A fascinating peculiarity of the Russian corporate landscape is circular or cross-ownership: situations where two companies own each other. While many countries restrict circular ownership, in Russia it is not only permitted butactually quite common. Understanding circular ownership can help analysts assess potential sanctions risks or identify other information they may need to determine a company’s exposure to such risks.

Open-Loop Circular Ownership

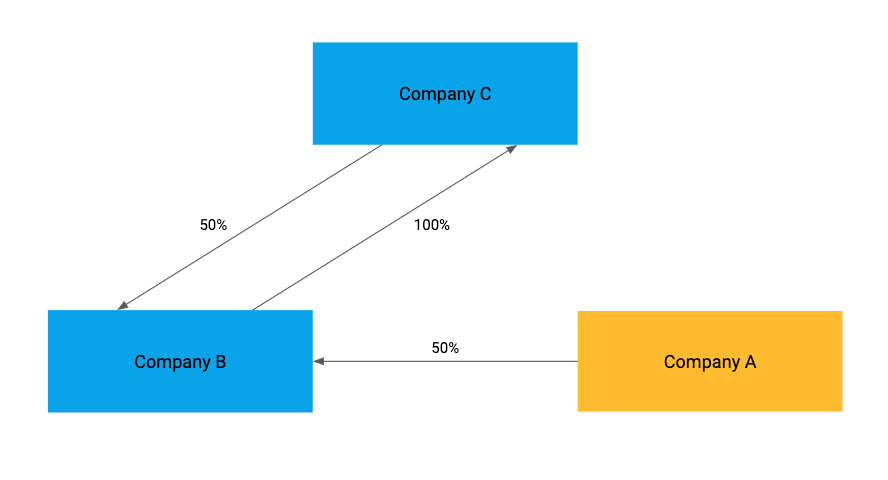

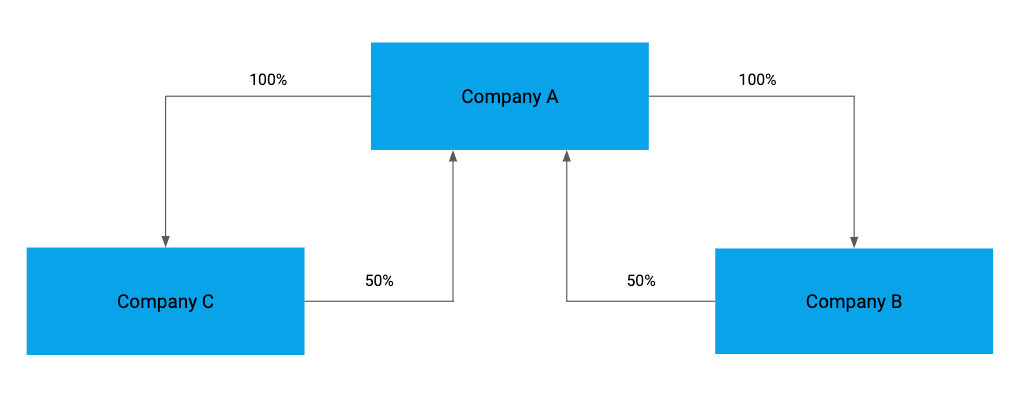

Some circular ownership loops are “open”—in other words, while there is a circle of cross-ownership, there is also one or more shareholders outside that circle. In these cases, the external shareholder is the ultimate owner of everything in the ownership loop. The image below demonstrates a hypothetical case of an “open loop.”

Fig. 1: Example of an open-loop circular ownership structure. Company A is the 100 percent beneficial owner of both Company B and Company C (see explanation below).

Determining the ultimate beneficial owner of a potential customer or supplier is an important part of conducting due diligence. It’s critical for ensuring compliance with laws such as sanctions when doing business with that partner.

Determining Ownership in an Open-Loop Ownership Structure

In the above “open-loop” ownership structure, Company A’s stake in Company B cycles through Company C. In other words, we can determine the beneficial owner of Company C in the following way:

1. Company A owns 50 percent of Company B.

2. Company B owns 100 percent of Company C. Therefore, Company A indirectly owns 50 percent of Company C.

3. Here is where the circle comes in. Company C owns 50 percent of Company B, which we just saw owns 100 percent of Company C. In other words, Company B seems to own 50 percent of itself.

