The International Consortium of Investigative Journalists (ICIJ) earlier this month released the Pandora Papers, a massive leak of confidential records that exposed the offshore financial activities of the world’s political elite.

The issues raised by the Pandora Papers are nothing new. The reporting does, however, vividly illustrate the importance of access to global beneficial ownership data in the fight against financial crime.

Many offshore and so-called “secrecy jurisdictions” restrict corporate transparency, but we can still learn about offshore companies and the people behind them through legally disclosed public data – if we know where and how to look.

Read on for a quick guide to investigating offshore companies and the intersection of leaked records and public data, with a few specific Pandora Papers examples.

Offshores and Illicit Finance: Nothing New

The Pandora Papers have refocused public attention on the offshore havens that facilitate illicit financial activity. But to many, including us, this isn’t all breaking news.

Anti-money laundering and compliance teams, regulators, and law enforcement are well aware of the situation described in Pandora Papers reporting, including:

- How politicians and other high net worth individuals use complex corporate structures to move money, hide assets, and avoid regulators

- The role of offshore service providers in facilitating illicit activity

- That some U.S. states are as opaque as (or more opaque than!) oft-cited secrecy jurisdictions like Panama and the British Virgin Islands

At a high level, the Pandora Papers give us more confirmation than insight.

At a granular level, though, the Pandora Papers have exposed the specific offshore dealings of hundreds of public figures that otherwise may not have come to light. Detailed reporting has kicked off government inquiries and criminal investigations around the world, and it can help compliance teams surface unknown risk and reassess the effectiveness of their AML and due diligence programs.

Public Data on Offshore Companies

Corporate transparency in secrecy jurisdictions is a problem. We’ve all felt that frustration when we trace a company’s ultimate beneficial owner to a shell in the Seychelles or Belize, where the shareholders are not publicly disclosed. Leaked data can provide a peek behind that curtain.

But we can learn a lot about offshore companies through legally disclosed public data, too. This is particularly true for Russia and Latin America, two regions heavily featured in Pandora Papers reporting. You can:

- Make sure you have access to all available corporate records for that jurisdiction

Not all offshores are total black holes. In fact, some common offshore jurisdictions are quite open, such as Cyprus, Malta, and Aruba.

- Look for disclosures in other jurisdictions

Offshore companies often do business in other, more transparent jurisdictions, and as a result may have to disclose ownership or control there. We’ve used Florida records to unmask a Cayman Islands company, Ukrainian records to unmask a BVI company, Panama records to unmask a St. Kitts company, and on and on.

It pays to understand the public data landscape, because certain datasets regularly prove useful for looking at offshores. For example, the Russian Central Bank and Ukrainian corporate registry both disclose ultimate beneficial ownership, and China’s Ministry of Commerce maintains a foreign investment directory that provides shareholder, director, and English trade names for all Chinese companies with foreign shareholders – including offshores.

- Check asset ownership registries

Offshore companies often are used to conceal the ownership of valuable assets, including real estate, aircraft, vessels, and more. Some jurisdictions, like Panama, maintain detailed registries that can help identify the people who own and control those assets. In the same vein, property records can help peel back the veil of anonymous companies.

These and other techniques can be combined and automated for offshores or any other company, as long as you have access to the right data and technology. (For more on that, read our report on automating beneficial ownership discovery.)

So How Do We Use the Pandora Papers?

We can design powerful workflows to combine public company records with other sources, like ship registries and trade data. We can do the same with the Pandora Papers, or any leaked corporate data.

Once the Pandora Papers data is available via the ICIJ Offshore Leaks database, investigators can use it as a proxy partial corporate registry for offshore jurisdictions where ownership and control aren’t publicly disclosed – with proper attention to its leaked status, of course. Leaked data is not the same as legally disclosed data, so analytical best practices require us to consider it separately.

We also can use public records to verify and expand on information disclosed in leaked confidential records. ICIJ used the public data in Sayari Graph this way as part of the Pandora Papers investigation.

