In the year since the United States left the Iran nuclear deal, Europe and Iran have taken steps to reinforce their mutual commitment to the agreement. Notably, two new special purpose vehicles (SPVs) have been incorporated in France and Iran. The SPVs are not operational yet, but in theory they could allow Europe and Iran to continue to trade despite U.S. sanctions.

The corporate filings of the SPVs provide insight into their structure and management. They also highlight possible sanctions risks that Europe and Iran may face as they seek to avoid the U.S. financial system

How Did We Get Here?

On May 8, 2018, the U.S. announced its intent to withdraw from the 2015 Iran deal, or Joint Comprehensive Plan of Action (JCPOA). On Nov. 5, it re-imposed sanctions on Iranian entities that it had previously lifted under the JCPOA. The European Union (EU) and Iran, however, remained committed to the deal.

In order to facilitate humanitarian trade, Germany, France, and the United Kingdom (the E3) created a Europe-based special purpose vehicle, the Instrument for Supporting Trade Exchanges (INSTEX SAS). Iran followed suit by creating a corresponding SPV, the Special Trade and Finance Instrument between Iran and Europe (STFI or the Persian acronym SATMA). Neither SPV is fully operational yet.

However, last month Iran called the future of these SPVs into question when it threatened to exit the JCPOA unless domestic economic conditions improve. In response, the EU restated its commitment to operationalizing INSTEX, which it hopes will help improve economic conditions in Iran and thus hold Iran to the JCPOA. The E3 further stated that they will only operationalize INSTEX if Iran continues to abide by the provisions of the JCPOA.

What is a Special Purpose Vehicle?

A special purpose vehicle is a separate subsidiary that allows a company to keep the appearance of risk off its main balance sheet.

Usually, private companies in the finance field create SPVs to isolate risk: if the main company is assessed or audited, this risk may not be immediately apparent. A poignant example is when Enron used an SPV to hide its losses leading to its bankruptcy scandal.

How Will the INSTEX-STFI System Work?

The SPVs will operate as ledger systems. Companies in Iran and Europe can communicate with one another and trade without engaging in direct financial transactions. Essentially, these companies will be able to operate entirely outside the U.S.-controlled financial system.

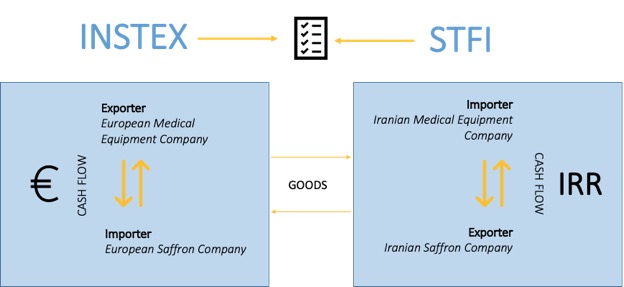

Here’s a hypothetical example (see Fig. 1 below):

1. An Iranian company agrees to buy medical equipment from a European manufacturer. Around the same time, an Iranian saffron grower agrees to sell saffron to a European spice distributor.

2. INSTEX will approve a transaction between the banks of the European medical equipment company and the European saffron importer. In Iran, STFI will approve a transaction between the banks of the two Iranian companies.

3. On behalf of the Iranian medical equipment importer, the European spice distributor will pay the European medical equipment manufacturer for the equipment it exported to Iran. On behalf of the European spice distributor, the Iranian medical equipment importer will pay the Iranian saffron exporter.

Fig. 1: The SPV structure allows goods to flow between Europe and Iran while keeping cash flows local.

What Can We Learn From the Special Purpose Vehicles’ Registration Documents?

