This is the first in a series on Iranian sanctions evasion in the maritime shipping industry. In case you missed it, you can read the introduction here.

Part 1: Our investigation into the Grace I’s ownership leads to an Emirati family with a history of supporting Iranian interests against international sanctions.

Grace Tankers Ltd.

The key to the Grace I’s ownership lies in a jurisdiction often deemed a dead end for investigators. When it was detained, the vessel was owned by a shell company in St. Kitts and Nevis called Grace Tankers Ltd.

St. Kitts is known as a secrecy jurisdiction for a reason. Minimal corporate disclosure requirements make it easy for companies to hide the identities of the people who control them. But Grace Tankers, like most St. Kitts companies, doesn’t actually do business in St. Kitts. This gives us an opportunity to peer behind the curtain by looking at public records from other, more transparent jurisdictions where the company operates.

For Grace Tankers, that meant Panama.

International law requires that all commercial vessels are registered with a country and are subject to that country’s laws — but it doesn’t have to be the shipowner’s country of origin. Some countries, like Panama, have open ship registries without any nationality or residency requirement. These “flags of convenience,” as they are sometimes called, offer shipowners an additional layer of anonymity. Ships engaged in criminal or other illicit activity often employ them.

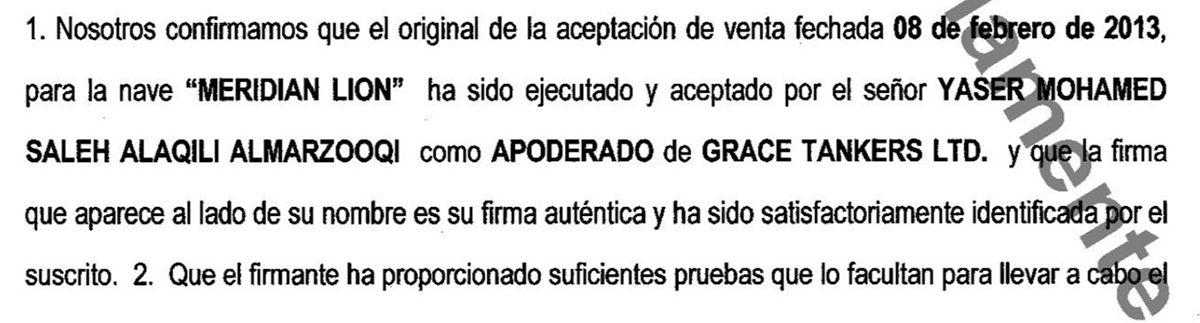

The Grace I was sailing under the Panama flag, so its owners were required to file certain administrative paperwork with the Maritime Authority of Panama. This included a notarized document from August 2016, recording Grace Tankers’ purchase of the Grace I (at that time named the Meridian Lion). The contract disclosed that a Dubai resident named “Yaser Mohamed Saleh Alaqili Almarzooqi” held power of attorney for the St. Kitts company behind this transaction (see Fig. 1).

[Fig. 1: Excerpt from 2013 Panamanian record shows Yaser Mohamed Saleh Al Aqili as “apoderado” (power of attorney) for Grace Tankers Ltd. in the purchase of the Grace I (then named the Meridian Lion).]

So Yaser Mohamed Saleh Al Aqili had legal control of Grace Tankers Ltd. and, by extension, the Grace I. This is our first glimpse of the Al Aqilis — an Emirati family with companies across the Middle East, deep ties to Iran, and a history of sanctions evasion and other illicit activity.

Who are the Al Aqilis?

The Al Aqili Group had its beginnings in Deira, Abu Dhabi in 1976, with a small fast-moving consumer goods (FMCG) trading company called Al Aqili Distribution.