Pandora Papers Investigations in Public Records

Dozens (and probably hundreds) of the public figures named in Pandora Papers reporting can be tracked through public records. Here are two quick examples:

- Putin’s Alleged Mistress

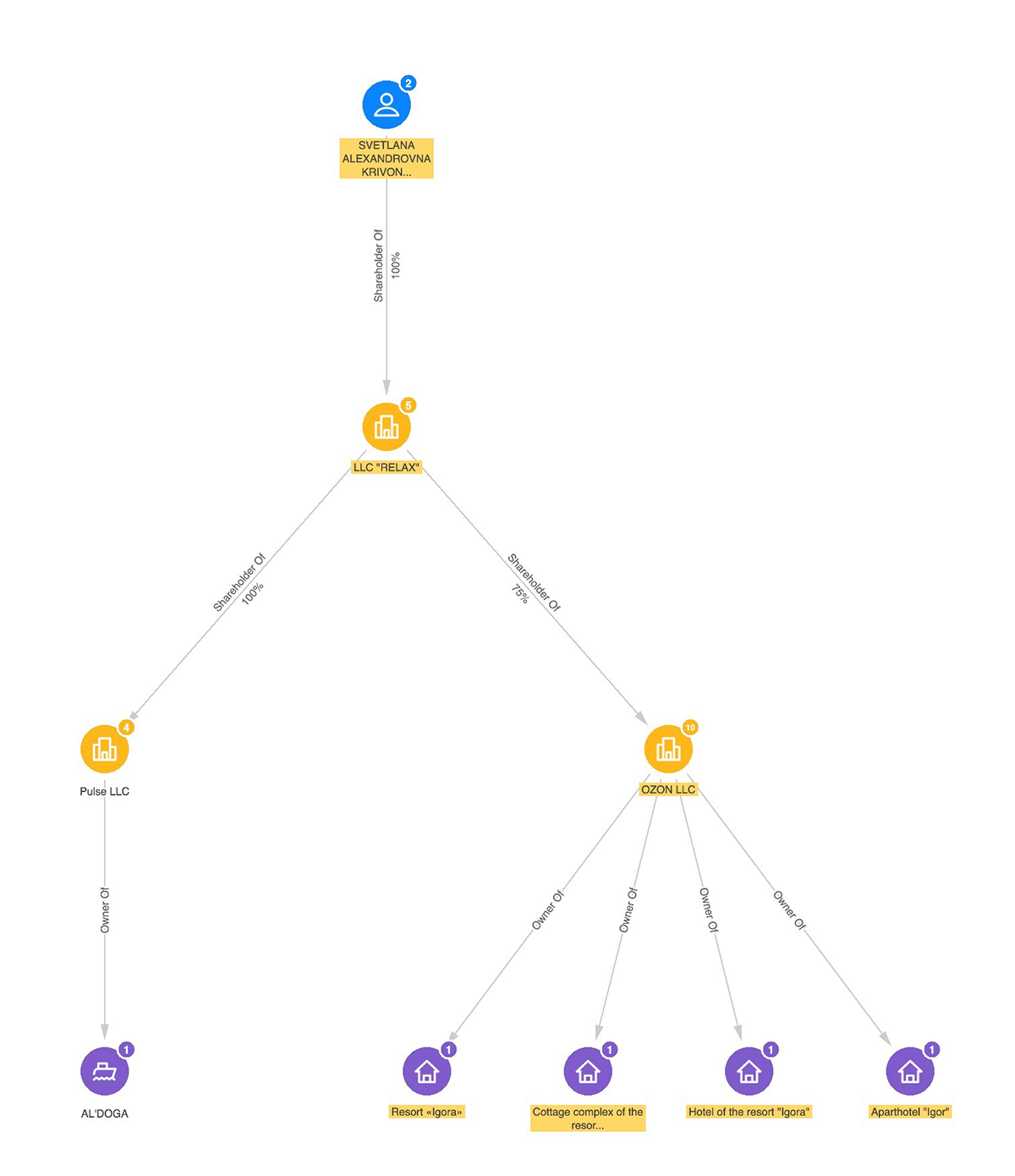

Svetlana Krivonogikh is alleged to be the mistress of Vladimir Putin, the president of Russia. She has been identified as having ownership stakes in several Russian companies used to hold luxury assets.

