OFAC sanctions the leader of the Chechen Republic and his horse trainer

The U.S. Treasury Department’s Office of Foreign Assets Control (OFAC) sanctioned Dubai-based Satish Seemar in December 2020 due to his role as a horse trainer for Ramzan Kadryov, the head of the Chechen Republic. OFAC sanctioned Kadyrov at the same time given his position as the head of the Kadyrovtsky, an organization that has engaged in serious human rights abuses, according to an OFAC press release.

Because of Seemar’s designation, all of his U.S. assets are blocked. Moreover, U.S. persons who pay him for his horse training or stable management services, or otherwise transact with other companies he owns and/or controls, could be in violation of U.S. law.

Seemar: six-time UAE champion horse trainer with links to Arab and non-Arab elite

Satish Seemar moved to the UAE in 1991 to help the ruler of Dubai, Sheikh Mohammed bin Rashid Al-Maktoum, establish Zabeel Stables, according to an autobiographical article. Seemar has since become the longest serving horse trainer in the UAE and recently won his sixth UAE trainer championship. He continues to manage Dubai-based Zabeel Stables, where Sheikh Al-Maktoum keeps his horses.

Open source information proves Seemar’s links to Arab and non-Arab elite, including Kadryov. Arab gulf elites are an influential source of investment funding, some of which has been linked to other financial crimes.

The equestrian-focused website BloodHorse lists Seemar as the trainer of North America, a racehorse owned by Kadryov. BloodHorse also lists the breeder, Qatar Bloodstock Ltd, which further deepens Seemar’s network into the orbit of Arab royalty beyond the UAE.

Qatar Bloodstock Ltd is a UK-based company that, as of this writing, is directed by Sheikh Fahad Bin Abdullah Bin Khalifa Al-Thani, a member of Qatar’s royal family and the son of former Prime Minister Abdullah Bin Khalifa Al-Thani.

QIPCO, a Qatar-based holding company, is the majority shareholder of Qatar Bloodstock Ltd., according to UK public records. QIPCO’s website shows that it is directed almost exclusively by members of the Qatari royal family, including Fahad and his father.

QIPCO’s portfolio comprises primarily general services and construction. However, a notable exception is Qatar Racing, which works in owning, racing, and trading thoroughbred horses. The company has horses-in-training around the world, including in the U.S. and UK.

Seemar’s U.S. and UK companies

A quick search in public records using Sayari Graph shows the network of companies controlled by Seemar. His UK companies have no public online presence, but range from real estate investments to vehicle repair. The latter is likely related to a personal interest in vintage vehicles given the name — Fast and Classic — and his statements from the aforementioned autobiographical article in which he claims to prefer “quality items only,” and therefore treated himself to a pair of $2,722 white gold cufflinks.

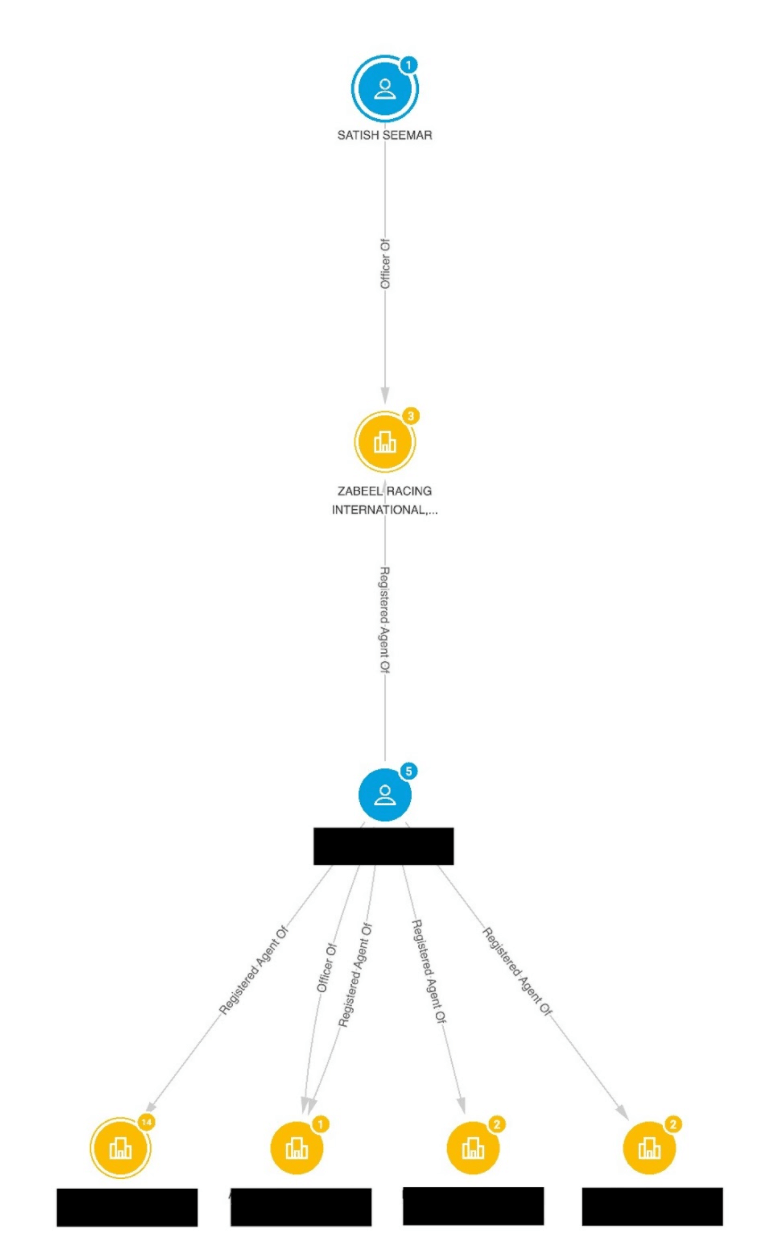

Seemar is the CEO of one California-based company in the U.S. — Zabeel Racing International, Corp. Given the use of the Zabeel name, it is likely Seemar uses Zabeel Racing to train horses or manage stables in the U.S. California public records list Zabeel Racing’s business purpose as equine-related investments and consulting.

Seemar’s California-based network is linked to other equestrian-focused ventures through Zabeel Racing’s registered agent, who happens to be the agent of an equestrian charity and a co-owner of one stable that promotes “exclusive access to the world of horse racing ownership,” according to its website.

Fig. 1: A Sayari Graph snapshot that shows Seemar as an officer of Zabeel Racing International, which has a registered agent linked to four other U.S.-based equestrian-focused entities.

While high-value equestrian horses and horse-racing have long been used as efficient money laundering vehicles, it is not a sport often linked to sanctions. However, Seemar’s network shows the global nature of horse racing and the investments that can be caught up in either breeding, purchasing, training, or stabling horses, and therefore exposing those in his network to sanctions-related risk.