While the lack of corporate transparency in offshore jurisdictions poses a significant due diligence challenge, not all offshores are as opaque as they seem. Easily accessible public registries from offshore jurisdictions combined with creative analytical techniques can help compliance and risk management teams unravel the mystery of offshore companies.

Offshore jurisdictions with transparent corporate data

Although offshore companies are notoriously difficult to investigate, it is a misconception that encountering an offshore company means the end of an investigation. In fact, there are several offshore jurisdictions with either freely available or paywalled corporate registries that can provide crucial details when investigating an illicit financial network.

For example, open and transparent corporate registries in Cyprus, Malta and Aruba all provide the nationalities of individuals and companies, in addition to shareholder and director information. The benefit of nationality data is that it allows investigators to more easily disambiguate illicit actors as well as generate leads to uncover other suspicious financial activities.

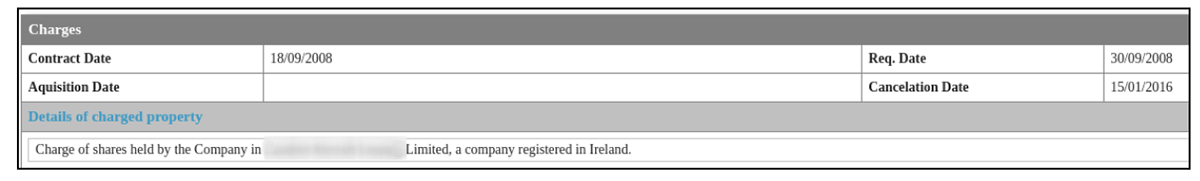

The Cyprus corporate registry goes so far as to also include information about a company’s mortgages and charges. This allows you to see details about the line of credit including the issuer, as well as the amount. Most notably, the registry also provides a description of the collateral used to secure financing. This can be essential in determining what assets the Cyprus company controls.

Fig. 1: An excerpt from the charges section of a Cyprus company’s registry page. Under the “Details of charged property” heading, we can see that financing was secured using the Cyprus company’s stake in an Irish company.

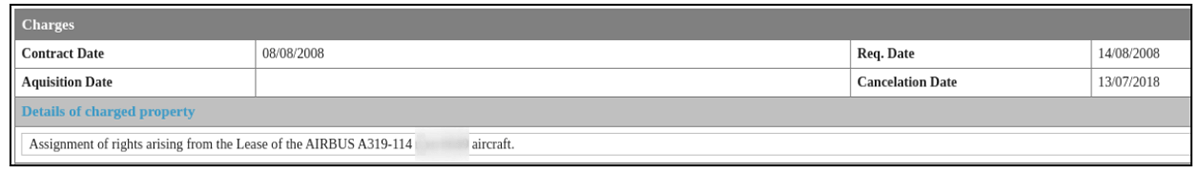

The collateral descriptions can also include physical assets including aircraft, vessels or land.

Fig. 2: Another excerpt from the charges section of a Cyprus company’s registry page. This time, the collateral is the right to proceeds of the lease of an Airbus A319-114 aircraft.

