With global markets nearing all time highs and increased diversification of the Russian economy, companies have seized the opportunity to issue their stock both at home and abroad. Russian companies through the first half of this year alone have expanded their presence on global markets through initial public offerings (IPO) at a pace not seen since before Russia’s 2014 annexation of Crimea.

Despite the recent boom, geopolitical and sanctions risk still remain important factors in evaluating Russian equities, which often require additional due diligence. When conducting an assessment of Russian companies issuing securities in the United States, U.S. Securities and Exchange Commision (SEC) filings combined with Russian public records can be valuable resources in measuring the sanctions risk exposure of a given firm.

Increased Diversification and the Resulting Russian IPO Boom

The recent growth of the consumer, technology, and e-commerce sectors in Russia has signaled a shift away from traditionally traded commodities, such as minerals and oil. This shift has provided new opportunities for Russian emerging markets to bring investments to global economies through IPOs of global depository receipts (GDR).

Companies like Ozon Holdings PLC (Ozon), an online retailer considered to be the Amazon of Russia, and more recently Fix Price Group Ltd (Fix Price), a Russia-based discount store chain, have seen success in their IPO debuts on NASDAQ and the London Stock Exchange, respectively. On the first day of trading Ozon’s valuation constituted $1 billion in its U.S. IPO, while Fix Price raised $1.7 billion in its London and Moscow offering.

Following the successes of Ozon and Fix Price, a number of other Russian companies – such as Softline, a major Russian IT company with global operations – are considering expanding through their own IPOs.

Sanctions Risk of Russian Firms Outlined in Corporate Disclosures

As part of the filings required to launch an IPO, the SEC requires companies to disclose certain information when registering their shares or GDRs in the United States.

When examining the SEC filings for Russia based companies, there are a number of key risk factors to look out for. These include: third-party risk in relation to the Crimea embargo, implementation of existing or future sanctions on Russia, and beneficial ownership risk associated with politically exposed persons.

Crimea as an Embargoed Jurisdiction and Third-Party Risk

Since Russia’s annexation of Crimea in 2014, the peninsula has become an embargoed jurisdiction that exposes Russian companies to operational and third-party risk in that region. Despite the fact that a Russian company may not have direct operations in Crimea, it is still possible for it to engage with entities located there as part of its business model.

For example, in examining SEC disclosures for Ozon, one prospectus reads that the company engages in “de minimis activities relating to Crimea, and these activities could potentially impede [Ozon’s] ability to raise funding in international capital markets.” Although Ozon does not operate on the ground in Crimea, it does rely on third-party vendors to deliver products and run a number of pick up locations in the region.

In the event that any of the third-party vendors are sanctioned for operating in Crimea, deliveries to the peninsula could be impacted, which could impact Ozon’s revenue. In addition, the application of secondary sanctions on entities conducting business in Crimea could have an impact on the company’s operations and result in losses due to reputational risk.

