Semiconductors power nearly all modern technology, from cars and smartphones to telecommunications equipment. Because design and manufacturing is complex and dominated by a small number of firms in the United States, Taiwan, and Europe, the Chinese government has spent decades investing in a domestic semiconductor industry.

Beijing has made semiconductor development and manufacturing a priority, in part due to U.S. export controls limiting China’s access to U.S. technologies. The number of companies that have registered as semiconductor firms in China has increased by 700 percent since 2010, according to an analysis by the Financial Times.

Under President Xi Jinping, the Chinese Communist Party has made renewed efforts to create an independent semiconductor supply chain under the “Made in China 2025” plan. The plan aims for China, the world’s largest consumer of semiconductors, to produce 70 percent of its own semiconductor needs by 2025.

Using public data to map the industry

To understand this landscape, Sayari analyzed our database of Chinese public records for companies with the word for “semiconductor” (半导体) in their registration.

We identified:

- 8,129 Chinese semiconductor companies. (Note that this list only includes companies with records in the National Enterprise Credit Information Publicity System (NECIPS), China’s most up-to-date and comprehensive corporate registry.)

- 35,000 unique entities that are direct or indirect shareholders of semiconductor companies. We used this list to identify the state-run agencies and investment vehicles that fund semiconductor companies.

- The specific government agencies funding these efforts.

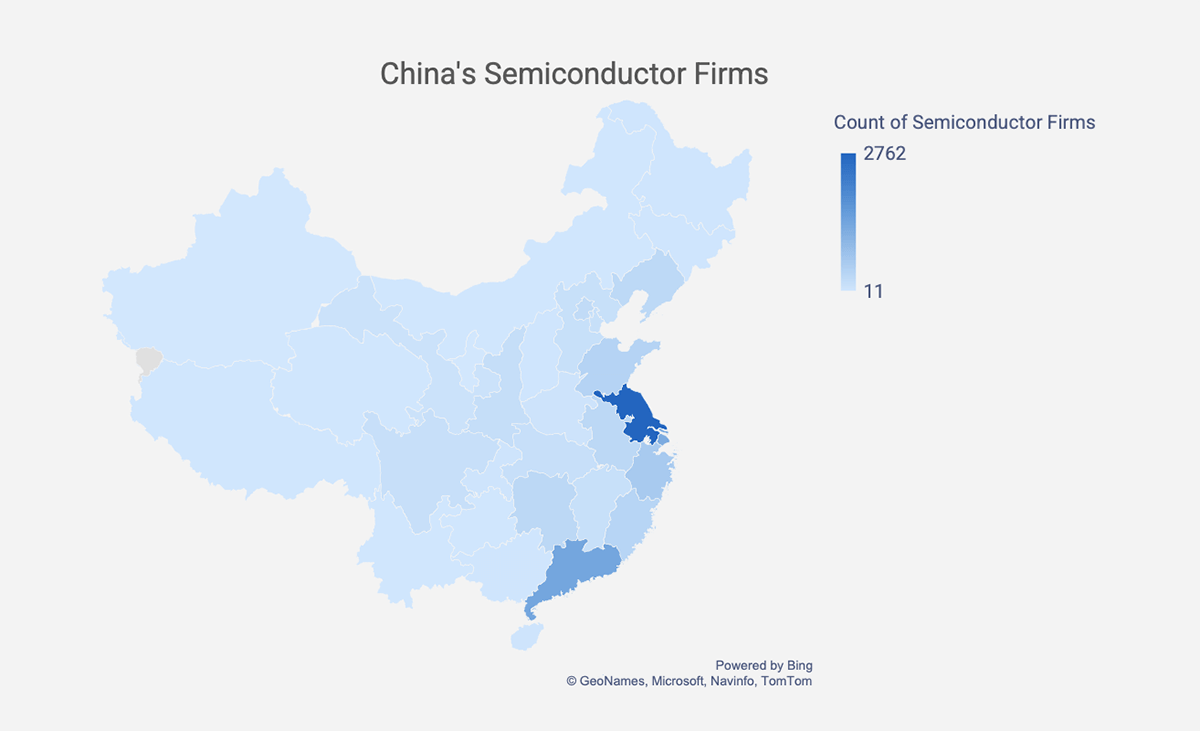

Key finding 1: Geographic concentration

China’s semiconductor industry is concentrated in the country’s eastern and southern coasts, hubs of technology and capital. More than half of the semiconductor firms are located in Jiangsu Province, Guangdong Province, and Shanghai, according to the registered addresses of the companies in our sample.

