Beijing has made China’s semiconductor development and manufacturing capabilities a priority, in part due to U.S. export controls limiting China’s access to U.S. technologies. The number of companies that have registered as semiconductor firms in China has increased by 700 percent since 2010, according to an analysis by the Financial Times.

Using public records and graph analytics, we compiled a dataset of over 8,000 semiconductor firms and the 35,000+ companies in their ownership networks to understand China’s semiconductor landscape.

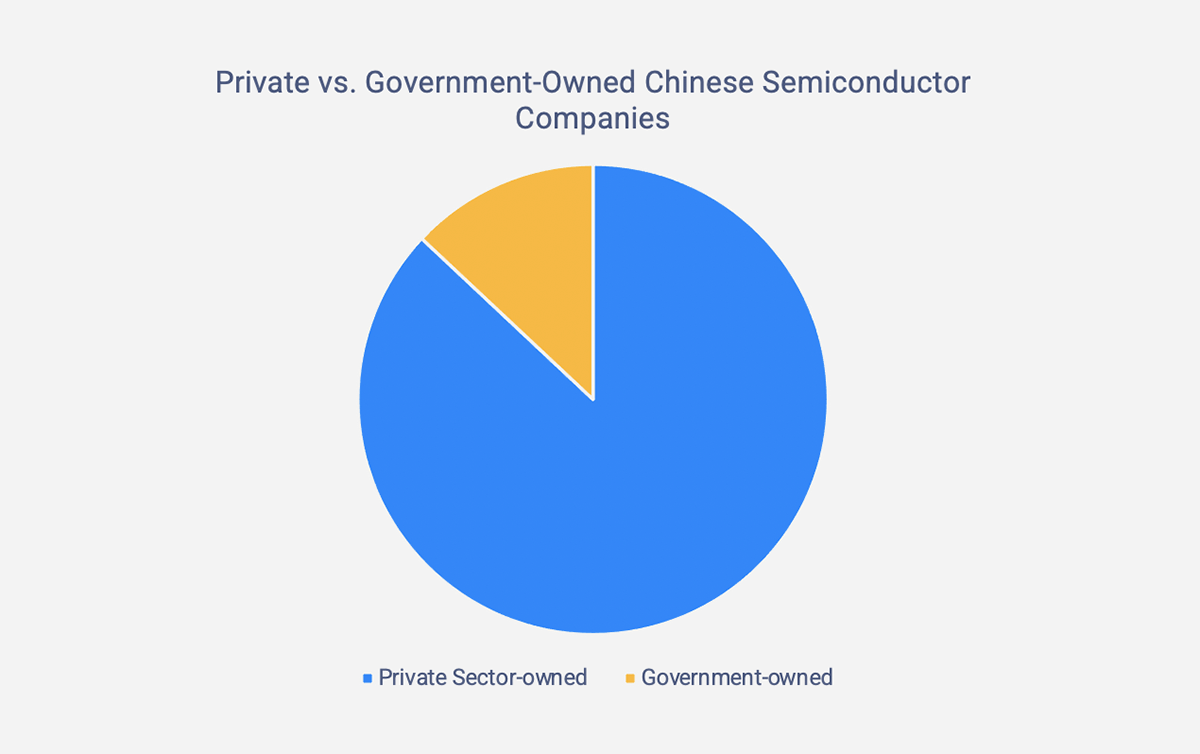

The Chinese government directly or indirectly holds shares in 13 percent of Chinese semiconductor firms, reflecting Beijing’s push toward self-reliance in the chipmaking industry. These investments primarily come from China’s State Council, but local governments across the country also own shares in semiconductor firms, indicating a nationwide drive to invest in a key industry.

Why is the Chinese government concerned about semiconductors?

The Chinese government has spent decades investing in a domestic semiconductor industry. But under Xi Jinping, the Chinese Communist Party has made renewed efforts to create an independent semiconductor supply chain under the “Made in China 2025” plan. The plan aimed for China, the world’s largest consumer of semiconductors, to produce 70 percent of its own semiconductor needs by 2025.

