The Chinese government uses state-backed investment vehicles to fund dual-use technologies, including semiconductors. These vehicles have sprawling global networks and create the risk that a supply chain might inadvertently support China’s military-civil fusion.

The National Integrated Circuit Industry Investment Fund, China’s largest state-run semiconductor investment vehicle, is closely connected to firms designated by the United States for their participation in military-civil fusion. The fund directly and indirectly owns shares in upwards of 3,000 companies, which are located in dozens of countries and operate in industries ranging from technology to real estate.

Semiconductor manufacturing has become a flashpoint in U.S.-China relations. Semiconductors are critical components of most high-tech supply chains, from smartphones to cars. Chinese firms are dependent on the United States for semiconductors, but the Chinese government has made tech supply chain independence a priority in recent years.

What is the Big Fund?

The National Integrated Circuit Industry Investment Fund (国家集成电路产业投资基金股份有限公司), known in China as the Big Fund (大基金), was set up in 2014 by China’s Ministry of Finance and China Development Bank Capital to invest in China’s semiconductor industry.

The Big Fund’s shareholders include Chinese government agencies and large state-owned enterprises. The fund’s largest shareholder is China Development Bank Capital, which is ultimately controlled by China’s Ministry of Finance and China’s State Council. The second largest shareholder is China National Tobacco Corporation, China’s largest state-owned tobacco company. In addition, two companies that the U.S. has designated for contributing to China’s military-civil fusion, China Mobile Communications Group and China Electronics Technology Group, collectively own about ten percent of the fund.

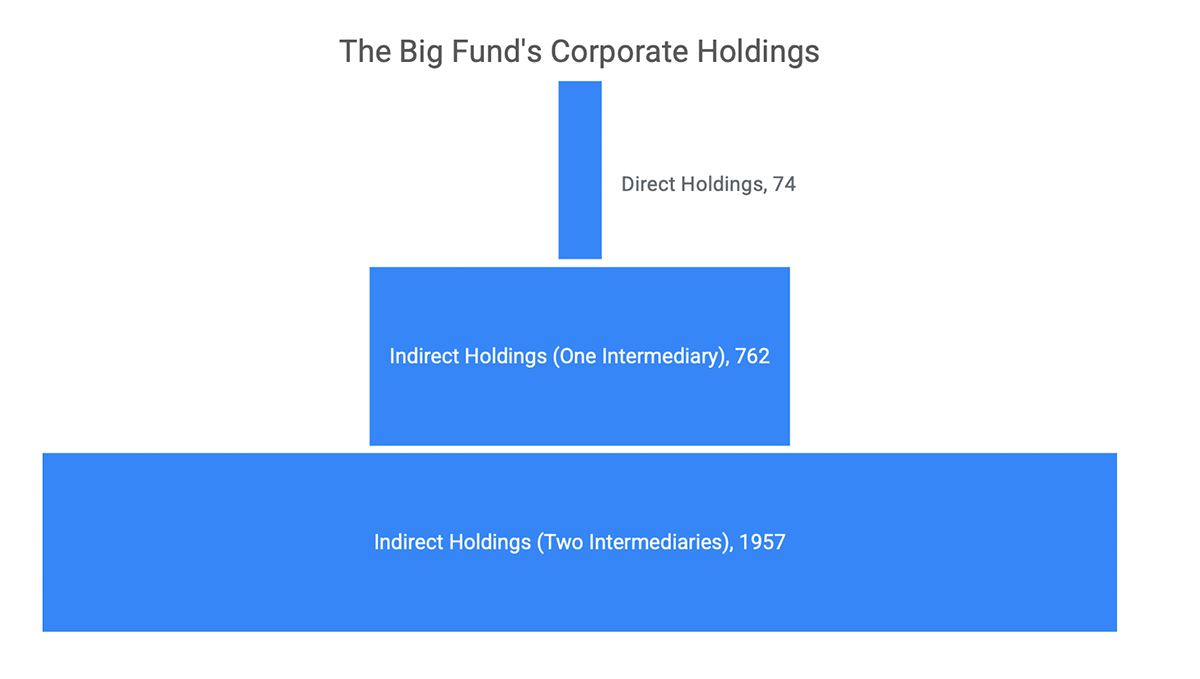

The fund does not solely- or majority-own any entities; instead, it maintains minority shareholding in over 70 companies. Many of these companies are themselves investment funds dedicated to funding semiconductor research, development, and manufacturing. In total, the fund has investments in 2,793 entities within three layers of ownership (see Figure 1).

Figure 1: The National Integrated Circuit Industry Investment Fund, or Big Fund, has 74 direct holdings, 762 indirect holdings with one intermediate entity, and 1,957 indirect holdings with two intermediate entities. Source: Sayari Graph.

About 67 percent of the fund’s investments go toward semiconductor manufacturing firms, according to a report from Eastmoney Securities. Other funds go toward semiconductor design, manufacturing, and packaging. Its investments also span information technology, 3D printing, and even real estate development.