4. We could go around this circle forever, but instead let’s return to Company A, which is outside the loop. Remember Company A directly owns 50 percent of Company B and, by extension, indirectly owns 50 percent of Company C. Therefore, Company A actually owns 75 percent of Company B: 50 percent of the 50 percent of itself that Company B owns through Company C, plus the 50 percent of Company B that Company A directly holds.

5. Now that we’ve determined that Company A owns 75 percent of Company B, we have to repeat steps two through four. Once we do this, we’ll see that Company A actually owns 87.5 percent of Company B (75 percent of the 50 percent of itself that Company B owns through Company C, plus the 50 percent of Company B that Company A directly holds).

6. If we continually repeat this process, we will determine that Company A actually holds 100 percent of Company B and, by extension, 100 percent of Company C.

Open Loops Used by United Shipbuilding Corporation Subsidiaries

To walk through a real world example, let’s take the case of Krasnoye Sormovo Shipyard PJSC and Marine and Oil-and-Gas Projects Group LLC.

United Shipbuilding Corporation (USC), which designs and constructs ships for the Russian Navy, is the largest shipbuilding company in Russia. In July 2014, the U.S. Department of the Treasury sanctioned USC for operating in the Russian defense sector.

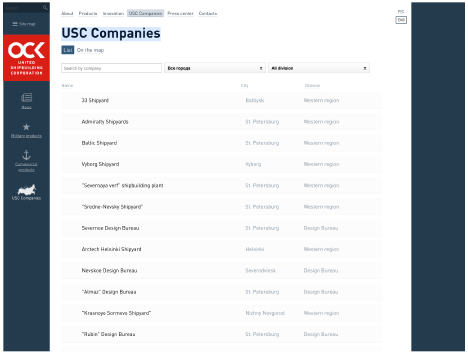

Fig. 2: United Shipbuilding Corporation subsidiaries listed on the USC website.

USC’s website lists the companies in its corporate group, including Krasnoye Sormovo Shipyard (ПАО «Завод «Красное Сормово»). “ПАО” signifies that Krasnoye Sormovo Shipyard is a public joint-stock company. This means that the company must file disclosure documents that reveal details about the entities it owns, and make them publicly accessible.

The company’s most recent quarterly report lists the commercial organizations in which it has at least a five percent stake. One of these is part of a circular ownership scheme.

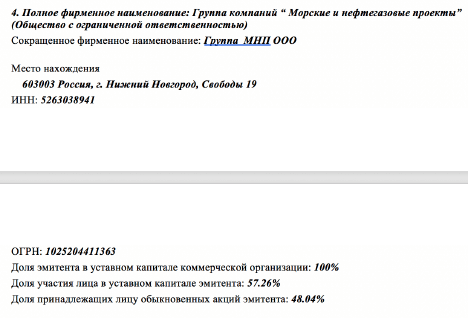

Fig. 3: Excerpt from the most recent quarterly report of Krasnoye Sormovo Shipyard, revealing its ownership of Marine and Oil-and-Gas Projects Group and vice versa.

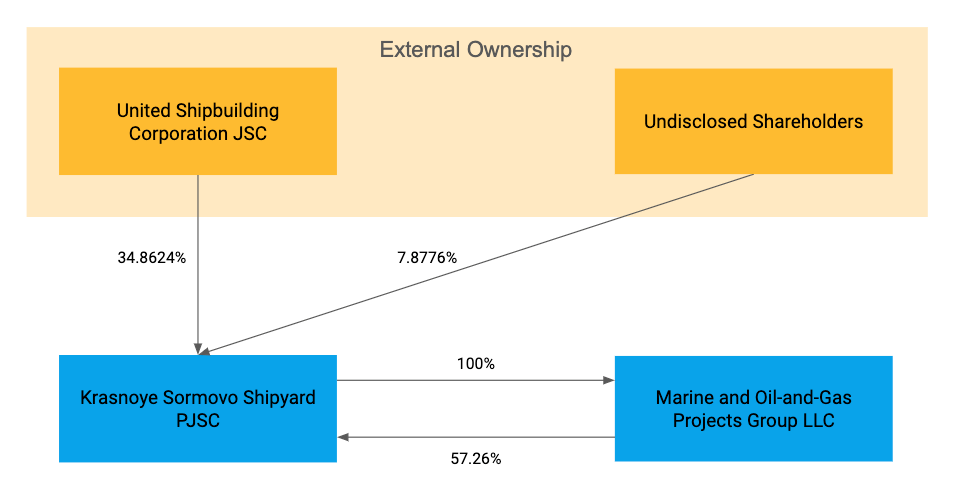

The most recent quarterly report reveals that Marine and Oil-and-Gas Projects Group LLC is 100 percent owned by Krasnoye Sormovo Shipyard. Moreover, Marine and Oil-and-Gas Projects Group itself owns 57.26 percent of Krasnoye Sormovo Shipyard.

