The Xinjiang Production and Construction Corp (XPCC), sanctioned last year for human rights abuses, is in the news again for links to the region’s solar energy industry.

Corporate records reveal that the XPCC owns multiple entities that research, development, and manufacturing solar technology. While some shareholding links to the XPCC are obvious, more often they are hidden behind multiple layers of ownership.

Xinjiang’s dominance in the solar value chain

Following the U.S. Customs and Border Protection’s ban on all cotton and tomato products from Xinjiang last December, regulators have turned their spotlight to the solar energy industry.

China accounts for roughly 80 percent of the global supply of polysilicon, a key component in solar panels, as well as 80 percent of the world’s solar panels. About 40 percent of the world’s polysilicon comes from Xinjiang, the province under scrutiny for human rights abuses against the Uyghur minority group.

The region’s solar industry consists of hundreds of players — only a few of the largest have been named in forced labor probes. Using Sayari Graph, we found over 600 entities registered in Xinjiang that disclose photovoltaic products or services in their business activities, and over 1,400 entities in the broader solar energy industry. This does not include all possible Xinjiang entities in this space, as the registered address may sometimes omit “Xinjiang,” and business activities are self-disclosed.

The XPCC provides more than just infrastructure to Xinjiang’s solar industry

Concerns of forced labor in Xinjiang are inextricable from the XPCC, a hybrid paramilitary and corporate structure that controls huge swaths of Xinjiang’s economy. The U.S. Treasury Department sanctioned the XPCC last July for human rights abuses against the Uyghur population.

While a 2021 report by the strategy consultancy Horizon Advisory named Daqo New Energy — one of China’s top polysilicon manufacturers — as having benefited from XPCC electricity, the XPCC’s hand in the solar industry extends much deeper.

Just as it does in Xinjiang’s cotton industry, the XPCC owns entities in the solar industry through its asset management arm and subordinate divisions. These entities operate in the research and development of solar energy technology, as well as the manufacturing of photovoltaic products.

For example, Xinjiang Hope Electronics Co., Ltd, a manufacturer of “photovoltaic products, equipment, and components for solar energy,” is 51 percent owned by the XPCC 12th Division State Asset Management (Group) Co. Ltd., the asset management company that is 91 percent owned by the XPCC 12th Division State-owned Assets Supervision and Administration Commission. A promotional video on the XPCC 12th Division’s official website touts the company as the XPCC’s flagship enterprise in renewable energy and photovoltaic products.

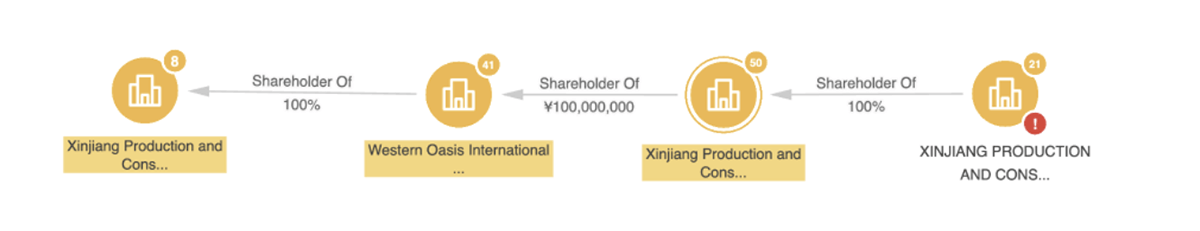

Ownership connections to the XPCC can be hidden

Some connections are clear. Urumqi-based XPCC Bioenergy Co., Ltd. signals its connections to the XPCC directly through its name. It discloses its business activities to include “research, manufacturing, development, and investment in solar energy industries,” and is 100 percent owned by Western Oasis International Industrial Group Co., Ltd. Western Oasis, in turn, is 100 percent owned by the XPCC State Asset Management Co. Ltd., the investment arm that is directly and 100 percent owned by the XPCC.

Fig 1: A Sayari Graph snapshot of the ownership relationship between XPCC Bioenergy Co., Ltd and the XPCC.

