Following the 2013 bankruptcy of the then recently privatized Serbian company Termoelektro JSC, the workers – many of whom had been laid off – filed a criminal complaint in 2014 alleging numerous abuses by the company’s new Russian management. At the time, much of the complaint relied primarily on the company’s internal documentation and filings, meaning key details and events may have been missed.

Now, as the still-ongoing bankruptcy proceedings enter their eighth year, we have uncovered additional information about some of the main allegations made in the criminal complaint. While we do not claim wrongdoing or criminality by any of the parties involved, the circumstances surrounding Termoelektro’s privatization and eventual bankruptcy warrant a second look.

The background of the case

Termoelektro was originally founded in Belgrade as a state-owned company in what was then Yugoslavia, in 1948. At its height, the company specialized in the construction, maintenance, and revitalization of various types of power plants ranging from thermo-energetic to industrial. Throughout its long history, it fostered numerous lucrative partnerships outside of Serbia and has participated in contracts all over the world – bringing Yugoslav engineering and design to the global market.

Like many state-owned companies, Termoelektro found itself swept up in the post-Yugoslavia privatization boom that erupted throughout the newly formed states in the mid-2000s. The company was privatized in 2007 by a group of Russian and Serbian investors linked to the Russian company Zarubezhenergoproekt JSC. Less than seven years later, much of the workforce would be laid off, the physical assets gone and the company capital vanished into a complicated web of offshores. The company finally declared bankruptcy in 2013.

Soonafter, Termoelektro’s workers filed a criminal complaint in a Belgrade court alleging fraud and embezzlement. The workers felt that they had been cheated and that the company itself had been bled dry by the new management, according to the complaint.

The Termoelektro workers ultimately leaked the full criminal complaint to the public in January 2014. While there was some public outrage and media pickup, the case still seemed to go nowhere and the bankruptcy proceedings seemed to continue unabated.

Upon reviewing the 2014 criminal complaint, we were left with more questions than answers. Leveraging public records from multiple jurisdictions, we have managed to map out the Termoelektro saga, including the likely offshore destinations for the allegedly embezzled funds.

Termoelektro’s privatization

The decision to privatize Termoelektro JSC was made on Dec. 21, 2005 by Serbia’s Privatization Agency. After an initial failed attempt to sell off the asset, Kharvinter LLC, a Russian company based in Moscow, stepped in and purchased approximately 38 percent of Termoelektro for €841,155 (~$1.1 million), in May 2007. Following a subsequent offer of shares a couple months later in July, Kharvinter’s stake increased to approximately 69 percent.

At the time, Kharvinter expressed intentions to increase Termoelektro’s business and overall revenue based on its own experience in the field. “The compatibility of the two companies was certainly the primary reason for purchasing the stake in Termoelektro,” Nebojša Vlahović, then-deputy general director of Kharvinter, told the Ekonomist magazine in September 2007. “I expect we will increase [Termoelektro’s] capacity on the market and hire about 400 new engineers and workers in the coming period.”

Under new ownership, Termoelektro set up a subsidiary – Termoelektro LLC – in Ivanovo, a city northeast of Moscow, on May 26, 2008, a little less than a year after the initial purchase. With the Russian subsidiary established, Kharvinter then proceeded to sell its entire majority stake in Termoelektro to Comfitrade S.A., a company registered in Switzerland, on June 19, 2008.

In a 2014 interview with Serbian film director Boris Malagurski, one of Termoelektro’s employees described Comfitrade’s entry into the picture. “So in 2008, a Russian-Serbian group bought [Termoelektro] from Kharvinter,” Zoran Stanković, a machine engineer, said in the interview. “Russian-Serbian group meaning [Vyacheslav] Arbuzov and Vadim Kumin who are former employees of Tekhnopromexport in Moscow, a major export and energy company.”

Kumin and Arbuzov are both from Ivanovo, Russia and following their time working together at Tekhnopromexport, they moved on to run Zarubezhenergoproekt JSC, an Ivanovo-based company that specializes in designing energy installations in Russia and abroad.