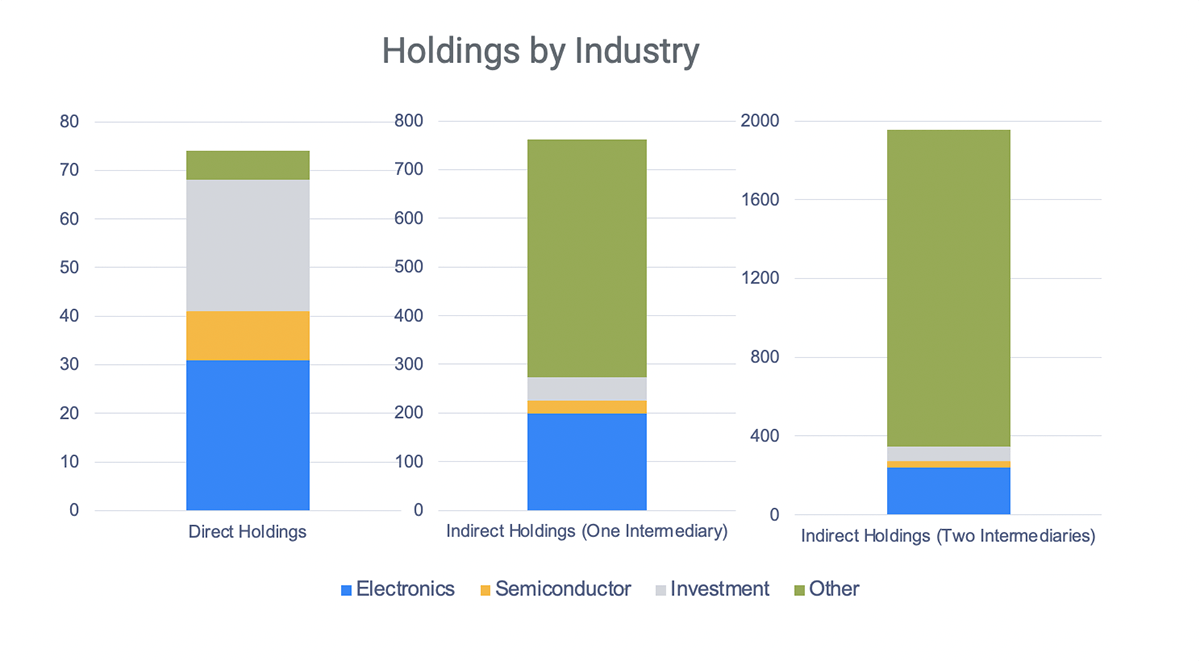

To get a high level look at the industries the fund invests in, we examined company names as they appear in Chinese government registries. Chinese company names usually contain information about the primary industry the entity is engaged in. We examined the number of entities within the fund’s portfolio with key industry terms including the following: semiconductors (电路), electronics (电 excluding 电路 or terms related to electric power generation), and investment (投资).

The Big Fund’s direct shares are concentrated on electronics and semiconductors, but over half of the fund’s indirect shares are companies that contain no reference to electronics or semiconductors in their name (see Figure 2.)

Figure 2: The Big Fund’s direct and indirect holdings sorted by industry. Note that each company’s industry was determined using company names. Source: Sayari Graph.

