Congress has taken a stand against money laundering like never before.

Called the “one issue that unites Washington” by The New Republic, The ENABLERS Act was overwhelmingly passed by the U.S. House of Representatives in July. The act, Establishing New Authorities for Businesses Laundering and Enabling Risks to Security (ENABLERS), seeks to change the United States’ reputation as a destination for dirty money.

Bundled into the broader National Defense Authorization Act, the goal of the ENABLERS Act is to finally hold American enablers of foreign kleptocrats accountable. Later this year, the bill will be voted on in the Senate where it faces favorable chances.

Far Reaching Anti-Money Laundering Reform

The ENABLERS Act is regarded as the most extensive anti-money laundering (AML) bill that the country has seen in decades. It expands the reach of the Bank Secrecy Act to various professional service groups that serve as ”gatekeepers” to the American financial system. These new groups will now need to adopt AML procedures that can help detect, flag, and prevent the laundering of corrupt or criminal funds into the United States.

“This is the single most important anti-corruption measure the United States Congress can adopt right now to prevent corrupt Russian officials and future kleptocrats from hiding and growing their dirty money in the United States,” said Scott Greytak, the advocacy director at Transparency International U.S. in a press release.

As the fallout from the Russian invasion of Ukraine has shown, illicit funds are pervasive in western financial markets, and anti-transparency efforts from Russia seek to keep it that way. Holding American enablers and financial gatekeepers accountable is a significant step in building a national anti-money laundering defense.

Corporate Service Providers Brace for Impact

The bipartisan-supported bill targets industries often at the center of corruption and money laundering scandals. In its current state, the bill aims at including trust and company service providers, lawyers, art dealers, investment advisors, and others. Until the act becomes law, the list of affected parties won’t be fully defined; but generally, it is expected to affect those providing corporate formation, trust, third-party payment, and similar legal or accounting services.

One of the industries where the ENABLERS Act could have an significant impact is in its application to third-party payment processors. Depending on how that term ultimately gets defined in the law, it could bring considerable change for Fintechs. Currently, the Bank Secrecy Act does not apply to payment processors who often fit into an exemption in the law.

As of now, American lawyers are able to legally set up anonymous shell companies, structure real estate deals, and lobby on behalf of oligarchic and dictatorial clients. Law firms aren’t legally required to check the source of their clients’ income, which leaves the door open for corrupt foreign actors.

If the ENABLERS Act comes into effect, legal and financial service providers not previously subject to AML regulations will need to start complying.

Tackling the Challenge of Compliance

While banks and other large financial institutions have had years to develop tactics to remain in compliance with AML regulations, largely thanks to the passage of the Patriot Act in 2001, other industries have been able to skirt these requirements.

>> Read Juan Zarate’s take on the latest in financial crime reform for compliance tips <<

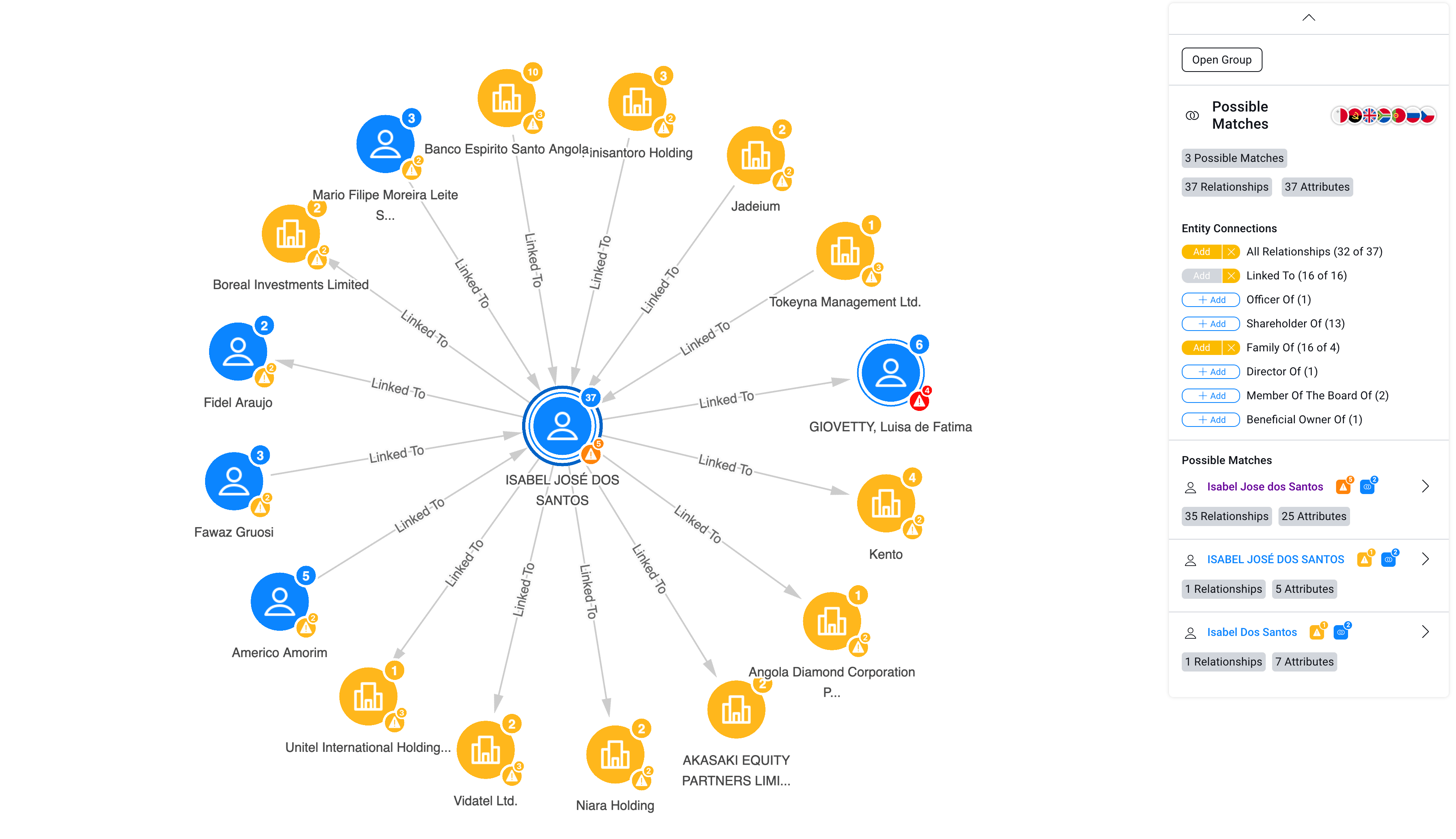

With all these new requirements potentially coming for corporate service providers, information will be the key to success with AML regulations. Platforms like Sayari Graph utilize open source records and graph technology to map out connections and establish links between illicit financial actors, their infrastructure, and related business networks and transactions. This gives analysts and investigators the power to efficiently and effectively vet clients in compliance with AML protocols.

Our team of analysts at Sayari will be keeping a close eye on the status of the ENABLERS Act and its potential rollout. If you’re looking to learn more about identifying company ownership and AML regulations, watch our public data Master Class, “Unmasking Offshore Companies Beyond The Pandora Papers.”