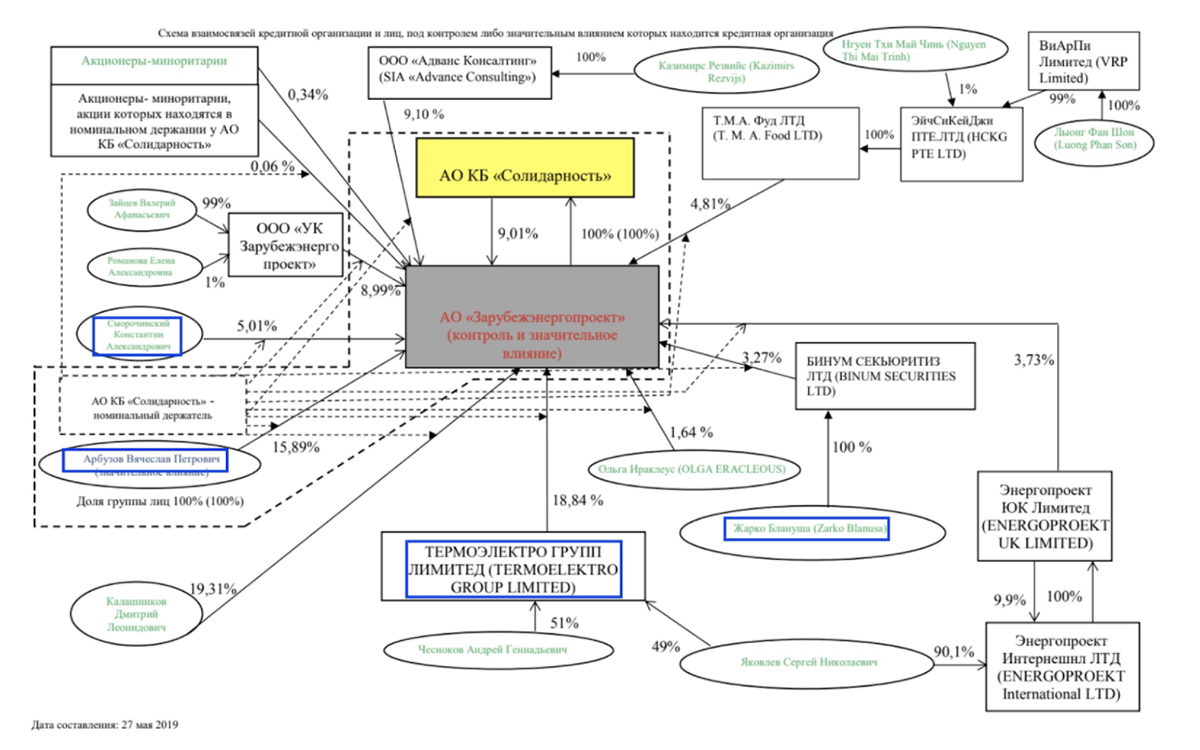

Fig. 1: A 2019 disclosure for a Russian commercial bank owned by Zarubezhenergoproekt showing the latter’s entire network. The individuals and entity (Termoelektro Group Limited) highlighted in blue were all at various points control parties of Termoelektro after Comfitrade purchased it from Kharvinter.

When things finally settled towards the end of June 2008, Termoelektro’s ownership looked like this: Comfitrade owned approximately 69 percent, individual shareholders owned approximately 29 percent and Termoelektro itself owned approximately 2 percent. The company’s total share capital amounted to RSD 365,358,030 (~$7.2 million).

However, the new management had big plans for Termoelektro and this ownership structure would be short lived.

New management

One of Comfitrade’s first orders of business as the new owner was to appoint members to the board of directors on Apr. 4, 2009. According to Stanković, many of the board members were athletes and individuals associated with Belgrade’s Partizan sports franchise. Zarubezhenergoproekt’s Arbuzov was also among the new board members.

At the same meeting, the new board adopted two key decisions regarding the company’s valuation that served to increase Comfitrade’s stake and clear out most of the minority shareholders.

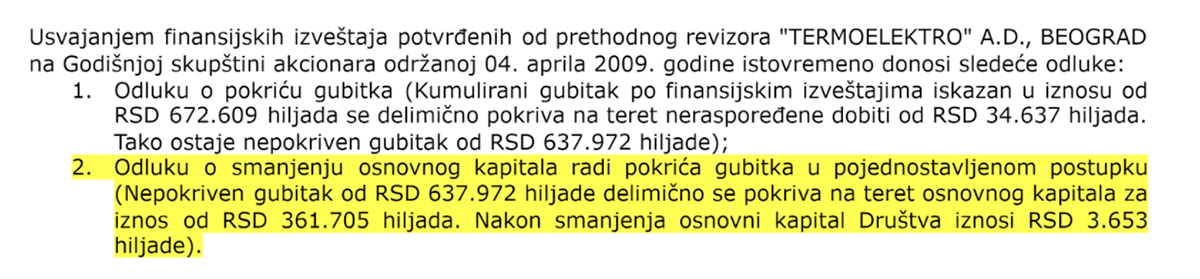

First, the new board adopted a decision to decrease the overall company capital from RSD 365,313,130 to RSD 3,653,130—a rate of 100:1. The board justifies this action as “covering losses.” The decrease reduced Comfitrade’s stake in Termoelektro from 442,300 shares to 4,423 shares.

