Europe and Iran have taken steps in recent months to continue international trade in the face of renewed U.S. sanctions. These efforts closely resemble techniques used by companies in the Democratic People’s Republic of Korea (DPRK) to trade with the outside world, despite severe U.S. sanctions prohibiting the use of U.S. dollars for trade with the DPRK.

Both cases demonstrate how companies, criminal and terrorist organizations, and governments around the world are adapting to U.S. sanctions. And both cases may present a path forward for other actors looking to escape the United States’ grasp.

Sanctions still impose costs on illicit actors. But incomplete implementation and inadequate due diligence by the financial sector mean it is increasingly possible to work around sanctions. Changing this trend requires financial institutions to see due diligence as a serious process involving rigorous investigation of the networks of individuals and companies associated with customers and their counter-parties.

Background: The Dominance of the Dollar

Due to the U.S. dollar’s liquidity, stability, and wide acceptance, a majority of global trade is invoiced in the currency. As a result, the United States has substantial leverage over foreign companies and individuals. This is the foundation of U.S. sanctions policy: the U.S. government can cripple a foreign actor’s economic activity by cutting it off from the U.S. financial system.

Any transaction in U.S. dollars must pass through correspondent accounts at banks in the United States. Practically, this means that dollar transactions by sanctioned parties can be seized by U.S. authorities.

To avoid this, sanctioned entities typically have two options when engaging in international trade:

– Hide their identity from U.S. banks and regulators

– Conduct transactions that don’t pass through the U.S. financial system

Because they have been subject to restrictive U.S. sanctions for so long, DPRK business managers, economic officers, and intelligence operatives are adept at operating outside the U.S. financial system. In particular, DPRK economic actors make frequent use of ledger systems to engage in trade advancing the DPRK’s weapons proliferation efforts.

The INSTEX-STFI Mechanism’s Ledger System

We explored ledger systems last month in our examination of the European and Iranian special purpose vehicles created to facilitate humanitarian trade after the United States withdrew from the 2015 Iran nuclear deal. Known as the INSTEX-STFI mechanism, the system will facilitate trade between companies in Europe and Iran. Rather than receiving payment from their counterparty in the other jurisdiction, trading companies are paid by other companies in the same jurisdiction who have sent goods in the opposite direction.

In discussing the Europe-Iran ledger system, we noted that the success of that system could serve as a model for other actors seeking to trade outside the U.S. financial system. Such actors also have another model they can look to. For years, DPRK companies and financial operatives have used similar ledger systems to bypass the U.S. financial system when conducting cross-border transactions.

