Chinese Corporate Records Reveal Foreign Investment in U.S. Energy Infrastructure

Chinese corporate records available in Sayari Search reveal that a Chinese government supervisory body beneficially owns a U.S.-based manufacturing facility that operates in the U.S. energy sector.

TEDA TPCO America Corporation (TEDA TPCO) is a Texas-based steel pipe manufacturing facility that builds casings for use in North American oil fields. According to official records, it is beneficially owned by the Tianjin State-Owned Assets Supervision Administration Commission. Its chairman of the board is a Chinese Communist Party (CCP) member.

This finding comes at a time when the U.S. Department of the Treasury proposed new regulations that expand the scope of transactions covered by the Committee on Foreign Investment in the United States (CFIUS). The proposed expansion of CFIUS is in response to heightened security concerns surrounding foreign investment in U.S. companies in the tech, infrastructure, and data sectors.

Public records research can help companies and regulators identify the potential risks associated with foreign participation in key U.S. industries. In this post, we show how we used Chinese corporate records to trace TEDA TPCO’s ownership from a Texas-based manufacturing facility to a Chinese government-owned entity.

CFIUS and Foreign Investment in U.S. Industry

CFIUS is a multi-agency government body charged with reviewing any merger, acquisition, or takeover that could result in foreign control of a U.S.-based entity. In September, the U.S. Department of the Treasury proposed new regulations that expand the scope of transactions and investments covered by CFIUS. These changes include non-controlling investments into U.S. companies in key industries and certain real estate transactions involving foreign persons.

These new regulations appear to be in response to concerns over the acquisition of American companies by Chinese entities. In September, U.S. lawmakers submitted a letter to the U.S. Secretary of Defense stating that the Chinese Communist Party is repurposing civilian technologies developed by private corporations for military aims and engaging in cyber espionage. The letter details how some Chinese state-owned enterprises acquire American firms to transfer proprietary information.

Using Corporate Records to Identify Foreign Shareholders

Chinese corporate records available in Sayari Search show that the Chinese government supervisory body Tianjin State-Owned Assets Supervision Administration Commission (Tianjin SASAC) wholly owns the China-based company Tianjin TEDA Investment Holding Co., Ltd.

Investment records provided by China’s National Development and Reform Commission, a macroeconomic management agency, indicates that TEDA Investment in turn wholly owns U.S.-based TEDA TPCO America Corporation (see Fig. 1). TEDA TPCO’s website confirms this.

Fig. 1: China National Development and Reform Commission indicating that TEDA Investment 100 percent owns TEDA TPCO American Corporation.

State corporate records show that TEDA TPCO is registered in Delaware and operates in Texas. According to its website, TEDA TPCO manufactures seamless steel pipe casings for oilfield use in North America.

TEDA TPCO’s Links to the Chinese Communist Party

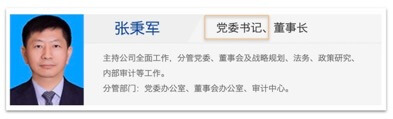

Corporate disclosures for publicly listed companies in China reveal that Zhang Bingjun, the Chairman of the board of TEDA TPCO, is a member of the Chinese Communist Party. As a CCP member, Zhang concurrently serves as the Secretary of the CCP party group of TEDA TPCO’s sole shareholder, China-based TEDA Investment (see Fig. 2), a detail omitted from TEDA TPCO’s website

Fig. 2: Screenshot of TEDA Investment’s website showing Zhang Bingjun’s position as a Secretary of the CCP Party Group

A party group is a body of at least three CCP members in national and local institutions. Party groups can play a leading role in directing a state-owned enterprise’s general direction and making decisions on macro-level control and national development strategy. TEDA TPCO’s corporate strategy and/or direction could be influenced by its parent company’s CCP party group and, by extension, the CCP more broadly.

Using Corporate Records to Understand Foreign Investment in U.S. Industry

At a time of increased concerns over foreign investment in the United States, TEDA TPCO’s links to the Tianjin SASAC and the CCP demonstrate the utility of public records. This case shows how public records can be used to assess potential risk associated with foreign participation in key U.S. industries and identify beneficial ownership structures linking private U.S. companies to foreign governments.

The public records data used to power this research is available through Sayari Search! If you’re curious how this data could drive insights for your team, please reach out here.