It will likely come as no surprise that real estate still functions as an attractive money laundering vehicle for criminals, considering the high value of properties, the ability to transact in cash, and subjective pricing.

Until recently, there were few anti-money laundering (AML) regulations targeted at the real estate industry. However, in recent years, much of the world has taken aim at strengthening AML enforcement and regulations. In the US alone, regulators have taken several steps to prevent this form of financial crime, including:

- FinCEN’s Advance Notice of Proposed Rulemaking, issued in 2021 to address money laundering vulnerabilities in the American real estate market

- The KLEPTO Act, introduced in the Senate in August 2022 and aimed at helping law enforcement track down the luxury assets of Russian oligarchs

- FinCEN’s renewal of its Geographic Targeting Orders this year, now expanded to cover the DC metro area

- The Treasury Department’s National Strategy for Combating Terrorist and Other Illicit Financing, which repeatedly includes real estate as a key vulnerability

Despite this push for more regulation and enforcement, a seemingly endless stream of journalistic investigations, data leaks, and law enforcement and regulatory actions suggests that the usage of real estate to disguise dirty money persists.

To assist in solving this ongoing issue, our experts at Sayari compiled a list of indicators to watch out for when investigating potential money laundering through real estate transactions. Follow several real-world examples to learn how you can start investigations related to the property ownership in Sayari Graph.

Money Laundering Risk Indicators

While each case is unique, there are several commonalities we often see in instances of money laundering through the property sector. By knowing what to look for, investigators can more quickly identify money laundering offenses.

Some of the potential risk indicators include:

- Multiple purchases and sales made by the same person or entity in a short period of time

- Properties that were either significantly over- or under-valued

- High-value cash purchases

- An unknown source of funds for purchases, often in the form of a foreign wire transfer where the originator and beneficiary are the same

- Cases where property is the owner’s only link to the jurisdiction where real estate is purchased – as opposed to someone who is known to do business there, for example, or has family who lives locally

- The use of proxies to purchase property in order to hide the true owner, which can include lawyers, relatives, or business associates

- The use of anonymous shell companies or other complex corporate vehicles to obscure the property’s true owner

Risk Indicators at Work

Once you’ve spotted one of the above red flags for money laundering, it’s time to dig deeper. In our latest webinar, one of the examples we shared was an investigation into the use of proxies to purchase real estate assets.

A 2021 investigation by the Organized Crime and Corruption Reporting Project, or OCCRP, found that Sergey Toni, a Russian national, had no profitable businesses or discernible business profile, yet owned real estate worth over $59 million. His father, Oleg Toni, is a deputy managing director of the state-owned company Russian Railways, which is one of the largest transportation companies in the world. Given Oleg’s role at a state-owned enterprise, his salary is likely insufficient to explain this level of wealth, raising serious questions as to the source of the funds used to purchase such a vast empire of real estate holdings.

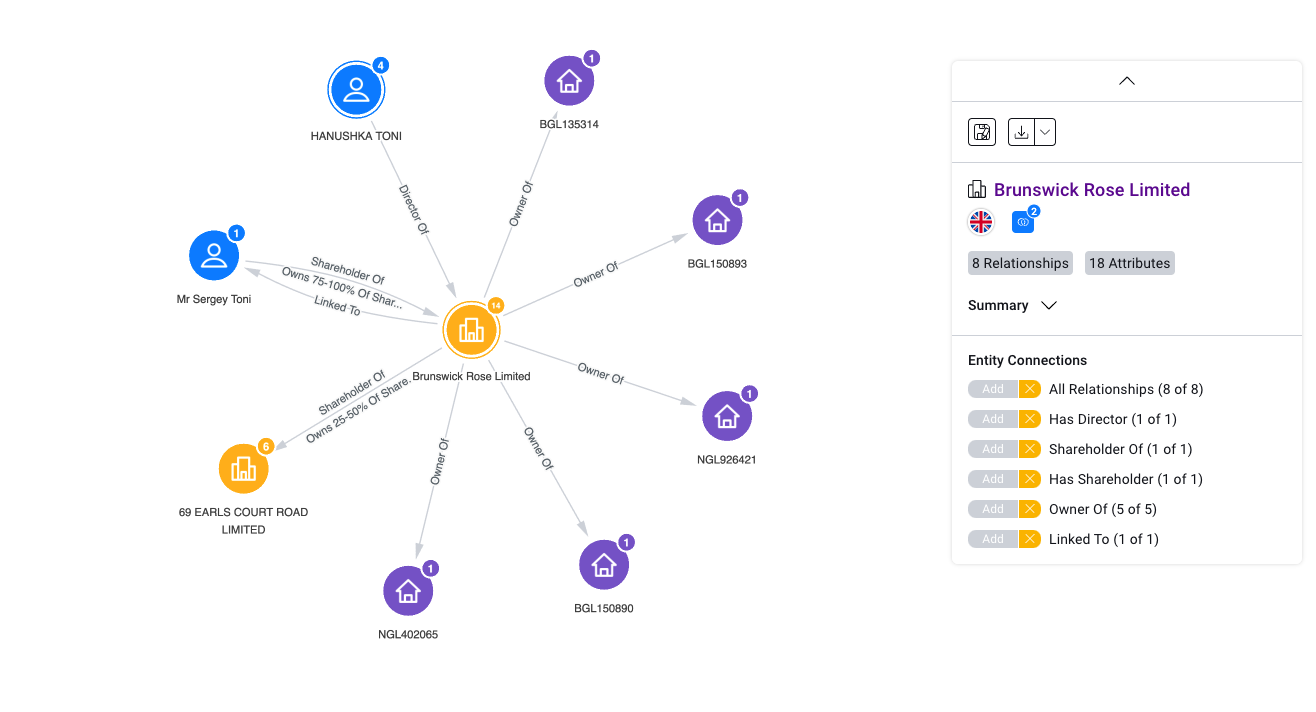

To get to the bottom of this case, our expert demonstrated how in Sayari Graph, you can combine ultimate beneficial ownership data with property records to identify holdings that may be ultimately owned by Oleg Toni, but that are held via corporate assets tied to his son. After identifying the connection to the company Brunswick Rose Limited, users discover that Sergey Toni is using this corporate vehicle for owning a number of properties around the United Kingdom.

For an in-depth look into the Sergey Toni case, along with other real-world examples, watch our webinar, Money Laundering Through the Property Sector: Headline Cases in Review. Through these examples, you’ll walk away with a better understanding of how public data is especially useful in navigating the corporate structures used to disguise real estate money laundering.