What is the FinCEN BIS Joint Alert?

In June of 2022, the Financial Crimes Enforcement Network (FinCEN) and the U.S. Department of Commerce’s Bureau of Industry and Security (BIS) issued a joint alert urging financial institutions to be vigilant against efforts by individuals or entities to evade BIS export controls implemented in connection with the Russian invasion of Ukraine.

>> Learn more about how the U.S. is cracking down on sanctions evasion <<

FinCEN and BIS provided a select list of potential red flag indicators of export control evasion that may be relevant to financial institutions and other covered institutions or persons. These transactional and behavioral red flags include:

1. A customer in the maritime industry transports commodities of concern and uses trade corridors known to serve as possible transshipment points for exports to Russia and Belarus.

2. The nature of a customer’s underlying business (specifically military or government-related work), type of service(s) or product(s) offered, and geographical presence pose additional risks of unintentional involvement in the evasion of export controls for Russia and Belarus.

3. A customer acquires new vessels for no apparent economic or business purpose or for use in shipping corridors involving one or more of the identified transshipment countries.

4. A customer purchases or sells vessels or other properties and goods identified as having been involved with or being blocked property under U.S. or partner country sanctions.

5. Transactions involving entities with little to no web presence.

6. Transactions involving a change in shipments or payments that were previously scheduled to go to Russia or Belarus, or a company located in Russia or Belarus, but that are now going to a different country/company.

7. Transactions involving payments being made from entities located in third-party countries not otherwise involved with the transactions and known to be a potential transshipment point for exports to Russia and Belarus.

8. Last-minute changes to transactions associated with an originator or beneficiary located in Russia or Belarus.

9. Parties to transactions with addresses that do not appear consistent with the business or are otherwise problematic (e.g., either the physical address does not exist, or it is residential).

10. Transactions involving consolidated shipments of luxury goods that previously would have been destined for Russia or Belarus, but are now destined for a transshipment country or a country without restrictions on exports/re-exports to Russia or Belarus.

11. Rapid shifts to new purchasers of transactions involving restricted luxury goods.

12. Transactions involving freight-forwarding firms that are also listed as the product’s final end customer, especially items going to traditional Russian transshipment hubs.

13. Transactions associated with atypical shipping routes for a product and destination.

14. Transactions involving entities whose website or business registration states the entities work on “special purpose projects.”

15. Transactions involving companies that display a certificate from the Federal Security Service of the Russian Federation (FSB RF), which allows these companies to work on projects classified as a state secret.

16. Transactions involving companies that are physically co-located with or have shared ownership with an entity on the BIS Entity List or the Department of the Treasury’s Specially Designated Nationals and Blocked Persons List.

17. New or existing accounts and transactions by individuals with previous convictions for violating U.S. export control laws, particularly if appearing to involve export and import activities or services.

18. When combined with other derogatory information, large dollar or volume purchases, including through the use of business credit cards, of items designated as EAR99 (or large volume or dollar purchases at wholesale electrical/industrial merchants, electrical parts and equipment providers, or electronic parts providers), in the United States or abroad, especially if paired with purchases at shipping companies.

19. Companies or individuals with links to Russian state-owned corporations (including shared ownership, as well as branches of, subsidiaries of, or shareholders in such state-owned corporations) involved in export-related transactions or the provision of export-related services.

20. Export transactions identified through correspondent banking activities involving non U.S. parties that have shared owners or addresses with Russian state-owned entities or designated companies.

21. Use of business checking or foreign exchange accounts by U.S.-based merchants involved in the import and export of electronic equipment where transactions are conducted with third country-based electronics and aerospace firms that also have offices in Russia or Belarus.

22. Transactions identified through correspondent banking activities connected to Russian petroleum-related firms or firms that resell electronics and other similar items to Russian firms.

What is the latest news from FinCEN and BIS?

Nearly one year after the initial joint alert, FinCEN and BIS issued a supplemental alert on the importance of continued vigilance for potential Russian export control evasion attempts. This supplemental joint alert provides financial institutions additional information regarding new BIS export control restrictions related to Russia, as well as reinforces ongoing U.S. Government initiatives designed to further constrain and prevent the Russian military from accessing critical technologies and goods.

>> Learn how to navigate Russian sanctions and prepare for new threats <<

The alert further details evasion typologies and identifies nine additional transactional and behavioral red flags to look out for when identifying suspicious transactions relating to possible export control evasion. These new red flags include:

1. Transactions related to payments for defense or dual-use products from a company incorporated after February 24, 2022, and based in a non-GECC country.

2. A new customer whose line of business is in trade of products associated with the nine HS codes, is based in a non-GECC country, and was incorporated after February 24, 2022.

3. An existing customer who did not receive exports associated with the nine HS codes prior to February 24, 2022, but who is receiving such items now.

4. An existing customer, based outside the United States, received exports associated with one or more of the nine HS codes prior to February 24, 2022, and requested or received a significant increase in exports with those same codes thereafter.

5. A customer lacks or refuses to provide details to banks, shippers, or third parties, including about end users, intended end-use, or company ownership.

6. Transactions involving smaller-volume payments from the same end user’s foreign bank account to multiple, similar suppliers of dual-use products.