Another section of the first-quarter 2019 report reveals that the owner of the remaining disclosed shares (34.8624 percent) of Krasnoye Sormovo Shipyard is United Shipbuilding Corporation.

Fig. 4: Ownership structure of Krasnoye Sormovo Shipyard PJSC.

We can go through the process outlined in the section above to determine USC’s stake in Krasnoye Sormovo Shipyard. When we do, we’ll see that USC owns roughly 80 percent of Krasnoye Sormovo Shipyard.

Why does this matter?

According to U.S. Department of the Treasury guidance, any company that is 50 percent or more owned by a sanctioned entity is also legally blocked. U.S. persons can’t engage in business with it, and U.S. financial institutions can’t process transactions for it.

It initially appeared that USC only held 34.862 percent of Krasnoye Sormovo Shipyard. That would mean Krasnoye Sormovo Shipyard is not legally blocked, despite the sanctions on USC. However, the circular ownership loop between Krasnoye Sormovo Shipyard and Marine and Oil-and-Gas Projects Group obscures USC’s actual ownership stake. In reality, given USC’s majority ownership, the shipyard company must be considered sanctioned.

Closed-Loop Circular Ownership Structure

Another technique used by Russian companies to obscure their beneficial ownership is a closed circular ownership loop, where all the direct and indirect owners are inside the loop. Unlike the open-loop examples outlined above, it is impossible to determine the beneficial ownership of closed-loop ownership structures using standard Russian disclosure documents.

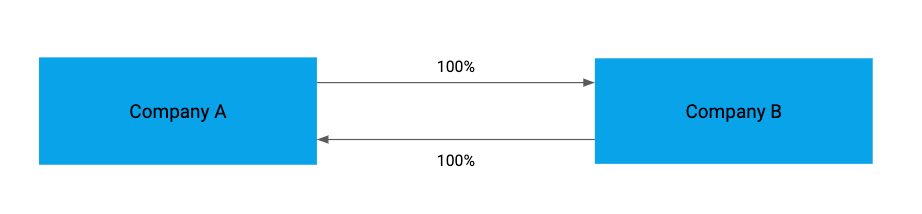

There is only one restriction on cross-ownership in Russia. Russian law stipulates that a company cannot have as a sole shareholder another company that has only one shareholder. It is necessary to include a third party in the membership of one of the companies. In other words, it is not legal for two companies to each own 100 percent of the other (Figure 5).

Fig. 5: This circular ownership structure is not permitted under Russian law.

An easy work-around for Russian businesses looking to adopt a closed-loop ownership structure is to introduce a third company into the mix. Figure six demonstrates how such an ownership structure might be set up.

Fig. 6: A closed-loop circular ownership structure that is permissible under Russian law.

In these cases, it’s impossible to determine the beneficial owner of these companies. However, by consulting other documents, it’s sometimes possible to understand who controls them. Such documents could include contracts, trade records, corporate records for co-located companies, and corporate records for other companies owned by a director of one of the closed-loop companies. These documents can supplement an analyst’s understanding of the relationships between closed-loop companies.

Conclusion

Circular ownership is a technique that is often used in Russia to consolidate control of companies or obfuscate their beneficial ownership. When this ownership is structured as an open loop, the stake of the shareholder(s) outside of the loop circulates through the loop, giving the external shareholder(s) beneficial ownership of all the companies in the loop. When there is a closed loop, it is not possible to definitively determine beneficial ownership using standard disclosure documents. In these cases, analysts may have to resort to other documents to further a corporate network investigation.

In both situations, it’s critical for analysts conducting due diligence to understand circular ownership loops when conducting investigations in Russia. Because they are legal in the country, they can be used to obscure ownership of companies that are owned by sanctioned companies or individuals. Identifying cases where this happens and taking the time to clear away the confusion of the circular ownership structure is an essential part of ensuring compliance with U.S. sanctions.

The public records data used to power this research is available through Sayari Graph! If you’re curious how this data could drive insights for your team, please reach out here.