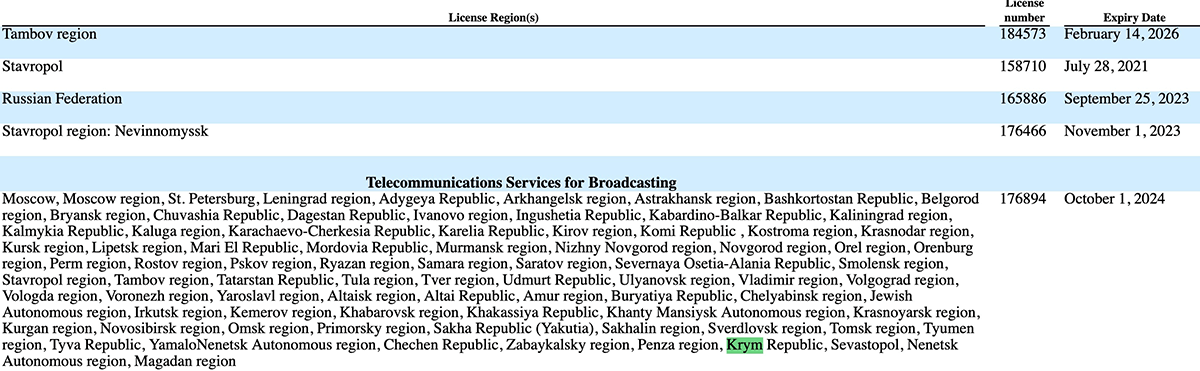

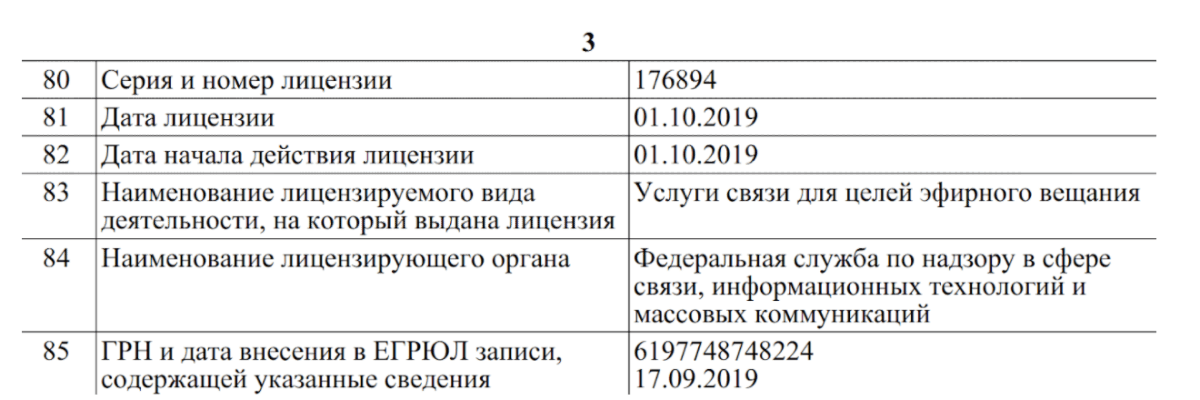

Crimea risk exposure is not solely limited to Ozon. The largest mobile network operator in Russia, Mobile Telesystems PJSC (MTS), which is traded on the New York Stock Exchange, also mentions Crimea operating risk in its SEC filings. While MTS does not disclose any direct Crimea-related business activity, a wholly owned subsidiary of MTS, Sputnikovoe TV LLC, does have a license to provide telecommunication services for broadcasting in Crimea and Sevastopol through October 2024 – confirmed by both its SEC filings, as well as its excerpt from the Russian Federal Tax Registry.

Fig. 1: Sputnikovoe TV’s license to broadcast in Crimea (highlighted in green) and Sevastopol as it appears in MTS’s 20-F SEC filing.

Fig. 2: Sputnikovoe TV’s license to broadcast in Crimea and Sevastopol, specified in MTS’s SEC filing, as it is shown in the Russian Federal Tax Registry.

MTS TV, a subscription television service offered by MTS, is available for purchase in Crimea from a number of third-party companies.

The Constant Threat of Future Russia Sanctions

One major point of concern around Russian companies is not only the current sanctions that have been implemented on Russia, but also the looming threat of potential future sanctions.

Global markets witnessed the consequences of Russia-related risk in April 2018, when the United States issued sanctions against Russia’s wealthiest and most politically connected businessmen and their companies. The U.S. Treasury’s Office of Foreign Assets Control’s sanctioning of Oleg Deripaska and his company En+, which was the first major Russian company listed in London since the 2014 annexation of Crimea, had resulted in significant losses for western institutions who had purchased the stock.

In assessing the current Russian IPO boom, one major player stands out. Vladimir Yevtushenkov and his Russia-based conglomerate Sistema PJSFC (Sistema) – whose GDRs are traded on the London Stock Exchange – have seen success in bringing their companies to western markets.

Pursuant to Section 241 of the Countering America’s Adversaries through Sanctions Act (CAATSA), Yevtushenkov was included in a January 2018 report presented to Congress while they were considering new sanctions targets. The report included a list of the 96 wealthiest Russian businessmen with senior level state connections, and whose estimated net worth was $1 billion or more.

At the time, U.S. representatives accused Yevtushenkov and his companies of participating in large construction and investment projects in Crimea. Russian President Vladimir Putin suggested in a 2016 statement that Sistema was planning to take part in the development of medical infrastructure in Crimea and Sevastopol. A spokesperson for Sistema, speaking to the media in 2018, denied any involvement in Crimea-based projects. Neither Sistema nor Yevtushenko were ultimately ever sanctioned.

Today, Yevtushenkov’s Sistema maintains significant ownership in a number of Russian companies whose stock is traded in the United States. This includes both Ozon and MTS, of which Sistema is a principal shareholder, beneficially owning 45.2 percent of Ozon and 50.02 percent of MTS.

Sistema is currently pursuing IPOs on the Moscow Exchange with floating shares available to foreign investors. This includes the recent debut of Segezha Group (a large forestry and paper product manufacturer), an IPO that netted a market capitalization of $1.68 billion, with 50 percent of the IPO purchased by foreign institutions. In addition, Sistema has hinted that its agriculture company Steppe, the medical clinics company Medsi, and its pharmaceuticals company Binnopharm are likely candidates for future public offerings.