Russian public records show that she indirectly owns a 37m luxury yacht called the Al’Doga, as well as four Russian resorts. One of these resorts, Igora, was named by the Guardian as part of its Pandora Papers reporting.

Interestingly, one of the companies Krivonogikh uses to control her assets, Relax LLC, shares an address with a sanctioned entity tied to Bank Rossiya. This makes sense, given alleged ties between Bank Rossiya, its ownership, and Putin – including alleged minority ownership by Relax LLC in Bank Rossiya as of the mid-2000s. A veterans association for an FSB spetsnaz (special forces) unit is in the same complex.

Fig. 1: Russian Federal Tax Registry and Russian Registry of Tourist Objects records shows Svetlana Krivonogikh owning a yacht and four resorts via several Russian intermediary companies.

- Former President of Paraguay and his Family

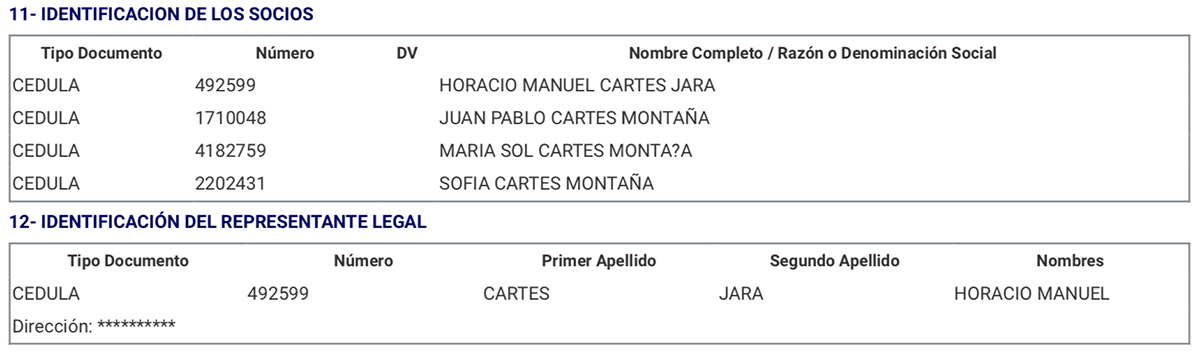

Horacio Cartes, the former president of Paraguay, is the ultimate beneficial owner of a Panama-registered company called Dominicana Acquisition S.A., according to the Pandora Papers and as reported by Spanish newspaper El Pais. El Pais also reported that Cartes, along with his three children, are the owners of a Paraguay-based company by the same name.

Public data from Paraguay’s tax registry (SET) shows that Cartes is the shareholder and/or disclosed legal representative of at least 33 companies in Paraguay. The Cartes Group website identifies many of these companies, but not all – and public data further shows that more than a dozen Cartes companies are also owned or controlled by his children.

Fig. 2: Paraguay Seubsecretaria de Estado de Tributacion (SET) record showing Cartes and his three children as shareholders of Dominicana Acquisition S.A., as of Oct. 20, 2021.

Beyond the Pandora Papers

The Pandora Papers illustrate why consistent access to company ownership information is critical in the fight against financial crime. Beneficial ownership registers are few and far between, and it’s not sufficient or practical to rely on leaked confidential data.

With public data and the tools and knowledge to unlock its value, we can start to address these critical transparency challenges, even in offshore jurisdictions.

Reach out if you’d like to access to the public records we referenced here or talk to our team about how to unite public data and Pandora Papers data in your workflows.