Fig. 2: Minutes from the Apr. 4, 2009 Termoelektro’s board of directors meeting where it was decided to reduce the share capital by a factor of 100 to address “uncovered” losses.

This decrease had the same effect on the holdings of minority shareholders. The decision also featured the provision that following the reduction, any shareholders with less than one full share would become co-owners of a pool of shares.

“The first thing the owners did was reduce the share capital by a factor of [100],” Stanković said during the interview. “This was to cover alleged losses totaling €4 million.”

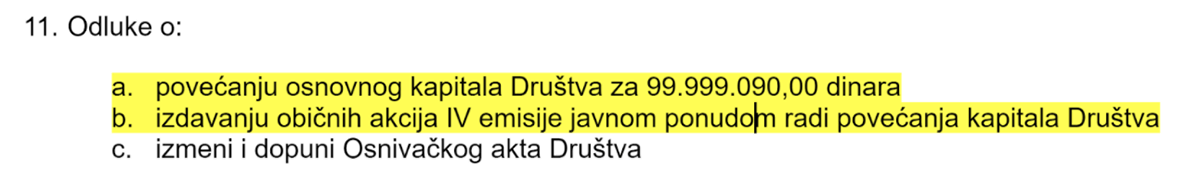

Immediately following the adoption of this decision by the board of directors, a second decision was adopted to increase the company’s capital by RSD 99,999,090 and issue 175,437 new shares.

Fig. 3: Excerpt from Apr. 4, 2009 minutes showing the subsequent increase in share capital of RSD 99,999,090.

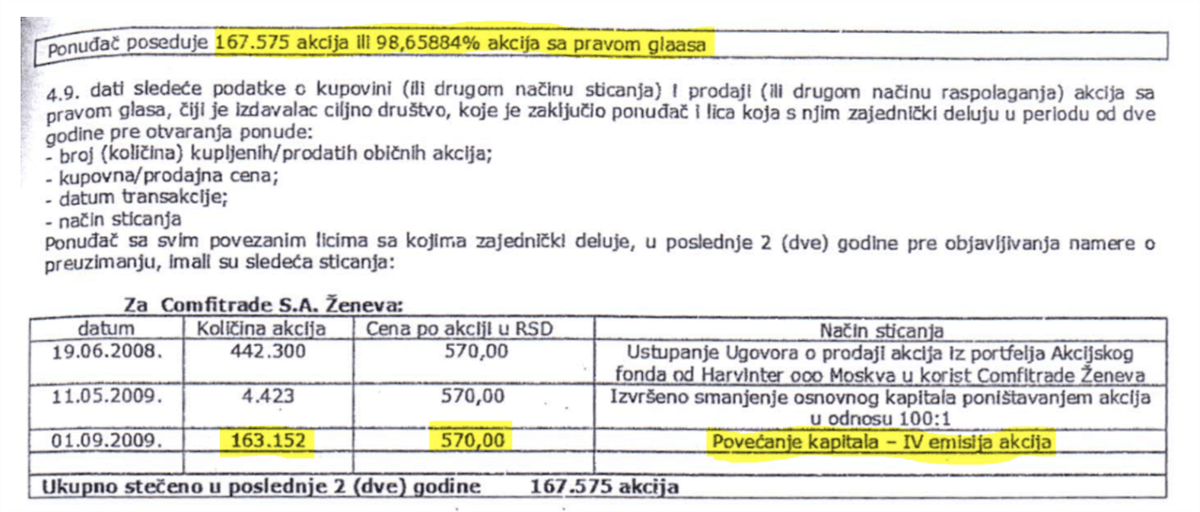

At the conclusion of the share capital increase, Comfitrade’s stake in Termoelektro comprised 167,575 shares or approximately 95 percent of the total share capital and approximately 99 percent of voting shares, according to documentation from Serbia’s Securities Commission.

