What is the CHIPS and Science Act?

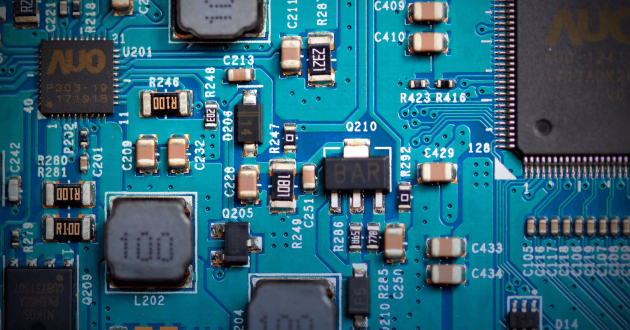

Signed into law on August 9, 2022, the Creating Helpful Incentives to Produce Semiconductors and Science Act (CHIPS and Science Act) aims to revitalize the US semiconductor industry by increasing domestic manufacturing and development

The act helps the United States respond to economic and national security issues resulting from the decline of its semiconductor industry, which has largely shifted to other countries over the past few decades, primarily China.

>> Read our research into the ownership networks of 35,000 semiconductor firms in China <<

The CHIPS Act invests roughly $280 billion into the industry over the next ten years:

- $200 billion is for scientific research and development.

- $52.7 billion is for semiconductor manufacturing and workforce development.

- $24 billion in tax credits for chip production.

- $3 billion slated for programs aimed at leading-edge technology and wireless supply chains.

Recipients of the CHIPS Act funding are prohibited from expanding semiconductor manufacturing in China and other countries that pose a national security threat. These restrictions apply for 10 years from the date of funding. The CHIPS Act also outlines that these restrictions are subject to change if the Secretary of Commerce, in coordination with the Secretary of Defense and the Director of National Intelligence, finds that it would be wise to expand restrictions to other technologies.

Why is the CHIPS and Science Act important?

The United States now makes only 12 percent of the world’s semiconductors, compared with 37 percent in the 1990s, according to an executive report. McKinsey research estimates that worldwide demand will keep growing, with semiconductors poised to become a $1 trillion industry by the end of the decade.

Since 2022, the Act has prompted research institutions and businesses to boost semiconductor manufacturing, STEM job creation, and workforce development. Many U.S. firms are dependent on chips made abroad, and the fragility of those supply chains has become increasingly evident.

While businesses need to weigh the value of federal funding against geographical manufacturing constraints, additional legislation might force their hands.

Export controls issued by the Biden administration in late 2022 caused suppliers of chip-making equipment to stall servicing of Chinese chip factories. These restrictions from the US Department of Commerce’s Bureau of Industry and Security are said to be among the toughest the United States has ever enacted and impose:

- Complex export controls that impact advanced computing integrated circuits (ICs), computer commodities, and semiconductor items.

- Heightened knowledge standards and due diligence requirements for U.S. businesses exporting to China.

Now more than ever, it’s important for Western suppliers to conduct investigations into their Chinese partners to ensure compliance with the new restrictions.

How can I ensure I’m in compliance with the CHIPS and Science Act?

If your business is receiving CHIPS Act funding, you need to ensure you remain compliant with restrictions on Chinese and other international manufacturers.

This is easier said than done. In recent years, Beijing has made domestic semiconductor development and manufacturing capabilities a priority, in part due to US export controls limiting China’s access to US technologies. The number of registered semiconductor firms in China has increased by 700 percent since 2010, according to an analysis by the Financial Times. This makes pulling away from Chinese manufacturing supply chains challenging.

>> Learn about China’s largest semiconductor investment fund <<

It is impossible to remain in compliance with semiconductor export laws if you lack information on associated importers, exporters, and buyers.

A commercial risk intelligence platform, such as Sayari Graph, leverages global public records and graph technology to map complex, cross-border corporate networks, thus providing a clear picture of companies in both the public and private sectors, their infrastructure, and relationships. This comprehensive view provides importers with broader context surrounding their partners and counterparties. If you’re looking to stay in lock step with regulators, BIS also relies on Sayari Graph data for regulating trade.

Sayari helps you avoid:

- Military End Users (MEUs): While there is an explicit list of Chinese MEUs to avoid, it is non-exhaustive. The burden falls on the exporter to identify unlisted threats. U.S. regulators, including BIS, have additionally emphasized the risks of doing business with Chinese military-industrial complex companies and state owned enterprises (SOEs).

- Hidden Connections: Sayari Graph enriches regulatory lists (like the BIS MEU, NS-CMIC, and Section 1260H) with complete subsidiaries, joint ventures, branches, trade partners, and affiliates. This allows exporters to quickly uncover hidden trade counterparty connections, including transshipment risk and geographic proximity to designated entities. Additionally in Graph, users can upload counterparty lists for efficient bulk screening for entities located in a military innovation zone.

To learn more about running supply chain investigations in China, watch our Masterclass to learn what you can uncover with Chinese public data.