Offshore jurisdictions with aircraft and shipping data

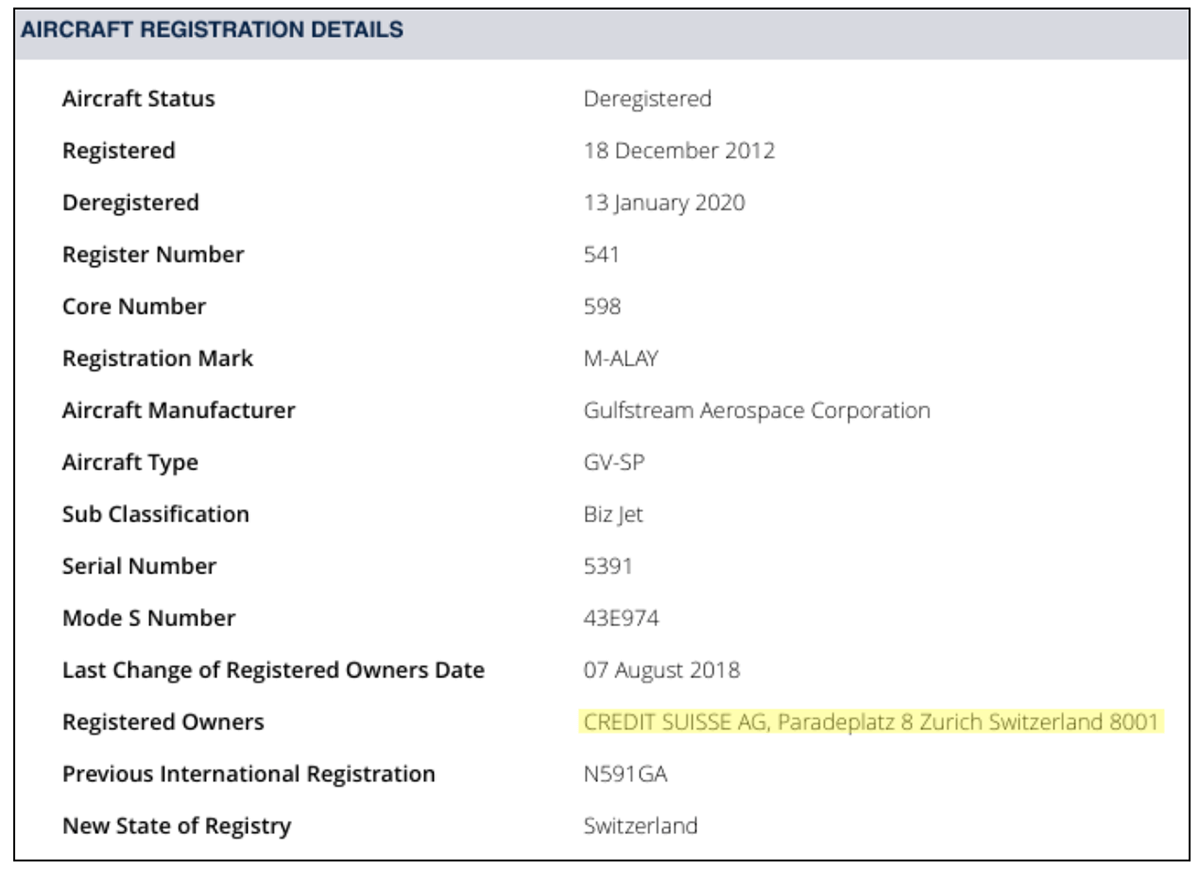

Offshore shell companies can also be used to evade taxes and launder money. In cases of tax evasion, offshore companies are often used to conceal assets, such as aircraft and vessels. Luckily, there are offshore jurisdictions that maintain aircraft and shipping registries, which can help investigators identify the ultimate beneficial owners of these fixed assets. Below is a list of popular offshore jurisdictions with readily searchable aircraft registries:

- Cayman Islands Civil Aviation Authority

- Cyprus Department of Aviation

- Guernsey Aircraft Registry

- Isle of Man Aircraft Registry

- Jersey Aircraft Registry

- Maldives Civil Aviation Authority

- Malta Civil Aviation Directorate

- Panama Civil Aeronautical Authority

- Seychelles Civil Aviation Authority

- UK Civil Aviation Authority *includes British Overseas Territories*

Fig. 3: Excerpt from the Isle of Man Aircraft Register for M-ALAY, a Gulfstream jet formerly owned by Russian oligarch Oleg Deripaska. The current owner of the aircraft, a Swiss bank, is highlighted in yellow.

