U.S.-designated Chinese companies that support China’s military-industrial complex control over 500 entities situated across China and operating in a variety of sectors, according to our public records analysis. Based on recent U.S. guidelines on Chinese military companies, these entities are at high risk of future designation.

U.S. targets the Chinese military-industrial complex

Last December, the White House published a list of “Chinese military companies” from Section 1237 of the National Defense Authorization Act. At the same time, the White House issued E.O. 13595 barring U.S. companies and individuals from investing in publicly traded securities issued by these companies.

In June, the Biden administration revised their definition of “Chinese military companies,” and the U.S. Department of Defense and the Department of the Treasury each released new lists of Chinese entities that support China’s military-industrial complex. The lists, known as the Section 1260H list and the Non-SDN Chinese Military Industrial Complex (NS-CMIC) list, include many of the same companies as the Section 1237 list, but also included parents and subsidiaries of previously named companies.

In addition, the White House amended E.O. 13595, adding that owners and subsidiaries of named companies may be at risk of future designation. This addition means that further due diligence is required to uncover these high-risk companies’ corporate networks.

Identifying high-risk Chinese corporate networks

Using Chinese public records in Sayari Graph, we identified the 83 companies named by the Defense and Treasury Departments in the Section 1237, Section 1260H, and NS-CMIC lists. We then identified these entities’ majority-owned subsidiaries within three layers of ownership.

Within these parameters, we uncovered 512 companies owned 50 percent or more by U.S.-designated Chinese military companies. (Note that we have run similar analyses on the NDAA Section 1237 list and the Bureau of Industry and Security Military End Users list.)

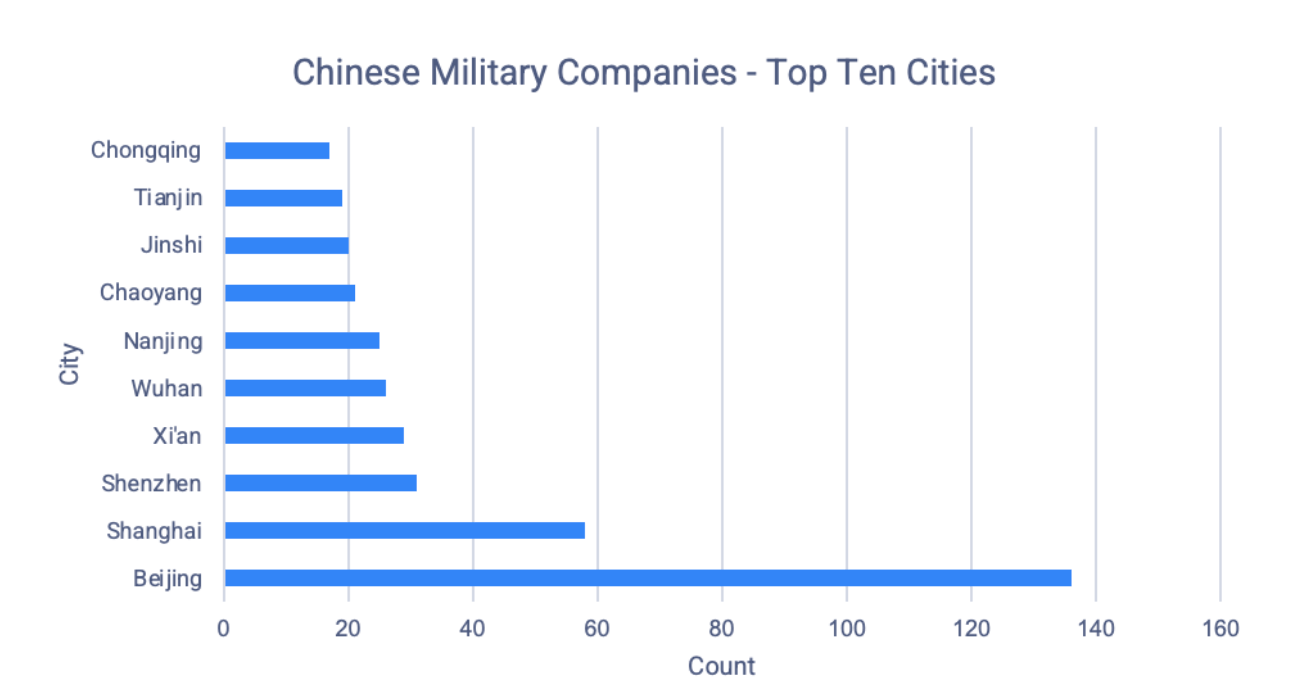

Beijing houses the most companies in our dataset, which reflects the city’s role as a technology hub and home to many state-owned enterprises.