In recent years, the U.S. government has issued export restrictions prohibiting U.S. firms from exporting semiconductor parts to certain Chinese firms without a license. These actions have increased the pressure on China to develop a self-sufficient semiconductor supply chain in order to maintain its level of semiconductor consumption.

Using graph analytics to map China’s semiconductor industry

To create a sample of Chinese semiconductor companies, we first identified every company in our database of Chinese public records with the word for “semiconductor” (半导体) in their registered business purpose. This resulted in a list of 8,129 companies. (Note that this list only includes companies with records in the National Enterprise Credit Information Publicity System (NECIPS), China’s most up-to-date and comprehensive corporate registry.)

We then followed each of these companies’ ownership links upstream up to three layers of ownership from the original entity. This resulted in approximately 35,000 unique entities that are direct or indirect shareholders of semiconductor companies. We used this list to identify the state-run agencies and investment vehicles that fund semiconductor companies.

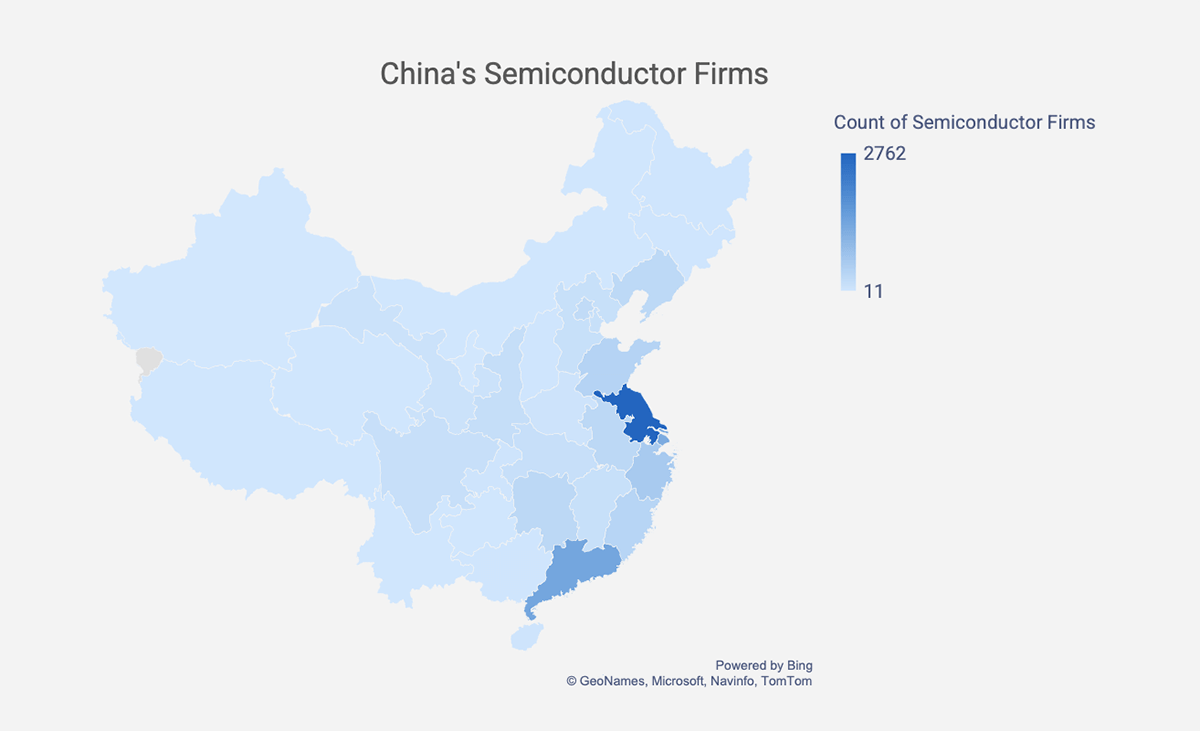

Semiconductor firms concentrated in few regions

China’s semiconductor industry is concentrated in the country’s eastern and southern coasts, hubs of technology and capital. More than half of the country’s semiconductor firms are located in Jiangsu Province, Guangdong Province, and Shanghai, according to the registered addresses of the companies in our sample.

Jiangsu province, where over 2,700 firms are based, is home to Jiangsu Changdian (JCET) and many of its subsidiaries. JCET is one of China’s leading semiconductor designers and manufacturers.

