Sanctions Risk is Global

Public records reveal links between a German logistics company under scrutiny by the United Nations for DPRK ties, and companies with a history of sanctions violations. These networks stretch from northern China to the western United States and potentially expose companies doing business with them to sanctions risk.

The German firm Muller + Partner was named in the most recent report by the UN panel that tracks sanctions violations by the Democratic People’s Republic of Korea (DPRK).

When conducting due diligence, it’s easy to assume that companies operating in the United States or Western Europe are largely free from DPRK sanctions risk. But illicit actors are not limited by national borders.

Our findings demonstrate the importance of assessing the risks associated with the broader networks of potential business partners. Investigators should take a global approach or risk missing critical links.

Müller + Partner’s Network and DPRK Exposure

The UN Panel of Experts on the DPRK reported earlier this year that it was investigating Müller + Partner’s ties with companies suspected of exporting luxury goods to the DPRK. This is a violation of UN sanctions (see p. 302 of the report). Based on our assessment of German corporate records, the panel appears to be referring to the company formally registered as Müller + Partner GmbH.

Müller + Partner and its officers have links to companies and individuals that have been sanctioned by the United States. Our investigation also found links to entities previously investigated by the Panel of Experts for violating UN sanctions on the DPRK.

Global Shipping Network

Müller + Partner’s website details its “worldwide network” of affiliates spanning 15 countries. Among these affiliates, Müller + Partner lists Seajet Company Limited in Beijing and Shanghai Muller + Partner International Logistics Co., Ltd. in Shanghai.

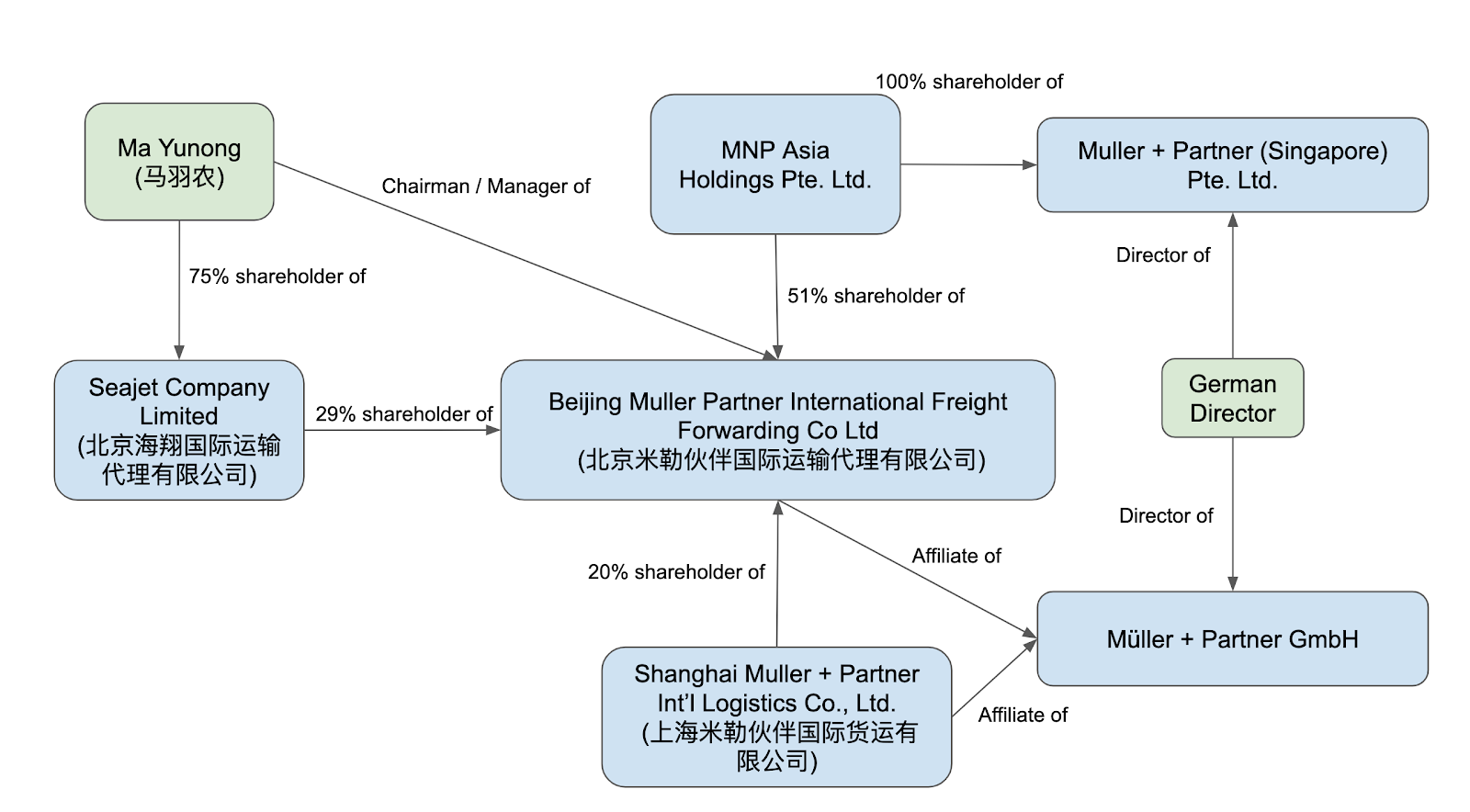

Chinese corporate records reveal that Seajet’s owner is a Chinese citizen named Ma Yunong. Shanghai Muller + Partner is a 20 percent shareholder of another Chinese company, Beijing Muller Partner International Freight Forwarding Co Ltd. Ma Yunong serves as the chairman, manager, and legal representative of Beijing Muller Partner, which has 29 percent shareholder Seajet Company Limited (see Fig. 1).