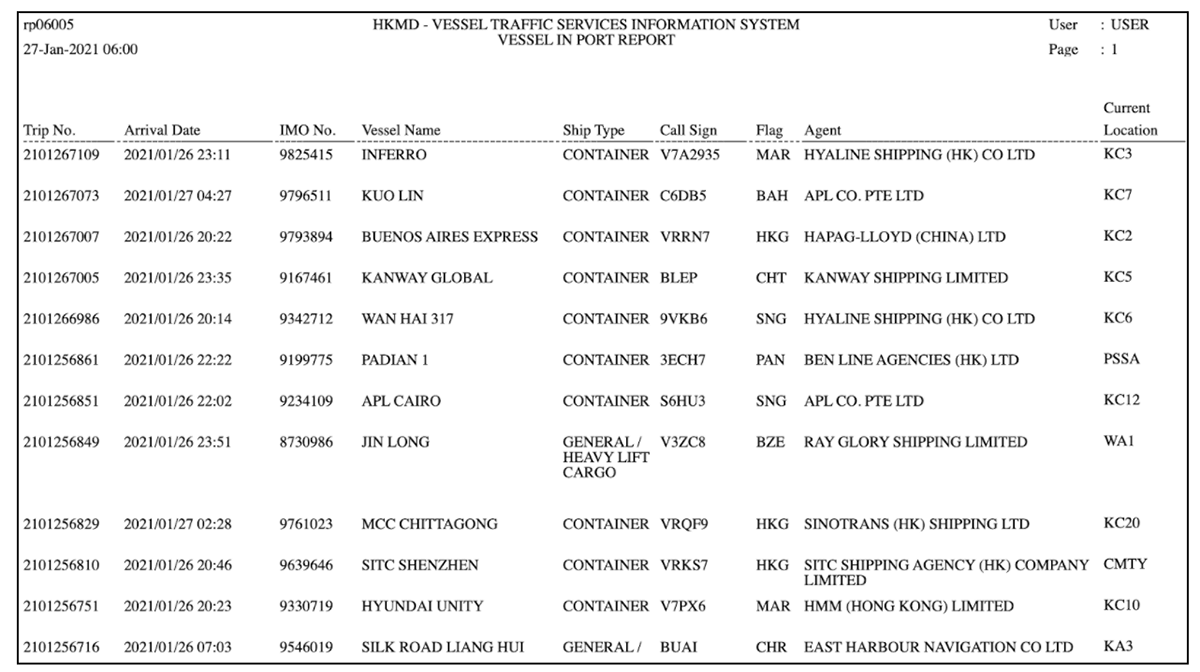

While shipping registries are not as prominent as aircraft registries in offshore jurisdictions, there are several countries with valuable maritime data. Malta, for instance, publishes a list of licensed commercial vessels with the vessel type, vessel name, and license holder recorded for each vessel. Hong Kong also issues its own list of registered vessels, in addition to traffic history reports for vessels entering and exiting Hong Kong ports in the past seven days.

Fig. 4: This snapshot taken from the Hong Kong Vessel Traffic Services Information System shows the list of vessels in port as of Jan. 27, 2021. The reports are updated daily and only include vessel traffic for the past seven days.

If a jurisdiction of interest doesn’t maintain a public shipping registry, you can alternatively seek out third-party, free-to-use data platforms such as Equasis, which allows users to filter searches for commercial vessels by name, International Maritime Organization (IMO) number, or flag. MarineTraffic, another third-party, paid data platform, is a live vessel tracker that allows users to filter by vessel type, including pleasure craft (e.g. yacht) — an important feature when investigating luxury assets held by shell companies.

The lingering issue of black hole jurisdictions

While many offshore jurisdictions provide transparent corporate data, there are still some countries, known as black hole jurisdictions, that provide little to no public records. Some of the world’s most opaque jurisdictions include the Cayman Islands, British Virgin Islands, Marshall Islands, St. Kitts and Nevis, and Seychelles.

Despite the challenges presented by black hole jurisdictions, there are still techniques that investigators can learn to gather essential information on offshore companies located within a black hole jurisdiction. As opposed to looking up an offshore company directly in its native registry, you can run a ‘backdoor’ search by locating the entity via registries with specialized data on foreign shareholders or investors. Through this approach, you may gradually acquire a more complete picture of an offshore company by finding its name, address, real estate holdings, shareholdings, and unique identifiers from multiple registries.