Fig. 4: Securities Commission document showing that Comfitrade controls nearly 99 percent of voting shares. The table below shows Comfitrade’s balance of shares over time, clearly showing both the capital reduction and subsequent increase.

In a single board meeting, Comfitrade had wiped out any meaningful opposition from the workforce and gained near complete control over Termoelektro’s future.

A bankruptcy several years in the making

With the company firmly under the control of the new management, Termoelektro’s board of directors got to work dismantling the company and preparing it for bankruptcy, according to the company’s workers. The process nonetheless began with them.

The board of directors convened on June 16, 2010 to discuss worker redundancies, according to minutes published by the Securities Commission. At this meeting the decision was made to terminate several workers units immediately – a decision which led to hundreds of layoffs. The workers allege that during this period, changes were also made selectively to some of their contracts, inserting salary caps and reducing salaries to minimum requirements.

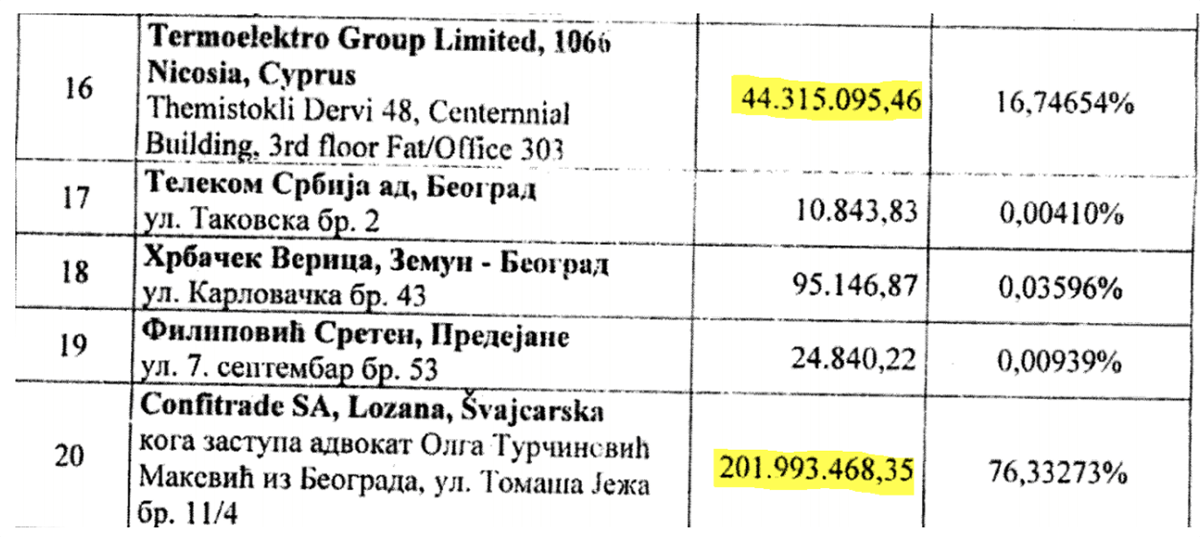

Once cost-saving measures had been implemented on the workforce, Termoelektro’s board then set its sights on squeezing value out of the company through the sale of its assets. It is here that we see for the first time the second offshore company involved in this scheme, Termoelektro Group Limited – a company registered in Cyprus.

The Cypriot market for Termoelektro trademarks

Termoelektro Group Limited was registered on Aug. 19, 2008, exactly two months after Kharvinter sold its shares of Termoelektro to Comfitrade. Its shareholders were not fixed and cycled every few months between a variety of Russians, Serbians and offshore companies. The company became the 100 percent shareholder of Termoelektro in December 2009 after the board converted the company from a joint-stock company to a limited liability company, according to Serbia’s business register.