Fig. 1: Map of the People’s Republic of China with provinces shaded based on the number of semiconductor companies located in each province.

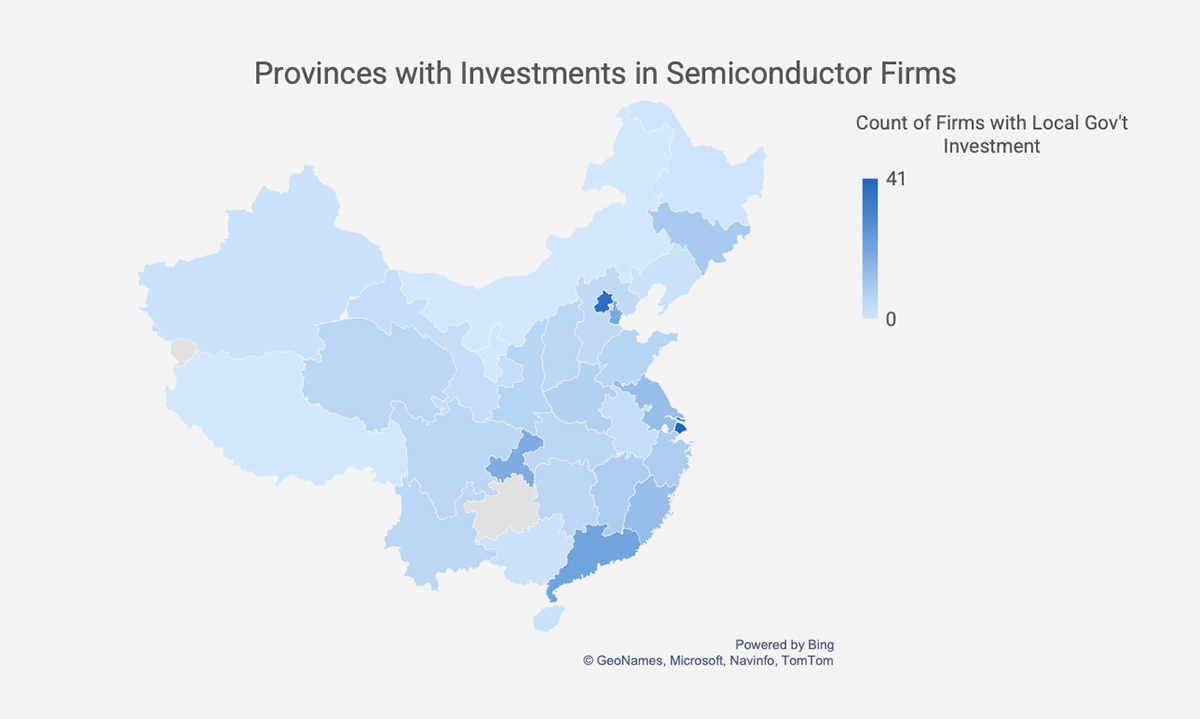

State ownership concentrated in central government and major cities

Fig. 2: Thirteen percent of Chinese semiconductor companies are owned wholly or in part by the Chinese government.

Among government-owned semiconductor firms, most are owned by the country’s central government via the State Council State-owned Assets Supervision and Administration Commission (SASAC). However, provincial, prefectural, and city-level governments — and their SASACs — have also invested in hundreds of semiconductor firms.

The Shanghai and Beijing municipal governments have invested in the most semiconductor firms in our dataset, likely due to the high concentration of talent in those cities.

Fig. 3: Map of the People’s Republic of China showing provinces shaded based on how many semiconductor firms their local government has invested in.

Tracking Chinese government investment across strategic industries

The Chinese government invests in industries that it has deemed strategically important. Direct ownership of firms is one of many ways that the government puts money toward key industries.

Public records and graph analytics indicate that the Chinese government, at both the national and local levels, owns a substantial percentage of China’s semiconductor industry.

China’s publicly available corporate registries offer comprehensive information on corporate ownership and business purpose. Running bulk ownership queries against companies with specific business purposes can be used to assess the level of state ownership in virtually any industry.