Chinese and Indian state-owned enterprises are key players in Iran’s aluminum supply chain, according to public records and commercial trade data provided by Panjiva.

Investigations into several Iranian facilities indicate routine foreign support at each stage of the aluminum production process, which could help support Iran’s ballistic missile program.

Jajarm Aluminum Complex

According to Iranian media, Iran opened its first alumina refinery — for refining bauxite ore into alumina, which is used to produce aluminum metal — at the Jajarm facility in July 2019. The bauxite supplied to this plant primarily comes from Iran’s North Khorasan province where the refinery is located. North Khorasan province holds the country’s largest mineral deposits of bauxite.

A recent Reuters special report found that the aluminum complex in Jajarm produces aluminum powder for Iran’s ballistic missile program based on the account of a former official who worked at the plant. The Jajarm aluminum complex is controlled by Iran Alumina Company (IAC), a subsidiary of Iranian Mines and Mining Industries Development and Renovation Organisation (IMIDRO).

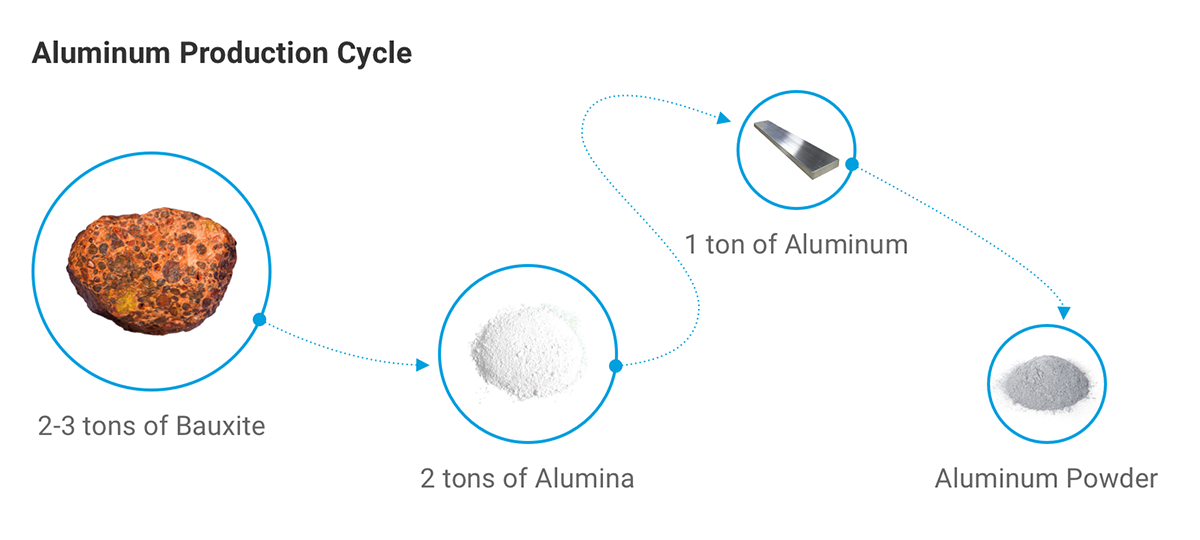

Fig. 1: Bauxite is an essential ore used in the production of aluminum oxide or alumina — it can then be converted into aluminum which is the primary material required for aluminum powder, a dual-use good. Aluminum powder is a key component in solid-fuel propellants used to launch missiles.

China’s Contribution — Machinery, Construction, and Training

Iranian media claims China Nonferrous Metal Industry’s Foreign Engineering and Construction Company (NFC) helped build the Jajarm aluminum complex and supplied roughly 40 percent of the equipment, equal to 38 million euros.

Panjiva trade data indicates that in 2017, China’s NFC made two shipments of machinery designed for earth, minerals or ores to Iran — worth roughly $400,000. These shipments indicate that NFC may still be engaged in Iran’s metals sector as a machinery supplier.

China’s NFC also helped finance the construction of an aluminum plant in the Lamerd Special Economic Zone controlled by South Aluminum Company (SALCO), which began operations in April 2020. Prior to the plant’s opening, SALCO sent nearly a hundred of its workers to China for training.

Bauxite Procurement From Guinea

Iran’s state-owned IMIDRO signed a contract last year to construct an alumina refinery in the Parsian Energy Intensive Industrial Special Economic Zone in Asaluyeh (a.k.a. Parsian Special Economic Zone). The contract is implemented by Aral Aluminum Company, which will produce alumina by importing bauxite from Guinea (it has the world’s second largest bauxite reserves) and India. Other exporters of aluminum ore (e.g. bauxite) to Iran as of 2019 include China, the United Arab Emirates, Turkey, and Hong Kong, according to the Tehran Chamber of Commerce.

Fig. 2: Iranian Imports of Aluminum Ores and its Concentrates (i.e. Bauxite) total $7.3 million in Iranian year 1397 (March 2018 – 2019), according to the Tehran Chamber of Commerce.

In Guinea, IMIDRO has a 51 percent shareholding of Société des Bauxites de Dabola-Tougué (SBDT); the other 49 percent shareholding is held by the Guinean government. SBDT first signed a contract to export bauxite to Iran in 1992 but the project never materialized. Talks to restart the project began in 2015, which led to an agreement between Guinea and Iran to extend bauxite exports for an additional 25 years.

The opening up of the mining site for SBDT is still under negotiation. A German-based subsidiary of IMIDRO, Mines and Metals Engineering GmbH, issued a tender for construction of SBDT’s mining site in 2018 — resulting in eight possible contenders, one of which was China’s NFC.

Indian Exports for Aluminum Production

Given the high transit costs of shipping bauxite from Guinea, Iran has also relied on India and other foreign suppliers to meet the demands of its growing alumina refining industry. Despite the withdrawal of many Indian companies from Iran after the reimposition of U.S. sanctions in 2018, Panjiva trade data indicates exports of bauxite from India to Iran as recently as February 2020.

In addition to supplying bauxite, India’s majority state-owned National Aluminium Company (NALCO) also sent Iranian Aluminum Company (IRALCO) and its subsidiary Amir Kabir Carbon Industry Company regular shipments of alumina over the past four years. The total value of NALCO’s alumina exports to Iran between January 2016 and April 2019 amounts to $174 million, according to Panjiva trade data.