It’s a frustratingly familiar scenario for investigators: you’ve tracked a target through multiple jurisdictions and identified a group of related corporate entities, but you’re stuck because you ran into a shell company from Delaware, the British Virgin Islands, or some other offshore tax haven.

You might be able to verify the company’s existence by searching in a bare-bones corporate registry, but all they have on file is a name and ID number.

Although this can seem like a dead end, it doesn’t have to be. It’s often possible to identify the individuals behind shell companies through activity in third party jurisdictions.

This entails two possible approaches: the “needle in the haystack” approach and the “panning for gold” approach. In both cases, the objective is to find your target shell company mentioned in a public document in another jurisdiction where the shell inadvertently discloses, or is legally obligated to disclose, some information about its beneficial owners.

Approach #1 – The Needle in the Haystack

The first approach consists of searching for the shell company in the public registries of jurisdictions where you suspect it might do business.

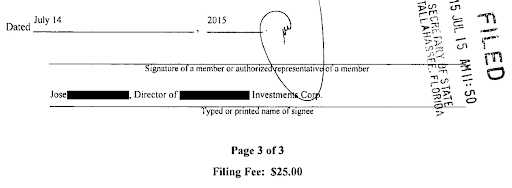

If you’ve run into a Cayman Islands company in a corporate network centered around Miami, you’ll want to search Florida corporate records to find entities for which the Cayman shell may be a manager or member. You can also look for your company in jurisdictions where it’s registered as a foreign entity or maintains a branch office. See below for an example of a Florida filing for an LLC managed by a Caribbean shell company that discloses the name of one of its Directors (Fig. 1).

Figure 1: Florida LLC filing discloses director of a Nevis company

Approach #2 – Panning for Gold

The second approach looks at the other side of the coin. Instead of systematically combing through registries on a per-jurisdiction basis, you’ll cast a wide net across multiple document sources, using tailored search terms and operators to filter out the noise.

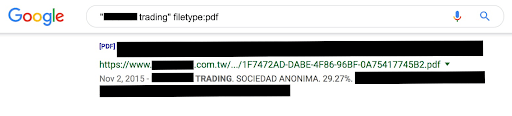

The image below shows a Google search for a Uruguayan shell company using the “filetype:pdf” operator to return only PDF documents. This operator typically yields corporate filings, regulatory documents, and other official public records. In this example, those results include Taiwanese stock exchange filings that disclose the Uruguayan company’s beneficial owners (Fig. 2).

Figure 2: Google hit for Taiwanese filing disclosing beneficial owners of a company in Uruguay

The risk to this approach is that you may miss valuable results while attempting to filter out noise. Not all useful documents are going to be PDFs, but applying too few filters will clog your search results with Yelp reviews, social media profiles, and news articles.

To help avoid this issue, you can try other operators, like site:.gov.cn (to locate documents located on Chinese government domains), or -Instagram, to remove any results that mention Instagram.

Google even offers a structured advanced search function to help make this easier. Of course, Google is not your only option. We use this technique every day in Sayari Graph. For each query, Sayari Graph automatically searches across hundreds of millions of public records from hundreds of jurisdictions.

This eliminates the noise of a Google search without compromising the breadth of results and effectively performs those dozens of individual registry queries for you all at once.

