A contractor for subsidiaries of Venezuela’s state-owned oil firm, Petróleos de Venezuela, S.A. (PDVSA), who was charged in March with money laundering is connected to over $5 million in property spanning Florida and California, along with five previously unidentified companies in Hong Kong.

Given the contractor’s alleged money laundering activities as outlined by U.S. prosecutors, these properties, along with the companies in Hong Kong—a known secrecy jurisdiction—could be tied to efforts to conceal illicit proceeds derived from overvalued contracts.

U.S. Prosecutors Charge Venezuelan Contractor with Money Laundering

On Mar. 20, 2020, U.S. prosecutors in South Florida filed a complaint charging dual Venezuelan-Italian citizen, Leonardo Santilli (aka Leonardo Santilli Garcia), with money laundering, along with two other related charges. Between 2014 and 2017, Santilli was allegedly awarded inflated contracts from subsidiaries of PDVSA to supply various types of “goods.” Santilli also allegedly paid bribes and kickbacks to PDVSA officials in exchange for the overvalued contracts.

The subsidiaries consisted of four joint ventures that were majority owned by PDVSA, along with a wholly owned procurement entity that was “responsible for the purchase of materials and equipment.” The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) sanctioned PDVSA in January 2019 “pursuant to Executive Order 13850 for operating in the oil sector of the Venezuelan economy.”

Santilli controlled at least four companies, two in South Florida and two in Venezuela, that served as brokers supplying the goods to the PDVSA subsidiaries, according to U.S. prosecutors. In total, Santilli’s companies received close to $150 million in inflated contracts, over $100 million of which was transferred to personal accounts held by Santilli or his family members, trust accounts, shell companies, or other Venezuelan nationals. A portion of these transfers were earmarked for officials of PDVSA subsidiaries as bribes and kickbacks in exchange for the inflated contracts, according to the complaint.

After examining bank account records for Santilli’s companies, U.S. law enforcement found that the companies had charged “substantial markups” for goods sold to the PDVSA subsidiaries. In at least three cases, Santilli’s companies received purchase orders that were between four and five times the market price for equipment such as hawkjaws, floating valves, and 55-gallon oil drums, according to U.S. prosecutors. Additionally, Santilli allegedly maintained a spreadsheet of payments that “appear to list bribe payments by date, amount, and recipient.” So far, U.S. authorities have seized $44.7 million related to the investigation.

The Santilli case falls within a broader investigation by U.S. law enforcement starting in 2017 that has “identified $1 billion in payments from PDVSA subsidiaries to bank accounts of various Venezuelan contractors in South Florida.” Santilli is but one of several contractors that have been targeted by U.S. authorities in recent years for bribing officials at PDVSA, as well as its subsidiaries, in exchange for overvalued contracts.

Florida LLCs Serve as Vehicles to Purchase Property in Florida, California

To trace assets that could potentially have been used to launder proceeds from inflated contracts, we conducted a public records investigation into Santilli’s network.

We uncovered that Santilli appeared on the incorporation documents of four Florida limited liability companies (LLCs) that would later purchase real property in Los Angeles County, California and Miami-Dade County, Florida. The total estimated value of all four properties is just over $5 million. Additionally, all property was purchased between December 2015 and April 2017, coinciding with the time period of the alleged illicit activity outlined in the criminal complaint. The four LLCs involving Santilli were:

- 2377 Glendon LLC (Active)

- 10421 Northvale LLC (Active)

- Manning 90064 LLC (Active

- Brickell Miami 5210, LLC (Inactive as of Sep. 28, 2018)

