A recent report from the U.S. intelligence community concluded that Mohammed Bin Salman (MBS), the crown prince and de facto leader of Saudi Arabia, ordered the “capture or killing” of journalist Jamal Khashoggi in 2018. Now calls are coming from human rights activists and some members of congress for the U.S. to sanction either MBS or Saudi Arabia’s sovereign wealth fund, known as the Public Investment Fund (PIF).

Public records show that MBS is the president of the PIF, which has a multi-billion dollar portfolio in the U.S. Although MBS and the PIF remain unsanctioned, if the U.S. decides to act, there would potentially be far-reaching effects on some large U.S. businesses due to these Saudi investments, as well as potential complications for U.S. businesses that have committed to working on PIF-led projects in Saudi Arabia.

Why the PIF?

Activists have recently targeted their efforts to sanction the PIF in light of President Biden’s unwillingness to sanction MBS. The campaign to sanction the PIF was recently bolstered by reporting about it’s ownership of two Gulfstream jets that ferried the hitmen between Istanbul and Saudi Arabia — providing a direct link between PIF assets and Khashoggi’s murder.

In 2018, before the murder of Khashoggi, MBS used his role as crown prince and president of the PIF to go on a well-publicized charm offensive — garnering favor with U.S. business leaders and politicians to portray Saudi Arabia as rapidly modernizing and open for investment while simultaneously using the PIF to invest in U.S. companies.

If the U.S. Treasury’s Office of Foreign Assets Control designates the PIF, its U.S. assets would be blocked. Moreover, U.S. persons who transact with companies that the PIF owns and/or controls would be in violation of U.S. law.

The PIF’s commercial ties to the U.S.

At the end of 2020, the PIF’s U.S. portfolio was worth over $12.7 billion and comprised 11 companies, according to an SEC filing. That figure does not include other investment vehicles that could indirectly link U.S. companies to the PIF. For example, Sanabil Investments is a wholly owned subsidiary of the PIF and invests in “promising venture capital-backed companies” around the globe, including the U.S., China, and Europe, according to its website.

Beyond the PIF having to pull its assets out of U.S. companies if sanctioned, there are also U.S. companies that plan to work on PIF-funded projects that are part of Saudi Vision 2030 — a strategic framework aimed at diversifying the Saudi economy and promoting a more secular version of the country.

One of the most ambitious Saudi Vision 2030 projects is known as NEOM — a tech-centric economic zone that focuses on sustainability and pedestrian-friendly infrastructure. NEOM is projected to cost $500 billion and cover an area similar to that of Belgium. A significant portion of the initial investment will come from the PIF, but Saudi leadership is hoping for a large amount of foreign direct investment to supplement the upfront cost. Sanctions would complicate the involvement of major U.S. companies that have committed to projects in NEOM by pushing the timeline or even putting the project as a whole in jeopardy.

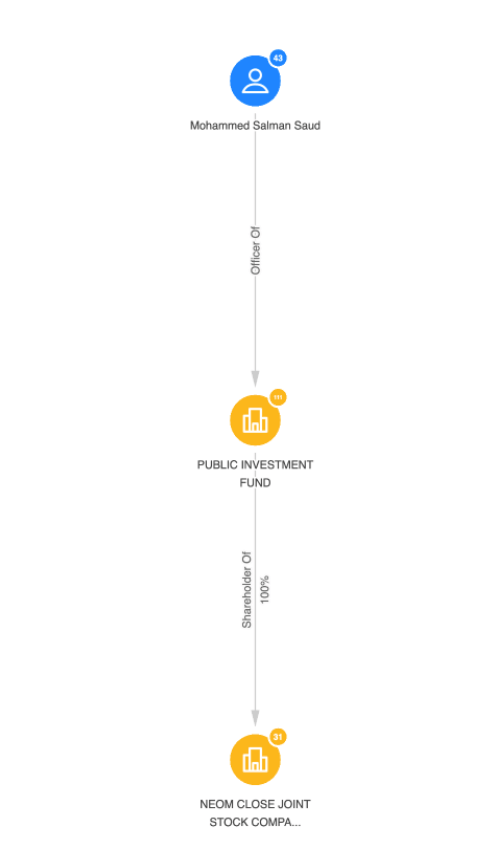

Fig. 1: A snapshot from Sayari Graph showing Mohammed Bin Salman as the president of the Public Investment Fund, which is the 100% shareholder of Neom Close Joint Stock Company.

Beyond untangling investments between the U.S. and Saudi Arabia, U.S. businesses would have to confront the issue of high-ranking PIF officials on their boards. Yasser Al-Rumayyan is the governor of the PIF and sits on the board of a large U.S.-based tech company that the PIF is heavily invested in. Al-Rumayyan is also the CEO of aforementioned Sanabil Investments.

With the PIF sanctioned, leadership would not be able to travel to the U.S. and their U.S. assets would be frozen, which would force a serious reevaluation by some of these U.S.-based companies regarding their relationships with the PIF. Moreover, sanctions would likely keep the PIF from hitting the ambitious target set by Al-Rumayyan of making the PIF the world’s largest sovereign wealth fund, with $2 trillion in assets by 2030.