Fig. 1: Corporate network of companies associated with Müller + Partner

In addition to appearing as an affiliate on Müller + Partner’s website, Beijing Muller Partner also has corporate ties to the German company. One of Beijing Muller Partner’s shareholders is Singaporean company MNP Asia Holdings Pte. Ltd. One of MNP Asia Holdings’ subsidiaries has a director who is also a director of Müller + Partner GmbH.

In other words, Müller + Partner doesn’t just list these affiliates on its website—it has active commercial relationships with them.

Seajet: A Source of Sanctions Risk

Seajet has been a target of the Panel of Experts since 2013. The panel found that DPRK state-run commercial airline Air Koryo, which the United States sanctioned in 2016, listed Seajet as an affiliate. The Panel of Experts has also provided evidence that in 2009 Seajet facilitated a shipment of weapons—including engines of battle tanks and armored vehicles—from the DPRK in violation of UN sanctions .

Seajet didn’t stop there. In 2016, the Panel reported that Seajet’s executive director and majority shareholder, Ma Yunong, acquired luxury automobiles on behalf of the DPRK government (see p. 45 of the report).

This involved more than just purchasing the vehicles and shipping them to the DPRK. Ma reportedly bought several Mercedes-Benz S-class automobiles and exported them to the United States, where he had customized armor added to them. He then exported them from the United States to China.

In China, a company called Liaoning Danxing International Forwarding Co. Ltd. received the armored cars. The customized autos ultimately appeared in a military parade in Pyongyang in 2012.

The United States sanctioned Liaoning Danxing in March 2019. According to the U.S. Department of the Treasury, the company “routinely used deceptive practices” to facilitate DPRK imports from the EU.

To what extent will these sanctions hinder the transnational network of logistics companies associated with Liaoning Danxing? We don’t know, but public records confirm that these companies are still operating actively. We identified another shipping company that operates from the same office as Liaoning Danxing. It is owned by some of the same individuals as Liaoning Danxing, but it is not sanctioned. Furthermore, corporate records reveal that Ma Yunong’s network—more than a dozen companies in China, Hong Kong, and the United States—is still active. The United States has not sanctioned any of these companies.

Affiliates on the High Seas

Müller + Partner’s links to the DPRK extend beyond Seajet. Another Müller + Partner affiliate, Muller + Partner (Singapore) Pte. Ltd, has ties to DPRK ocean shipping networks.

Muller + Partner (Singapore) is wholly owned by MNP Asia Holdings Pte. Ltd. MNP Asia Holding’s sole shareholder is also the sole shareholder of another Singapore company, Loco Line Pte. Ltd.

Between 2011 and 2017, Loco Line was the registered owner of the cargo ship Tong Myong 9. Tong Myong 9 has operated under the flag of the DPRK since 2017. Its current owner is DPRK shipping company Ryugyong Corp. But the vessel’s links to the DPRK extend back to 2011, when Loco Line acquired it.

From 2011 to 2012, Tong Myong 9’s ISM manager—a company responsible for ensuring that a vessel operates safely—was the Hong Kong company Sea Star Ship Co., Limited. At the time, Sea Star Ship’s shareholders included two individuals who have been involved in several instances of DPRK sanctions evasion on the high seas. This includes Koti, a DPRK-linked oil tanker that we profiled last month.

In Conclusion

Müller + Partner DPRK Exposure

In conclusion, Müller + Partner has extensive links to shipping and logistics companies in China and Singapore. Public records and UN Panel of Experts investigations indicate that several of these companies have been involved in multiple instances of U.S. and UN sanctions evasions.

Müller + Partner may not have known about these links when it started working with these companies. However, these companies’ ties to illicit actors have been publicly reported for several years.

Keep Your Eyes Open for Sanctions Risk

Müller + Partner’s global network—and the cross-border operations of the DPRK-affiliated actors it works with—demonstrates the importance of looking beyond a single company. It is critical to also examine their broader networks of companies and individuals.

The global nature of these networks also reminds us that it’s not enough to look at a company’s primary jurisdiction when conducting due diligence on a potential supplier, partner, or distributor. Illicit actors frequently operate across international borders. Investigators who limit themselves to one jurisdiction risk missing half the picture.

As Müller + Partner shows, a company based in the U.S. or western Europe is not inherently free of sanctions risk. Effective due diligence needs to consider not only the company itself but also its officers and ultimate beneficial owners. While identifying and checking those individuals may require jumping national borders, it can pinpoint critical sources of risk that might otherwise be missed.

The public records data used to power this research is available through Sayari Search! If you’re curious how this data could drive insights for your team, please reach out here.

Image credit Uwe Brodrecht