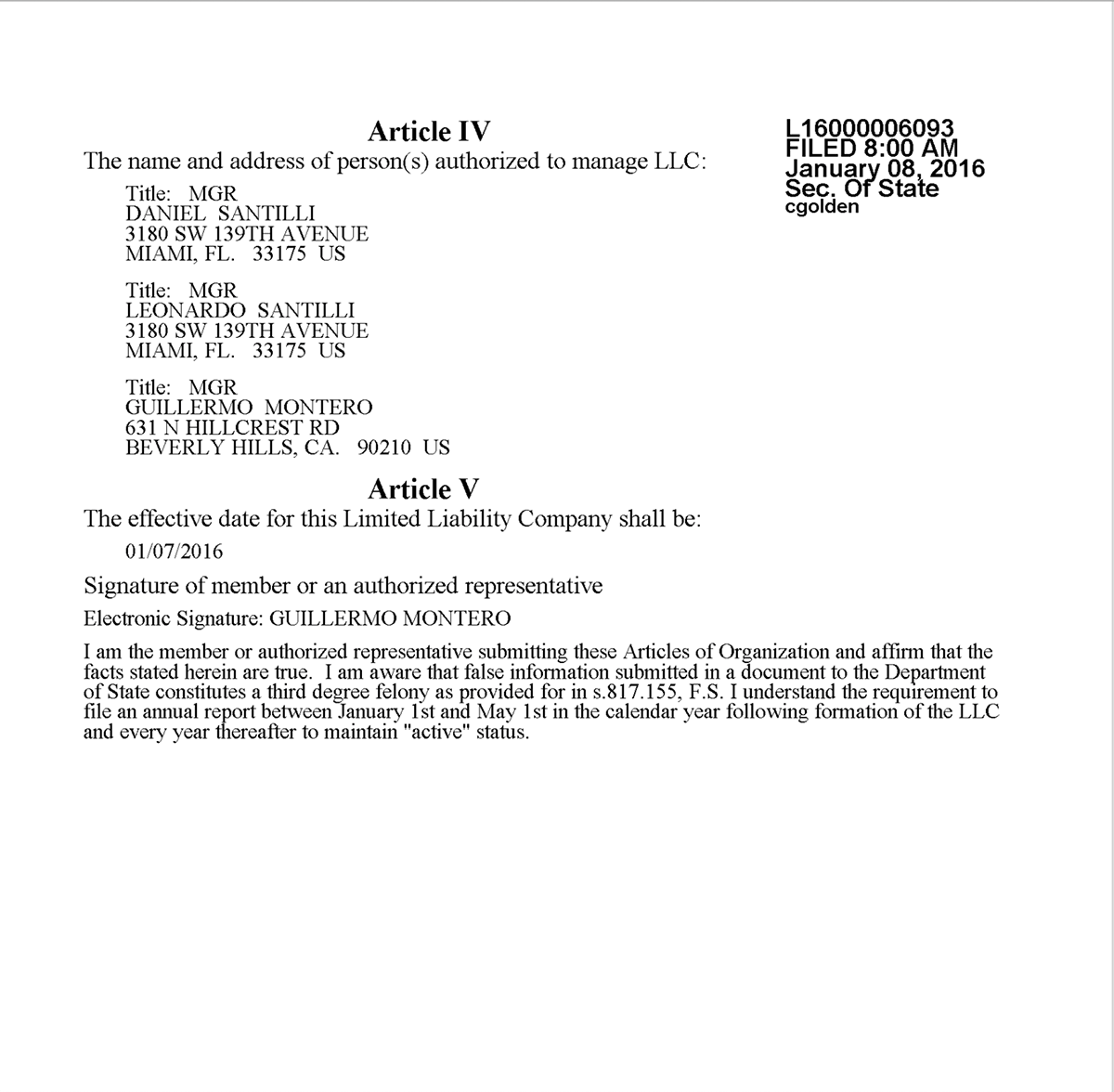

The first of these Florida LLCs to be incorporated and purchase property was 2377 Glendon LLC. At the time of incorporation on Jan. 7, 2016, the company listed Leonardo Santilli, his brother Daniel, and another individual by the name of Guillermo Montero as the managers.