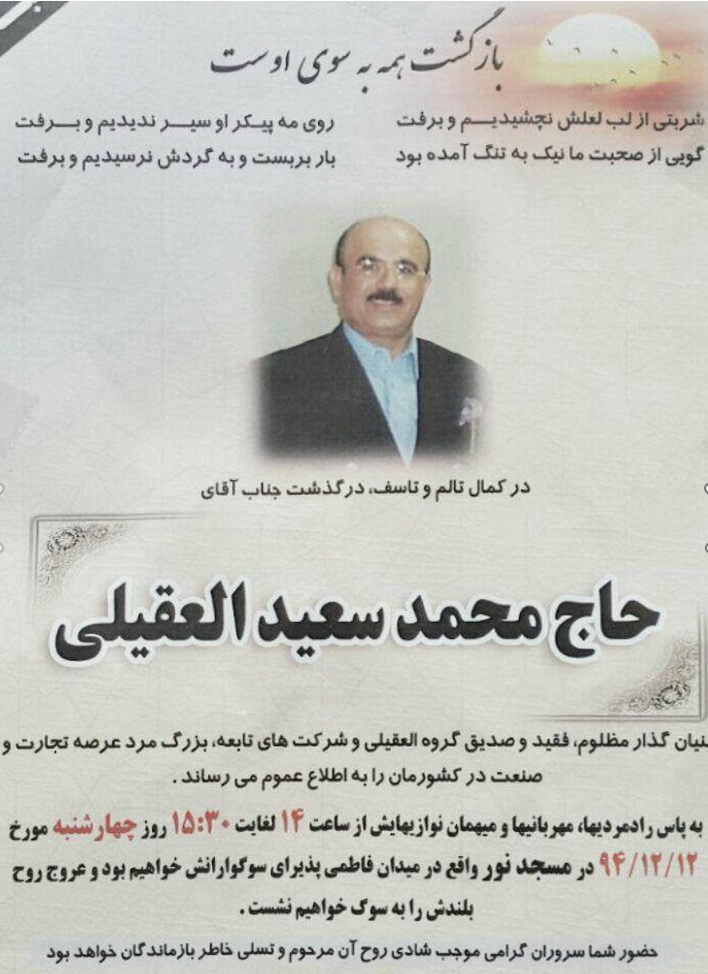

Under the leadership of Mohamed Saleh and Mohamed Saeed Al Aqili (see Fig. 2), it expanded into an international conglomerate operating across sectors as diverse as real estate, petrochemicals, retail, and construction.

[Fig. 2: Mohamed Saeed and Mohamed Saleh Al Aqili in front of the Al Aqili Group logo. Source: Al Aqili Distribution.]

The Al Aqili corporate network is expansive. Public records show the Al Aqilis in direct or indirect control of dozens of companies (if not hundreds) across the Middle East and reaching as far as the Czech Republic, India, Malta, the United Kingdom, and, of course, St. Kitts. More than 60 different Emirati companies are registered to the Al Aqili Group’s Dubai post office box alone.

Mohamed Saeed Al Aqili was the Al Aqili Group’s CEO and Vice Chairman until his death in February 2016. Per UAE court records, his family inherited much of his business empire. Company disclosures confirm that today Al Aqili Group companies are predominantly owned by Mohamed Saeed’s relatives, including the same Yaser Mohamed Saleh Al Aqili who controlled Grace Tankers.

The Al Aqili Group’s Ties to Iran

Publicly available sources tell a complicated story about the Al Aqili Group’s history in Iran. On the one hand, they describe long-standing and profitable business interests, supported by high-ranking government officials. On the other hand, they report allegations of cigarette smuggling, failed investments in the banking sector, and outstanding loans to the Iranian ruling elite.

A few elements of this story are credible and directly relevant to our investigation of the Grace I.

Business in Iran

First, the Al Aqili Group has a well-established business presence in Iran. Al Aqili family members directly and indirectly control numerous Iranian companies, all clearly documented in Iranian public records.

The Al Aqili network in Iran includes numerous public and private companies, many based in the investment-friendly Qeshm Free Zone. Some of the companies are owned directly by Mohamed Saeed or other Al Aqili relatives; others have Al Aqilis as ultimate beneficial owners through multiple layers of corporate ownership in Iran and abroad. Several Iranian businessmen seem to act as local facilitators, appearing repeatedly on the boards of different Al Aqili subsidiaries.