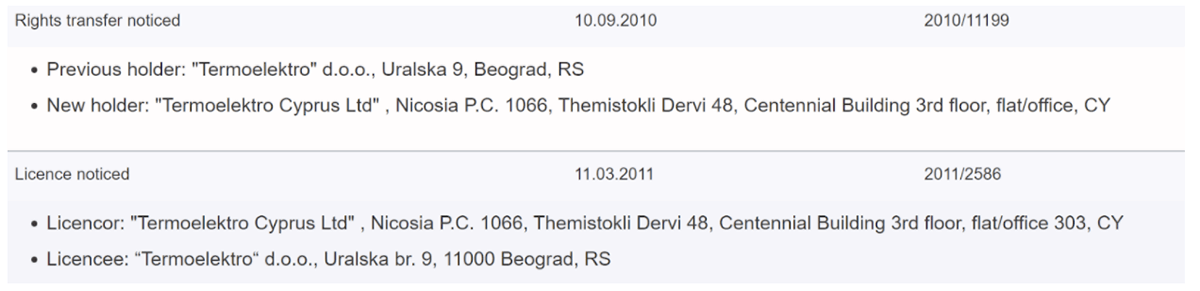

For its first two years of operation, Termoelektro Group Limited remained largely dormant. However on Aug. 18, 2010, it purchased the Termoelektro trademark from Termoelektro in Serbia for the small sum of RSD 300,000, according to a sale agreement provided by the Termoelektro workers.

The reason for the sale became clear several months later in March 2011, when Termoelektro Group Limited entered into an agreement with Termoelektro in Serbia, under which the latter could use the trademark under license. Termoelektro was now paying an offshore company a fee to use its own trademark.

Fig. 5: Excerpt from Serbia’s Register of Trademarks showing Termoelektro Group Limited’s acquisition of the Termoelektro trademark and the subsequent licensing agreement.

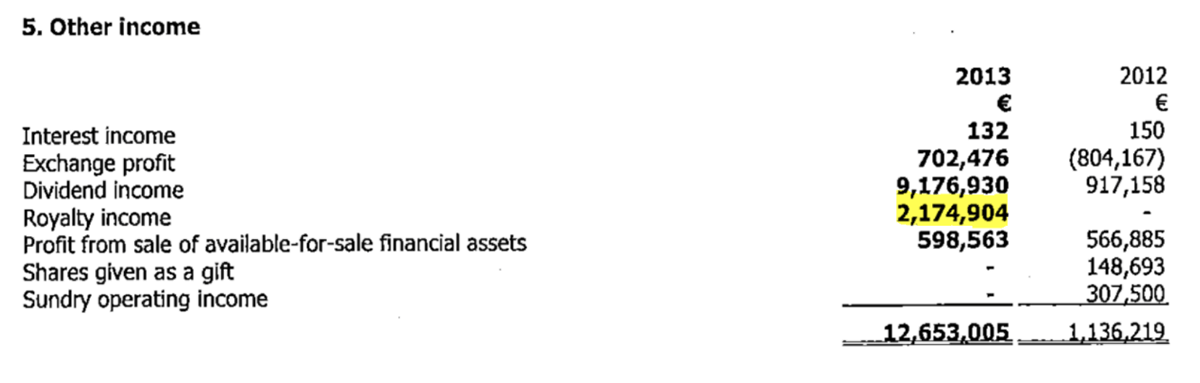

Interestingly, in reviewing Termoelektro Group Limited’s annual accounts for 2013, we found that the company listed €2.18 million in “royalty income.” While there is no way to confirm whether this income was tied to the trademark licensing deal, it is worth noting that there was no royalty income listed for the previous year.

Fig. 6: Excerpt from Termoelektro Group Limited’s 2013 annual accounts showing approximately €2.2 million in “royalty income.”

What happened to the equipment?

A major allegation made in the criminal complaint is that Termoelektro’s new management accelerated the company’s decline by selling off its physical assets for a fraction of their worth. Prior to privatization, Termoelektro had maintained operations in several other countries, including Germany. In the complaint, the workers allege that the management began to sell off the assets through the Serbian Termoelektro in 2013, but collected the sales proceeds with Termoelektro LLC, the Ivanovo-based Russian subsidiary of the same name.

We were unable to confirm this allegation in its entirety, but trade data seems to lend some credibility to the workers’ account of events.

On Oct. 17, 2013 Termoelektro sent over nine tons of welding machinery worth $211,764 to Termoelektro LLC in Russia, according to commercial trade data. The shipment was sent from Germany.

While that particular shipment was sent directly by Termoelektro (it was listed as the shipper on the bill of lading), there were several others

Between October 2013 and August 2014, Termoelektro LLC in Russia received over 65 tons shipments of various parts and equipment used in power plants worth more than $6.8 million from Germany. However, the shipper in this case was Comfitrade. We could not definitively confirm that this equipment originated from Termoelektro’s operations in Germany, but the timeline and parties involved do seem to line up.