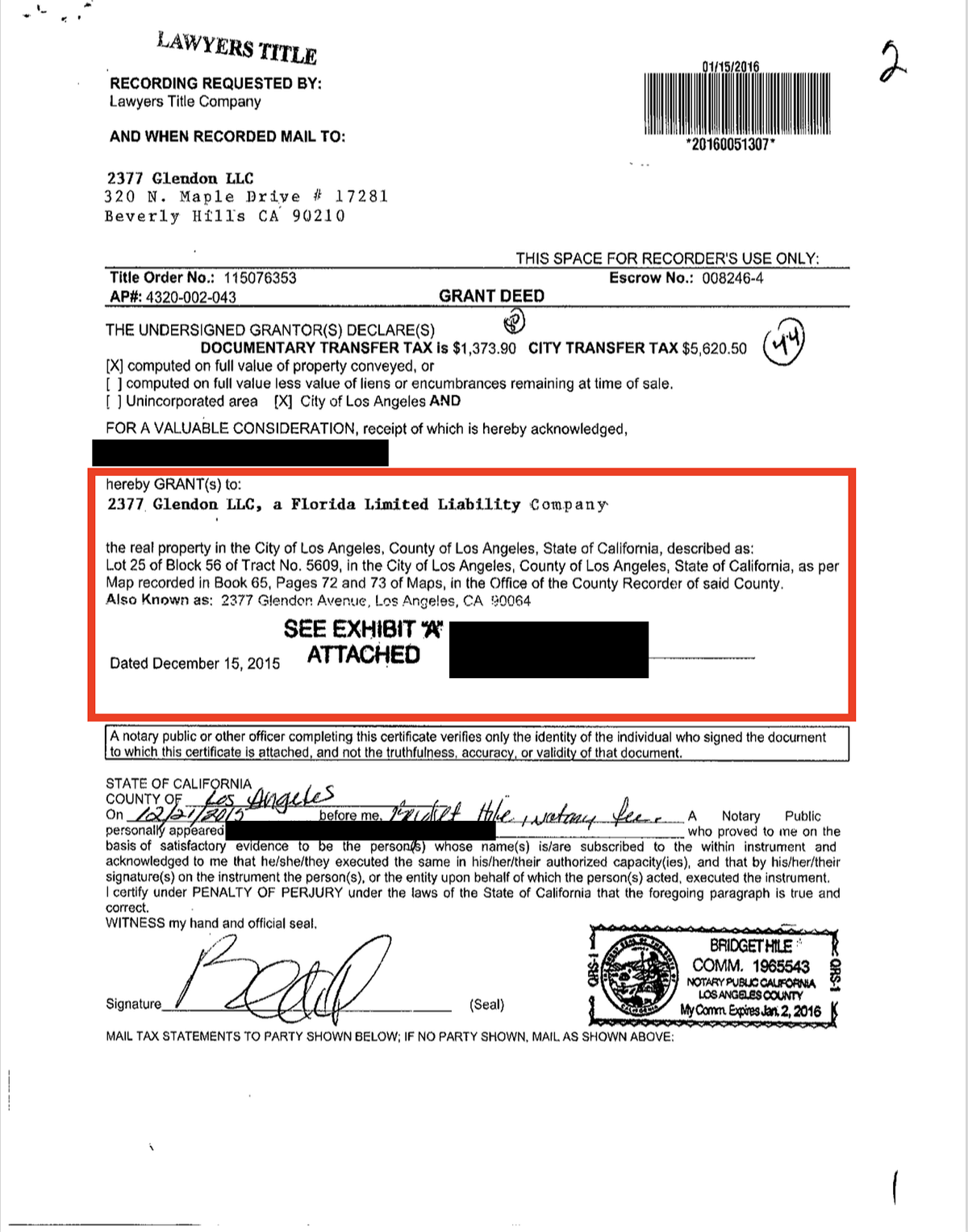

Interestingly, the company appears on a grant deed as the grantee for the sale of property in Los Angeles County dated Dec. 15, 2015, three weeks before the company was formally incorporated. The value of the property at the time of sale was $1,249,000, according to property records from Los Angeles County.

