Russia has long relied on Western dual-use technologies like advanced integrated circuits to re-supply its military and defense industrial base. Since Russia’s invasion of Ukraine, however, enforcement bodies have established a wide range of sanctions and export control packages in order to disrupt the war effort and increase its economic cost to Russia.

Australia, Canada, New Zealand, the United Kingdom, and the United States, alongside the European Union and Japan, have prioritized HS codes of certain controlled items that Russia is using to manufacture weapons systems, including integrated circuits (microelectronics), electronics items related to wireless communications manufacturing equipment of electric components of circuits, and other electronics and non-electronics items.

However, despite such coordinated efforts to impede Russian illicit procurement schemes, Russian companies have succeeded in obtaining dual-use goods through third-party countries.

Sayari analysts set out to identify the countries most responsible for this transshipment to Russia and, leveraging trade data in Sayari Graph, discovered that about 95 percent of all high priority dual-use technology shipments to Russia between January and May 2023 were sent from 10 countries across Asia, the Middle East, and Eastern Europe.

Most notably, more than 80 percent of the shipments were sent from China and Hong Kong, suggesting that the two countries continue to play an outsized role in supplying the Russian government with a wide range of needed military technology. Recent research has identified Hong Kong in particular as a “prominent node in Russia’s illicit procurement network,” with $400 million worth of integrated circuits exports to Russia in 2022, double that of the prior year. Due not only to Hong Kong’s role as one of the busiest ports in the world, but also to increased influence from China, Hong Kong’s role in aiding Russia’s war efforts in Ukraine warrants scrutiny.

The Model: Exploring the Scope of a Known Actor’s Unknown Trade Networks

On February 29, 2024, the Department of Justice announced that Russian citizen Maxim Marchenko pleaded guilty to money laundering and smuggling goods from the United States after his September 2023 arrest for allegedly participating in an overseas network that illegally procured large quantities of dual-use, military grade OLED microdisplays for Russian end users. According to the indictment, Marchenko is a Russian national residing in Hong Kong who leveraged three shell companies — Alice Components Co., Ltd. (Alice Components), Neway Technologies Limited (Neway Technologies), and RG Solutions Limited (RG Solutions) — alongside two co-conspirators to acquire dual-use technology from United States companies and to ship it to end users in Russia.

Given the growing interest surrounding Hong Kong’s role in supporting Russia’s war efforts, investigation into the trade relationships shown in Russian customs data between Marchenko’s companies and Russian importers can shed light on:

- What goods were sourced,

- Who received the illegal shipments

- What Western companies might have consequently and unintentionally aided in the Russian war effort.

<<Download the full report for a complete list of findings>>

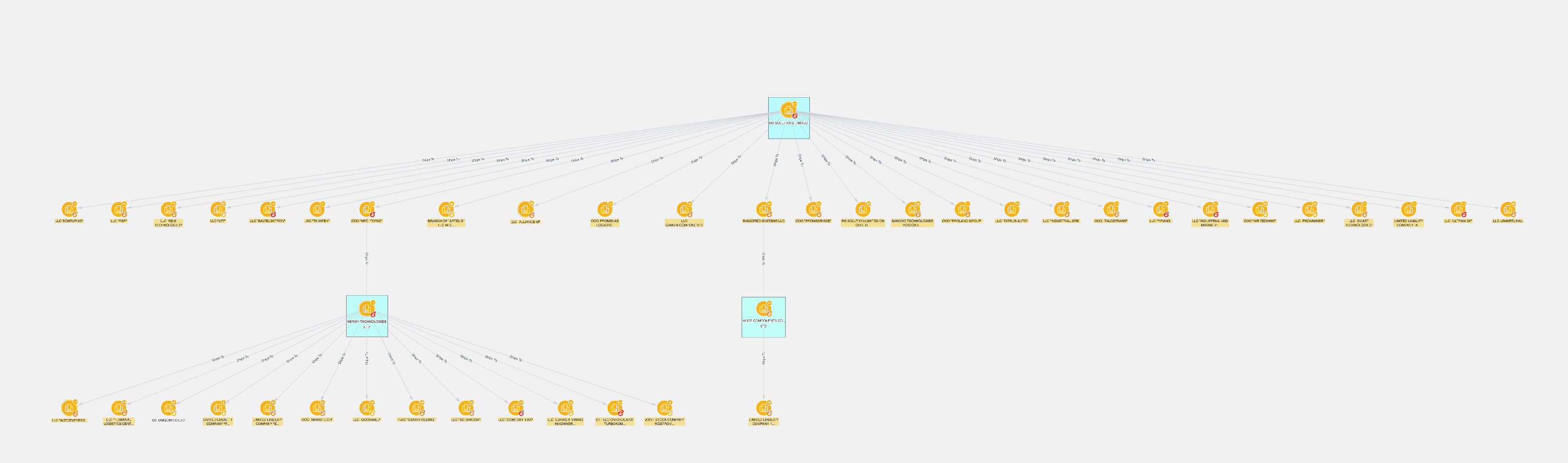

By applying this model, Sayari analysts found that Marchenko’s Hong Kong companies exported at least 2,771 shipments to more than 40 companies in Russia.

Fig. 1: Sayari Graph network depicting Marchenko’s companies (highlighted in blue) and the 40+ Russian entities to which they ship.

The goods shipped by Marchenko’s Hong Kong companies included integrated circuits, inductors, electrical capacitors, processing units for automatic data-processing machines, parts for internal combustion engines, and parts of telephone sets, among others. Of the HS codes shipped, 27 appear in BIS guidance on electrical components that are essential for Russia’s war efforts, accounting for 45% of all goods exported by Marchenko to Russian companies.

While trade data does not reveal any direct shipments from the United States to Hong Kong associated with Marchenko’s companies, Sayari analysts used shipment descriptions to find connections between the goods exported to Russia and Western companies.

Analysis of trade data can uncover how Russian companies circumvent trade restrictions by relying on dual-use goods shipped from third party countries. To prevent the continued reliance on Western semiconductors and other BIS high priority goods, semiconductor manufacturers should use guidance by BIS and FinCEN to understand red flags for potential export controls evasion.

Furthermore, compliance teams can leverage Sayari trade data and corporate relationships to identify potential vectors by which Russian companies are evading sanctions and export controls — both through the named third-party companies, specific trade relationships, and shipments from companies in these third-party countries.

Read the full report for case studies illustrating the application of this analytical model.