These Iranian holdings include, for example:

– Grand Distribution Co., a fast-moving consumer goods retailer and direct subsidiary of Al Aqili Distribution based in Tehran. Mohamed Saeed was Chairman of its board of directors in 2015, prior to his death (see Fig. 3).

– Qeshm Tobacco Co., a tobacco distributor in the Qeshm Free Zone partially owned by Grand Distribution Co. Importing tobacco was at one time very profitable for the Al Aqilis, who were netting USD $300 million per year by 2007, according to leaked U.S. State Department records. Since then, however, accusations of illicit cigarette smuggling and an investigation by Iranian authorities reportedly damaged their business.

– Qeshm Cement Co., also based in the Qeshm Free Zone, in which Qeshm Tobacco Co. holds a stake. As of its most recent board meeting last February, Qeshm Cement’s board chairman was Hamed Mohamed Saeed Al Aqili, as a representative of one of its other shareholders, Qatar-based United Gulf Cement.

[Fig. 3: Memorial notice for Mohamed Saeed Al Aqili, shared by Grand Distribution Co. Source: Facebook.]

Sanctions Evasion

Second, the Al Aqilis have a history of helping Iran evade international oil sanctions.

In April 2014, the U.S. Treasury’s Office of Foreign Assets Control (OFAC) sanctioned Mohamed Saeed Al Aqili and several of his companies in Dubai. According to OFAC, Al Aqili leveraged his extensive network of companies in the UAE and abroad to help Iran evade sanctions. This included disguising the Iranian origin of the oil he sold and facilitating financial transactions for sanctioned Iranian banks. Al Aqili also apparently collaborated with other sanctioned oil brokers and facilitators in the Gulf.

In these actions, Mohamed Saeed Al Aqili seems to have played a role similar to the better-known Babak Zanjani. Zanjani, a wealthy Iranian businessman, brokered oil sales on behalf of the sanctioned Ministry of Petroleum through dozens of companies he controlled in the UAE, Turkey, and Malaysia. He was arrested in late 2013 on charges of stealing billions of dollars from the Iranian government, convicted, and currently sits on death row in Iran.

Zanjani’s saga showed Iran’s determination to sell its oil in international markets, despite sanctions — and how an enterprising middleman could generate enormous profits by facilitating those sales. The Al Aqili Group, with its army of subsidiaries, would be similarly well positioned to arrange oil sales.

This is particularly true now that the Al Aqilis themselves are no longer sanctioned. OFAC delisted Mohamed Saeed and his companies through the 2016 implementation of the Joint Comprehensive Plan of Action (better known as the Iran Deal). When the Trump administration subsequently withdrew from the deal and sanctions “snapped back” on, the Al Aqilis stayed off the list.

Ties to the IRGC

Third, the Al Aqilis have close ties to Iran’s Islamic Revolutionary Guards Corps (IRGC).

The IRGC is a branch of the Iranian military that wields considerable political and economic power. The organization itself, and many of its leaders, are currently under U.S. sanctions in connection to Iran’s ballistic missile and nuclear programs, state-sponsorship of terrorism, and human rights abuses. Notably, the IRGC has provided consistent financial and material support to Bashar Al-Assad.

U.S. authorities have drawn a clear link between the Al Aqilis and the IRGC. As part of the 2014 designation, OFAC specifically stated that Mohamed Saeed Al Aqili arranged oil sales for the IRGC.

We found plenty of Iranian media and other open source allegations of IRGC ties, often in relation to the illicit cigarette smuggling trade that the IRGC reportedly controls. Though generally more rumor than fact, these reports align with the cooperative business relationship OFAC described.

More Connections to the Al Aqilis

Given all this, it is not surprising to discover that an Al Aqili-controlled company owned the Grace I when it was smuggling IRGC oil to Bashar Al-Assad’s Syria. But Yaser Al Aqili’s control of Grace Tankers Ltd. was only the beginning. As we continued to unravel the network around the Grace I, we ran into the Al Aqilis again and again.

Next week: In Part 2 of this series, we take a closer look at the Singapore-based ship manager that operated the Grace I while it was smuggling oil.

Photo Credit: Tony Hogwood, MarineTraffic.com