Fig 1. Left: A page from an articles of incorporation filing with the Florida Secretary of State listing Leonardo Santilli, along with his brother Daniel, as the founding shareholders of 2377 Glendon LLC. Right: A grant deed showing the sale of property in Los Angeles County to 2377 Glendon LLC on December 15, 2015.

In April 2016, Leonardo and Daniel Santilli, along with Guillermo Montero, appeared on a second Florida company, 10421 Northvale LLC. Less than a month later, the company purchased property in Los Angeles County for $1,505,000.

The pattern then continued into 2017, when on Jan. 30, Brickell Miami 5210, LLC purchased a luxury condo on 1300 S Miami Ave for over $1.4 million. And on Apr. 3 of the same year, Manning 90064 LLC purchased property for just over $1 million in Bay Harbor Islands. The companies Manning 90064 LLC and Brickell Miami 5210, LLC were registered with the Florida Secretary of State in August and October 2016, respectively. Leonardo Santilli appeared as a manager of both companies at the time of incorporation.

The connection between Leonardo Santilli and the four companies, along with his alleged role in paying bribes to officials of PDVSA subsidiaries and laundering the proceeds from inflated contracts, suggest that these properties could have served as vehicles for money laundering.

A Corporate Network Spanning South Florida, Panama, Venezuela, and Hong Kong

Apart from the four aforementioned companies, Santilli is currently or was previously connected to at least six additional businesses in South Florida, six in Venezuela, and two in Panama.

Perhaps most notably, Santilli appears as a 50 percent shareholder of Corporación Guayana Oro, C.A., a Venezuelan mining firm. The company is located in Venezuela’s Orinoco Mining Belt, one of the country’s most important gold mining regions. Additionally, he is listed as a director and secretary of a Panamanian food distribution company, Corporacion Empresarial Alimentos del Sur, S.A. (CEASSA), which has also appeared in Venezuela’s government contractors registry.

Companies and individuals associated with Venezuela’s gold mining sector as well as the state-run food distribution program, CLAP, have been targeted in recent months by OFAC. In March 2019, OFAC began applying pressure on the Venezuelan gold industry by sanctioning the state-owned gold mining firm, Minerven. And in July and September 2019, OFAC sanctioned several individuals and companies that have allegedly been engaged in high-level graft and money laundering schemes related to the CLAP program. We did not find any evidence to suggest that CEASSA has been involved in supplying food for the CLAP program.

Leonardo Santilli, et al. Incorporate Companies in Hong Kong

Apart from owning or controlling companies in South Florida, Venezuela, and Panama, Leonardo Santilli and his family members also own and control five previously unidentified businesses in Hong Kong.