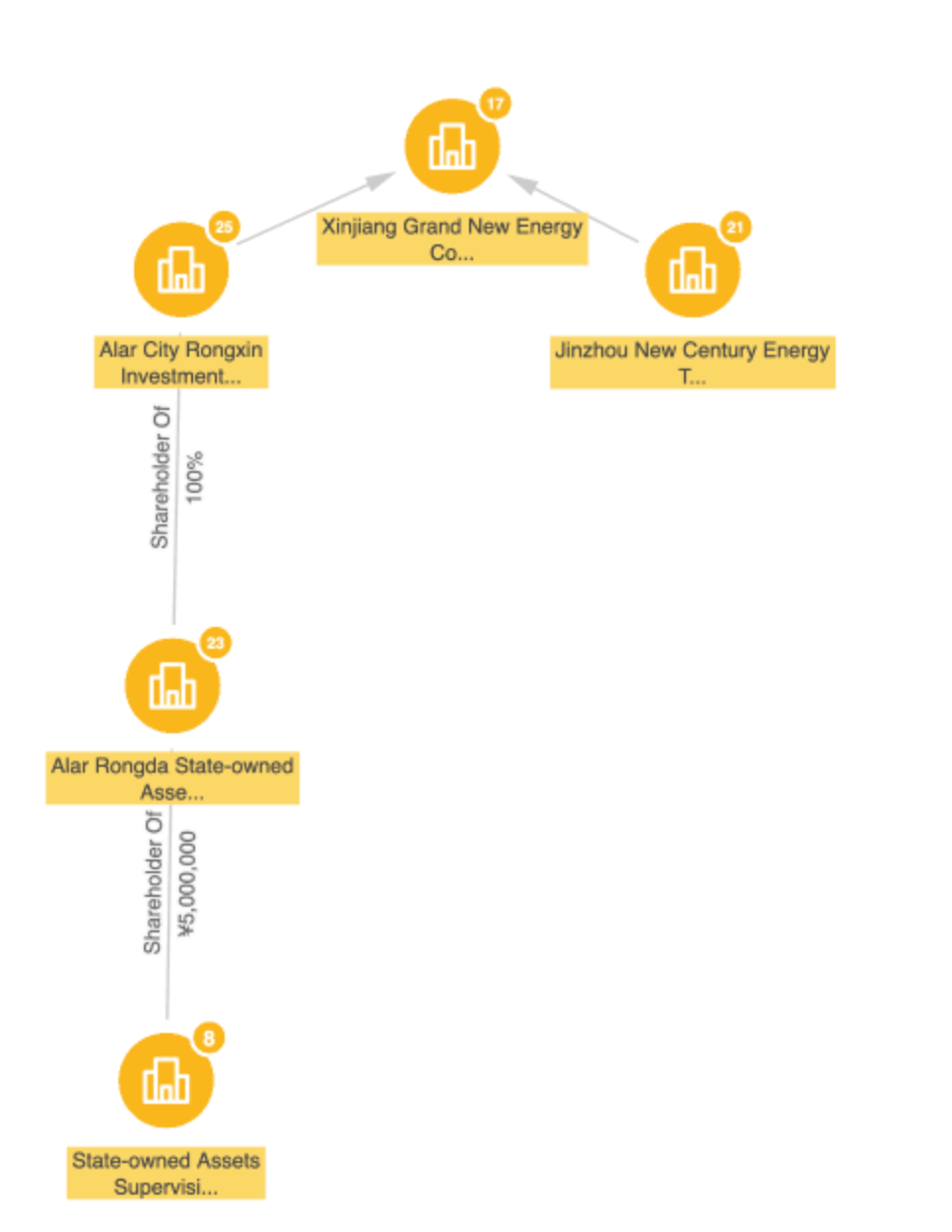

However, XPCC ownership is not always obvious. Xinjiang Grand New Energy Co., Ltd., a company registered in Alar, Xinjiang, discloses its business activities to include the production of polysilicon raw materials and solar cells, as well as the import and export of various commodities. Its two shareholders are Alar City Rongxin Investment Co. Ltd (43 percent) and Jinzhou New Century Energy Technology Group Co., Ltd. (57 percent).

Tracing the beneficial ownership reveals that Alar City Rongxin Investment Co. Ltd. is 100 percent owned by the XPCC First Division SASAC, but through another intermediary entity, the Alar Rongda State-Owned Assets Investment Management Co., Ltd.

Fig 2: A Sayari Graph snapshot of the ownership relationship between Xinjiang Grand New Energy Co., Ltd and the XPCC First Division SASAC.

Solar supply chain complexity requires better due diligence

Minimizing exposure to forced labor extends beyond vetting for XPCC ownership. In an industry with complex supply chains, it can be difficult to untangle the provenance of solar products. Large solar manufacturers have facilities across multiple cities and may source polysilicon from other manufacturers altogether.

For example, Trina Solar, one of China’s largest solar module manufacturers and exporters, sourced polysilicon from a company linked to the XPCC. Trina Solar regularly exports to the rest of the world, including to its California-based subsidiary, according to trade data from Panjiva.

Public records can help vet supply chains for links to the XPCC

The U.S. House of Representatives has already passed the Uyghur Forced Labor Prevention Act, which, if passed by the Senate, will ban all U.S. imports from Xinjiang unless CBP determines the product is free of forced labor.

Given the role of the XPCC in managing Xinjiang’s labor force and its own sanctioned status, any connection to the XPCC could constitute a regulatory red flag. With limited access to the region, publicly disclosed corporate records are essential for due diligence teams seeking to trace supply chains and perform KYC checks.