7. Parties to transactions listed as ultimate consignees or listed in the “consign to” field do not typically engage in business consistent with consuming or otherwise using commodities (e.g., other financial institutions, mail centers, or logistics companies).

8. The customer is significantly overpaying for a commodity based on known market prices.

9. The customer or its address is similar to one of the parties on a proscribed parties list, such as the BIS Entity List, the SDN List, or the U.S. Department of State’s Statutorily Debarred Parties List.

How can I ensure I’m in compliance with the FinCEN BIS Joint Alert?

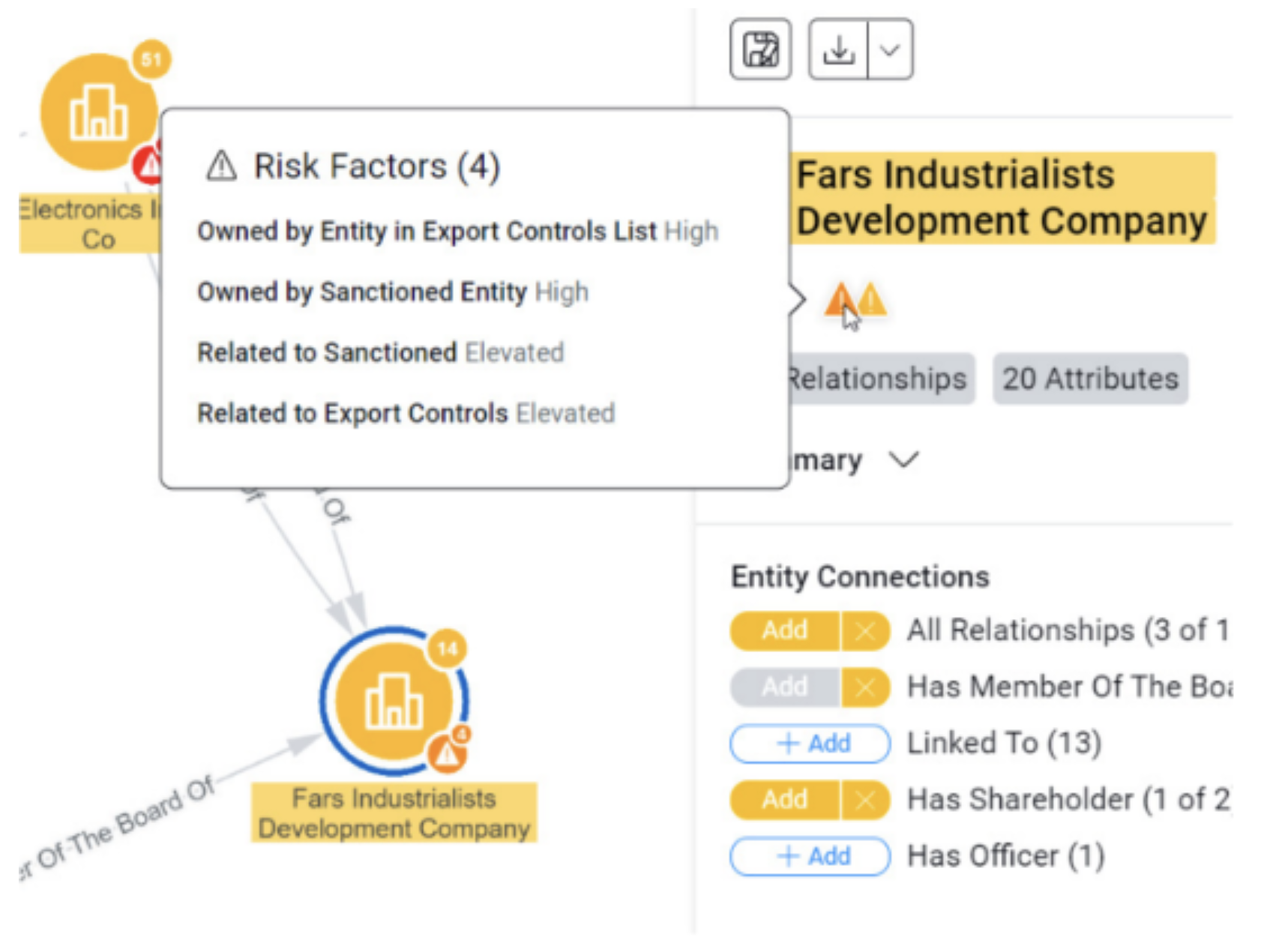

Sayari’s commercial risk intelligence allows investigative teams to thoroughly and efficiently perform due diligence on suppliers, vendors, distributors, customers, and other third parties. Precomputed risk indicators and a suite of graph analytics tools empower compliance teams to quickly and confidently conduct due diligence on global third parties to uncover any ties to Russia.

- Get “single-click” beneficial ownership mapping and distance calculations between your targets and watchlisted entities

- Mitigate reputational risk with comprehensive adverse media from across 120 jurisdictions

- Tailor searches to your exact requirements with filters based on risk type, jurisdiction, and distance-to-risk

Speed up your compliance investigations with Sayari Graph. See the impact for yourself with a personalized demo of Sayari Graph. For inspiration, watch one of our in-house analysts perform an example investigation in this Master Class on tracking assets of Russian oligarchs.