Figure 1: Top ten cities represented in our collection of Chinese military company subsidiaries. Cities were determined by the company’s registered address in Chinese public records.

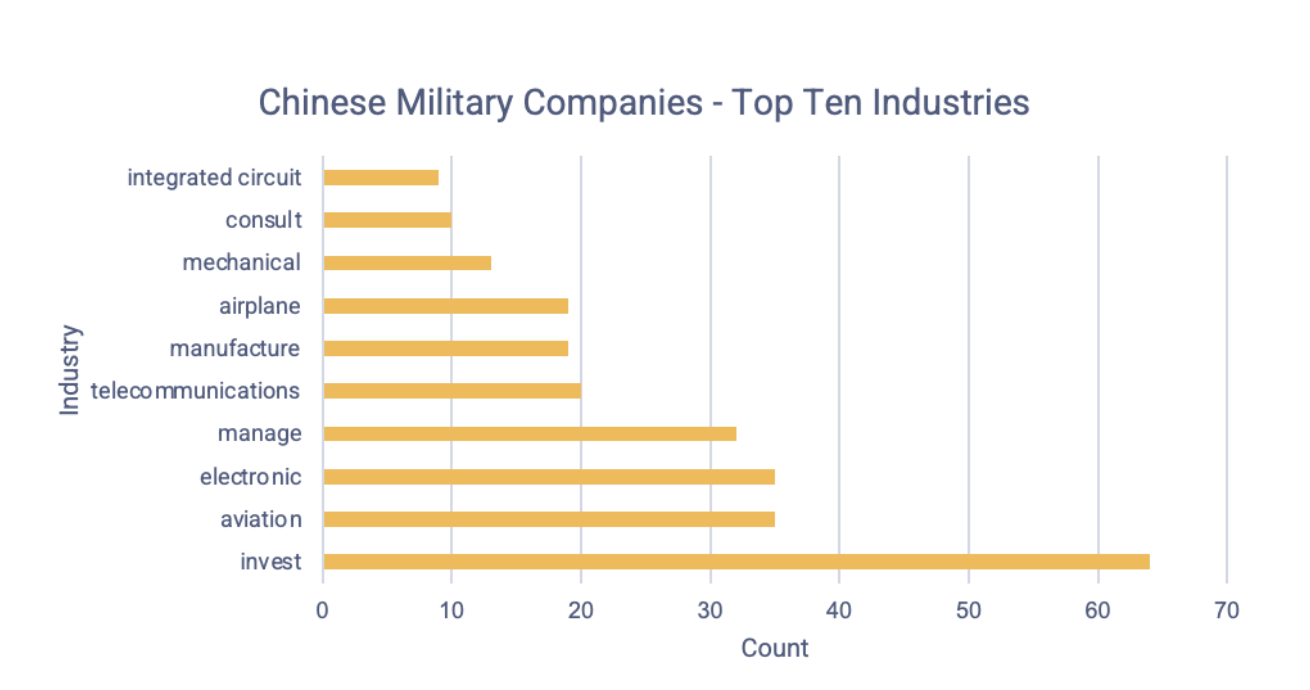

Investment firms make up the largest share of these companies. Other industries represented in this dataset include aviation, telecommunications, manufacturing, and semiconductors.

Figure 2: Top ten industries represented in our collection of Chinese military company subsidiaries. Industries were determined based on Chinese company names, which are required by law to include the company’s primary industry.

China Communications Construction Group Limited, also known as CCCG, owns over half of the subsidiaries in our dataset. CCCG is a state-owned enterprise owned directly by the State Council’s State-owned Asset Supervision and Administration Commission (SASAC). The U.S. added it to the 1260H and NS-CMIC watchlists in June.

CCCG’s primary operational subsidiary, China Communications Construction Company (CCCC), is actively involved in military-civil fusion efforts through strategic agreements with the People’s Liberation Army and the company’s Military-Civil Fusion Office. CCCC itself was named in the Section 1237, Section 1260H, and NS-CMIC lists.

Non-obvious ties to military-civil fusion

None of the more than 500 subsidiaries of Chinese military companies identified in this analysis mention the military in their name or registered business purpose. Many also do not reference their parent company in their company name, further obscuring their ties to known participants in military-civil fusion.

Additionally, the subsidiaries participate in a variety of industries beyond aerospace and engineering, meaning that the risk is spread across a growing number of industries.

As the U.S. evolves its policies aimed at mitigating U.S. support of Chinese military-civil fusion, it becomes more critical to understand military-civil fusion and the corporate networks that support it.

You can request access to our dataset here.