A common sanctions evasion technique used by Iranian companies is to obscure corporate ownership ties behind a complex layer of offshore shell companies and affiliates. This technique makes it difficult to identify the offshore holdings of sanctioned Iranian entities, as well as their activities.

Fortunately, public records from Iran’s official stock exchange database can help investigators overcome this issue by providing crucial details on the ultimate beneficial ownership (UBO) of Iranian subsidiaries based in high-risk offshore jurisdictions. To show how this is done, we will look at two sanctioned Iranian companies and investigate their ties to offshore subsidiaries based in Hong Kong, Germany, and the UAE.

Figuring out the shareholding structure of MIDHCO’s subsidiaries

In January 2021, the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC) sanctioned Middle East Mines and Mineral Industries Development Holding Company (MIDHCO) and its subsidiaries for supporting Iran’s metals sector — a key revenue stream for the Iranian government. Among the sanctioned MIDHCO subsidiaries included Germany-based GMI Projects Hamburg GmbH and Hong Kong-based World Mining Industry Co., Ltd.

Although OFAC already established that both companies are subsidiaries of MIDHCO, public records gathered from several jurisdictions can give us a more accurate and complete picture of their underlying shareholding structure.

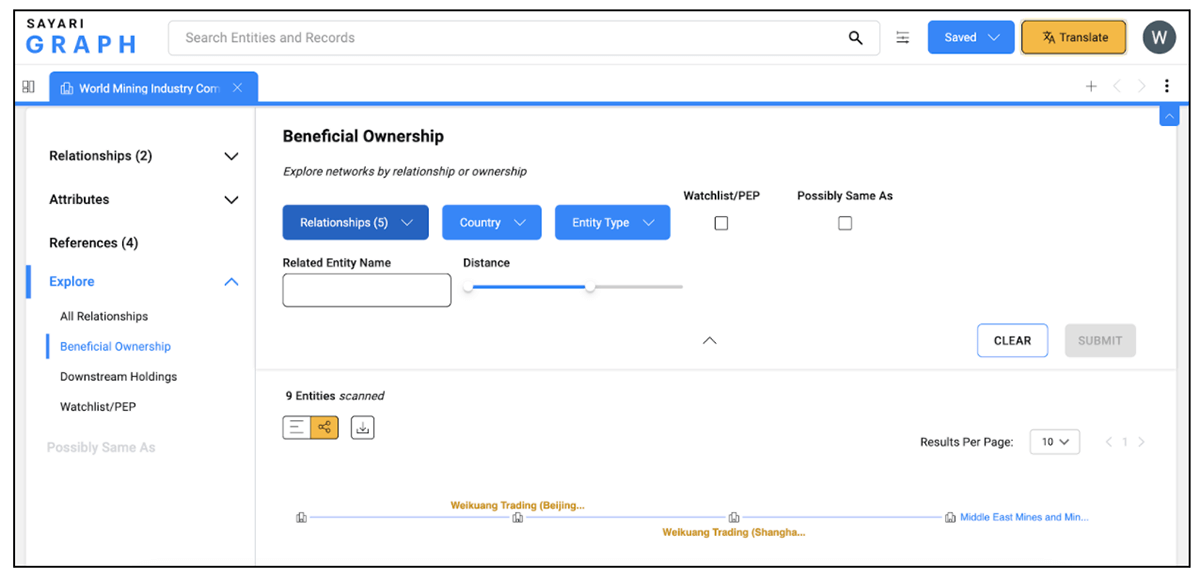

Using Chinese public records, for example, we find that MIDHCO and its subsidiary World Mining Industry Co., Ltd. are actually separated by two intermediary companies. German records, on the other hand, indicate that MIDHCO is the sole owner of GMI Projects Hamburg GmbH, ruling out the possibility of there being additional minority stakeholders.

Fig. 1: World Mining Industry Company Limited’s dossier in Graph shows that Iranian conglomerate MIDHCO is its ultimate beneficial owner via two China-based companies, according to Chinese public records.

