Industrial companies, particularly those in advanced manufacturing, face growing pressure from regulations designed to prevent exports to military end users (MEUs). As the list of restricted entities grows, so does the compliance burden.

While checking government watchlists is essential, it is no longer enough. Manufacturers must also detect non-list-based risk to prevent diversion of dual-use or sensitive goods to sanctioned entities and confidently address the urgent question: “How can I prevent my products from showing up in an adversary’s weapons systems?”

List-based risk grows for the industrial sector

Many industrial products — such as bearings, machine tools, electronic integrated circuits, semiconductor manufacturing equipment, testing equipment, and navigational instruments — are now considered high-priority targets for military diversion. Because these items appear on the Bureau of Industry and Security (BIS) Common High Priority Items List (CHPL), manufacturers must aggressively protect them.

Manufacturers must also contend with a growing list of restricted entities. The BIS Entity List of companies subject to export restrictions has grown from 1,350 entries in 2019 to approximately 3,350 as of March 2025.

Identifying list-based risk is only part of MEU due diligence

Screening against watchlists is just the first step because many risks are “off-list.” For example, while the new BIS 50% rule increases the number of entities subject to export control regulation, the rule doesn’t provide a corresponding screening list. Under this rule, any entity that is at least 50 percent owned by an entity on the Entity List or the MEU List is automatically subject to the same export restrictions as its listed owners.

Previously, these subsidiaries, parent companies, and sister companies were distinct legal entities, but now thousands of them are restricted despite not appearing on traditional screening lists.

>> Hear Akin’s Kevin Wolf, Matt Borman, and Eileen Albanese break down the BIS 50% Rule <<

Comprehensive export control due diligence requires that industrial compliance teams go beyond lists to map their customers’ upstream ownership, screen for addresses, and uncover risk of illicit transshipment, particularly for high-risk regions like Russia and China. Failure to exercise sufficient diligence means facing substantial fines, loss of market access, and brand reputation damage.

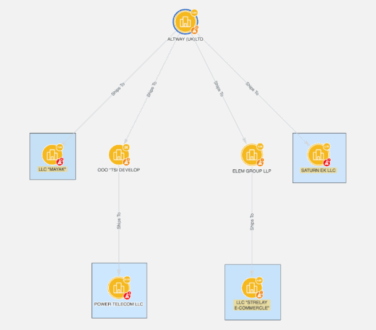

Sayari’s report Mitigating Diversion Risk of Dual-Use Technology Using Public and Commercial Data highlights a case study of this risk. Our data shows Altway (UK) Limited’s trade history contains indirect exposure to Russia. Altway shipped dual-use goods to Elem Group in Kazakhstan and TSI Develop in Uzbekistan, who shipped some of the same goods to Russia. Any manufacturer selling electronics to Altway would need to investigate these links to ensure their products don’t end up in Russian weapons systems.

Fig 1: Sayari Graph network chart depicting Altway (UK) Ltd’s direct and indirect trade exposure to Russia. Entities in blue are based in Russia.

To meet the complex challenges of identifying non-list-based risk, such as transshipment, means that manufacturers must replace inefficient, manual research across multiple jurisdiction databases with a single solution to map the evidence-based trade relationships and corporate networks of customers and distributors.

>> Learn techniques to reduce the risk of exporting to Chinese military companies <<

Sayari for MEU due diligence

Sayari’s combination of comprehensive corporate and global trade data empowers compliance teams to make confident decisions to stay on the right side of export regulations. Sayari helps organizations identify risky end-use scenarios by providing visibility into:

- Watchlisted entities

- Russian contractors engaged in sensitive or military projects

- Chinese companies involved in “military-civil fusion”

- Ultimate beneficial ownership (UBO) to detect when entities are 50% or more owned by a restricted party

The Sayari Signal MEU and Military Intelligence End User (MIEU) module identifies entities that may be subject to the restriction of exports of sensitive goods and technologies because of their involvement in military activities. The Signal BIS50 module identifies thousands of entities majority-owned by BIS Entity List and MEU List companies to support compliance with the recent BIS 50% rule.

>> Discover how the Sayari BIS50 Signal Module enhances export control due diligence <<

When integrated with Sayari Graph, our flagship product for in-depth entity investigation, Signal empowers industrial compliance teams to not only stay ahead of sudden regulatory shifts by proactively identifying high-risk entities before they are flagged by regulators, but also to leverage context to make faster, more informed decisions about the risks they face.

To learn more about how Sayari can help your trade compliance team conduct efficient due diligence and stay ahead of rapidly changing regulatory requirements, request a personalized demo.