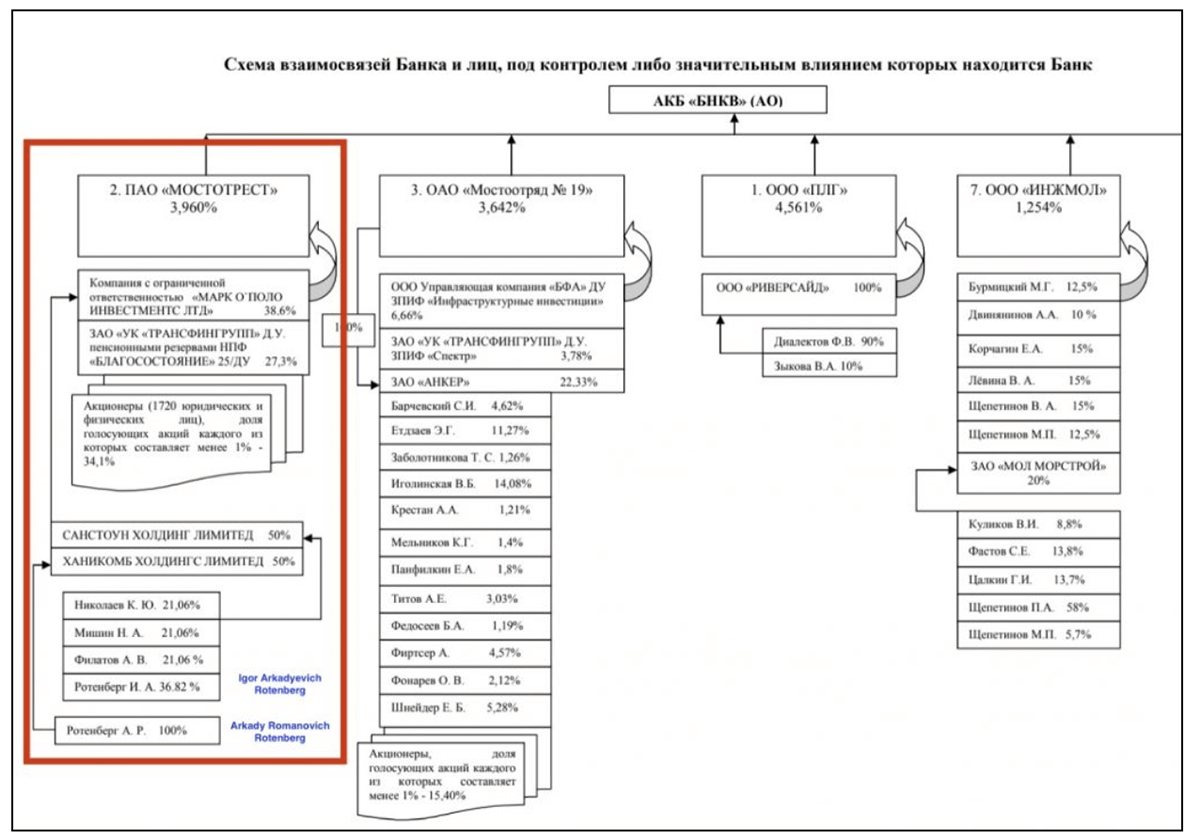

For example, if you know that an offshore entity of interest may have a stake in a Russian financial institution, you can check that institution’s public filing to determine the ultimate beneficial ownership of that offshore. This is possible because Russian financial institutions are required to report UBO.

Fig. 5: At the bottom of the red box, we can see that, as of the date of this report, Honeycomb Holdings Limited (Ханикомб Холдингс Лимитед), a BVI company, is beneficially owned by Russian oligarch Arkady Rotenberg. This information would not be available in the native BVI registry.

These methods work downstream as well. For instance, you can discover the real estate holdings of companies registered in black hole jurisdictions through the UK Land Overseas Company Ownership registry, which provides data on companies with property in England and Wales. Many companies in the database are incorporated in black hole jurisdictions, including the British Virgin Islands, Cayman Islands, Isle of Man, Marshall Islands and Seychelles.

Another resource for collecting information on companies in black hole jurisdictions is China’s LHNB MOFCOM Foreign Investment Directory, which contains shareholders, directors and English trade names for companies with foreign shareholders registered in China.

When effectively combined together, publicly available data from multiple sources enables investigators to illuminate black hole jurisdictions by providing the entity attributes, relationships and references necessary to expose illicit financial networks.