The Big Fund’s overseas holdings

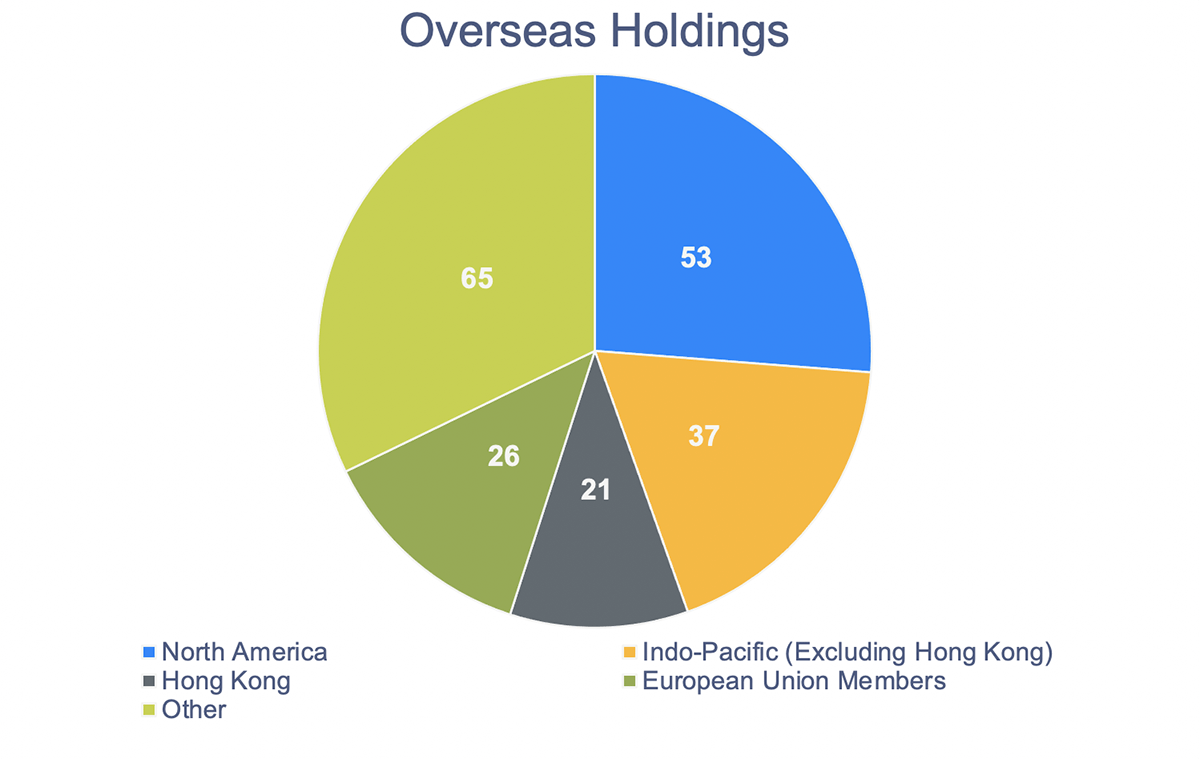

The Big Fund’s reach extends far beyond China. Of the fund’s 2,793 holdings within three layers of ownership, over 200 are registered in and/or operate outside of China.

Using publicly available government records from both China and other jurisdictions, we examined entities ultimately owned by the Big Fund that appear in overseas government records or have registered overseas activities with China’s Ministry of Commerce. The nature of these firms’ overseas presence or activities varies on a case by case basis. Some of these entities appear on overseas watchlists, such as the Section 1237 list, which would be registered by our methodology as a form of overseas activity within the jurisdiction the watchlist was issued.

Figure 3: Countries of registration for all of the Fund’s holdings within three layers of ownership. Note that the firms designated on watchlists appear in our dataset as having a presence in that jurisdiction. Source: Sayari Graph.

Some of the fund’s overseas investments operate in industries outside of tech. For example, the Big Fund owns seven percent of Shanghai Wanye Enterprise Co. Ltd., a property development company that manages real estate and hotels. Shanghai Wanye also owns a semiconductor research subsidiary, according to its company website. Shanghai Wanye has a subsidiary registered in California, Wanye International Inc.

The Big Fund also co-owns companies alongside U.S. firms. For example, VeriSilicon Microelectronics (Shanghai) Co. Ltd. has investment from the Big Fund, Intel and VantagePoint, a U.S.-based venture capital firm. VeriSilicon focuses on semiconductor design and has a subsidiary in California, as well as a research and development center in Texas.

The Big Fund’s links to military-civil fusion

The Big Fund both owns and is owned by companies that the U.S. has identified as Chinese military companies.

The Trump and Biden administrations designated two of the Big Fund’s shareholders as Chinese military companies. China Electronics Technology Group Corporation (CETC) and China Mobile Communications Group both appear on U.S. regulatory watchlists under the Section 1237, Section 1260H, and the National Security-Chinese Military Industrial Complex.

These companies collectively own about ten percent of the Big Fund. (CETC employs researchers that work specifically on dual-use applications for technology, and China Mobile has built telecom infrastructure on militarized artificial islands in the South China Sea.)

In addition, the Big Fund owns shares in at least half a dozen other Chinese military companies identified by the U.S. government, including Semiconductor Manufacturing International Corporation (SMIC) and its subsidiaries. The U.S. Department of Commerce named SMIC as a “military end user” in 2020 and imposed export restrictions on the corporation.

The Fund also co-owns companies alongside named Chinese military companies. For example, the Big Fund owns 15 percent of the Shanghai Zhaoxin Investment Management Center. Shanghai Zhaoxin’s majority shareholder is SMIC Juyuan Equity Investment Management, one of SMIC’s investment arms.

Driving government goals through investment

The Chinese government uses investment strategically in sectors they have signaled are a priority. Semiconductors are one of the Chinese government’s investment priorities, and their applications range from civilian to military uses. The Big Fund’s massive multinational network reflects the scale of the Chinese government’s strategic investment in a key industry. And as the country’s largest state-backed semiconductor investment fund, it is uniquely positioned to support the government’s military-civil fusion efforts.

The fund’s holdings don’t exclusively exist to support military-civil fusion – there are plenty of civilian uses for semiconductors, but the Chinese government’s investment in them is also a reflection of an economic strategy designed to decrease China’s reliance on foreign tech.

The National Integrated Circuit Industry Investment Fund is only one component of this strategy, but understanding the fund’s portfolio provides a concrete picture of how this strategy can manifest. Direct investments are focused in semiconductors, but the broader investment network reaches farther beyond.