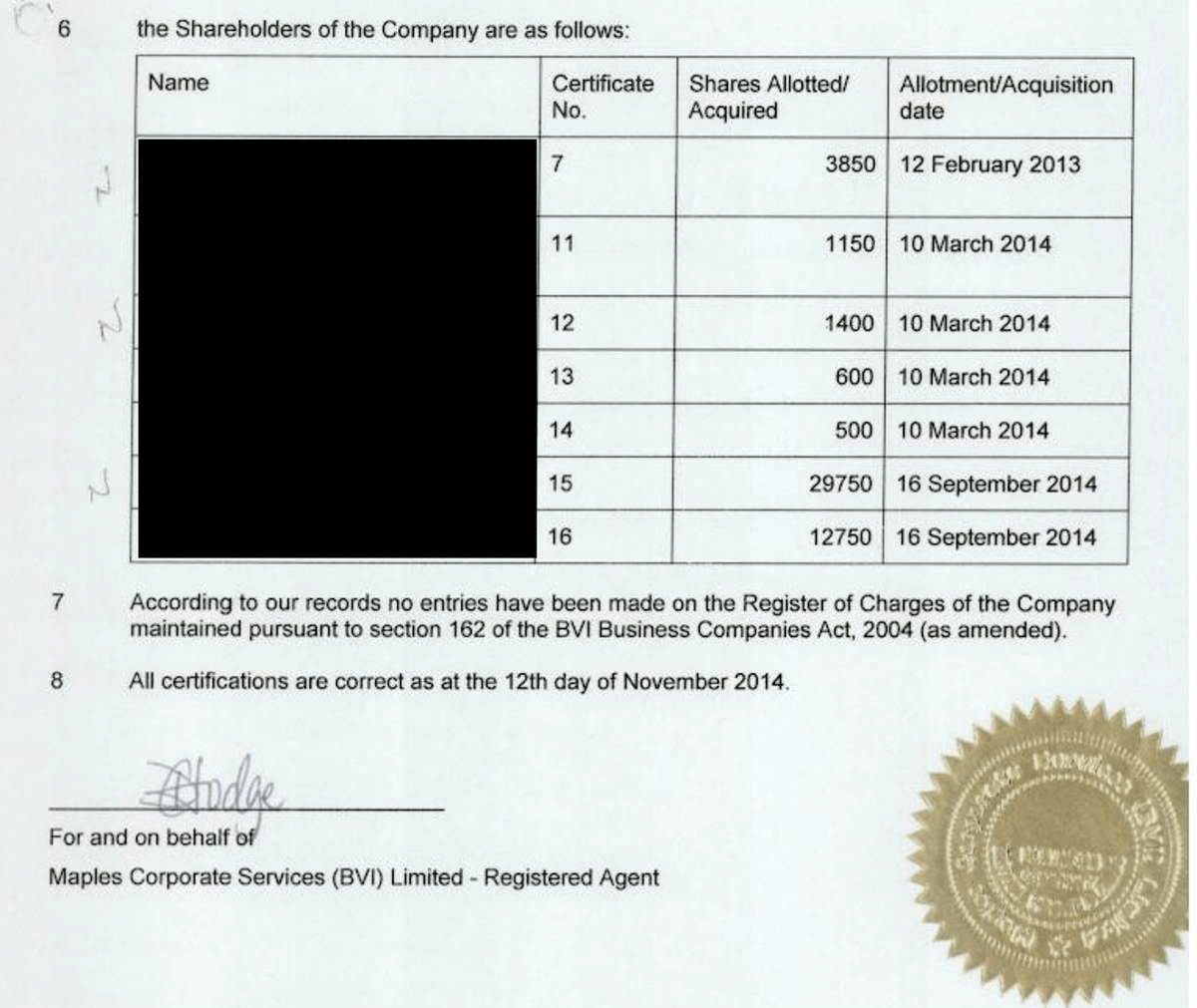

See, for example, two documents filed for different companies in South Sudan and Honduras, respectively. The Sudanese document discloses the shareholders of a British Virgin Islands limited company (Fig. 3).

