Western insurers in Russia may be at risk of funding reinsurance payouts for liabilities exposed to sanctions, due to a 2017 piece of Russian legislation. In addition, the legislation may have presented new ways for investigators to identify which insurers in Russia are assuming risk for sanctioned entities.

In January 2017, Russian legislation came into force mandating that all insurance companies in Russia seeking reinsurance offer no less than 10 percent of their ceded risk to the Russian National Reinsurance Company (RNRC) — a state reinsurance body held by the Central Bank of Russia. In other words — 10 percent of reinsurance premiums paid by an insurer in Russia must be offered to the RNRC.

According to Articles 13.2 and 13.3 of the legislation, the RNRC can accept, refuse or change the amount of the offers provided by commercial insurers. However, it must accept ceded liabilities affected by so-called sanctions risk.

Western reinsurers abandon Russia in the wake of sanctions

When insurers take on significant risks on behalf of their clients, they often seek to minimize exposure by transferring some of that risk to a reinsurer — paying a premium to that entity in exchange for taking on the risk. This method ensures that no single liability in a portfolio has the power to bankrupt the insurer in the event of a payout.

This is typically a global process involving insurers in one jurisdiction shopping around in other markets to lower premiums and spread the risk around. However, in the wake of Western sanctions against Russian businesses and oligarchs, many Western reinsurers pulled out of existing contracts with Russian insurers ceding risk on sanctions-exposed liabilities, Nikolay Galushin, chief executive of the RNRC, told Reuters in June 2018. This prompted the need for a state reinsurer, the result of which was the RNRC.

According to Galushin, “[The RNRC] has taken the risks of all who had pulled out.” He went on to say that the single-event liability limit exceeds 20 billion rubles ($320 million). However, should a sanctioned entity payout exceed that limit, the Central Bank of Russia stands ready to provide more funds, according to Galushin.

Are western insurers funding reinsurance payouts for sanctioned liabilities?

Despite Galushin’s 2018 assurances that the Central Bank of Russia is effectively providing a line of credit for the RNRC in the event of a massive payout, the legislation also means that a lot of the state reinsurer’s funds are also coming from the mandatory ceded risk offers. It is worth noting that the 10 percent rule applies to all insurers in Russia, including subsidiaries of western insurers. While these companies are not in direct violation of sanctions, this legislation does raise questions as to whether or not these premiums could be eventually used to cover a payout to a sanctioned entity.

The riskier they come, the harder they fall

In Russia, the phrase “sanctions-exposed liabilities” typically means defense materials produced by entities listed in Section 231 of the Countering America’s Adversaries Through Sanctions Act (CAATSA 231) — a U.S. sanctions program focused on the Russian defense sector. And these liabilities can be massive.

For example, in December 2017, a shipment of S-400s — a Russian-made advanced surface-to-air missile system — was destroyed after the ship carrying it was caught in a storm en route to China. The total damages amounted to approximately $166.7 million, according to lawsuits filed by Rosoboronexport in January 2019 against the shipper Baltic Trans-port. Rosoboronexport is Russia’s sole state intermediary for the trade of defense and dual use products. Should the shipper have been found to not be liable, the insurer in this case, Independent Insurance Group (Независимая Страховая Группа), would have had to issue that expensive payout.

The vacuum caused by western reinsurers pulling out of these contracts made insuring Russian weapons shipments, as well as other sanctioned assets, such as industrial plants, quite risky. This has led to something of a knee-jerk reaction by the state, rushing into action a piece of legislation that was not universally popular among Russian insurers and legal professionals due to the mandatory concessions and partial nationalization of the industry.

Using ceded risk percentages to determine sanctions exposure

While the legal code has provided a solution for insurers in Russia seeking reinsurance, it has also provided a way for investigators to identify which of those insurers may have more exposure to sanctions risk. Recall that if the ceded liabilities offered by an insurer to the RNRC are exposed to sanctions risk, the RNRC must accept the offer. An insurer that has significant liabilities exposed to sanctions risk will most likely opt to cede them to the state reinsurer.