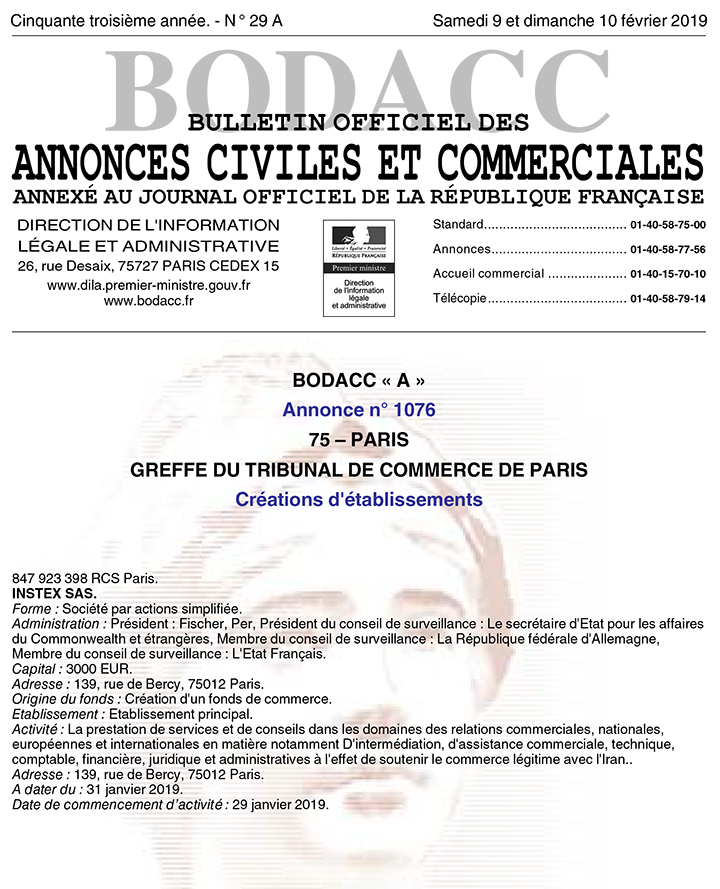

INSTEX Registration in France

Company Information

Start of Activity: Jan. 29, 2019

Date of Announcement: Jan. 31, 2019

RCS Number: 847 923 389

Type: Joint Stock Company

Address: 139 Rue de Bercy 75021 Paris

Starting Capital: 3,000 EUR

Fig. 2: Announcement of the registration of INSTEX SAS in the French official gazette.

Government Control of INSTEX

The French official gazette shows the E3 taking on shared responsibility for INSTEX (see Fig. 2). INSTEX is registered in Paris, France. Its president is German banker Per Fischer. The chairman of the supervisory board is the UK’s foreign secretary. The governments of France and Germany also serve as members of the supervisory board.

It is unusual for governments to appear on the supervisory board of any company in France. This lends additional legitimacy to INSTEX and creates a “sovereign shield” of government officials who cannot be prosecuted, potentially insulating INSTEX from U.S. pressure.

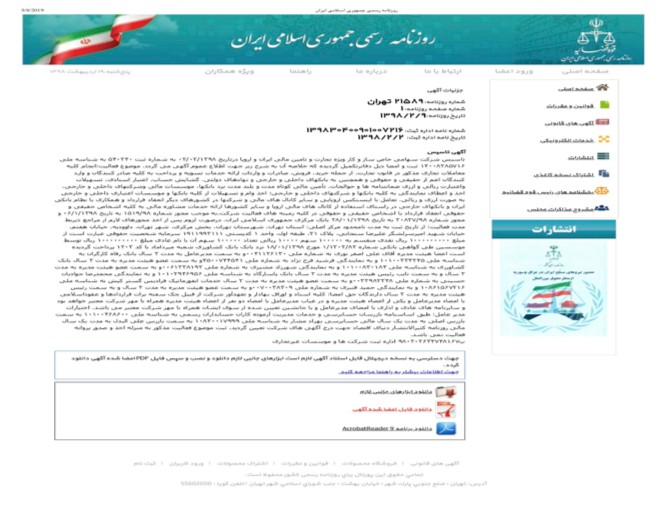

STFI Registration in Iran

Company Information

National ID Number:. 14008285716

Registration Number: 540240

Type: Private Joint Stock Company

Address: No. 31 Shahid Amirsarlashgar Alireza Sanjabi Street, Third Floor Unit 1, Seventh Street, Davoodiyeh, Tehran

Capital: 1,000,000,000 IRR (approximately 21,000 EUR)

Fig. 3: Announcement of the registration of STFI in the Iranian official gazette.

STFI Ownership and Control

According to the Iran official gazette announcement, the STFI was approved by the Central Bank of Iran (CBI) and incorporated on Apr. 17, 2019 (see Fig. 3). It is a private joint-stock company governed by five board members. Board members of Iranian private joint-stock companies are also shareholders, so we can say that these five board members are also shareholders of the STFI. However, we do not know their exact shareholding amounts, and there may be other undisclosed shareholders.

