Two Swiss banks are calling for Fahad Al-Rajaan, a Kuwaiti businessman and the former Director General of the Public Institution for Social Security (PIFSS), to be extradited and tried in Switzerland, UAE media reports.

Al-Rajaan fled to the UK in 2014 after a whistleblower triggered an investigation into his time at PIFSS. Kuwaiti officials accused Fahad Al-Rajaan of embezzlement in 2016 during his tenure as Director General of Kuwait’s PIFSS, a position he held since 1984. Now two private Swiss banks, from among the 38 defendants, are calling for this case to be heard in Switzerland where most of the transactions occurred.

PIFFS is using the UK court system to pursue Al-Rajaan. PIFFS alleges that Al-Rajaan stole approximately $850 million from the fund through kickbacks and commissions, according to UK court documents from June 2020. About $513 million went to Al-Rajaan while the remaining went to associates involved in the scheme. Al-Rajaan allegedly moved the ill-gotten funds through bank accounts and front companies in Switzerland, Lebanon, Singapore, the Bahamas, and the British Virgin Islands, according to local media.

Al-Rajaan spent lavishly during the period of alleged criminal activity. His lawyers claim that a conservative estimate of Al-Rajaan’s spending over the last 30 years is between $210 and $214 million. Al-Rajaan used some of the funds to buy fine diamonds and real estate in the U.S. and Switzerland. Moreover, his residence in London is a five-bedroom serviced apartment in the upscale Knightsbridge area — he purchased it for approximately $8.6 million in 2006.

Swiss authorities began investigating Al-Rajaan in 2012. Kuwait issued an international arrest warrant in 2016 before sentencing Al-Rajaan in absentia to a 10-year prison term. British authorities arrested Al-Rajaan in April 2017 with the intent to extradite him, but he applied for political asylum. His claim is still processing as of June 2018.

The Criminal Court in Kuwait, after a second trial in June 2019, sentenced Al-Rajaan and his wife Mona Al-Wazzan to life imprisonment and hard labor with a combined fine of $312 million for “appropriation and facilitating the seizure of the PIFSS money,” according to KUNA, the official Kuwait news agency.

Gulf Capital in International Investment

The Arab Gulf countries are powerful players in the international investment and wealth management spaces with notoriously opaque modi operandi. Moreover, their sovereign wealth funds are often controlled by a few decision makers who are close to ruling families. Therefore, Al-Rajaan’s case is important for investors working in Gulf finance or for investigators, like those tracing Al-Rajaan’s assets.

Kuwait has the oldest sovereign wealth fund in the world — established in 1953 — and is the fourth largest in the world with $524 billion in global assets. The PIFFS was established shortly after in 1955, holds $72 billion in global assets, and has been described in a leaked U.S. cable as “an investment powerhouse.”

Al-Rajaan in Public Records

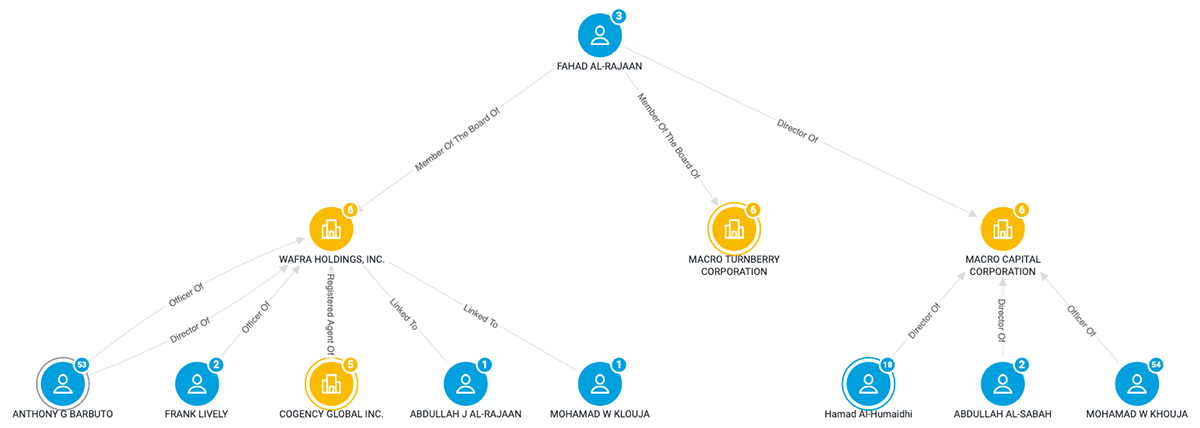

Fig. 1: Sayari Graph snapshot showing Fahad Al-Rajaan linked to Wafra Holdings Inc., Macro Capital Corporation, and Macro Turnberry Corporation.

Moreover, Macro Turnberry Corporation and Macro Capital Corporation list Abdullah Al-Sabah — a last name signifying a link to Kuwait’s ruling family.