The final step

With the trademark acquired, the workforce laid off, and the physical assets being sold off, Termoelektro’s management initiated bankruptcy proceedings in 2013. For the remaining workers the announcement was unceremonious.

Stanković claims that throughout the entire period there were four different groups of directors and their sons who came in and out of the company, before finally a Russian director came in 2013 and shut everything down.

“The last one to come through was this Russian guy who came here to lock up about a year-and-a-half to two years ago,” said Stanković in the interview. “He drove the workers out, locked up, took the computer passwords, and left for Russia.”

Stanković and his coworkers would spend the next several years working with lawyers to regain what they believed they were owed by the company.

Things were far from over for the management, however. As is standard procedure, the bankruptcy court in Serbia appointed a bankruptcy trustee to draft a reorganization plan in which it is decided how Termoelektro’s remaining assets are distributed to its creditors in a bid to keep the company alive. Termoelektro filed the final version of its bankruptcy reorganization plan in December 2014.

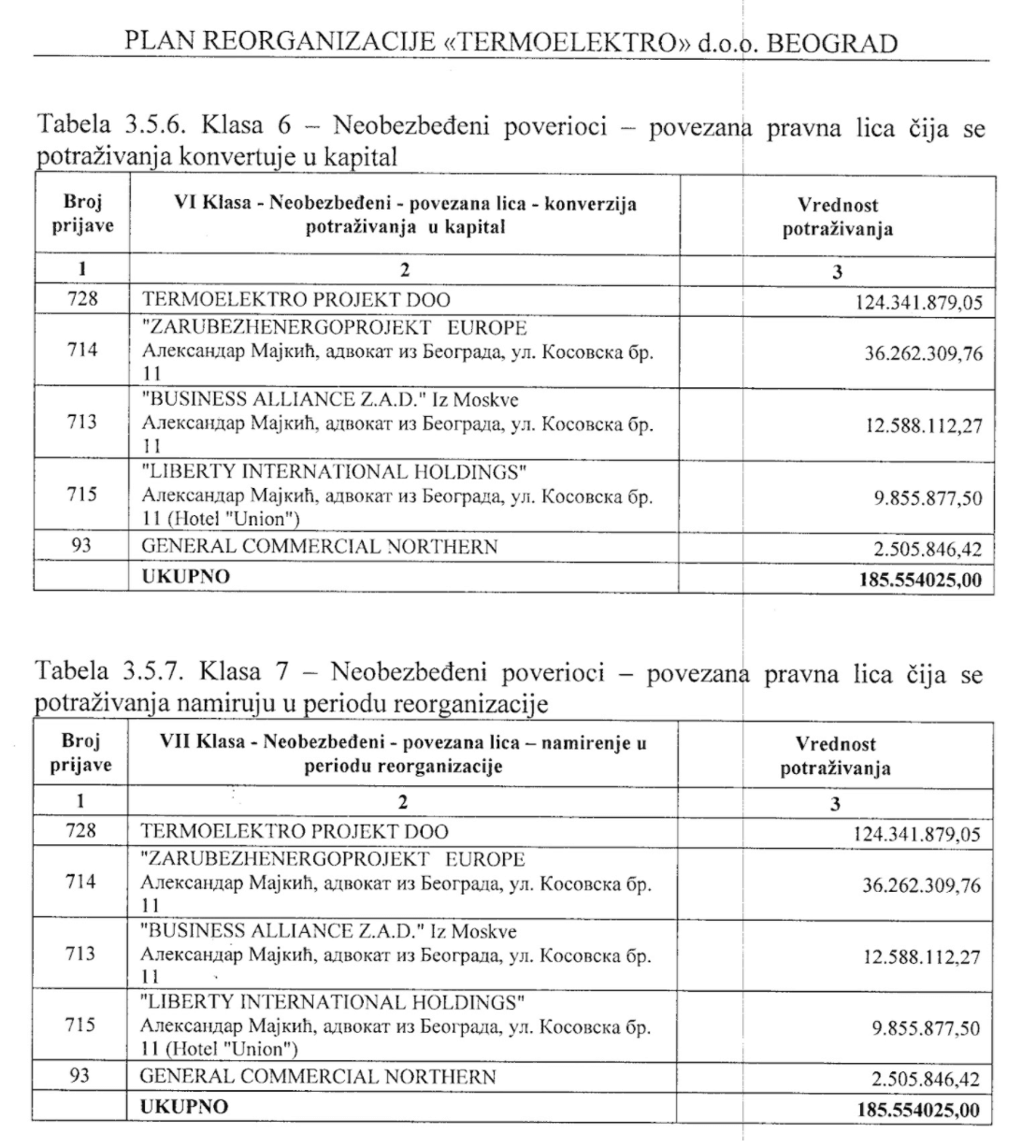

The bankruptcy reorganization plan details debts owed to over 700 creditors. While the vast majority are workers and clients of the company collecting a few hundred – and in some cases thousand – dollars each, a few creditors stand out.

