Failing real estate conglomerate Evergrande has thousands of downstream subsidiaries across dozens of industries, many of which could be impacted by the company’s likely restructuring.

What is Evergrande?

Evergrande Group is China’s largest real estate developer conglomerate, which is now receiving international attention due to its inability to repay the company’s massive debts. After Chinese regulators implemented a new set of safety measures to reduce risk in the property sector last year, Evergrande was cut off from forms of bank credit it had come to rely on. On Sep. 23 and again on Sep. 30, the group failed to make interest payments to overseas creditors, prompting international inquiry into the company’s financial health.

Many Chinese developers have spent decades relying on debt to expand. Evergrande is known for exceptionally creative financing and high debt reliance even by industry standards. Evergrande’s official debt amounts to two percent of China’s GDP, and some estimate the group’s off-balance sheet debts could add an additional one percent of GDP.

Evergrande’s subsidiary network

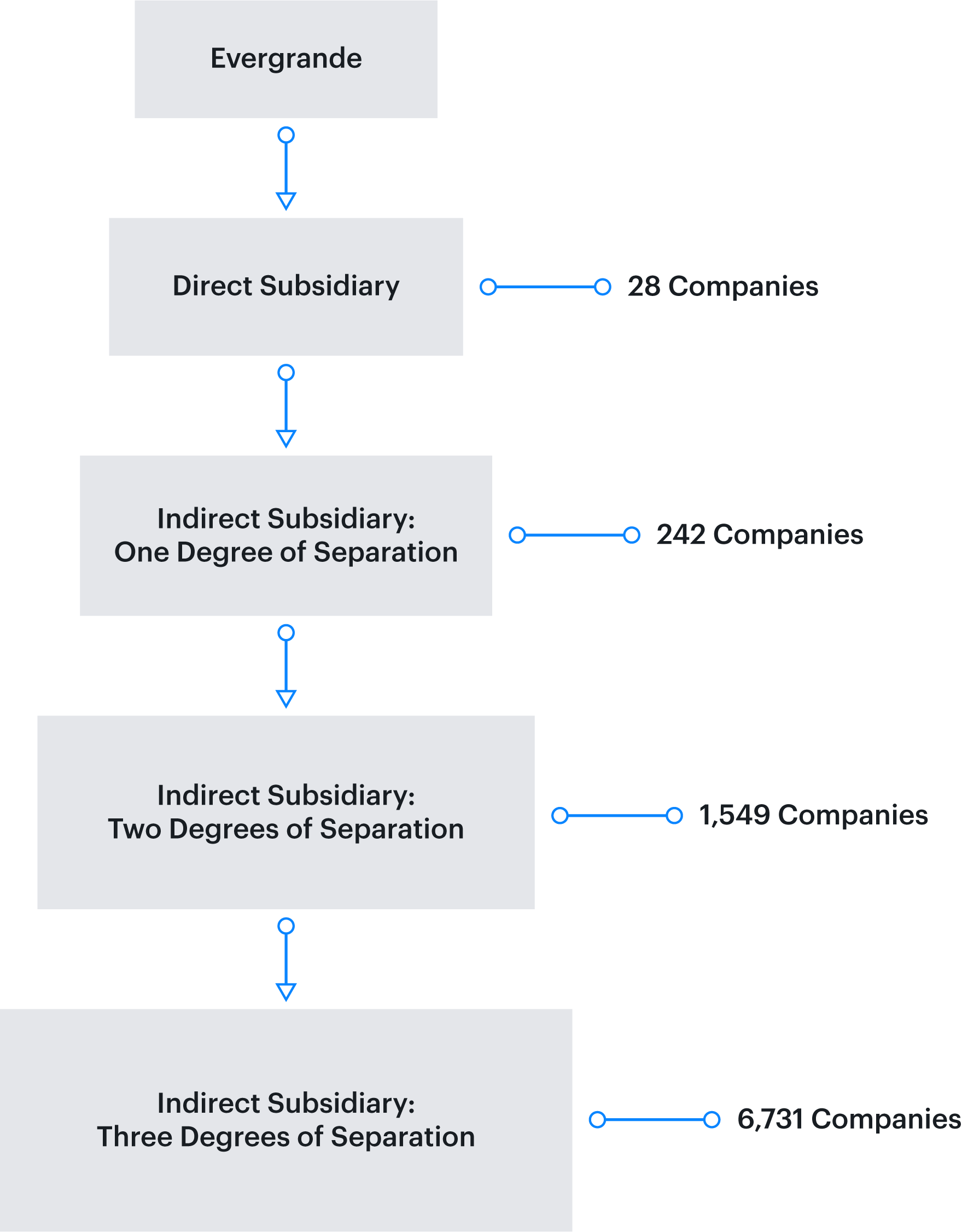

Based on China’s corporate records, we have tracked Evergrande’s portfolio of company holdings and found thousands of companies featuring it as a direct or indirect owner. This study includes both majority and minority owned companies (see Fig. 1).

Fig. 1: Evergrande’s holdings and number of companies at each ownership layer

Evergrande is exceptional for a high degree of industry diversification among its holdings. High profile subsidiaries covered by international media include Evergrande Spring (深圳市恒大饮品有限公司), a water bottling company which was considering a Hong Kong IPO earlier this year, and electric vehicle manufacturer Evergrande Auto (恒大新能源汽車).

Among Evergrande’s holdings, we found a broad array of industries seemingly unrelated to the group’s core real estate business. Some examples include:

- 21 food or beverage companies

- 122 renewable energy companies

- 15 semiconductor companies

- 13 education related companies

- 334 distinct entities comprising the Shaanxi Broadcast and Television Network (陕西广电网络)

It is difficult to say to what extent Evergrande itself is involved in the corporate governance of its holdings. Generally, companies with greater degrees of separation from a parent are less likely to be directly managed by their ultimate parent. However in some cases, such as was the case during IPO negotiations for Evergrande Spring, Evergrande has negotiated or otherwise become directly involved on behalf of indirect subsidiaries three degrees of separation from itself.

Evergrande’s network impact

Given past strategies taken by Chinese regulators when dealing with large failing companies, it is likely that Evergrande will be restructured to help pay off their financial obligations.

The impact of a restructuring would be felt far beyond the real estate sector given the breadth of Evergrande’s corporate holdings. Even if regulators manage to prevent Evergrande’s debt from affecting financial markets, several of the thousands of downstream companies could be sold or liquidated to allow Evergrande to compensate its bondholders as part of its restructuring.