Semiconductor supplier Nexperia is at the center of a dispute between the Dutch government and China. The fallout from Dutch regulatory action disrupted global supply chains and threatened automotive production lines worldwide. For automotive and manufacturing leaders, the implications are clear: knowing your direct suppliers’ risk profiles is no longer enough to ensure supply chain resilience and protect against supply chain disruptions.

Nexperia: a case study in geopolitical risk

Nexperia, a Dutch semiconductor company, was acquired by Wingtech Technology, a Chinese partially state-owned semiconductor and communications company, in 2018. Nexperia manufactures “standard” chips — the essential “nuts and bolts” components that automotive manufacturers, in particular, rely on for controlling motors, lighting, and assistance systems.

In 2024, the U.S. placed Wingtech on the Bureau of Industry and Security (BIS) Entity List. By June 2025, U.S. officials reportedly told The Hague that Nexperia would be subject to U.S. export controls unless its Chinese CEO, Zhang Xuezheng, was replaced and greater corporate separation from Wingtech was demonstrated. These controls would bar U.S. firms from supplying Nexperia with restricted technologies. The U.S. announced the 50% / Affiliates Rule in late September 2025, extending export controls to majority-owned subsidiaries such as Nexperia.

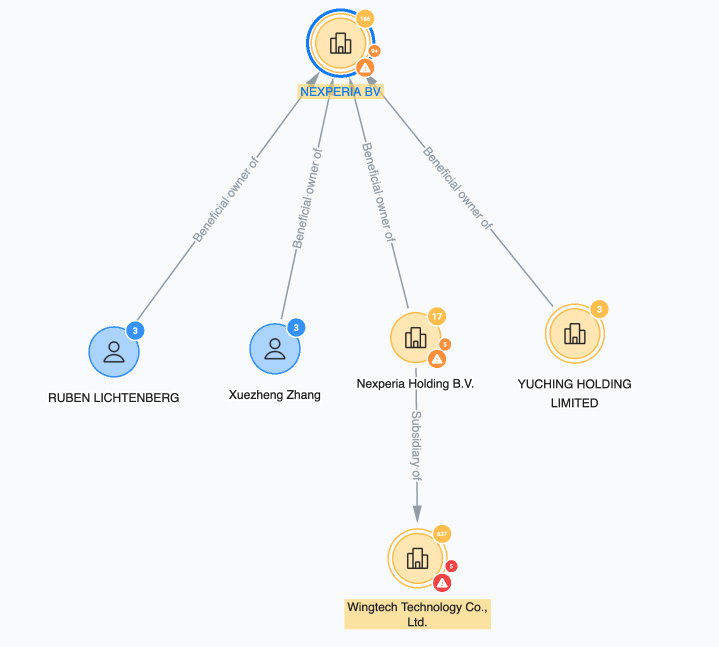

Figure 1: Data in Sayari Graph shows the ownership structure of Nexperia, as well as indicators of associated risk factors. Dutch corporate data and information from the US Department of Commerce reveals Nexperia is ultimately owned by Wingtech Technology Co., Ltd. Wingtech is flagged for several risk factors, including for being listed on the BIS Entity List.

Shortly thereafter, the Dutch government, concerned about economic security and IP transfer to China, used the Goods Availability Act to take control of Nexperia. In response, China, which packages and finishes most of the Nexperia chips, placed a prohibition on their export.

For weeks, global automotive supply chains were disrupted, with production pauses in Mexico. EU manufacturers said they were “days away” from stoppages.

In mid-November, the Dutch government suspended its decision to take supervisory control of Nexperia as a gesture of “goodwill” to Beijing, and China lifted the export ban in response.

It’s impossible to predict how long this truce might last. For organizations that rely on Nexperia parts finished in China, this uncertainty makes for significant supply chain fragility.

>> Learn how one automotive supplier used Sayari for enhanced due diligence <<

What are the implications for supply chain management?

The Nexperia case highlights growing alignment between European screening measures and U.S. export control policy. There are three major implications for corporate supply chains:

- Supplier ownership matters. A supplier’s ownership structure can be a single point of failure, even if the facility itself is local. Nexperia’s headquarters are in the Netherlands, but its ultimate ownership by the Chinese entity Wingtech triggered concerns that prompted the Dutch government to take control, creating uncertainty and disruption.

- Export control actions by other countries can affect legacy M&A activity. After adding Wingtech to its BIS Entity List, U.S. officials reportedly told the Dutch government that Nexperia would be subject to export controls. Shifting geopolitical climates can impact a previously approved acquisition and disrupt supply chains.

- Tier-n supply chain transparency is critical. Many companies impacted by Nexperia’s disruptions didn’t buy directly from them; they bought parts from tier 1 suppliers who had Nexperia chips embedded within their sub-components. Supply chain risk management must extend beyond direct suppliers.

>> Learn how to maximize visibility into sub-tier suppliers within automotive supply chains <<

How can organizations prevent a Nexperia-level event in their supply chains?

To address these risks, supply chain leaders must:

- Identify the UBO. Look beyond a supplier’s headquarters location when mapping your supply chain. Identify the ultimate beneficial owner (UBO) to understand the jurisdiction that actually controls the asset — and the resulting geopolitical implications.

- Track M&A activity. Monitor M&A across your suppliers, and develop contingency plans for those suppliers undergoing activity involving sensitive jurisdictions.

- Map multi-tier dependencies. Conduct multi-tier mapping for all critical product lines to identify not only who assembles your product, but whose materials are embedded within product sub-assemblies.

>> Discover how one automotive OEM accelerated supplier risk prioritization <<

Building resilient supply chains with Sayari

Sayari solutions directly address the uncertainty arising from geopolitical shifts such as the Nexperia event by providing organizations with the data to uncover ownership, fully map suppliers beyond tier 1, and support supply chain diversification.

Our purpose-built technology delivers deeper visibility into supply chains and illuminates ownership structures. By layering corporate ownership data with import-export information from 75+ reporting countries, Sayari makes it easy for auto supply chain teams to:

- Validate intelligence gathered from direct suppliers.

- Vet sub-tier suppliers and determine corporate ownership.

- Build product-specific multi-tier supply chain maps.

This comprehensive outside-in view of the supply chain provides procurement and compliance teams with a broader context surrounding their suppliers and increased confidence in decision making.

To learn more about how Sayari’s solutions can help your organization maintain resilient supply chains, request a complimentary supplier risk screening.