The U.S. Treasury’s Office of Foreign Assets Control (OFAC) sanctioned key players in Iran’s oil industry in October for providing financial support to the Islamic Revolutionary Guard Corps-Qods Force (IRGC-QF). In the official press release, OFAC claims that the sanctioned National Iranian Tanker Company (NITC) set up Atlantic Ship Management LLC as a front company in the United Arab Emirates (UAE) to obfuscate NITC shipping activity in circumvention of U.S. sanctions.

Our investigation into Atlantic Ship Management and its UAE-based local agent illustrates the importance of identifying local agents acting as nominee shareholders when looking into foreign entity registration and hidden ownership ties of illicit actors.

Specifically, we identified a common local agent across multiple sanctioned UAE-based networks operating in discrete industries — this finding highlights that local agents and their associates deserve attention and consideration in Middle East-focused due diligence investigations.

We also found nearly 200 individual foreign shareholders, 136 of whom are Iranian nationals, connected to Atlantic Ship Management’s UAE-based affiliates. This further demonstrates the difficulty in conducting effective due diligence when dealing with complicated local ownership structures.

How UAE foreign ownership laws indirectly promote nominee shareholders

A nominee shareholder is the registered owner of shares held for the beneficial owner. A nominee shareholder — either an individual or an entity — may be appointed based on legal requirements, or because the beneficial owner does not wish to have the shares registered in its own name.

In the UAE, non-citizens are barred from acting as majority shareholders for companies in 13 industries, thereby requiring foreign companies and local branches to recruit Emirati nationals as local agents for registration purposes.

Recent reforms in UAE foreign direct investment laws have increased the number of industries allowing 100 percent foreign ownership (known as the “positive list”). There are currently 122 industries that allow full foreign ownership of UAE commercial companies, as of the reform measures enacted in November 2020.

However, both the petroleum sector and commercial agency services (i.e. intermediaries who negotiate the sale or purchase of goods on behalf of clients) remain on the “negative list,” which bans majority foreign ownership. Given Atlantic Ship Management’s role as a front company for the NITC, it would likely be included in the UAE’s negative list for operating in the petroleum and commercial agency services sectors — requiring an Emirati majority shareholder by law.

Atlantic Ship Management’s affiliates and their 100+ Iranian shareholders

We also uncovered a common Emirati local agent with majority shareholding in over 100 UAE-based companies affiliated with Atlantic Ship Management. Given the Emirati individual’s majority shareholding of companies tied to many foreign nationals, it is possible that they are merely a local agent, as required by UAE law for certain sectors, and the companies are in fact controlled by the foreign shareholders.

A pattern of nominee shareholders working for separate sanctioned networks

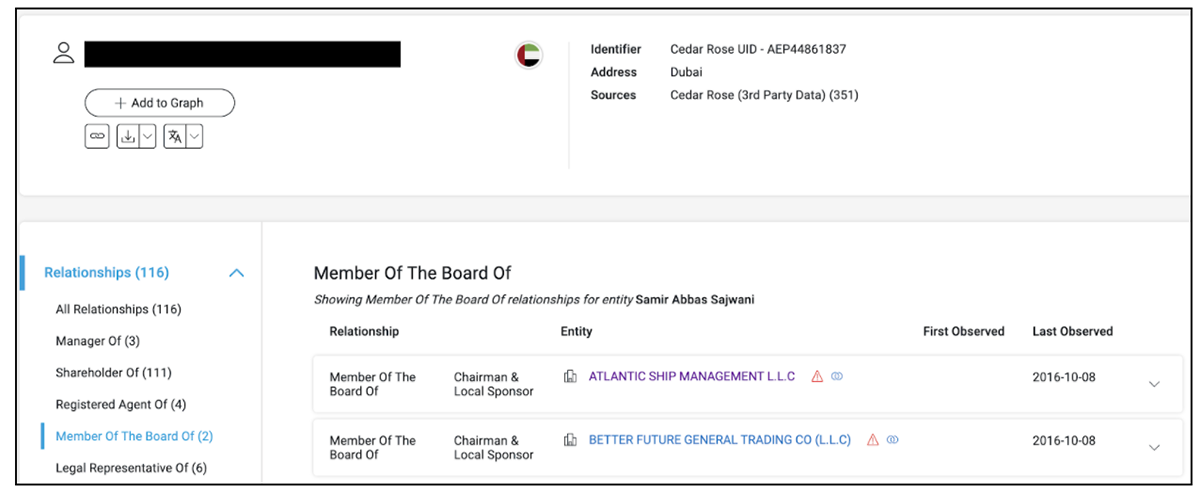

The same Emirati national also appears as chairman of the board and “local sponsor” for both Atlantic Ship Management, the previously mentioned sanctioned entity, and Better Future General Trading Co LLC (Better Future). OFAC sanctioned Better Future earlier this year for acting as a metal exporter and sales agent of Esfahan’s Mobarakeh Steel Company in Iran. Better Future has no ostensible connection to Atlantic Ship Management.

Fig. 1: This Sayari Graph snapshot shows two unrelated OFAC-designated Iranian companies connected to the same Emirati national and local agent, according to public records in Sayari Graph.

The discovery of this Emirati national working on behalf of two sanctioned companies was not the only instance of a local agent working for seemingly unrelated sanctioned business networks. In fact, we found four additional instances where Emirati nationals held majority shares of multiple companies tied to sanctioned Iranian networks.

It is possible the involvement of these Emirati individuals mostly relates to foreign ownership laws. Still, investigators should consider the possibility that sanctioned actors could exploit UAE regulations by using nominee shareholders to disguise their own ultimate beneficial ownership to evade sanctions.