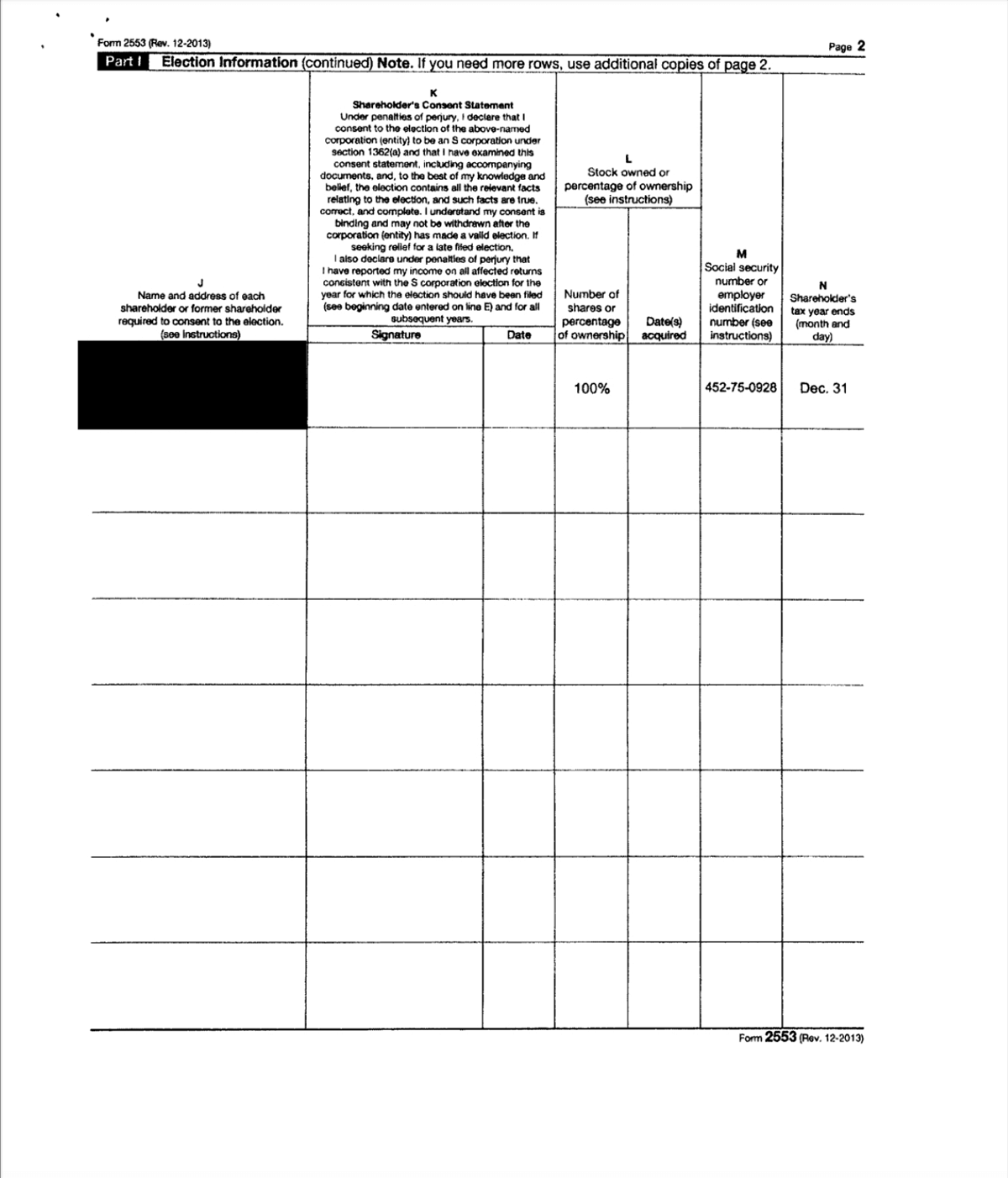

The Honduran document contains a scanned copy of an IRS Form 2553 disclosing the 100% shareholder of a California corporation – a document that is not publicly available in the United States (Fig. 4).

Figure 3: South Sudan corporate document disclosing the shareholders of a BVI company

Figure 4: Non-public IRS form appended to public Honduran corporate disclosure

Between these different approaches, you should find plenty of ways to get around the secrecy laws of the world’s offshore havens.