Notably, Jiangsu province is home to over 2,700 firms, including Jiangsu Changdian (JCET) and many of its subsidiaries. JCET is one of China’s leading semiconductor designers and manufacturers.

Fig. 1: Map of the People’s Republic of China with provinces shaded based on the number of semiconductor companies located in each province.

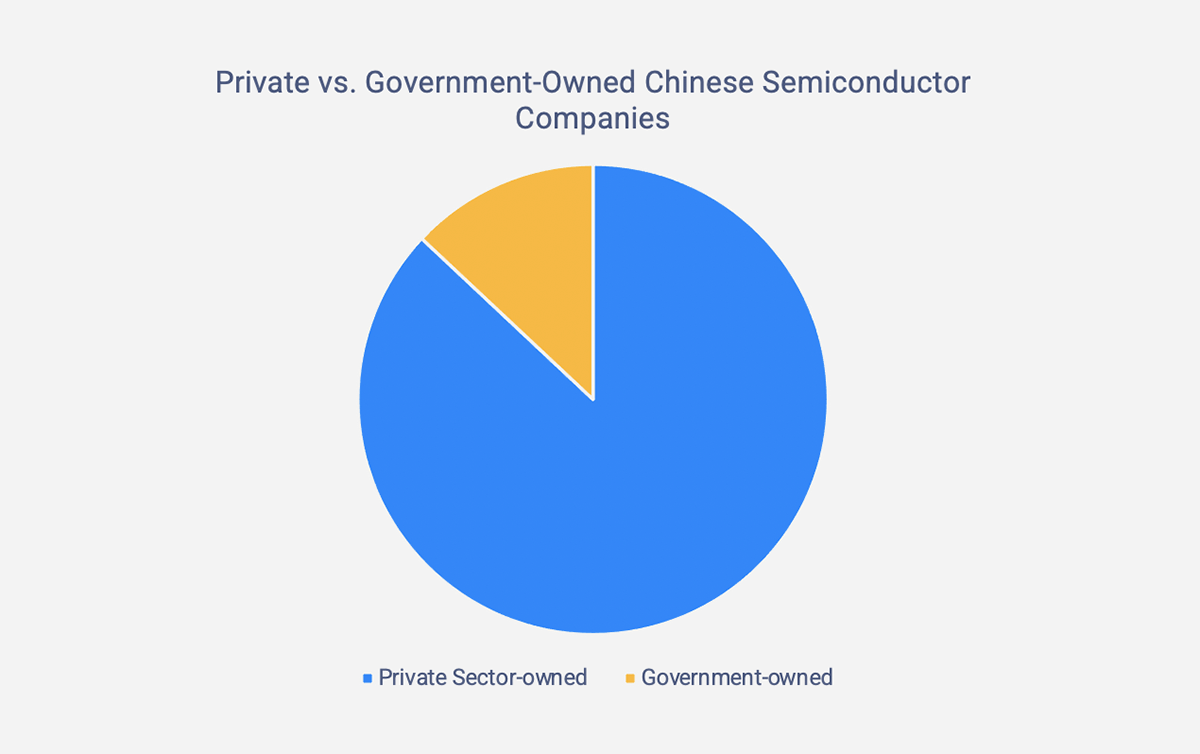

Key finding 2: Heavy state involvement

About thirteen percent of the semiconductor companies in our sample are partially or wholly owned by Chinese government entities within three layers of ownership. Indeed, Chinese government entities may have indirect stakes in more semiconductor companies beyond three degrees of ownership

Fig. 2: Thirteen percent of Chinese semiconductor companies are owned wholly or in part by the Chinese government.