DPRK Use of Ledger Systems

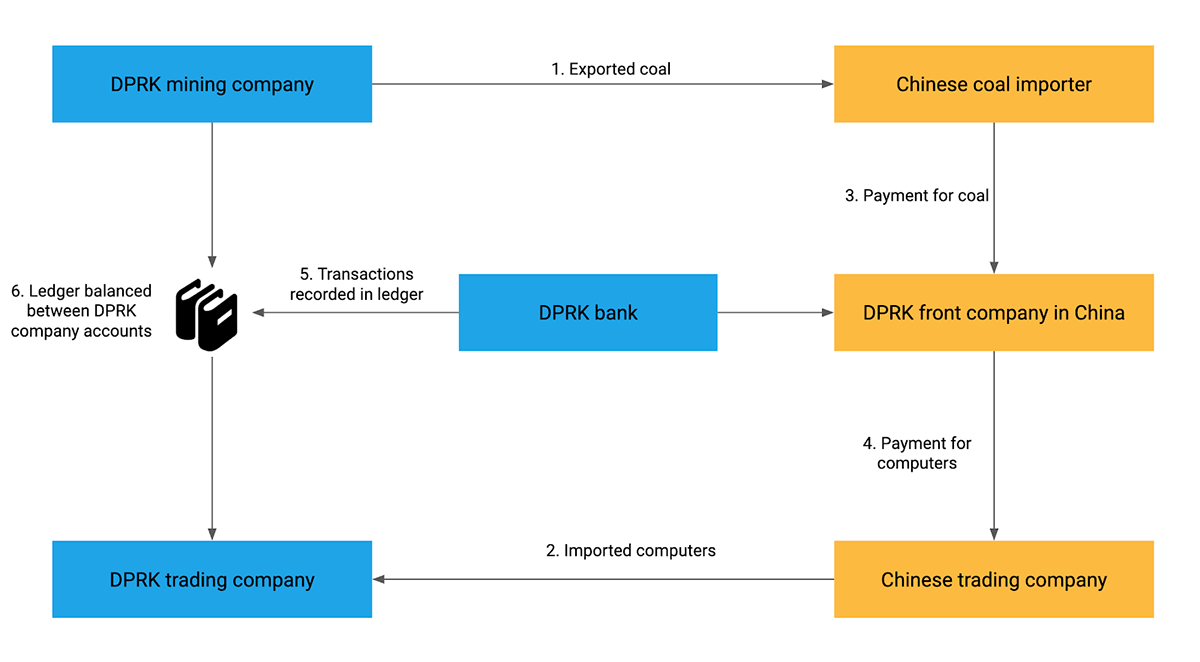

The primary functional difference between DPRK ledger systems and the INSTEX-STFI mechanism is the former’s reliance on a centralized facilitator. INSTEX-STFI simply coordinates payments between European companies and Iranian companies. In contrast, DPRK ledger systems typically pass all payments through a front company in China, Hong Kong, or some other jurisdiction outside the DPRK. The following example reflects the typology of these systems:

1. A DPRK mining company exports coal to a Chinese coal importer.

2. Another DPRK company imports computers from a Chinese trading company.

3. Rather than paying the DPRK mining company, the Chinese coal importer transfers money to the Chinese bank account of a Chinese front company established by a representative of a DPRK bank.

4. The DPRK bank’s front company then pays the Chinese trading company for the computers imported to the DPRK.

5. The DPRK bank records both transactions in a ledger.

6. The DPRK bank balances the ledger by transferring funds between the domestic accounts of the mining company and the importer.

Europe and Iran have taken steps in recent months to continue international trade in the face of renewed U.S. sanctions. These efforts closely resemble techniques used by companies in the Democratic People’s Republic of Korea (DPRK) to trade with the outside world, despite severe U.S. sanctions prohibiting the use of U.S. dollars for trade with the DPRK.

Both cases demonstrate how companies, criminal and terrorist organizations, and governments around the world are adapting to U.S. sanctions. And both cases may present a path forward for other actors looking to escape the United States’ grasp.

Sanctions still impose costs on illicit actors. But incomplete implementation and inadequate due diligence by the financial sector mean it is increasingly possible to work around sanctions. Changing this trend requires financial institutions to see due diligence as a serious process involving rigorous investigation of the networks of individuals and companies associated with customers and their counter-parties.

Background: The Dominance of the Dollar

Due to the U.S. dollar’s liquidity, stability, and wide acceptance, a majority of global trade is invoiced in the currency. As a result, the United States has substantial leverage over foreign companies and individuals. This is the foundation of U.S. sanctions policy: the U.S. government can cripple a foreign actor’s economic activity by cutting it off from the U.S. financial system.

Any transaction in U.S. dollars must pass through correspondent accounts at banks in the United States. Practically, this means that dollar transactions by sanctioned parties can be seized by U.S. authorities.

To avoid this, sanctioned entities typically have two options when engaging in international trade:

– Hide their identity from U.S. banks and regulators

– Conduct transactions that don’t pass through the U.S. financial system

Because they have been subject to restrictive U.S. sanctions for so long, DPRK business managers, economic officers, and intelligence operatives are adept at operating outside the U.S. financial system. In particular, DPRK economic actors make frequent use of ledger systems to engage in trade advancing the DPRK’s weapons proliferation efforts.

The INSTEX-STFI Mechanism’s Ledger System

We explored ledger systems last month in our examination of the European and Iranian special purpose vehicles created to facilitate humanitarian trade after the United States withdrew from the 2015 Iran nuclear deal. Known as the INSTEX-STFI mechanism, the system will facilitate trade between companies in Europe and Iran. Rather than receiving payment from their counterparty in the other jurisdiction, trading companies are paid by other companies in the same jurisdiction who have sent goods in the opposite direction.

In discussing the Europe-Iran ledger system, we noted that the success of that system could serve as a model for other actors seeking to trade outside the U.S. financial system. Such actors also have another model they can look to. For years, DPRK companies and financial operatives have used similar ledger systems to bypass the U.S. financial system when conducting cross-border transactions.

DPRK Use of Ledger Systems

The primary functional difference between DPRK ledger systems and the INSTEX-STFI mechanism is the former’s reliance on a centralized facilitator. INSTEX-STFI simply coordinates payments between European companies and Iranian companies. In contrast, DPRK ledger systems typically pass all payments through a front company in China, Hong Kong, or some other jurisdiction outside the DPRK. The following example reflects the typology of these systems:

1. A DPRK mining company exports coal to a Chinese coal importer.

2. Another DPRK company imports computers from a Chinese trading company.

3. Rather than paying the DPRK mining company, the Chinese coal importer transfers money to the Chinese bank account of a Chinese front company established by a representative of a DPRK bank.