Termoelektro-Projekt LLC, a Serbian company majority-owned by the Cyprus-based Termoelektro Group Limited, was determined by the bankruptcy trustee to be owed over $2.5 million by Termoelektro. The reorganization plan dictates that the amount would be split into two classes. Termoelektro-Projekt LLC would receive half of the amount as shares in Termoelektro, and the other half would be paid out in cash over a four-year period.

Fig. 7: Excerpt from Termoelektro’s bankruptcy reorganization plan showing debts owed to five “related parties.” The first table details amounts to be issued as share capital, the second details those to be issued in cash.

Interestingly, four years later in 2018, Termoelektro-Projekt LLC filed its own bankruptcy reorganization plan. In it, it was determined that the company owed two companies a combined sum of over $2.5 million. Those two companies were Termoelektro Project Limited in Cyprus and Comfitrade in Switzerland.

Fig. 8: Excerpt from Termoelektro-Projekt LLC’s 2018 bankruptcy reorganization plan in which over $2.5 million is determined to be owed to Termoelektro Group Limited and Comfitrade (typo in the original).

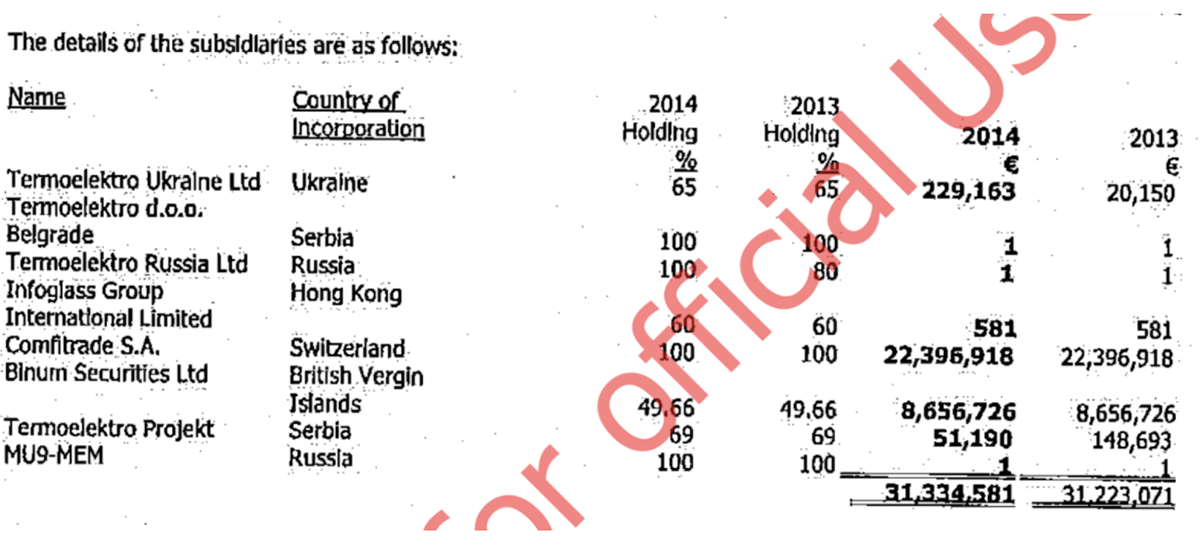

Fig. 9: Excerpt from Termoelektro Group Limited’s 2014 annual accounts showing the company’s subsidiaries and its investment in them. Below the table we have included the auditor’s qualified opinion that they had no materials to confirm the valuation of a BVI-based subsidiary – a major red flag.

While we do not allege illegal activity on behalf of Zarubezhenergoproekt or Termoelektro Group Limited, it is our hope that this investigation into what happened to Termoelektro highlights the importance of conducting adequate due diligence when dealing with foreign investors. This is especially true when privatizing state assets that are integral to the local economy.