pulead Technology Industry holds a joint development project with Canadian-based Nano One Materials to produce lithium iron phosphate (LFP) cathode materials. Nano One Materials has partnerships with U.S. and European car manufacturers.

- Ningbo Shanshan Company Ltd. is long-term battery manufacturing partners with Samsung SDI, LG Chem, and Contemporary Amperex Technology Ltd. (CATL), according to public records from the Shanghai Clearing House. All three of these companies are known lithium-ion battery suppliers within the tech and automotive industries.

Similar to the Glencore case, we could not determine whether the cobalt purchased by battery manufacturers from Huayou Cobalt was mined by child laborers. However, there is reason to believe that cobalt purchased from Huayou Cobalt could potentially originate from mines reportedly using forced child labor, based on public records and open-source information unveiled in the course of this investigation.

Conclusion

As demonstrated by our investigation of the Glencore and Huayou Cobalt networks, cobalt mined by child laborers in the DRC can easily fall into the hands of leading consumer brands without their awareness or consent. Companies conducting business with leading cobalt suppliers like Glencore and Huayou Cobalt should be aware of this supply chain risk and conduct thorough due diligence on all parent companies, holdings, and associates with regularity.