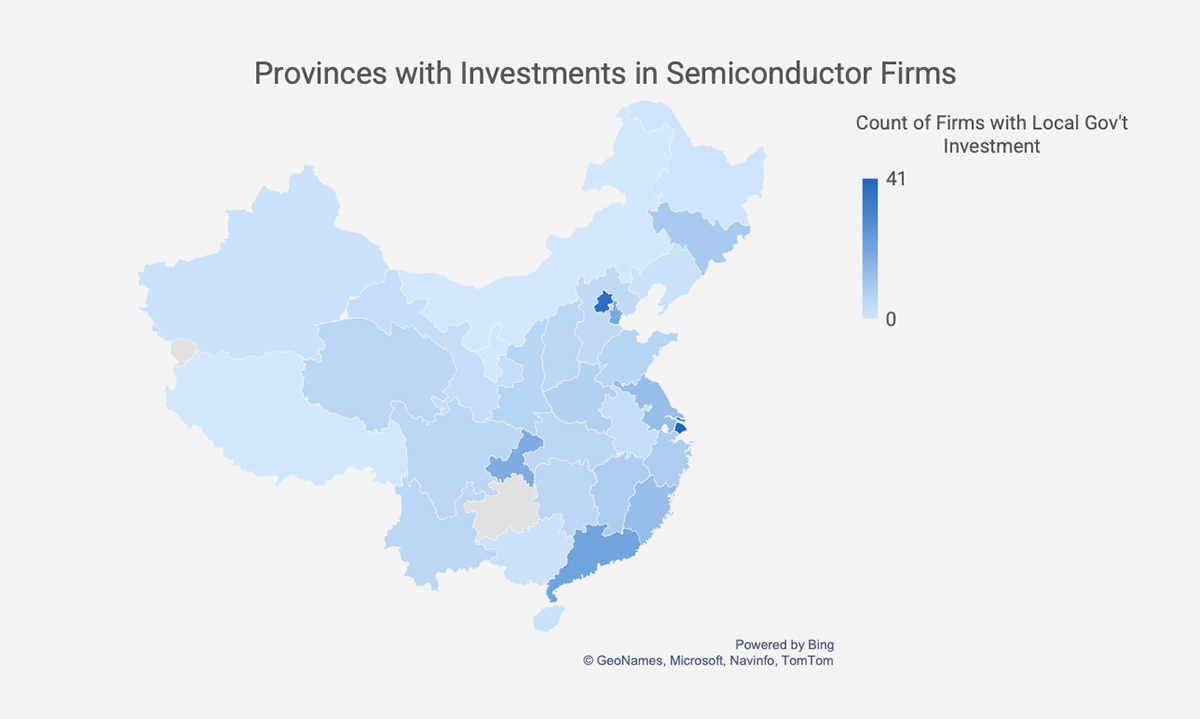

Who is investing?

- Central Government: Among government-owned semiconductor firms, most are owned by the country’s central government via the State Council State-owned Assets Supervision and Administration Commission (SASAC).

- Local Government: Provincial, prefectural, and city-level governments — and their SASACs — have also invested in hundreds of semiconductor firms. Shanghai and Beijing municipal governments have invested in the most semiconductor firms in our dataset, likely due to the high concentration of talent in those cities.

Fig. 3: Map of the People’s Republic of China showing provinces shaded based on how many semiconductor firms their local government has invested in.

Tracking Chinese government investment across strategic industries

The Chinese government invests in industries that it has deemed strategically important. Direct ownership of firms is one of many ways that the government puts money toward key industries.

Public records and graph analytics indicate that the Chinese government, at both the national and local levels, owns a substantial percentage of China’s semiconductor industry. For global suppliers and policymakers, understanding these state-backed networks is essential for navigating export controls and supply chain risks.

China’s publicly available corporate registries offer comprehensive information on corporate ownership and business purpose. Running bulk ownership queries against companies with specific business purposes can be used to assess the level of state ownership in virtually any industry.