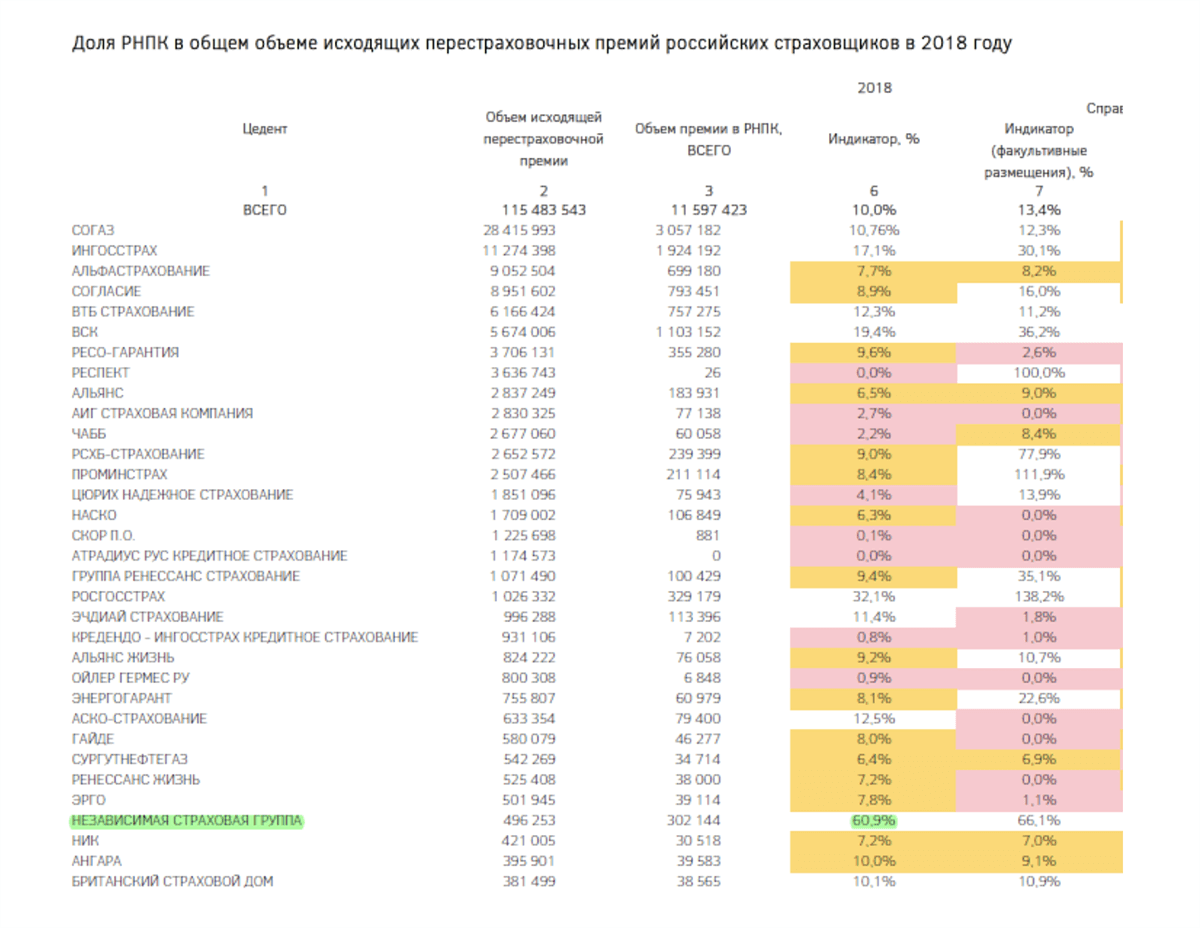

The RNRC publishes a list of insurance companies in Russia, along with the percentage of their ceded risk held by the state reinsurer. Using this publicly available information, investigators can identify which insurers in Russia have percentages of ceded risk (to the RNRC) significantly higher than 10 percent, to prompt further research into their clients and associated liabilities.