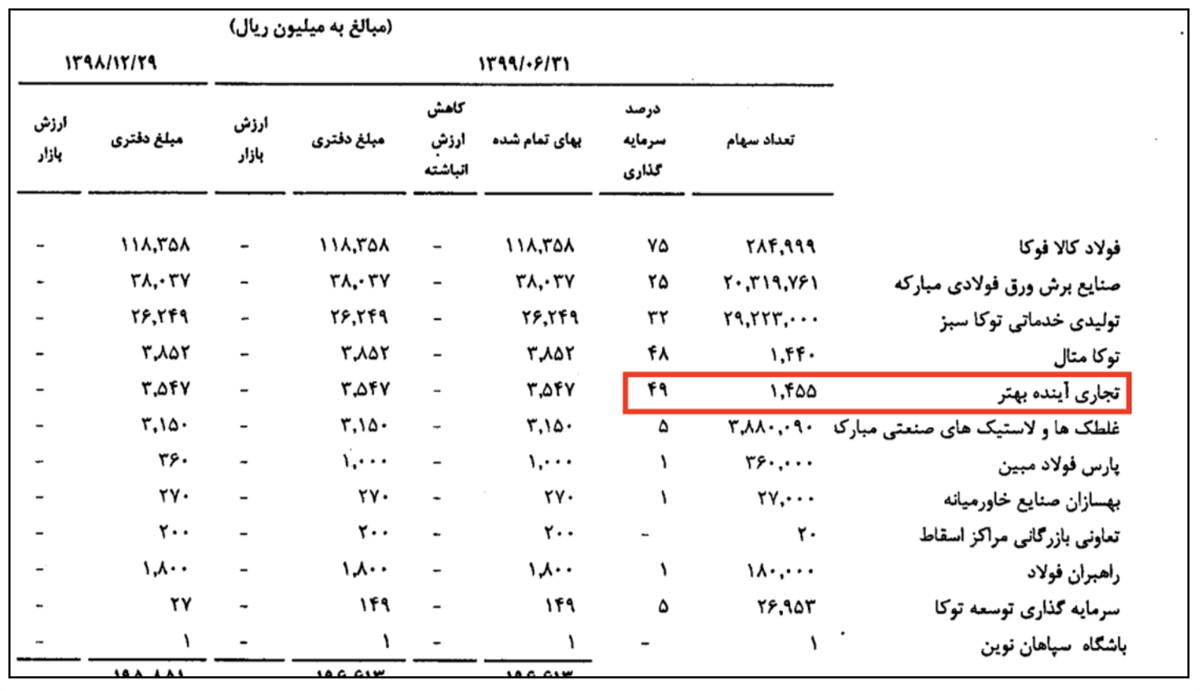

We also identified both companies in filings published in CODAL, the official database of Iran’s Securities and Exchange Organization, which confirmed that MIDHCO holds a 100 percent stake in both offshore subsidiaries. In contrast to the Chinese public records, however, the simplified data from CODAL allows us to quickly identify the UBO of the subsidiary while omitting its intermediary owners.

Fig. 2: MIDHCO’s September 2020 financial statement as provided by CODAL. The red box shows MIDHCO’s shareholdings in offshore subsidiaries Global Mining Industry and World Mining Industry based in Germany and China, respectively.

Using Iran’s UBO data to identify nominee shareholders

The first example described a scenario where public records from the native jurisdiction of the offshore subsidiary confirm information in CODAL. However, it becomes harder to distinguish nominee shareholders from the true beneficial owner when the native registry of the offshore subsidiary does not match the ownership data from CODAL.

To examine this issue, we will take a deeper look into Better Future General Trading Company, a UAE-based company sanctioned by OFAC in June 2020 for helping facilitate sales in Iran’s metals industry.

Better Future General Trading Company is 49 percent owned by Tuka Tadarok Trading Company, a subsidiary of Iranian entity Esfahan’s Mobarakeh Steel Company, according to CODAL records. However, third-party data sourced from official corporate records in the UAE shows that Better Future General Trading Company has the following shareholders:

- 51% – Emirati national

- 23% – Tuka Foolad Investment Company (Iranian subsidiary of Esfahan’s Mobarakeh Steel Company)

- 23% – Tuka Tadarok Trading Company (Iranian subsidiary of Tuka Foolad Investment Company)

- Iranian national

Fig. 3: The screenshot above shows the September 2020 financial statement of Tuka Tadarok Trading Company from CODAL. The red box indicates that Tuka Tadarok Trading owns 49 percent of UAE-based Better Future General Trading Company.

Because we know from the first example that CODAL lists UBO relationships, we can confidently make certain assumptions about the network based on the two sources of information.

The discrepancy in the shareholder structure of Better Future General Trading between CODAL and the UAE data can be explained if we assume that all the Iranian shareholders in the UAE records are merely nominee shareholders for Tuka Tadarok Trading. By doing so, we can consolidate the share ownership of all the Iranian shareholders together and attribute them to Tuka Tadarok Trading, which matches the 49 percent ownership stated in the CODAL records.

Although we cannot prove with absolute certainty that the Iranian national is tied to the same network, it is likely that they are acting as a nominee shareholder on behalf of Tuka Tadarok Trading, given that their three percent stake is included in the 49 percent listed in CODAL. On the other hand, Tuka Foolad Investment Company is clearly connected to Tuka Tadarok Trading, acting as its parent company.

While there is more analysis involved when the native registry of an offshore subsidiary conflicts with CODAL, cross-referencing sources from multiple jurisdictions gives investigators the opportunity to identify the nominee shareholders of offshore subsidiaries, in addition to uncovering their ultimate beneficial owners.

The two cases outlined above highlight the benefit of using Iranian public records to acquire up-to-date and accurate UBO data on offshore companies based in jurisdictions with comparatively less corporate transparency. More than that, these cases also demonstrate how Iran’s UBO data can be repurposed to confirm critical details from other registries and identify nominee shareholders when there is conflicting shareholder data.