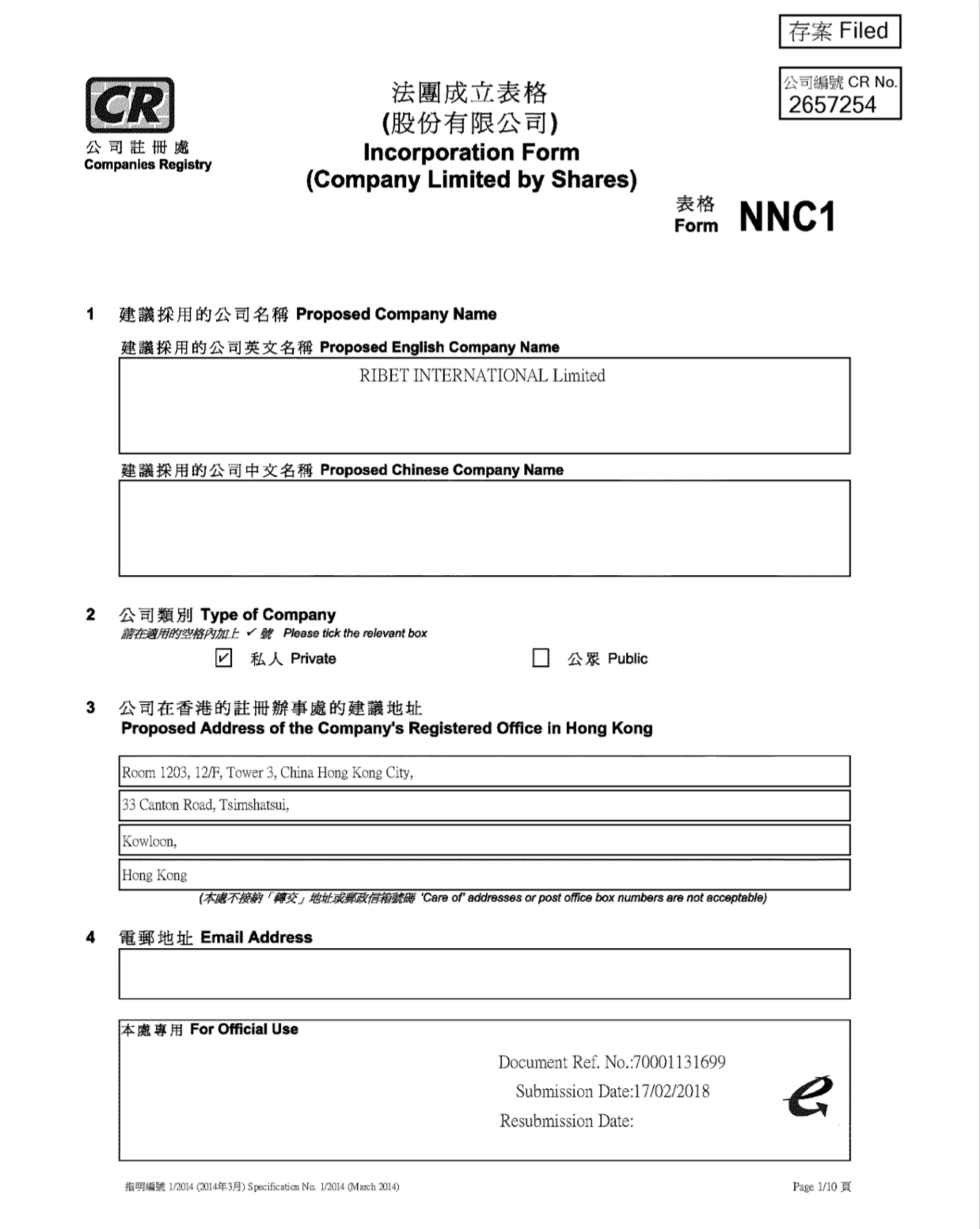

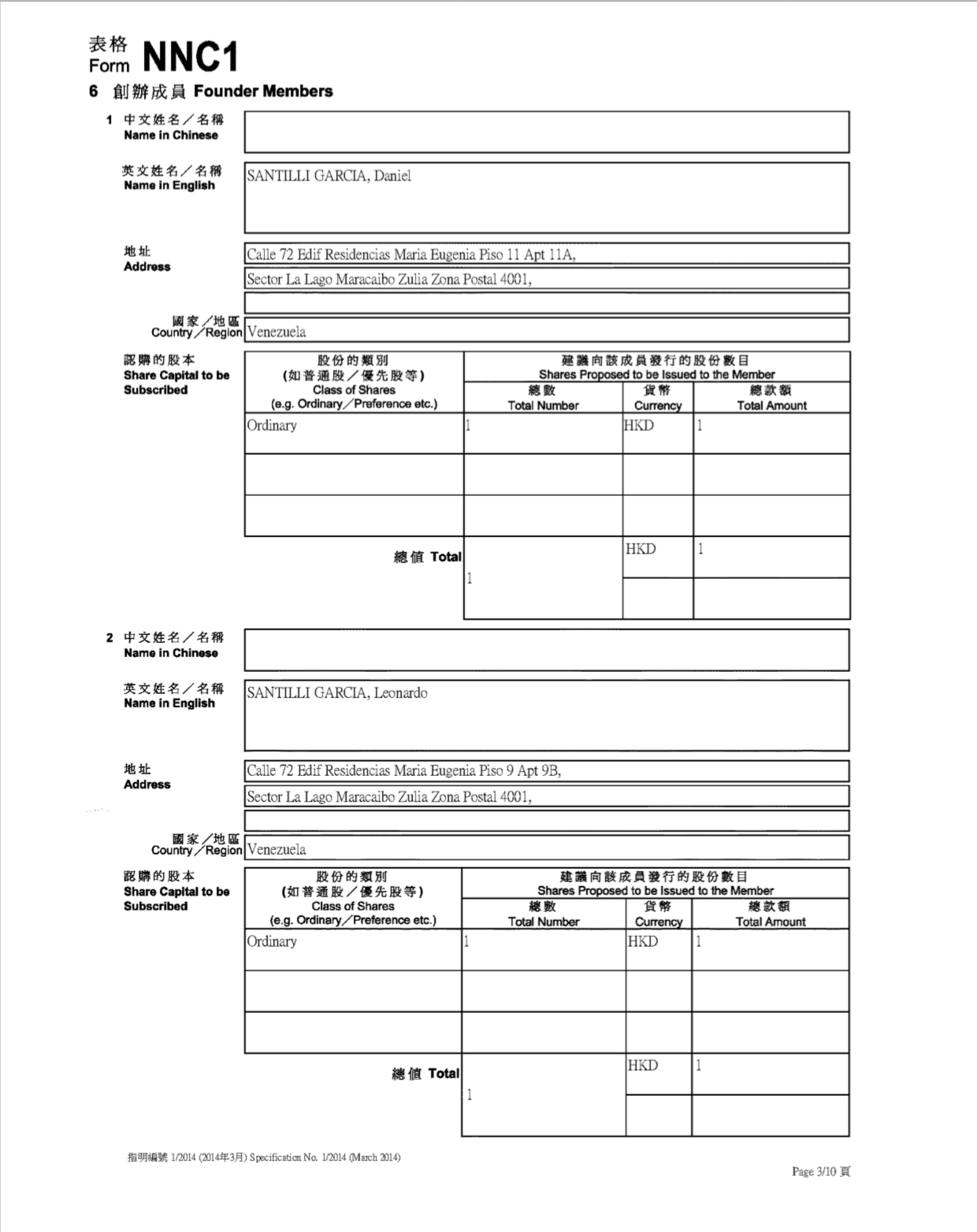

In November 2017, Santilli, along with five family members, founded Constructora cosaco c.a Limited, with a total share capital of HKD 6 ($0.77) split evenly among them. Santilli would go on to become a founding shareholder of two additional companies in Hong Kong in February and June of 2018: Ribet International Limited and PLD Inversiones C.A. Limited.

Fig 2. Leonardo Santilli among the founding shareholders of Ribet International Limited in Hong Kong.

Interestingly, Ribet International Limited shares a name with a company (Ribet International LTD) incorporated in the British Virgin Islands (BVI). In the criminal complaint against Santilli, U.S. prosecutors allege that on at least two occasions in February and August 2017, Santilli “caused a transfer” of approximately $10 million to an unidentified BVI-based company controlled by himself and his family. While we were unable to identify any links between Santilli and Ribet International LTD in BVI, the fact that this company shares a name with a Hong Kong-based company owned by Santilli and his family, suggests that this could potentially be the unidentified BVI-based entity mentioned in the complaint.

Finally, in 2018, Santilli’s family members incorporated two additional companies in Hong Kong: Constructora Cosaco, C.A. Cosaco Limited and Pld inversiones C.A., PLD, Limited.

Santilli and his family members’ connections to companies in a secrecy jurisdiction, such as Hong Kong, raise questions as to the true purpose of these companies and whether they have been used to conceal illicit proceeds derived from overvalued contracts from PDVSA subsidiaries. Additionally, Santilli’s repeated appearances on companies with direct family members suggest that these individuals could also potentially be implicated in his alleged illicit activities, and thus warrant further investigation.