For example, we previously examined the case of Independent Insurance Group, an insurer of a shipment of S-400s worth approximately $166.7 million. When we examine the ceded risk percentages for insurers in Russia for 2018 published by the RNRC, we see that 60.9 percent of Independent Insurance Group’s ceded risk went to the RNRC — 50.9 percent more than the required offering. This resulted in the company paying approximately $3.95 million in reinsurance premiums to the RNRC in 2018.

Fig. 1: An excerpt from 2018 showing the outgoing premiums (for ceded liabilities) from insurers to the RNRC. Independent Insurance Group is highlighted in green, along with its associated percentage in column 6.

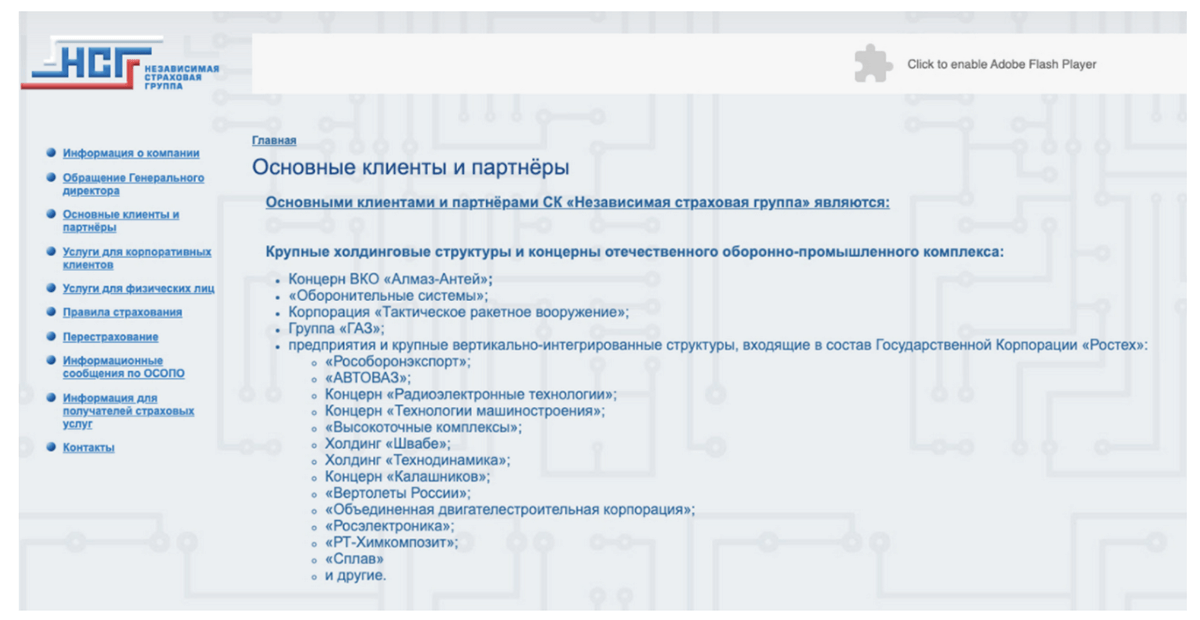

This is not a perfect science. There is nothing stopping an insurer from opting to offer more than the mandatory 10 percent of ceded risk to the RNRC, and doing so does not automatically indicate sanctions risk. Additional investigation is always necessary. In this case, a trip to Independent Insurance Group’s website revealed a client list that reads like a who’s who of CAATSA 231.

Fig. 2: A screenshot for the Independent Insurance Group website, which lists primary clients and partners.

Independent Insurance Group’s clients include familiar faces from under the Rostec umbrella, such as the aforementioned Rosoboronexport, as well as Kalashnikov Concern, a small arms manufacturer. Rostec is a state corporation under which several key manufacturing and technological entities of Russian defense operate. In addition to the Rostec family of companies, Independent Insurance Group also lists Almaz-Antey, the producer of the S-400 surface-to-air missile system as a client.

Photo: Vitaly Kuzmin (CC-BY-SA 4.0).