4. The DPRK bank’s front company then pays the Chinese trading company for the computers imported to the DPRK.

5. The DPRK bank records both transactions in a ledger.

6. The DPRK bank balances the ledger by transferring funds between the domestic accounts of the mining company and the importer.

Fig. 1: Sample use of a ledger system by DPRK and Chinese companies to facilitate cross-border trade.

For a more detailed overview of how this system works, consult the Financial Crimes Enforcement Network’s typology of illicit DPRK financial activity.

In the above example, no money crosses the DPRK-China border. Transactions can be conducted in non-dollar currencies (steps 3, 4, 6), preventing U.S. financial institutions from seeing and blocking them. And even if some transactions are in dollars (such as steps 3 or 4), the DPRK source of the funds can be hidden. As the transactions are between non-DPRK actors, they may not raise red flags at U.S. financial institutions.

Vulnerabilities of the DPRK Ledger System

While the ledger systems used by sanctioned DPRK economic actors have enabled the DPRK to skirt U.S. sanctions and continue to engage in international trade, they suffer from a handful of vulnerabilities. Similar vulnerabilities also may threaten the viability of the Europe-Iran ledger system.

Additional Transaction Costs

First, reconciling cross-border trade via a ledger is inherently more convoluted and laborious than two parties directly trading. By requiring that more counterparties be consulted and adding additional steps to the process of trading, this raises the cost and lowers the ease of doing business with DPRK companies. European companies interested in trading with Iran may find similar costs associated with the INSTEX-STFI mechanism.

Balancing Trade

Second, the ledger system functions most effectively when there is a balance between the value of imports and exports. However, the total value of DPRK imports has long exceeded the value of the country’s exports by a significant margin. In some cases, DPRK actors have tried to reconcile this imbalance by smuggling large amounts of cash across international borders. Iran and the EU have not publicly clarified how the INSTEX-STFI mechanism would overcome a trade imbalance.

Reliance on Middlemen

Third, even when using a ledger system, some DPRK economic actors still move money through the U.S. financial system. In these cases, they frequently rely on middlemen in foreign countries, particularly China, Hong Kong, Singapore, and Russia. These middlemen obscure the money’s movement into or out of the DPRK. This method imposes additional costs on the DPRK: middlemen expect compensation for assuming the risks associated with violating U.S. law.

The U.S. government has identified, sanctioned, and indicted some of these middlemen, in some cases seizing money they attempted to transfer through the U.S. financial system on behalf of the DPRK. The most notable recent cases are the Chinese company Dandong Hongxiang Industrial Development Co., Ltd. and Singaporean citizen Tan Wee Beng.

These indictments have provided evidence of the mechanisms the DPRK used to evade U.S. sanctions. With front companies, multiple bank accounts, and false disclosures, they facilitated millions of dollars worth of transactions for DPRK companies.

However, there are many front companies and middlemen against which the United States has not taken action. For example, companies in Malaysia, Singapore, and Hong Kong have opened U.S. dollar bank accounts and transacted on behalf of Glocom, a DPRK network that sells military radio equipment. The United Nations Panel of Experts on the DPRK has laid out in extensive detail these companies’ efforts to evade sanctions and the failures of financial institutions to conduct adequate due diligence (see p. 64-66 of the panel’s 2018 report).

Conclusion

The ledger systems used by DPRK economic actors are undoubtedly more laborious than directly trading with counterparts in other countries. However, by avoiding the U.S. financial system, they allow DPRK companies and intelligence operatives to reduce the impact of sanctions. Rather than stifling illicit DPRK activities completely, sanctions instead raise their cost.

The typology of ledger systems used by DPRK actors for illicit economic activity is remarkably similar to the proposed INSTEX-STFI mechanism and shares several of the same vulnerabilities. Both systems force companies to rely on foreign actors who are willing to assume some sanctions risk. And an unequal balance of trade can impede both systems.

More critically, both ledger systems represent a growing threat to the effectiveness of economic sanctions. By demonstrating that it is possible to engage in international trade while bypassing the U.S. financial system, they show illicit actors everywhere that sanctions don’t necessarily mean the party is over. It may be costly, but even under U.S. sanctions there are still ways to ensure the money flows.

The application of open-source data and new technologies by financial institutions presents an opportunity to counter the weakening of sanctions. In particular, the reliance of illicit actors on middlemen is an exploitable vulnerability. Financial institutions and law enforcement agencies can use public records to thoroughly investigate the web of shareholders, subsidiaries, and associates that surround companies. This can uncover connections that might otherwise be missed. And it has the potential to reinforce sanctions as a tool of U.S. foreign policy.

The public records data used to power this research is available through Sayari Search! If you’re curious how this data could drive insights for your team, please reach out here.