Three of the legal person board members are major Iranian banks: Refah Bank, Bank Keshavarzi, and Bank Pasargad. The U.S. sanctioned all three banks when it left the JCPOA on Nov. 5, 2018, as part of the resulting “snapback” measures

Faradis Informatics

Iranian online banking services company Faradis Informatics Gostar Kish Services Co. is also a board member. The Faradis Informatics representative on the STFI board (and the STFI board chairman) is Hamid Ghanbari, a former CBI banker. A closer examination of the company raises a number of questions:

– What is the significance of Ghanbari’s leadership role within Faradis Informatics and the STFI more broadly? Possibly his ties to the CBI lend legitimacy to the STFI. At the same time, however, the CBI is sanctioned by the United States, which increases the STFI’s potential sanctions exposure (see discussion below).

– While the company is a founding board member and shareholder of the STFI, Iran’s corporate registry lists its legal status as “suspended.” It is unusual to see a company with this legal status on the board of a newly-founded company. Is this a clerical error? If Faradis Informatics is truly suspended, how can it be a founding shareholder and board member of the STFI?

Sanctions Risk and the Special Purpose Vehicles

INSTEX Exposure to U.S. Sanctions Violations

The U.S. is watching these vehicles closely. In May, the U.S. Department of the Treasury warned the INSTEX president about potential sanctions exposure. “Engaging in activities that run afoul of U.S. sanctions can result in severe consequences, including a loss of access to the U.S. financial system,” wrote Sigal Mandelker, the Treasury Department’s undersecretary for terrorism and financial intelligence.

Media reports emerged earlier this week indicating that the U.S. government is considering placing sanctions on the STFI because of its ties to the Central Bank of Iran. Such an action would increase the sanctions risk associated with INTSEX and make the system very difficult to operationalize.

Is STFI Already Legally Blocked in the U.S.?

Regardless of whether the U.S. sanctions the STFI explicitly, it is possible that the STFI is already legally blocked because of its ownership.

Because of the STFI’s corporate type, we know its board members must also be shareholders, but we don’t know what percent of the company they hold. The U.S. has sanctioned at least three of these shareholders. Therefore, the STFI may be majority-owned by sanctioned entities.

If so, the STFI itself would be legally blocked, per guidance from the U.S. Treasury’s Office of Foreign Assets Control. Both OFAC and the EU block entities that are fifty percent or more owned by sanctioned people or entities.

While the JCPOA lifted EU sanctions on Iran (including on the Central Bank), those sanctions could snap back into place if the EU or Iran exits the JCPOA. If that happens, the STFI also could be considered blocked under EU law.

Sanctions Compliance for European Companies

Furthermore, in order to comply with existing EU sanctions, European companies utilizing INSTEX must verify that the goods they are providing or receiving will not benefit sanctioned entities directly or indirectly (see Article 10d of these EU regulations). The burden of due diligence and compliance will be on companies utilizing INSTEX, not INSTEX itself.

Sanctions compliance for companies doing business in Iran presents a significant challenge, given the extent to which currently sanctioned sanctioned Iranian companies and state- or military-controlled organizations have penetrated the economy.

This is true not only for entities sanctioned by the U.S. but also those that remain sanctioned by the EU or the United Nations. At Sayari, we have identified hundreds of companies owned or controlled by the Islamic Revolutionary Guard Corps (IRGC) and other sanctioned entities. Most have not been publicly named or connected to any obvious sanctions risk.

The Future of Sanctions Enforcement

More broadly, the SPVs represent a challenge to sanctions enforcement internationally. The INSTEX-STFI system utilizes common corporate structures in both Europe and Iran, making it a simple and attractive way to trade outside the U.S. dollar.

For Iran, setting up similar vehicles to facilitate trade with countries beyond the EU would be relatively simple. If the SPVs establish trade between Europe and Iran successfully, they could serve as models for Iran to continue to trade with other countries outside the U.S. financial system. U.S. adversaries such India, China, and Russia see this as an opportunity to diminish the US ability to use the U.S. dollar to achieve its foreign policy goals.

What’s Next?

With both special purpose vehicles registered and functional, we may see European companies utilize the vehicles to come to Iran’s aid to improve economic conditions and give Rouhani a reason to maintain the JCPOA.

However, European companies may see the risks of sanctions as too great to engage in the INSTEX-STFI system. So, for now, the future of the INSTEX-STFI special purpose vehicles remains uncertain.

The Iranian and other public records data we used to power this research is available through Sayari Search! If you’re curious how this data could drive insights for your team, please reach out here.